Weekly Power Outlet US - 2024 - Week 17

Natural Gas, EVs, India Power

Natural Gas, EVs, India Power

Energy Market Update Week 17, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

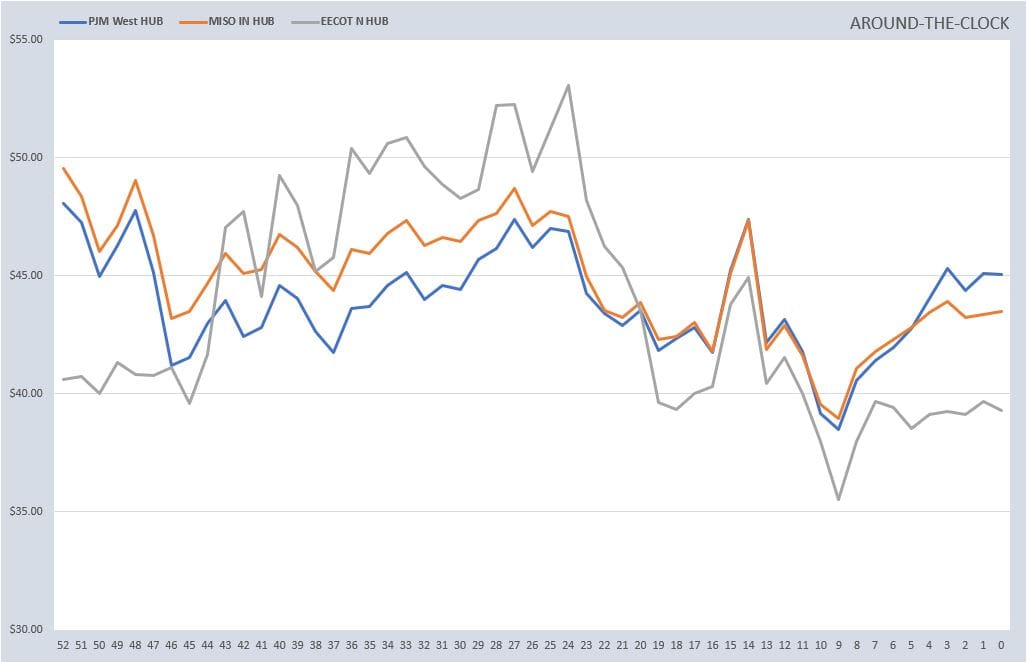

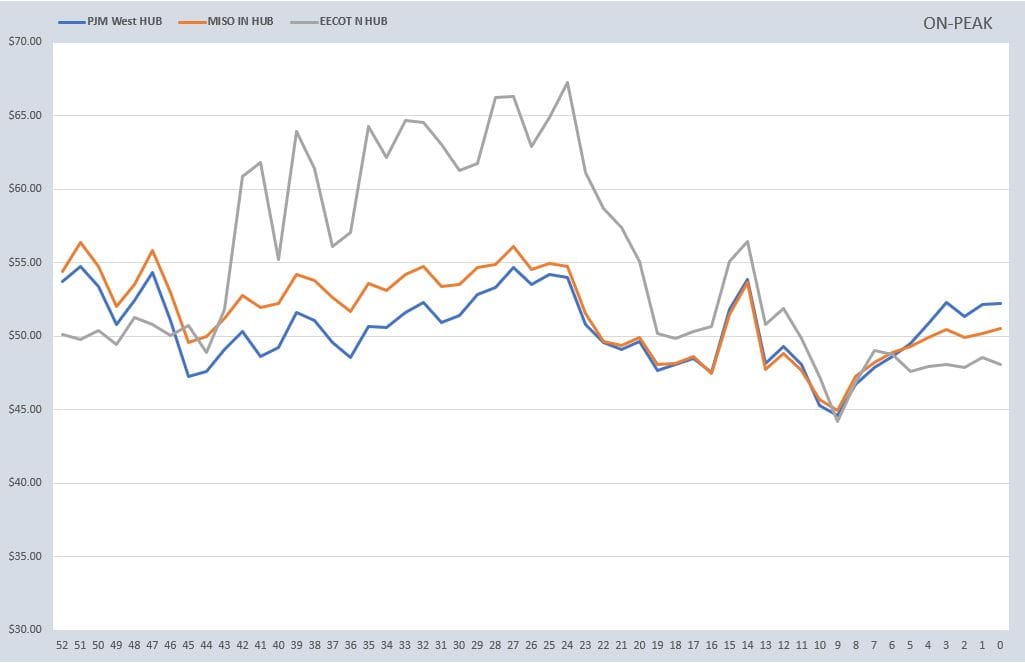

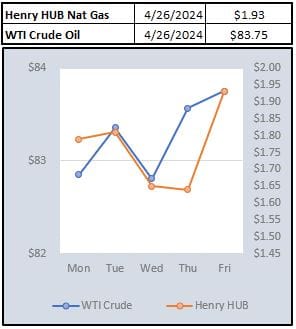

Electric prices, both day-ahead, and longer-term futures were fairly flat week over week. They didn't reflect the somewhat wild ride of the natural gas market. Actually, given where gas is trading, it's probably fair to say big chart moves are like big moves on the kiddie roller coaster....probably fun and scary for some more than others. EIA storage numbers were well above expectations with a build of 92 Bcf vs. estimates of 79 Bcf. This number following a report that a train at Freeport LNG export terminal had tripped and had not been restarted cutting export capacity. The two news events helped take the June contract (new front month) from $2.15 at the beginning of the week to $1.90 this morning.

There were a few things in the fundamental story for natural gas bulls to point to, although timidly. US production has now ducked negative on a weekly YoY measurement. This week's production stood around 98 Bcf/d compared to over 100 for almost all of last year, and a peak earlier this year of over 105 Bcf/d. Also, there is starting to be some talk of European and Asian LNG buyers trying to play, what we call stock market, and delay purchases hoping for better prices. While that might be a prudent play, Econ 101 teaches what happens if all start buying late in the season playing catch up. Long time bears have said production needs to come down, and we all know Asian and European buying can certainly move the US domestic market. Both of these are worth watching.

If you live in the world of EVs, it's been an interesting week. Early in the week, IEA released its Global EV Outlook 2024 with a headline reading that the "the world's electric car fleet continues to grow strongly". Reading beyond the headlines, they did use the qualifier, "despite near-term challenges in some markets". With the ink barely dry on their report, earnings reports from Tesla, Hertz, and Ford this week highlighted some of those challenges.

Telsa led the parade with a YoY decline in car sales for the first time in four years. Musk referred to pressures globally on EV sales as part of the issue. There was talk of a less expensive car on the way with a possible launch coming before 2025. Musk almost seemed more interested in talking about the other initiatives at Tesla than he did cars.

Hertz was next up and saw a 15% stock move down after reporting weaker earnings, highlighting the continued issues with its EV fleet. Hertz took a $195 million charge on in the quarter on EVs held for sale, which follows $245 million last quarter. In the words of COO Justin Keppy, "we increased the EV disposal plan by another 10,000 units, bringing the combined reduction to 30,000 vehicles, which we expect to complete by the end of the year.". If you recall, Hertz started to sell off EVs last quarter as high costs and low customer interest were becoming a problem.

Finally, Ford weighed in with its earnings which seemed to be ok, although not because of EVs. CNN Business summed it up best with their headline, "Ford just reported a massive loss on every electric vehicle it sold". That "massive loss" was $1.3 Billion or $132k for each car sold in the quarter. Ford included R&D and other design costs which will continue to add to costs in future quarters.

On the flip side of the doom and gloom, GM's report did include some comments about dealer adoption sounding positive. They said product launch will be paced with customer demand and that the past high costs, like those at Ford currently, have gotten them to the point of some new launches.

From time to time we get asked if we are negative EVs, which is fair given our writings, but the answer is no. We just think this is a little harder than building a baseball diamond in a corn field somewhere in Iowa. If you build it, they might not come in this case.

This week, India's Federal Power Ministry released a report stating that the country's power generation capacity would grow just over 9% trying to meet the needs of predicted heat and economic growth. According to their statistics in a year-end report, India has roughly 420 GW of installed capacity, which is about twice the size of PJM. Adding 9% to that number would be equivalent of adding an ISO-NE to the generation stack. The increase will come from gas, coal, biomass, wind and solar with all rising around the 9% level. The caveat, fossil fuels make up just over three quarters of the generation stack. Given those numbers, we should expect to hear more about coal fired plant builds and LNG contracts going forward.

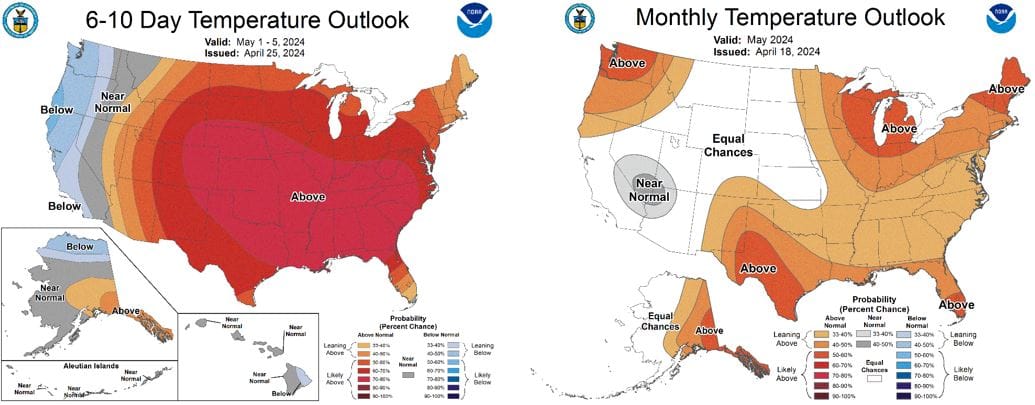

NOAA WEATHER FORECAST

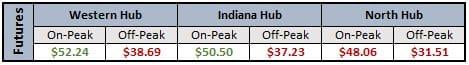

DAY-AHEAD LMP PRICING & SELECT FUTURES

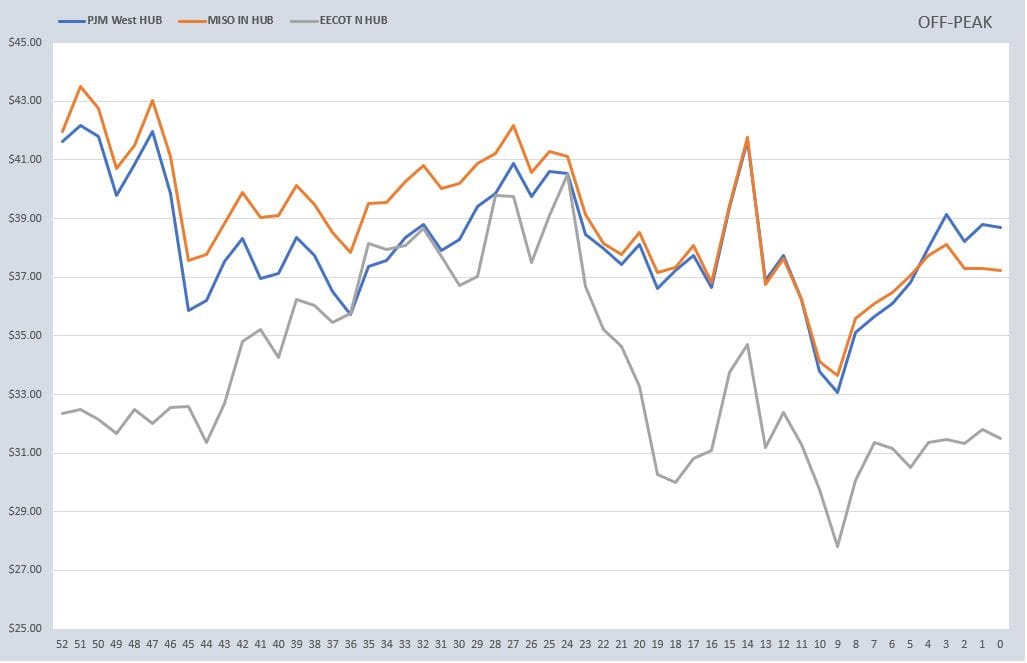

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

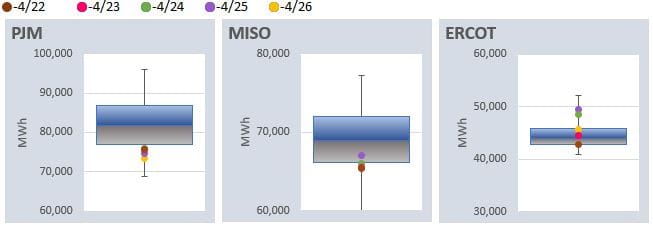

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: