Weekly Power Outlet US - 2024 - Week 18

Wall Street and Utilities

Wall Street and Utilities

Energy Market Update Week 18, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

This week we took the time to pour over the investor first quarter earnings presentations by a handful of investor owned electric utilities (IOU). While revenues and EPS are cool, we try to find themes or one-off points of interest in these calls. Often times we stumble onto a theme that is common to all. This quarter, not surprisingly, it's data centers. Specifically, the load growth associated with them and the plans around meeting these loads. This week's WPO will be dedicated to some of the discussions on datacenters and other things we found interesting in some of the calls.

For those not familiar with the earnings conference call of IOUs, we can share a quick overview. The company makes a statement, usually the CEO, then shares some financials, usually the CFO and then it is open to Wall Street analysts that follow the company asking questions. The earnings call dance between company and analysts goes something like this....are you growing your load demand (increasing revenue)? How are you going to meet load growth (integrated resource plan/generation assets)? And, the biggie, how and who, is going to pay for it which means a discussion on rate cases or financing assets. Not surprisingly, Wall Street loves earnings, and they want to know the plan associated with being a steward of "their" capital...and it better be good!

So, with that, let's take a look at the data center discussion. There are numerous IOUs reporting numbers every quarter. In fact, there are so many our sanity would be threatened trying to listen to or read the transcript from all the earnings reports. Because of that, we try to take a decent sample with American Electric (AEP), Wisconsin Energy (WEC), Xcel Energy (XEL), Florida Light and Power or Nextera (NEE), DTE Energy (DTE), Southern Company (SO), and a few others.

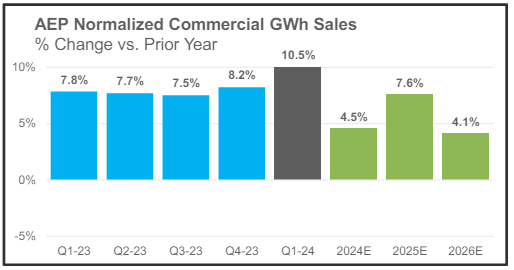

Starting with load growth, almost everyone had double digit growth YoY in data center. Below is an example of the trend in growth from AEP where they are working through large load growth in Indiana and Ohio. XEL said their total load growth will grow 3% annually led by double digit data center growth. Microsoft has proposed a data center on the site of Sherco (Becker, MN), their biggest coal plant that is scheduled to be retired, and added MSFT may become their biggest customer in the state of MN. Not to be outdone, WEC has been working with MSFT on a 315-acre site that has a planned 1,400 MWs of new generation associated with it. CEO Gale Klappa told all to be ready for news from MSFT in the near term regarding even more expansion. SO, said data centers were up 12% YoY with 75% of that coming from existing sites and the other 25% from new sites. Data center growth is not breaking news, but the numbers do seem to be growing with each passing quarter.

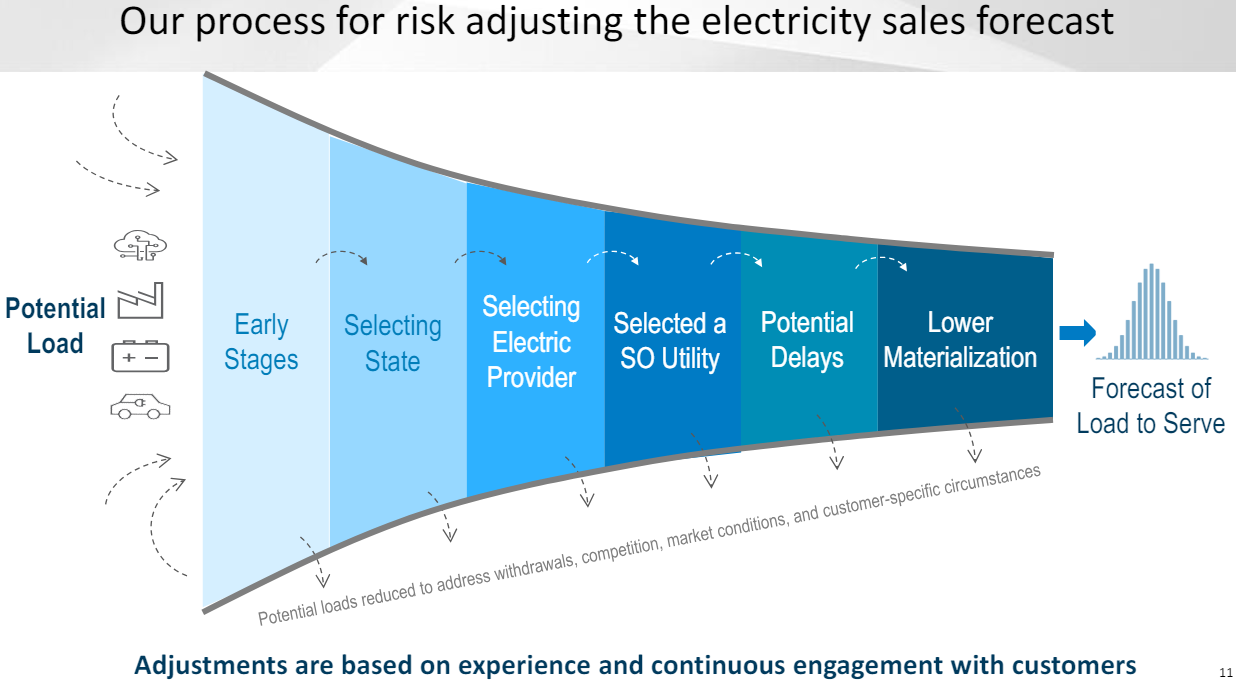

As you can imagine, Wall Street likes load growth because it usually correlates with revenue growth. That said, what Wall Street doesn't like is uncertainty. So, when IOUs start projecting forecasted load growth, there needs to be some reasoning behind it. Also, it seems that some hyperscale data centers (usually 50 MW or greater) have decided to shop around. Hyperscale centers also understand that they are an attractive customer and have a little leverage, and not to mention, they have shareholders and analysts calls to address as well. Because of that, there has been some gamesmanship, or negotiating, with IOUs for pricing and share of new generation costs. As expected, this very practice can leave utility analysts a little uneasy when it comes to load forecasts and the generation to match it. Said another way, good luck being the CEO that starts a billion-dollar project based on a customer that decides to move elsewhere. Because of this, there were a fair number of questions about vetting of customers and how IOUs think about future load. For the most part, IOUs are requesting upfront capital. Instead of trying to spell it out, below is a good representation from the SO investor presentation.

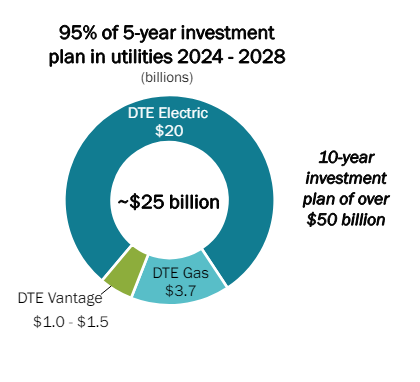

Now that we've established some certainty around load growth, how is the generation needed going to be sourced or built, and financed? Everybody has a plan or projection, and it looks something like the DTE slide below.

There is always an IRP, or plan with specific projects, and a price tag associated with it. As expected, lots and lots of renewable talk has come up during this part of most of the conference calls. For instance, Nextera/FLP is planning on adding 21 GW of solar in the next ten years. The who is going to pay for these questions have been pretty interesting. As expected, the individual state commissions aren't thrilled about any plan where the rate payers would wear the brunt of added generation to meet load demand from data centers. For the most part, the comments from CEOs suggests that the big players like MSFT, Amazon, and Meta understand this and are willing to take on some of these costs. When it comes to the conversation of IOUs spending capital to build or buy generation, it almost seems like you can hear the analysts in the background putting pencil to paper calculating various debt/equity ratios and making sure the numbers make sense. This is the part of the call where the CEO usually quickly lets the CFO answer questions and there is some back and forth until the analyst has some reasonable understanding of the numbers and we can all move on.

Frankly, it takes a special kind of interest or attention span to sift through any earnings call and utility calls can be much worse. That said, the expansion the industry is facing from load growth has made these calls more interesting as conversations seem to be more real world and not just financial. More than once a scene from the movie Margin Call popped into my head this quarter. It's a Wall Street movie about the 2008 banking crisis and in the scene the CEO says the music has stopped when talking about a report from a risk analyst. The analyst responds, 'this report shows the music just slowing, if it stopped it would be much much worse.'. While not a perfect analogy, if the load demand to generation story is just starting, the generation projections aren't even close to what will be needed.

If you're still with us, we will add a few other things we found interesting in the calls.

As expected, SO raved about Vogtle 3 and 4 coming online this week. Some discussion was started as to 5 and 6 already.

NEE, as if almost responding to SO, was quick to point out that nuke is no good. Renewable (specifically solar) can be mobile and go to where the load is needed.

XEL talked a lot about the Texas wildfires. It seems insurance will be enough to cover most of the claims. Also, they mentioned RFPs for 5-10k MW in the next couple years.

DTE in what seemed like a well-orchestrated slip of the tongue, said they'd be open to offers for DTE Vantage which is their renewable arm.

And finally, almost everyone had comments on the new EPA rules regarding fossil emissions, but I think interim CEO Ben Fowke of AEP summed it up for everyone when saying they would consider legal challenges. From the earnings call transcript, "...our industry has come so far in carbon reduction. And I think we're trying willing to do so much more, but it has to be with affordability, reliability, and resiliency in mind. And I'm just-I'm really passionate about that. And you never like to have to sue, but we're going to do what we have to do to defend our grid and our customers that use that grid every single day.".

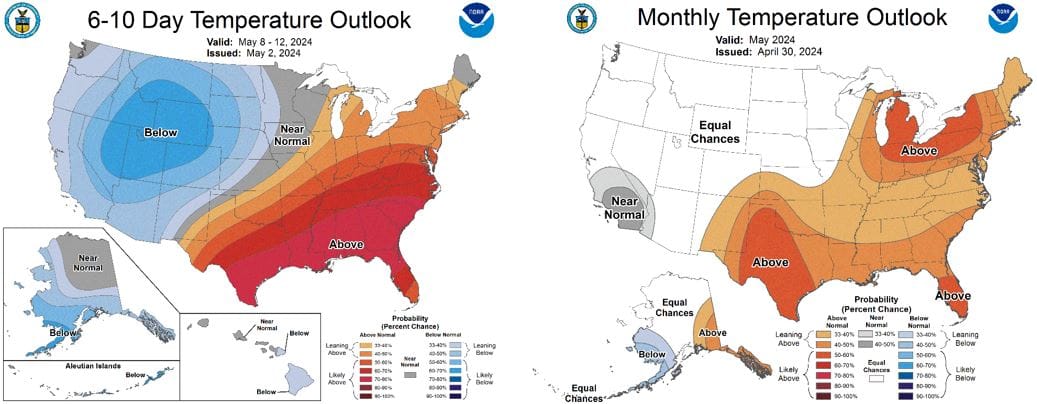

NOAA WEATHER FORECAST

DAY-AHEAD LMP PRICING & SELECT FUTURES

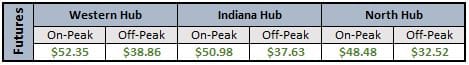

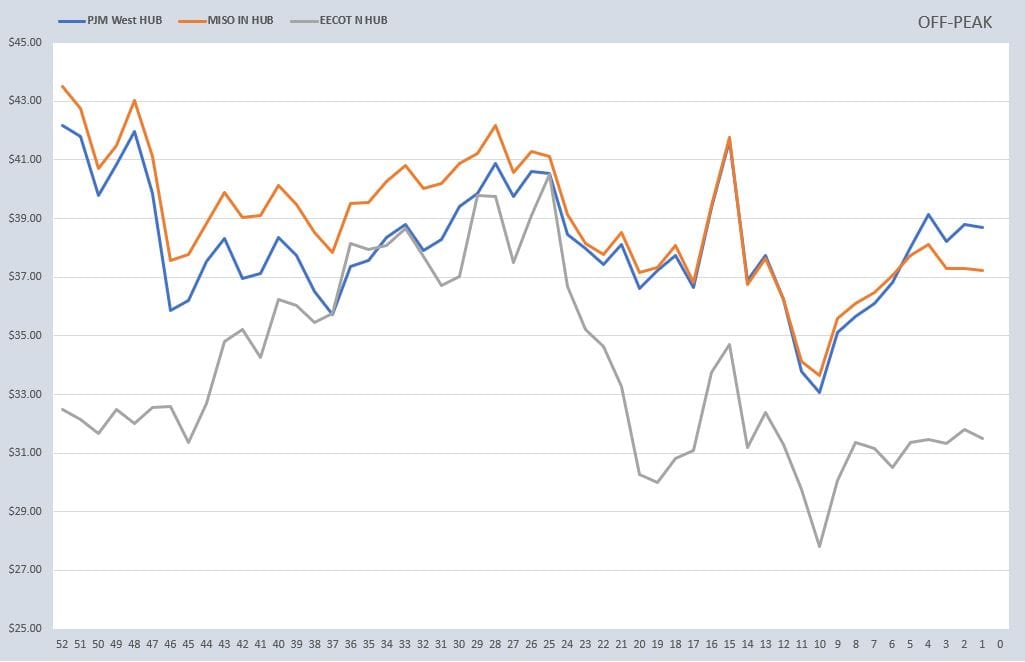

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

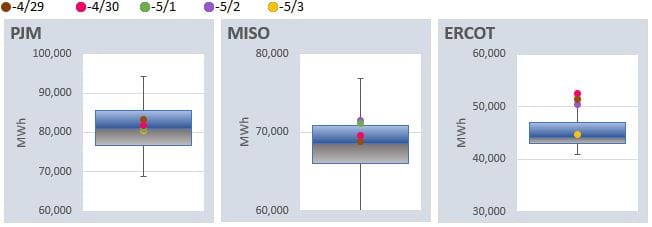

DAILY RTO LOAD PROFILES

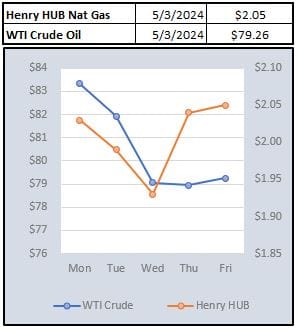

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: