Weekly Power Outlet US - 2024 - Week 11

Natural Gas, STEO, Legend

Natural Gas, STEO, Legend

Energy Market Update Week 11, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

Once again electricity prices were muted as natural gas continues to trade at, or near, historic lows. The EIA storage report was a yawner as a reported 9 Bcf withdrawal was slightly more than the 3 Bcf estimates. This now puts inventories at 16% more than last year and roughly 37% higher than the five-year average. To put that into context, if we had another withdrawal equal to that during Winter Storm Heather in January, we'd still be ahead of last year's storage numbers. Said another way, add a zero to this week's withdrawal number (mark it 90 Dude) and we'd be up 12%. There is plenty of gas in storage.

This week EIA released their monthly Short-Term Energy Outlook (STEO). In the past we've raved about this report as it is full of interesting data and forecasts. While the report covers all forms of energy, for us it's natural gas we focus on for obvious reasons. This week's WPO is going to be a dive into some of these numbers.

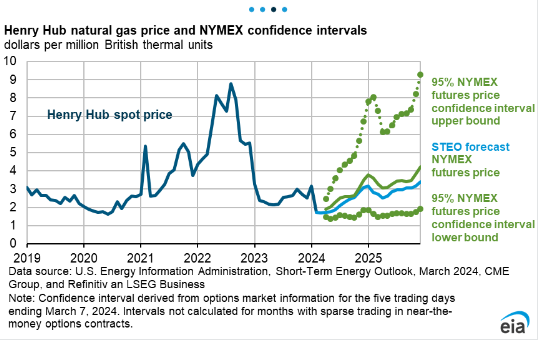

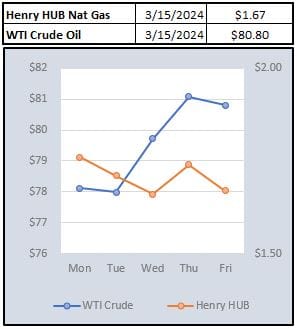

Regarding prices, in the report they state given the end of winter weather and the storage levels, they are forecasting Henry Hub natural gas prices to remain below $2/MMBtu through Q2 of this year. February's final average of $1.72/MMBtu was 30% off their forecast for the month. Speaking of forecasting, we found the chart below somewhat amusing. It's not the forecast, it's the confidence intervals that are a little broad. Having a 95% confidence gas won't end the year above $8 or below $2 has a saying on trading desks...."you could drive a truck through that spread.".

Getting off topic a bit, this spread in "confidence interval" is why we always preach in hedging programs that are thought out establishing some sort of targets. A well thought out plan with targets specifying trade execution help alleviate some of that finger in the air trying to feel the winds of the market. When markets look more like an AI stock than a rational commodities market, a plan is key.

EIA is keeping their prediction for gas production unchanged from February at just under 104 Bcf/d. Over the past couple weeks we've cited some of the big companies cutting production. EIA is stating that LNG export demand will be enough to support their forecast for 104. While we don't do forecasting ourselves, if these prices remain where predicted, we'd expect production cuts to continue. Remember our commentary about the cure for lower prices is lower prices and almost always involves a change in supply or demand.

Also of note, EIA is adding some color on generation. They are increasing their utility-scale solar generation numbers to 6% of total generation in 2024 which is up from 4% last year. Conversely, they expect the continuation of slowing coal, with it providing 15% of generation compared to 17% last year.

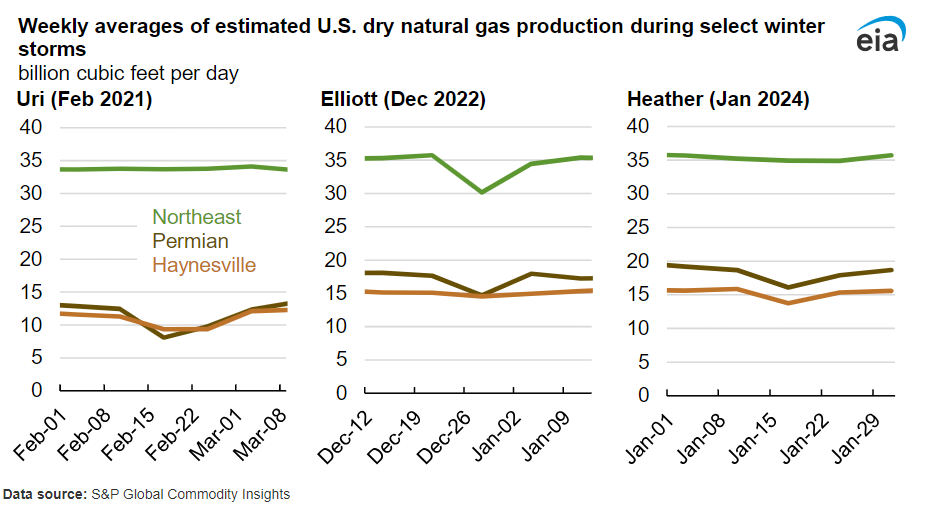

Staying on the theme of EIA this week. They presented another interesting chart this week. In the past few winter storms, well freeze offs have been a concern in the natural gas world. As the chart shows below, natural gas production dropped fairly dramatically in each region most affected by the storm. PJM talked about natural gas failures being a major problem during Elliot, and we can see clearly it wasn't just the plants, but availability of gas as well.

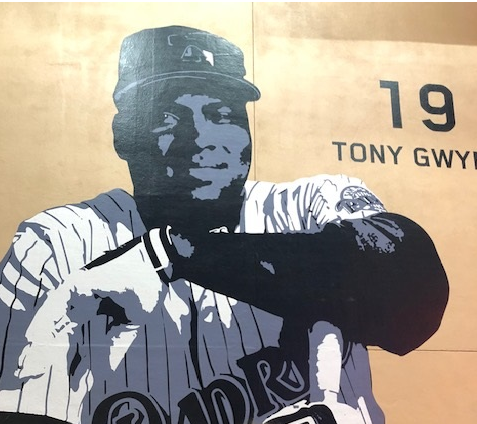

Finally, if you're a sports fan, spring brings the best of two worlds with the NCAA men's basketball tournament and opening day. Since we tend to be numbers guys, we thought we'd share this amazing statistic provided by an X favorite, BaseballHistoryNut. Hall of Famer Tony Gwynn (and personal favorite) dished out 590 assists in his four year All Conference career as a point guard at San Diego State. In 20 years as a big leaguer, he struck out 434 times. For context, HOFer Rod Carew (also a favorite) struck out 1028 times in 27 more career at bats. Amazing.

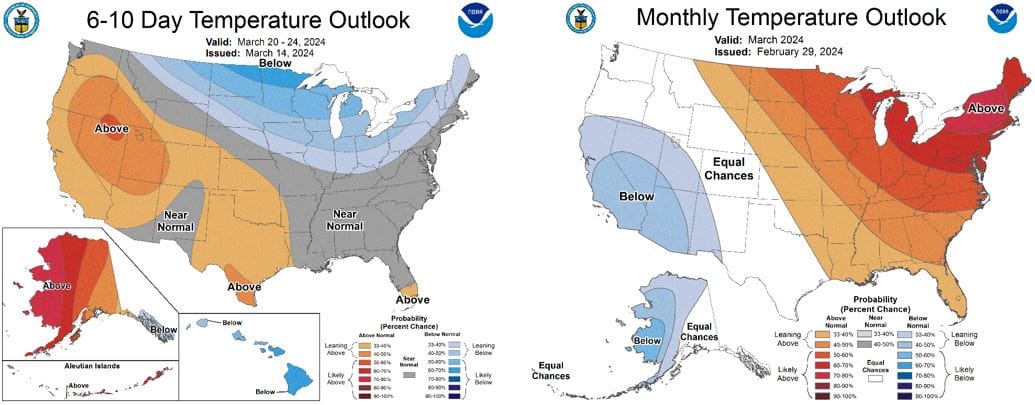

NOAA WEATHER FORECAST

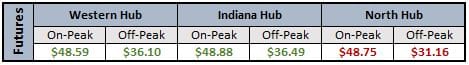

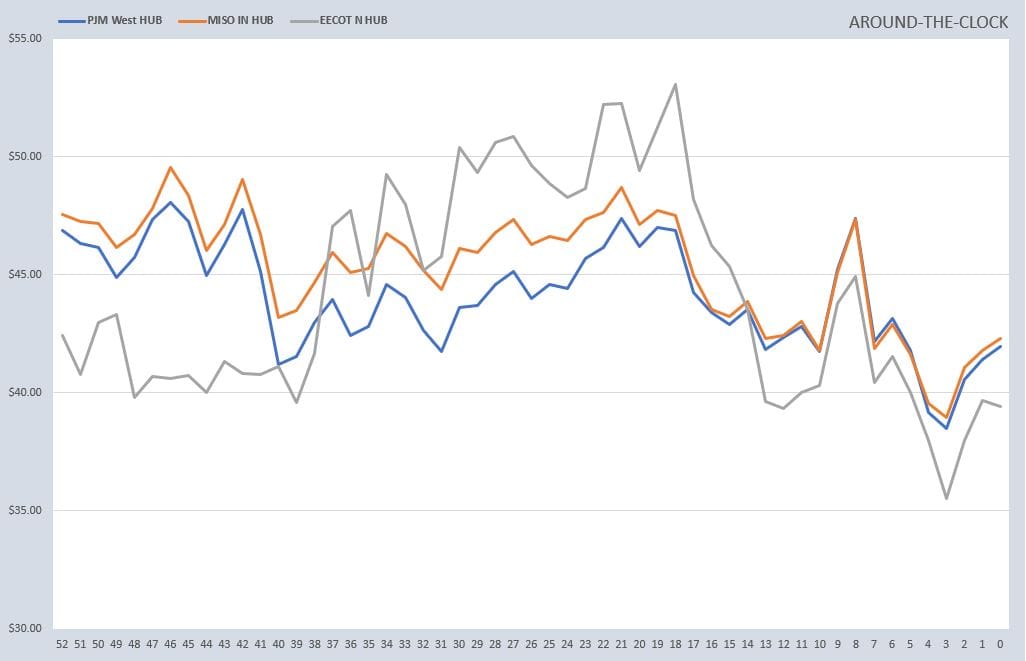

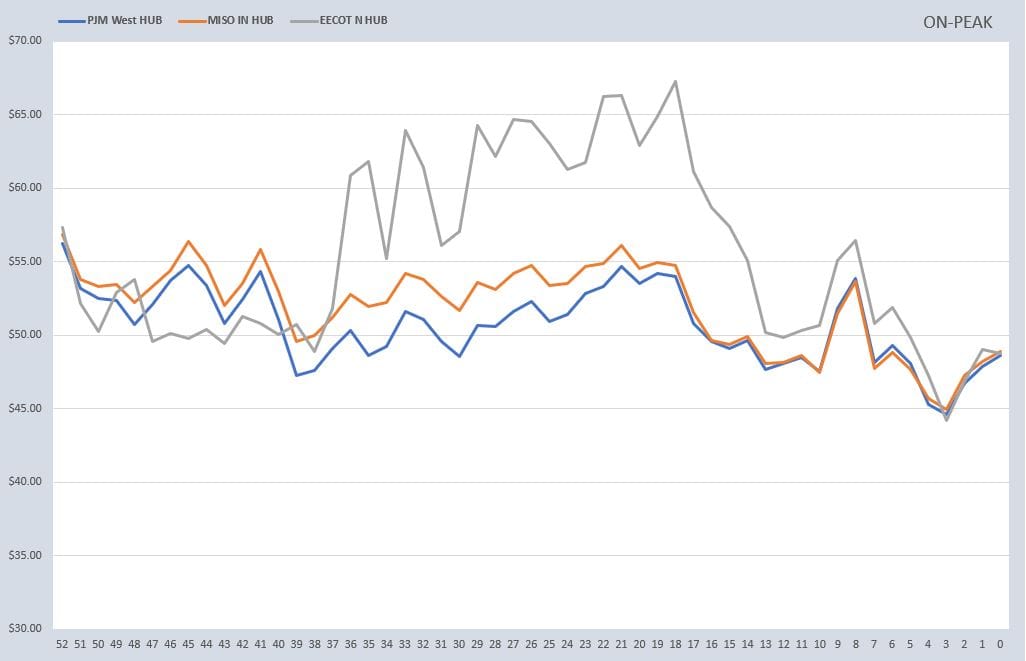

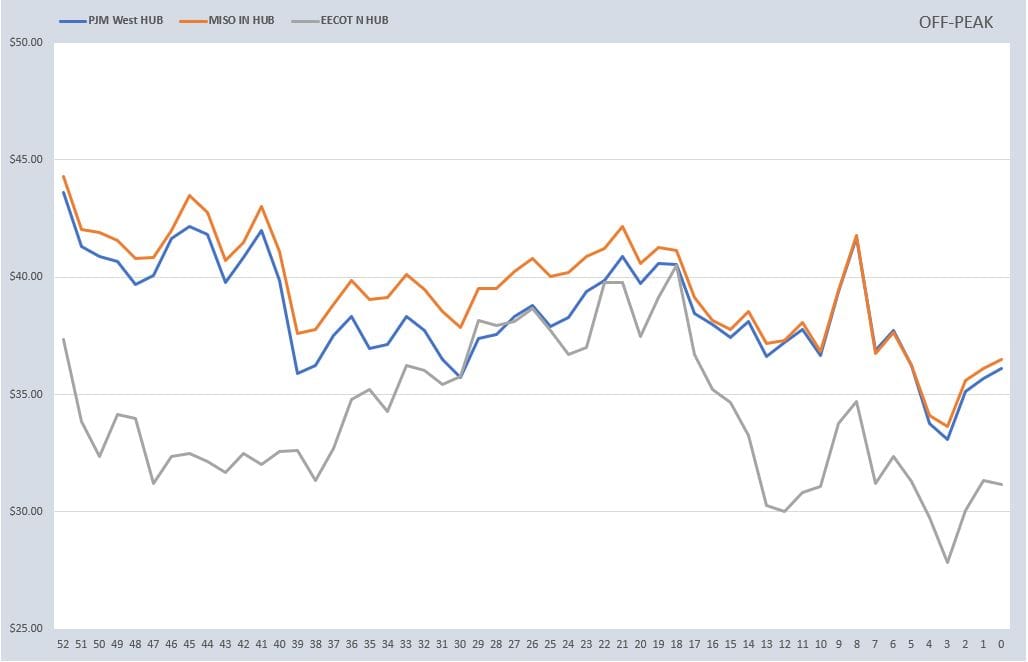

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

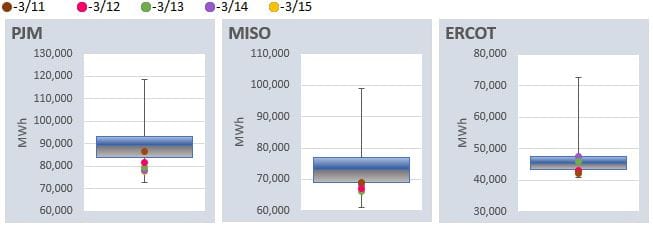

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: