Weekly Power Outlet US - 2024 - Week 10

Gas Production, Compute Power, MISO Transmission

Gas Production, Compute Power, MISO Transmission

Energy Market Update Week 10 brought to you by Acumen.

For More Updates Like This, Subscribe Here!

A few weeks ago, we wrote about Chesapeake Energy cutting production as prices have reached levels of questionable profitability. It was part of our idea that historically the 'cure for low prices is lower prices', meaning eventually production gets cut. This week, the country's biggest natural gas producer added to production cuts as they said they'd cut 1Bcf/d gross production. EQT is the biggest producer of gas in the US.

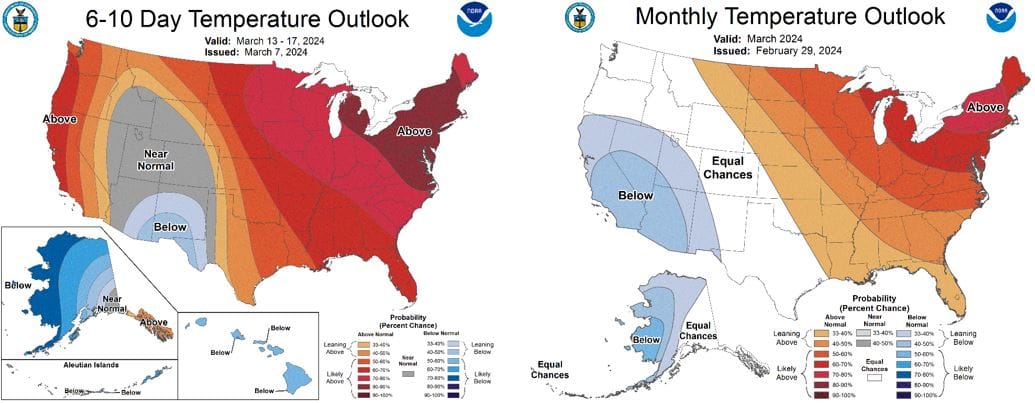

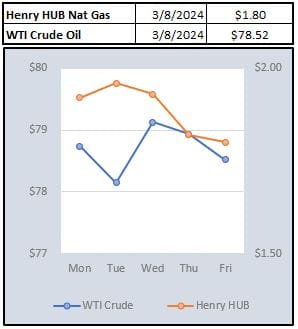

Natural gas initially rallied with the EQT news, but the rally stalled as the week moved along. The EIA storage report showed an inline withdrawal of 40 Bcf leaving inventories roughly 13.6% ahead of last year and a staggering 31% ahead of the five-year average. Given those numbers, and the weather maps below, there needs to be even more work done on production cuts before the market can move meaningfully higher.

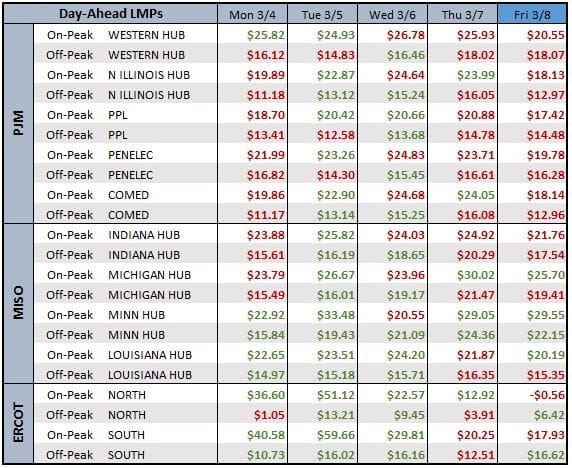

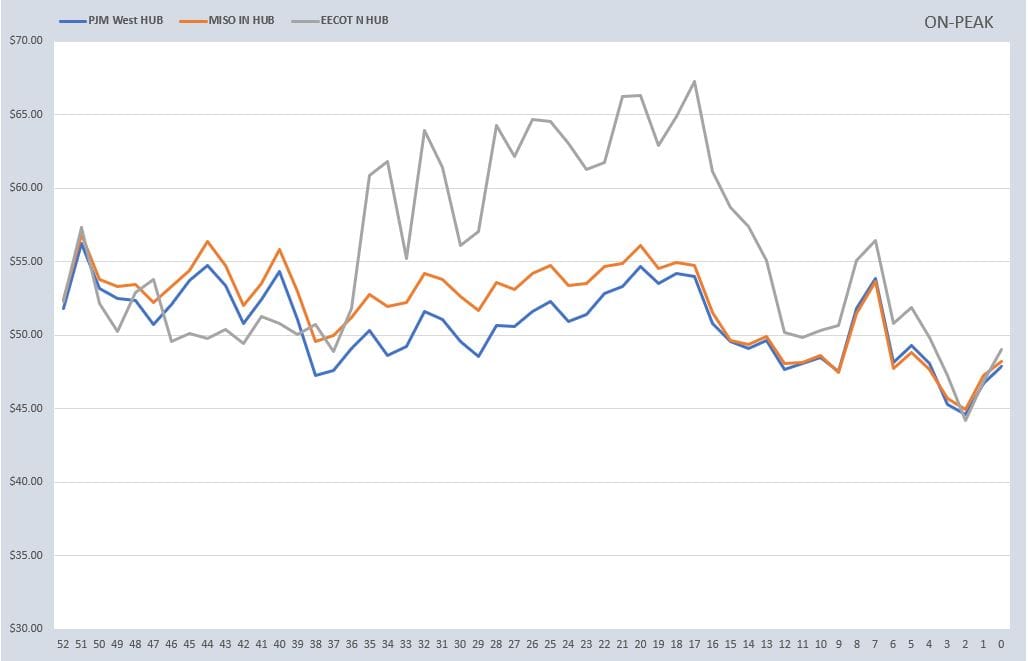

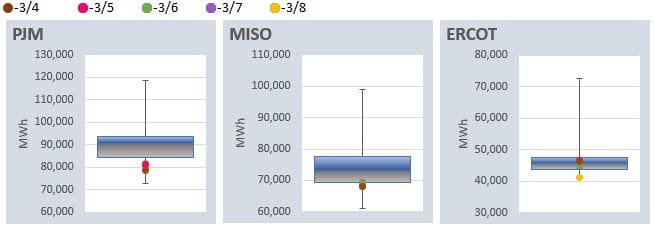

Day-Ahead electric prices continue to reflect the mild winter and soft gas prices. March of last year was considered fairly mild and MISO In Hub On Peak averaged $33.5/MW over the month. Looking at this weeks prices, they look to be roughly 25% lower with the average below $25/MW. For the record, 2022 prices settled above $53/MW.

We've teased that AI, or our new favorite term Compute Power, might become the weekly staple of the WPO. Well, this week, Amazon Web Services delivered for us. AWS announced that they are acquiring, from Talen Energy Corp, its 950 MW Cumulus data center in Pennsylvania. The data center sits right next to the 2.5 GW Susquehanna nuclear station. As part of the deal, Talen will supply power to the data center from the plant with a ten-year PPA.

In our last post of 2023, we reiterated that we weren't in the predictions game, and then made a prediction that 2024 would be the year of transmission. So far, the news hasn't been coming fast and furious, but instead slower and more measured with some of the same issues around land control and permitting being the story. This week, MISO gave us a little something to read over and think about. They released their tranche 2 of long-term transmission planning. The most interesting part of the plan is the focus of moving wind from the west to the east. If you look at MISO LMPs on a daily basis, know there is plenty of generation trapped in the Midwest. This plan only makes sense.

NOAA WEATHER FORECAST

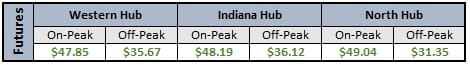

DAY-AHEAD LMP PRICING & SELECT FUTURES

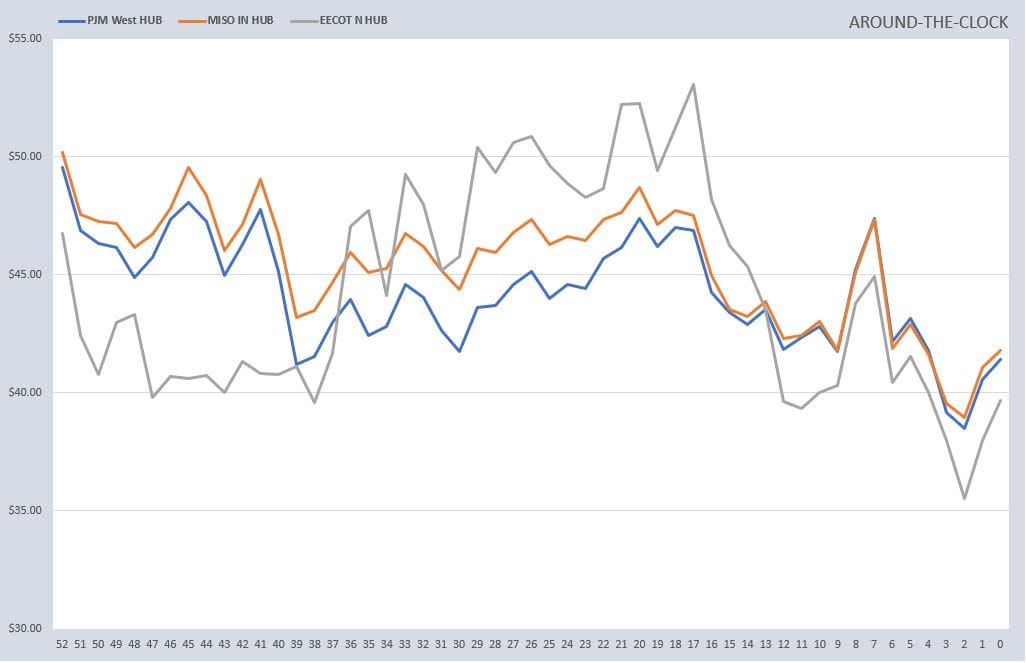

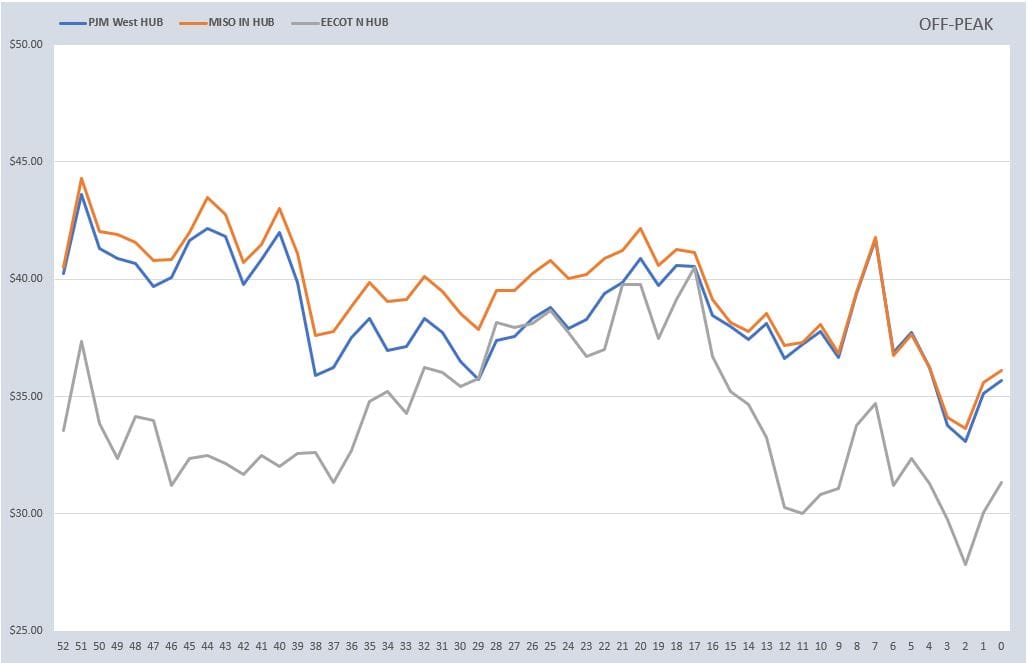

RTO AROUND THE CLOCK CALENDAR STRIP

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: