Weekly Power Outlet US - 2024 - Week 16

Electric Prices, Semiconductors, FERC as Dean Wormer

Electric Prices, Semiconductors, FERC as Dean Wormer

Energy Market Update Week 16, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

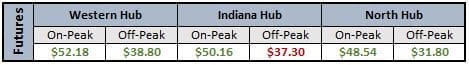

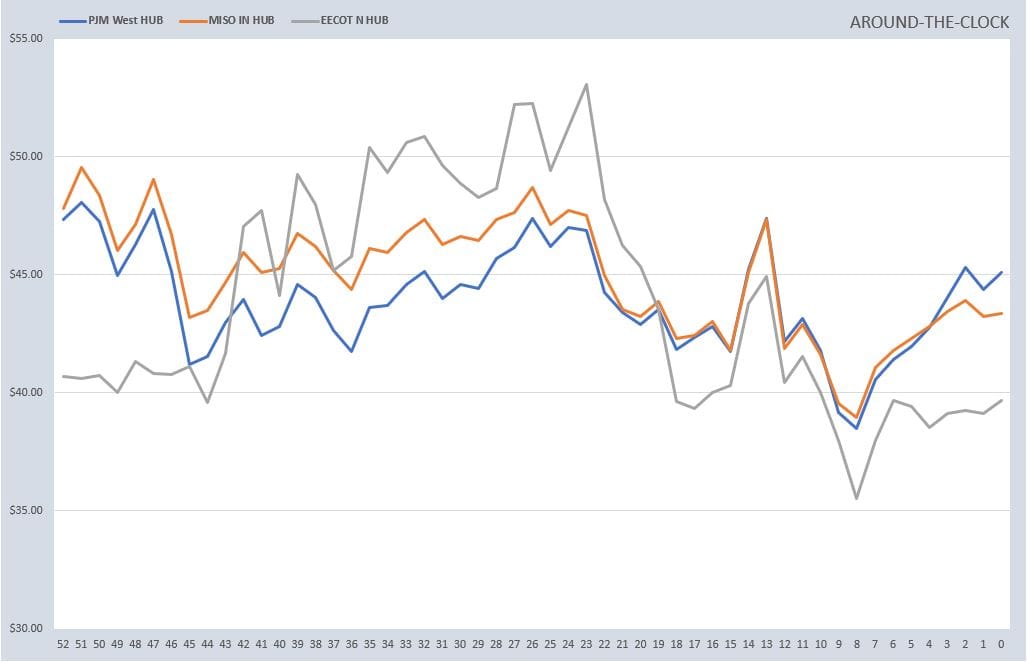

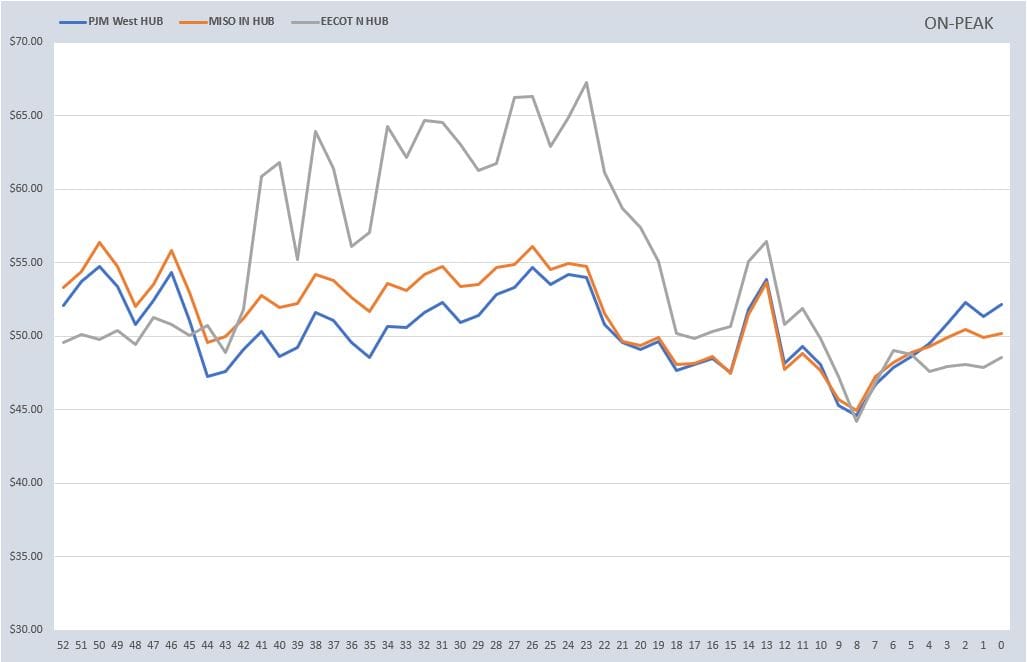

Day Ahead electric prices were fairly flat this week as seasonal spring temperatures settled across the US between bouts of severe storms. Of note for now, it looks like the pullback in the 1-year futures curve was a one-week hiccup.

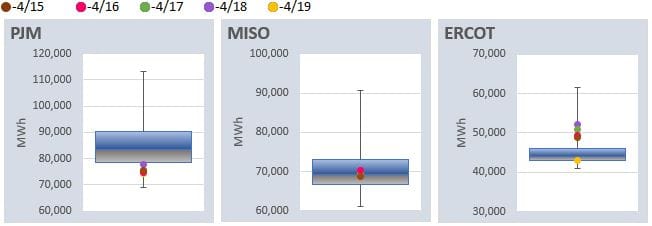

The natural gas market had a little excitement midweek, when a pipeline that supplies parts of the US exploded outside Edmonton AB. There was a slight rally as news outlets like the CBC were warning how long it might take to find the issue and fix. As it turns out, the issue was identified fairly quickly and any hysteria faded quickly. It's worth pointing out the current state of the gas market....potential minor disruption is met with bullish optimism, while fundamental reality is meant with a bearish retreat as prices moved quickly back down.

The EIA report was another yawner as 50 Bcf was injected into storage vs. the estimates of 44 Bcf. Storage is now 36.4% more than the 5-year average.

We've commented on how we appreciate corporate earnings season as Wall Street analysts get to hear from and ask questions of managements on quarterly earnings calls. This week we found an interesting take from Taiwan Semiconductor (TSM). We tuned in to listen for commentary on AI chips regarding the ongoing growth which relates to compute power and electricity. Interestingly enough, we heard some comments about electricity, but it was in the context of TSM having to raise prices as they are looking at significant price increases for electricity. This comment from CFO Wendell Huang, was of interest,

"We have just guided our second quarter gross margin to decline by 1.1 percentage points to 52% at the midpoint, primarily due to impact from the earthquake on April 3rd, as just discussed, and higher electricity costs in Taiwan. After last year's 17% electricity price increase from April 1st, TSMC's electricity price in Taiwan was – has increased by another 25% starting April 1st this year. This is expected to take out 70 to 80 basis points from our second-quarter gross margin."

While we haven't done any work on electricity prices in Taiwan, a 17%, followed by 25% rise seems like it might be an issue for industries with big electric footprints. TSM is the biggest semiconductor foundry in the world at 46% of total capacity. Their business is making semiconductor chips for companies. When you think Nvidia chips, Apple iPhones, Qualcomm telecommunication chips, and AMD processors, think Taiwan Semiconductor.

September 17, 2020, was the day FERC order 2222 was hot off the presses. This was going to be revolutionary as access to the wholesale electricity markets was going to be granted to almost all generation and even some demand response! Fast forward three and a half years, and this seems more and more like a dream instead of reality. Seemly, this has gone from great idea to a very complicated implementation that has seen most of the ISOs push start dates out to late 2020s or 2030 and testing the patience of some regulatory bodies....including FERC at times.

This week MISO and NYISO had FERC 2222 news. MISO updated its working group plans, and it seems, they are still on calendar 2030 for implementation. NYISO on the other hand, got the blessing from FERC to set the minimum of 10kW for aggregation and access to wholesale pricing markets within NYISO (the New York Commission was looking for a smaller minimum). In writing his concurring comments, Chairman Phillips stated, "To date, NYISO has been at the forefront of developing a participation model for DERs and seeking to implement that model expeditiously. We urge NYISO to build on that good work and to honor its stated commitment to work with its stakeholders to reassess the 10 kW minimum capability requirement as it gains experience implementing its DER participation.".

This might be dating ourselves, but we couldn't help but picture Chairman Phillips as Dean Vernon Wormer in the classic Animal House scene where he addresses the gang from Delta House about their grades just before kicking them out of school. Playing NYISO is Robert Hoover. "Mr. Hoover, 1.6; four C's and an F. A fine example you've set.". The other ISOs are all probably Kroger, D-Day, and Bluto, and hopefully none is Kent Dorfman when the FERC says "well, out with it".

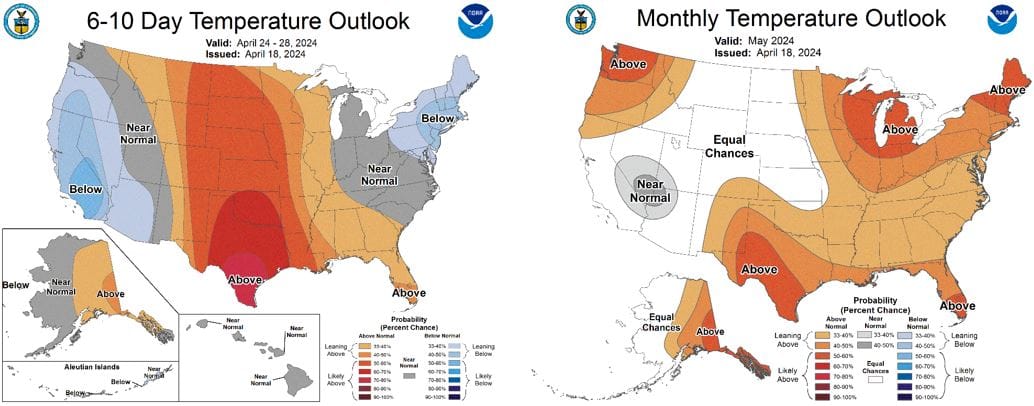

NOAA WEATHER FORECAST

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

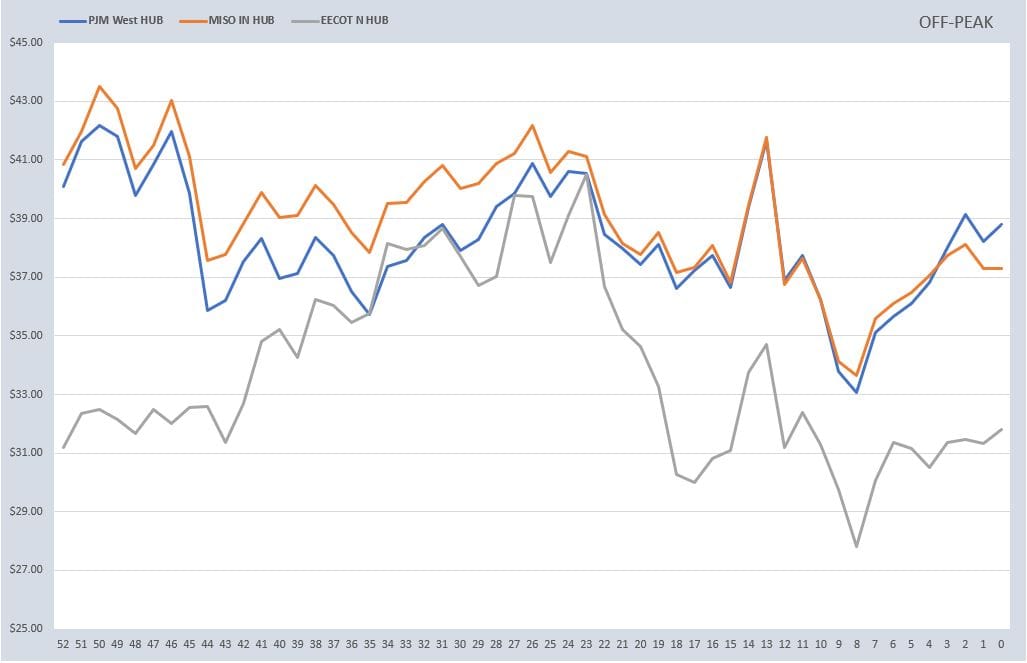

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: