Weekly Power Outlet US - 2024 - Week 2

Hello Winter, Gas and Wind, EVs.

Hello Winter, Gas and Wind, EVs

Energy Market Update - 2024 - Week 2 , brought to you by Acumen.

For More Updates Like This, Subscribe Here!

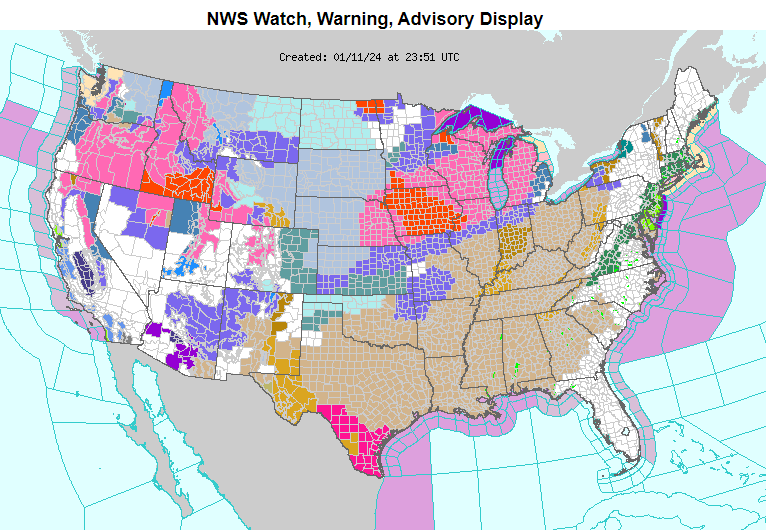

Winter has arrived and with an impressive entrance. This weekend might be the Super Bowl of weather (insert any other favorite metaphor) for the folks at the National Weather Service. Looking at the map below, most of the country is already covered in advisories, watches, or warnings with most in the central US being cold related conjuring up pictures of Elliot and Uri.

Not to be outdone by the folks over at the NWS, the RTO/ISO control centers have been busy this week. Below the map are a list of alert messages out from MISO, PJM, SPP, and ERCOT.

The MISO Reliability Coordinator (RC) is declaring Conservative Operations, effective from 01/13/2024 06:00 EST to 01/17/2024 22:00 EST

SPP is extending the current Resource Advisory for its entire Balancing Authority effective 5 a.m. CT Sunday, Jan. 14 until an anticipated end time of 12 a.m. CT Thursday, Jan. 18. This change extends the advisory from a previous anticipated end time of 12 a.m. CT Tuesday, Jan. 16.

PJM WESTERN A Cold Weather Alert has been issued from 00:00 on 01.14.2024 through 23:59 on 01.17.2024 Per M-13

ERCOT has issued a Weather Watch from January 15-17 due to forecasted extreme cold weather across the ERCOT region, higher electrical demand, and the potential for lower reserves. Grid conditions are expected to be normal during an ERCOT Weather Watch.

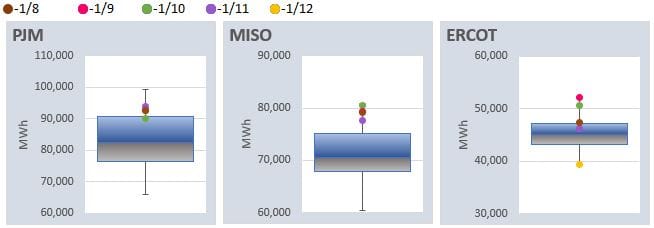

Natural gas futures have reacted to the upcoming winter weather as the February front month has moved from $2.75 to $3.25 this week. Thursday's EIA data showed a withdrawal of 140 Bcf compared to an estimated 120 Bcf. This shouldn't be all that market moving considering current levels of storage. What has the market a little spooked is the potential for supply issues. This week production pulled back to three-month lows, which again given storage levels shouldn't be a big deal, but the market also remembers Uri and Elliot. In both cases, because of freeze up and other complications, output dropped around 20 Bcf/d which is about a 20% cut in production.

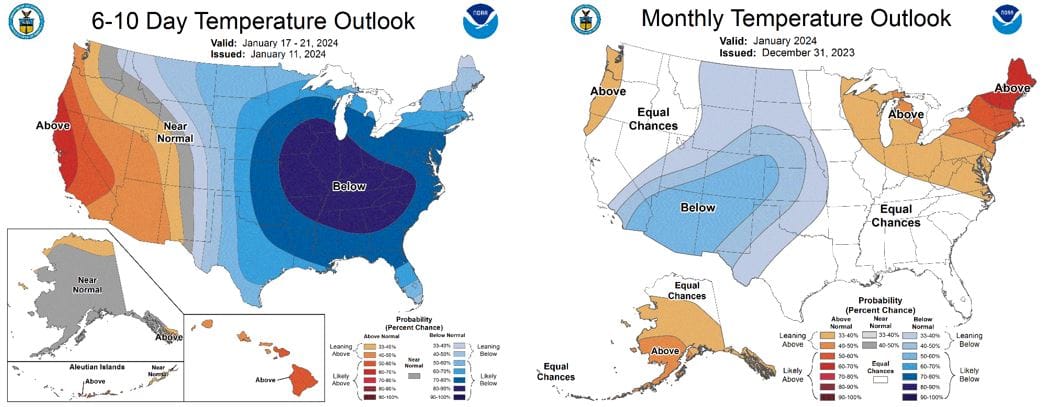

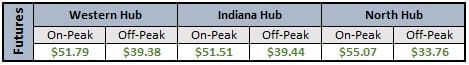

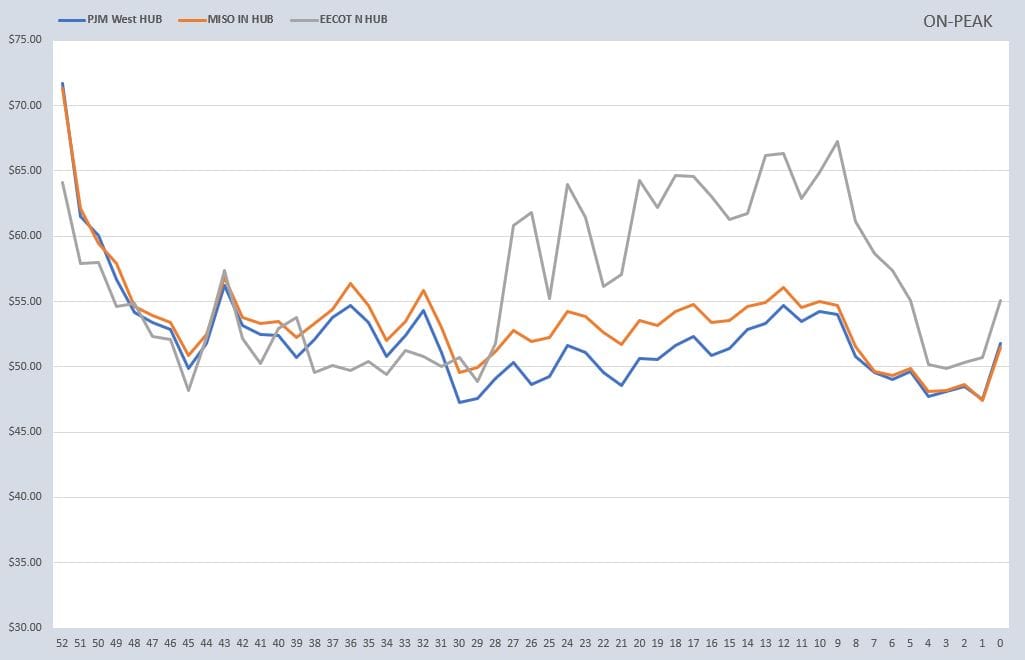

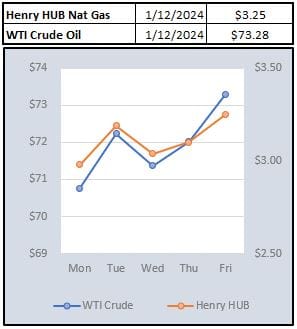

Interestingly, if natural gas supplies should remain relatively uninterrupted, Day Ahead pricing might seem like a nice fall day. Looking at pricing below, today's DA prices are reflecting the start of some of the cold moving in. Using prices as a guide, it'd be hard to conclude that it's getting cold-what gives? Referring back to our NWS map, if you drill down to the bulk of those advisories, they all have wind in them. Wind advisory, wind chill warning, blizzard warning...wind might save the day, should both wind and gas not have catastrophic cold weather issues. In any event, it looks like a good weekend to grab a favorite beverage and watch some football.

Last week we highlighted another gut punch for offshore wind as Equinor and BP put Empire 2 on hold. This week EV's are the renewable headline of angst. Rental car company Hertz Global Holdings announced that they are selling 20,000 EVs (about one-third of total EVs) from their US fleet opting for gas powered vehicles. This is a one hundred and eighty degree turn from their goal of having 25% of the fleet electric by the end of 2024. Depending on what outlet your read the story, Hertz is getting rid of the cars because drivers can't handle them, thus increasing damage costs, or customers don't want them along with high maintenance costs. Either way, this adds to news that's been trending toward a slower EV adoption as of late.

NOAA WEATHER FORECAST

DAY-AHEAD LMP PRICING & SELECT FUTURES

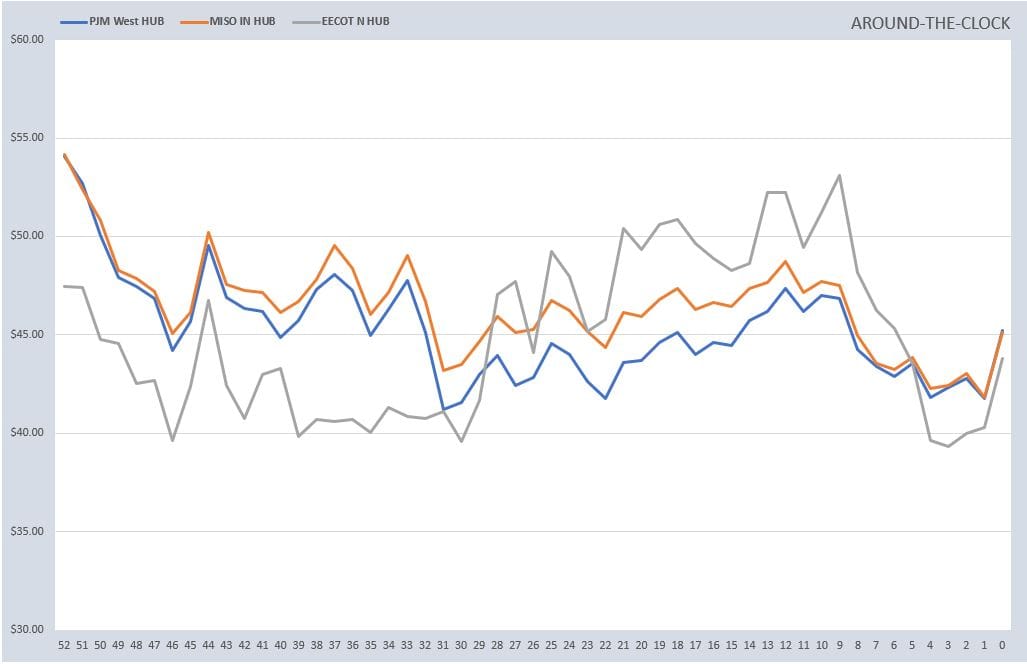

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

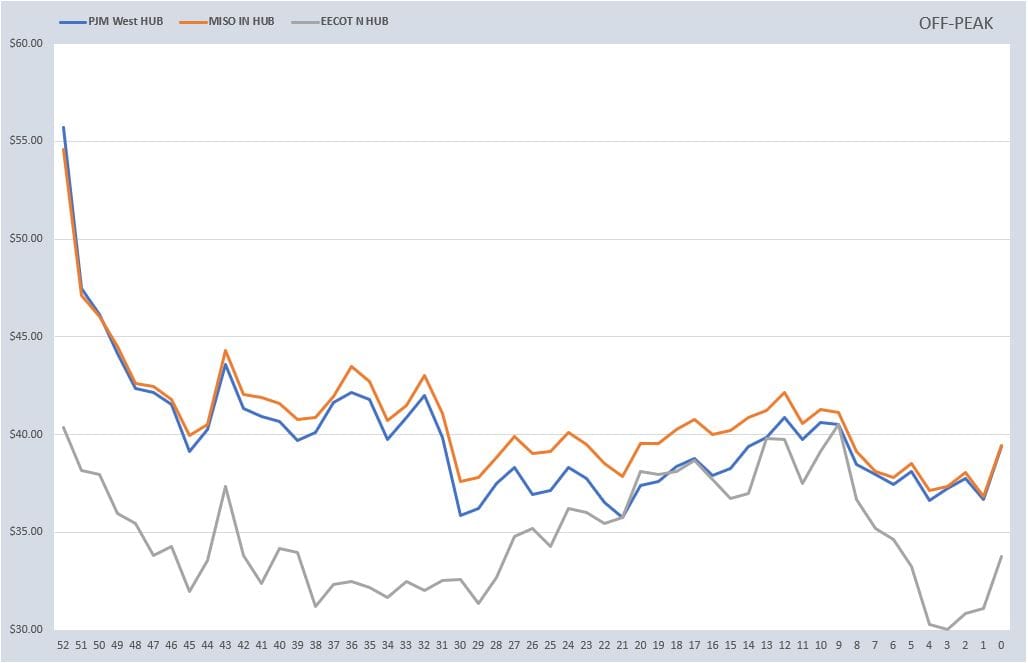

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: