Weekly Power Outlet US - 2024 - Week 23

Gas and Electric, NYISO, 2050

Gas and Electric, NYISO, 2050

Energy Market Update Week 23, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

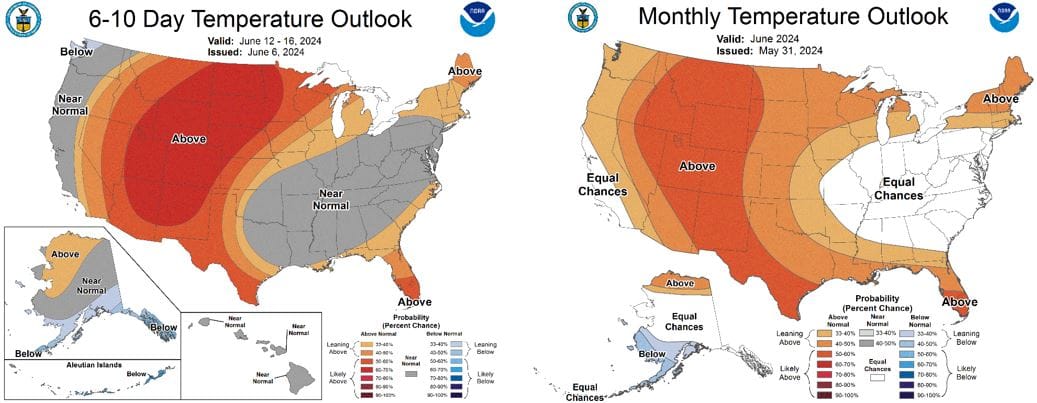

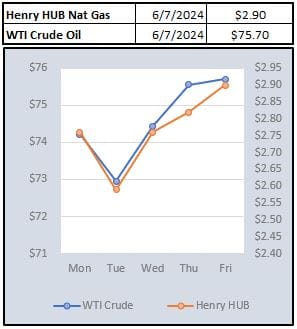

Natural gas futures have been in one of those extreme Disney Park roller coaster rides over the last couple weeks. If you recall, lower production was met with higher production rumors which leave us....frankly, I'm not sure. The July contract has traded from $3.20 to $2.55 and enjoying a round trip back to $2.90 late this week. There wasn't much in the EIA storage report as 98 Bcf is injected versus a consensus of 86 Bcf. As cliche as this is, scroll down to the middle of the WPO and the forecasted weather maps might be telling the story.

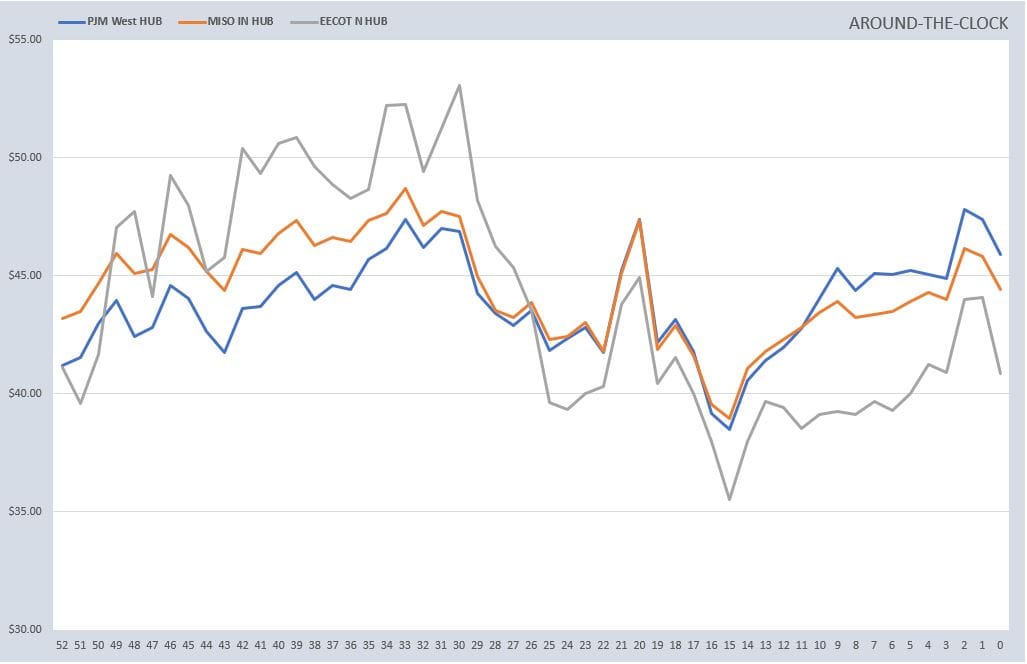

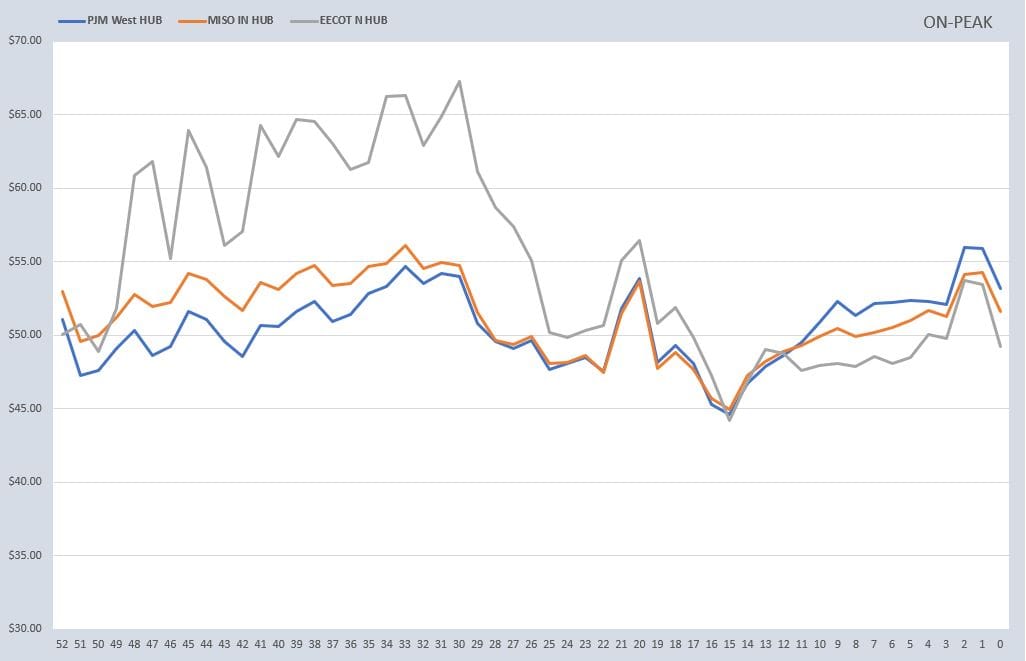

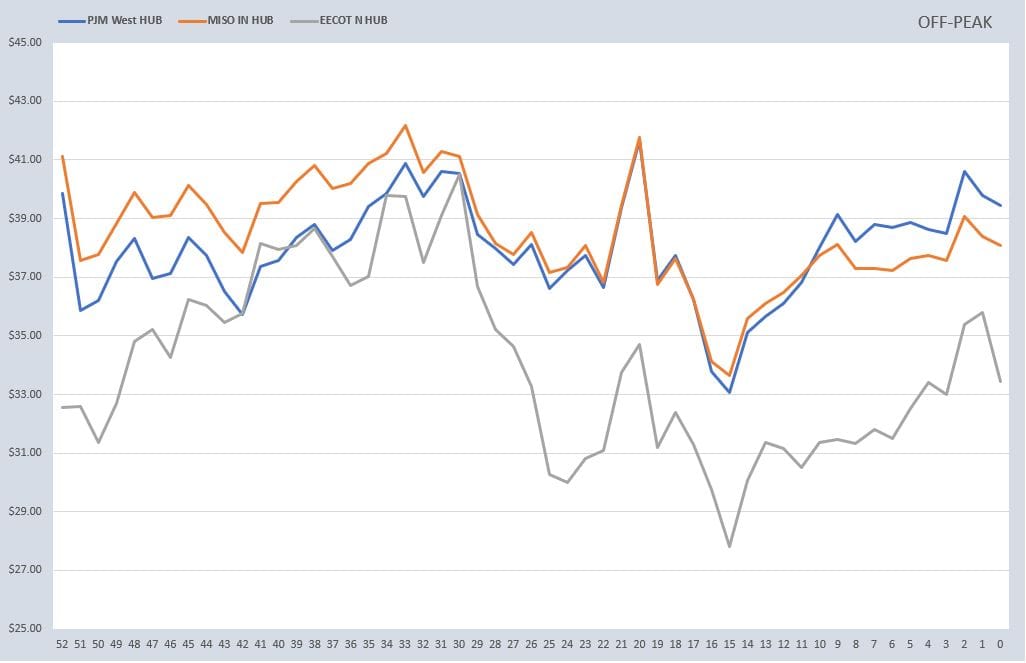

For the most part, electricity futures have been following natural gas in lock step as would be expected. Interestingly enough, looking at the ATC futures strips below, the three trading hubs we follow are kind of right back where they were a year ago. PJM is a touch higher, but for the most point, we are back to a year ago. We often mention the $50 on peak seems to be a real support level so it's worth watching again.

The New York ISO released their annual Power Trends report this week. The report is a comprehensive and very well-done report on the state of the NYISO addressing long term reliability. The report is broken into the grids current and future states and the markets associated with it.

Given the largest US media market lies within the NYISO, it's not surprising that the media picked up on the report. The focus came on summer reliability, load growth, and baseload generation retirements. Declining reliability issues, specifically NYC, have been identified as the region waits on the completion of a transmission line from Canada. Specifically, the NYISO expects summer load to be roughly 31.5 GW under normal conditions, with 35 GW of resources available to meet the load. Where it gets a little tricky, is during some extreme weather, or heatwave. According to the report, should the average daily temperature hit 95 for three consecutive days, demand would rise to the point where starts eroding excess reserves. If that temperature goes up a touch more, the reliability margin is basically zero and all available capacity is used to meet demand and we all know what the next step is.

This week CPC Corp of Taiwan signed a long-term supply agreement with QatarEnergy for a period of 27 years. While these long-term agreements aren't new, the length and the fact it's with Tiawan sent us down another of our rabbit holes. Taiwan has been one of the leaders in carbon neutral by 2050, so seeing them agree to delivery of fossil fuels beyond that was interesting. With that, we decided to dive into their 2050 plan to carbon neutrality. Like most countries, electricity generation is their biggest current carbon footprint, bigger than transportation and industry combined. Their path is going to include renewables accounting for 60% of generation and installation of smart substations will be 100%. While this may be doable, signing fossil contracts beyond 2050 just seemed counterintuitive.

This got us thinking to the Net Zero America 2050 electrify everything movement from a couple years ago. This was a paper that came out of Princeton back in the fall of 2021. It's been a while since we read it, but we've just never believed it possible. Last year, both Wood McKenzie and Bloomberg were out with reports that tagged the bill of global net zero at somewhere around $2 Trillion a year with a good chunk of that spending here in the US. For us, it's not a matter of technology, it's just not feasible with current economic conditions.

To be fair, we could steal some of the plan from Taiwan that states zero-waste, low carbon diet. Reasonable buying and zero waste catering are two of the action items on that list. After stopping at Starbucks for a $7 Cold Brew on a walk back from a catered event that saw half the food left for the trash, I don't like our odds on that either.

NOAA WEATHER FORECAST

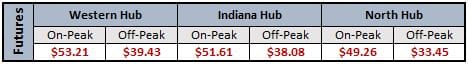

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

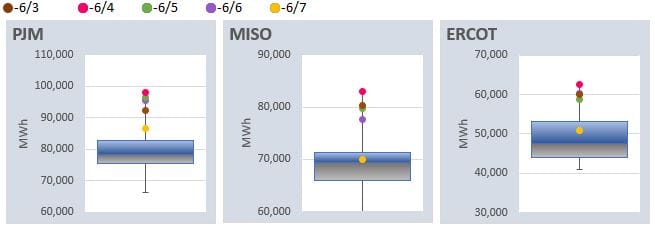

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: