Energy Hedging 101 - The What, The Why, The How.

In the Weekly Power Outlet, we often refer to our comments being directed at those in the energy markets who are considered hedgers, not speculators. Perhaps it's time for a deeper discussion on our view of hedging. In this post we will be covering some of the basic concepts behind the what, the why, and the how.

What is Hedging?

Open the Wall Street Journal to the markets section on any given day and you will see that you can trade just about anything. You can trade stocks, bonds, derivatives on stocks and bonds, currencies, gold and silver, packages of student loans, carbon credits, and things like yellow grease and tallow (if you don’t know, don’t ask). Unbelievably, there was once a marketplace for weather. Given all that, of course electricity can be traded, and thus hedged.

Before we delve into the mechanics of trading, first let us describe what hedging is and what it is not. Type 'hedging' into your favorite search engine and you will get a fair number of slightly different descriptions. For us, hedging is a customized contract between two parties to buy or sell something (in our case electricity) at a specified price on a future date, seeking to limit exposure to fluctuations in prices. Hedging is not speculation, which involves trying to make a profit from a price change in a security and realizing all profit or loss associated with the change in price.

Our hedging conversations mostly revolve around electricity and natural gas. There's a pretty good chance that when you mention electricity hedging inside the conference rooms of co-ops, municipalities, industrial consumers, or producers, 'hedging' will be interpreted as 'trading' where trading electricity brings up memories of the Wild West and recordings of Enron traders talking about “turning the lights out on grandma.” That is not hedging, but because of that, let’s use the image of a farmer as an example. Each spring, a farmer has inputs (such as seed, fertilizer, and fuel) that they hope to turn into an output (a crop) and sell at a profit. In this example, if the prices are favorable, the farmer can buy seed, fertilizer, and fuel in advance while also having the same ability to sell a crop at a future date for a certain price. The ability to fix prices for delivery at a future date is hedging.

Electricity, like corn, can be traded in various block sizes, different contract lengths, and at numerous settlement nodes. Electricity can also be traded with physical delivery, which includes scheduling in the ISO/RTO, or financially, which means basic swap contracts are designed to settle at a specified trading node at a certain time. Both achieve the same goal but entail different counterparty contracting.

Why Hedge?

Now that we have a basic description of hedging, why and how do we do it? Let's cover some of the reasons 'why', and maybe even some of the reasons 'why not'. Part of the answer as to 'why hedge' is explained in the definition. Hedging fixes prices, reducing the risk associated with market fluctuations. Whether it's a commercial or industrial making widgets, a municipal or co-op procuring or generating electricity, or hospital or university, most institutions have some budget and risk controls in place. Having the ability to fix prices provides opportunities to lock in advantageous prices to budget and also achieve risk parameters.

While hedging can be a great tool for budgeting and risk management, we do have to acknowledge the possible downside to hedging trades. Just as fixing a price is viewed as beneficial, when the underlying (electricity) moves against you, having a fixed price when moving in your favor can create an opportunity cost. Basically, you've bought or sold something that could have been done at a much better price. In our view, opportunity costs are a lot easier to manage than unhedged extreme price moves. While opportunity costs usually lead the 'don't hedge' argument, there are other risks to hedging such as counterparty risk, the cost to hedge, and even hedging the wrong commodity. For example, some will hedge natural gas as a way to protect against moves in electric markets. While they are very correlated, there are instances when they trade independently. We only need to look to last year when natural gas spiked on geopolitical events, while daily electric prices settled higher, but not to the extent of natural gas.

How to Hedge

Just as a financial planner doesn’t have a blanket program for anyone who walks through the door, hedging may provide different solutions for different issues for anyone where electricity is a significant part of their cost or revenue structure. Creating a hedging program is just as important as the execution, and we will address that in a future post. Once a hedging plan is in place and opportunities are identified, they need to be executed properly.

Over the past 25 years or so, the ability to execute financial transactions has had a dramatic transformation thanks to technology. There are some that will read this who have only ever logged onto their smartphones to buy and share bonds, stocks, commodities, and etc. in a few keystrokes. This has come a long way in how we do our trading, as not that long ago, a phone call was needed to be made to a broker at a brokerage firm and you dictated verbally that you wanted to buy a share of a stock (such as Microsoft). The broker might have had to walk over to a machine to get a quote to relay back to you. If the price was right, the broker would then need to relay it somehow to a trading floor where a trader might have to call another market maker to execute a bilateral trade, which clears once both sides agree. The total time it took to buy a share could have been 30 minutes if you were lucky.

Why the history lesson? Believe it or not, executing hedging trades in electricity can be a little more similar to the old days of buying stock and not so much like today, where you download your favorite brokerage app and buy or sell with a keystroke. Actually, there are variations of both. We won’t go into all the aspects of setting up the ability to hedge, but we do want to give some details.

In a direct bilateral market, whether you are a buyer of electricity or a seller, you need a willing partner to execute your hedge trade or take the other side. In some cases, it might be preferable to have multiple trading partners (which could include a bank, a utility, or a generation owner), each with market-making ability for pricing competition and to spread counterparty risk. Just as you would when opening a brokerage account, there needs to be a contract in place between the two entities. The standard for physical electricity is the master agreement for the purchase and sale of electricity developed by the Edison Electric Institute and the National Energy Marketers Association, usually referred to as an EEI after its author. This agreement covers things such as transaction terms, scheduling, events of default, payment and banking details. Typically, an additional document will be associated with the master which lays out the collateral terms. To trade financial swaps, a similar document governed by the International Swaps and Derivatives Association is used. Trading financial swaps is a little bit easier. It's possible to set up a clearing relationship with an execution firm giving the ability to trade on an exchange. The exchange will clear trades through your firm account, making it less onerous to set up trading partners. As expected, there are extra costs.

Once contracts are in place, hedge trading can begin. Presumably, the market has reached a level deemed attractive or other factors have initiated a reason to enter a hedge trade. Regardless of whether you're a buyer or a seller, the next step for physical electricity would be to contact the contracted counterparties asking for bids or offers for the volume, time frame, and trading point. After selecting the best terms and agreeing on a trade, confirmation of the trade would be signed by the two parties and a bilateral contract is established.

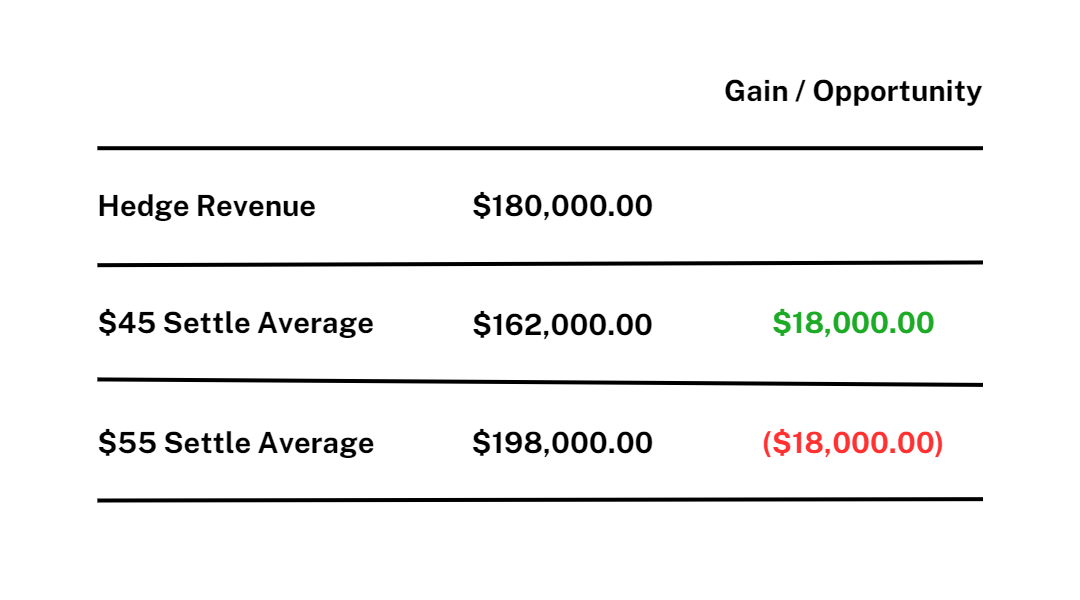

As an example, a generator sells a 5MW block of electricity for physical delivery settled in the day ahead market for the month of November (720 hours) for $50/MWh around the clock at PJM Western Hub. That means that the generator has locked in revenue of $180,000 for the contract (5MW x 720 hours x $50/MW) for 5MW regardless of where the day ahead market settles. As the month of November starts, each day PJM will establish a day ahead price for the PJM Western Hub with an average at the end of the month.

In the example above, we can see when the market average settles at $45 for November, the generator created $18,000 on the 5MW block selling a hedge. Conversely, the generator had an opportunity cost of $18,000 if the price settled at $55. In either case, the generator will be paid $50/MWh for its generation.

As an aside, since this is a physical trade, the trade will need to be scheduled in PJM. If the generator is unable to deliver the physical electricity, PJM will settle the trade in the Day Ahead or Real Time market. In the Day Ahead market, the metrics would look the same as the example above. In the Real Time market, the generator would be subject to some market risk. This example could also be used as a consumer with revenue becoming cost.

Conclusion

Hedging can seem confusing and risky in the wrong context. With the creation of a strong program and discipline of execution, it can vastly reduce risk and help with budgeting certainty. With the right partner, some of the steps that seem confusing and daunting can be understood and turned into a plan to meet many needs.

Acumen has the right tools and experience to construct and execute your hedging program. Let us help you with your journey.