Weekly Power Outlet US - 2024 - Week 26

Load Growth, Compute, Wind Power

Load Growth, Compute, Wind Power

Energy Market Update Week 26, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

Over the past year we've done a handful of presentations talking about electricity market volatility. We try to take a commonsense approach to what we think are going to be things adding to volatility and talk a lot about those things from week to week here in the WPO. To us, the main drivers are natural gas becoming the marginal fuel setting prices, grid transition with inadequate transmission and intermittent generation, and load growth.

Over the past couple years, the conversation about load growth has had a couple different front men. First it was electrify everything and net zero, then EVs, now compute power. When we comment on electric price volatility, we also mention population growth and/or migration. To us, electrify/net zero is a challenging landscape due to the political will and the cost. If you've read the WPO with any regularity, you've seen numerous sightings of articles and events that point to the EV adoption predictions being very overstated.

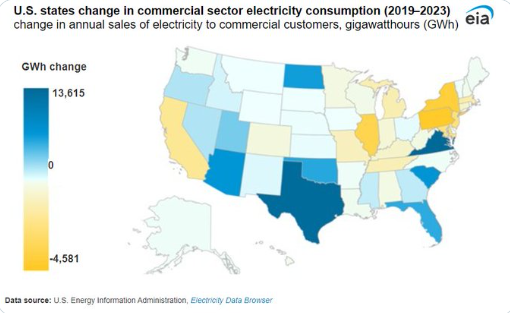

Finally, there is compute power and population, and those we find very real. Today the EIA put out a graphic that puts into a picture some of what this looks like. This graphic was presented to show how computing power has grown over the last four years using commercial consumption. We would also conclude there might be some population migration included. The states where we think of computing power have shown up as big increases, specifically Texas, Virginia, and North Dakota. North Dakota, really? Yup, not to get off track here, but North Dakota has become a hot bed of computing power with pent up cheap wind energy in the east (again, inadequate transmission), and cheap natural gas in the Northwest part of the state as a byproduct of oil exploration in the Bakken.

Regarding population, pick your favorite political narrative as we aren't touching that one, but it is fair to assume that states where commercial power usage is down are seeing population moves. As populations shift, more or less commercial load tends to follow them as more people require more Costco, Target, or Walmart stores.

Sticking with load growth and compute power, this week saw some interesting happenings with Amazon and their attempt to locate at Talen Energy's Susquehanna nuclear plant in Pennsylvania. AEP and Exelon are challenging this agreement, basically saying that if they are allowed to do this, it would essentially be a free ride for AWS to use the transmission system without paying for it and pass additional costs along to customers in PJM. Rather than try to summarize Talen Energy's response to the claim, we are including their press release below. This issue is going to get interesting and will be watched by many. One of the claims of AEP and Exelon is if this is allowed, there will be a mad dash for collocation with power plants, upsetting a PJM capacity market that is already becoming more jumbled.

Talen Energy Corporation ("Talen") (OTCQX: TLNE) today issued the following statement:

The rapid emergence of artificial intelligence and data centers has fundamentally changed the demand for power and leads to an inflection point for the power industry. Talen's co-location arrangement with AWS brings one solution to this new demand, on a timeline that serves the customer quickly. We believe powering the data center economy will require an all-of-the-above approach, which includes both metered and behind-the-meter solutions.

Exelon and AEP's protest of the Susquehanna ISA is a misguided attempt to stifle this innovation by interfering with an ISA amendment agreed to and supported by all impacted parties – which Exelon and AEP decidedly are not. The factual recitations in the protest are demonstrably false. The legal positions are demonstrably infirm. And nearly all the issues raised by Exelon and AEP are not subject to FERC oversight, because transmission is not implicated. Fundamentally, Talen has the right as a competitive generation company to contract with AWS to sell long-term, committed power. PPL, as the regulated utility that has an actual stake in this ISA, agrees that Talen has the right to sell power directly to AWS and signed an ISA amendment that gives PPL reliability assurances. PJM agrees the ISA is appropriate, and itself filed the application for FERC approval.

We will move with dispatch to resolve this matter quickly at FERC.

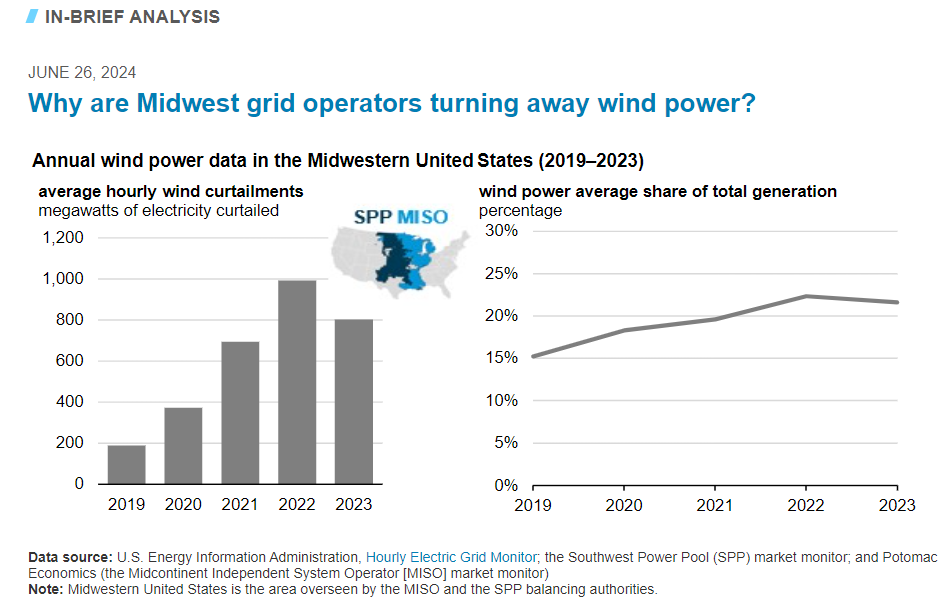

We might as well stick to our topics on market volatility. Regarding inadequate transmission, EIA had another interesting chart and article this week.

The article is worth a read, but if short on time, readers probably already know the issues. Basically, too little transmission and wind units are physically thus economically easier to shut down. As an aside, a good chunk of MISO's market monitor, Potomac Economics annual state of the market report gets taken up by this topic. Not surprisingly, this results in billions of dollars.

The WPO will be taking a week reprieve to celebrate the birthday of the USA. Enjoy the holiday and look for us in two weeks!

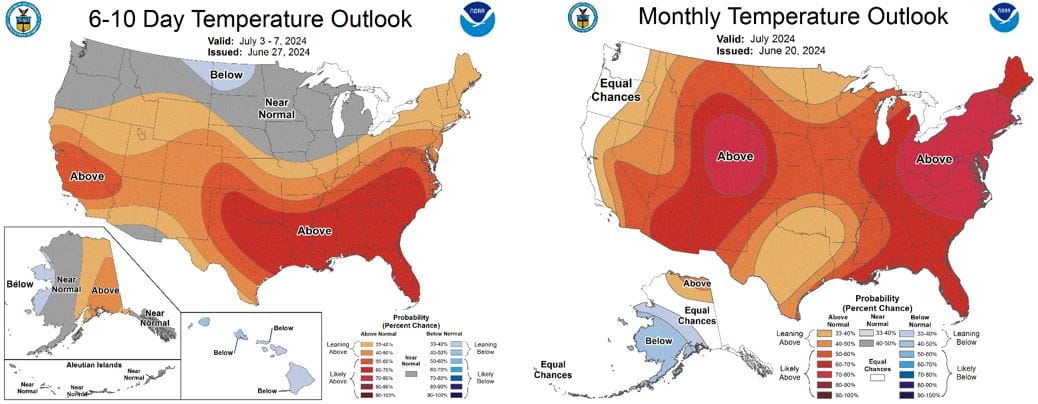

NOAA WEATHER FORECAST

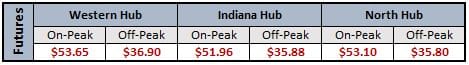

DAY-AHEAD LMP PRICING & SELECT FUTURES

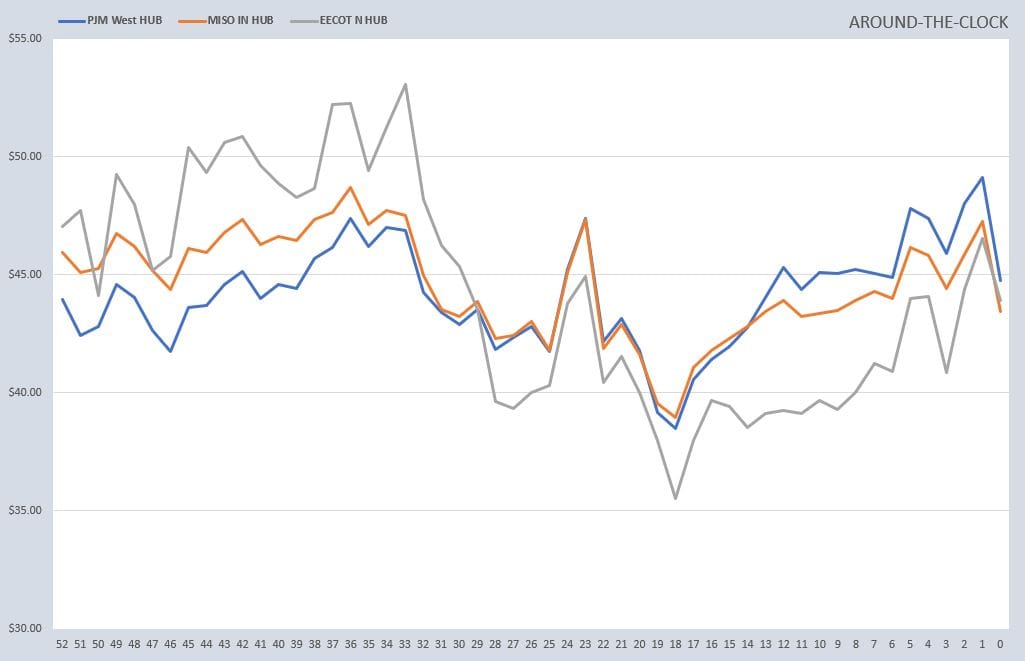

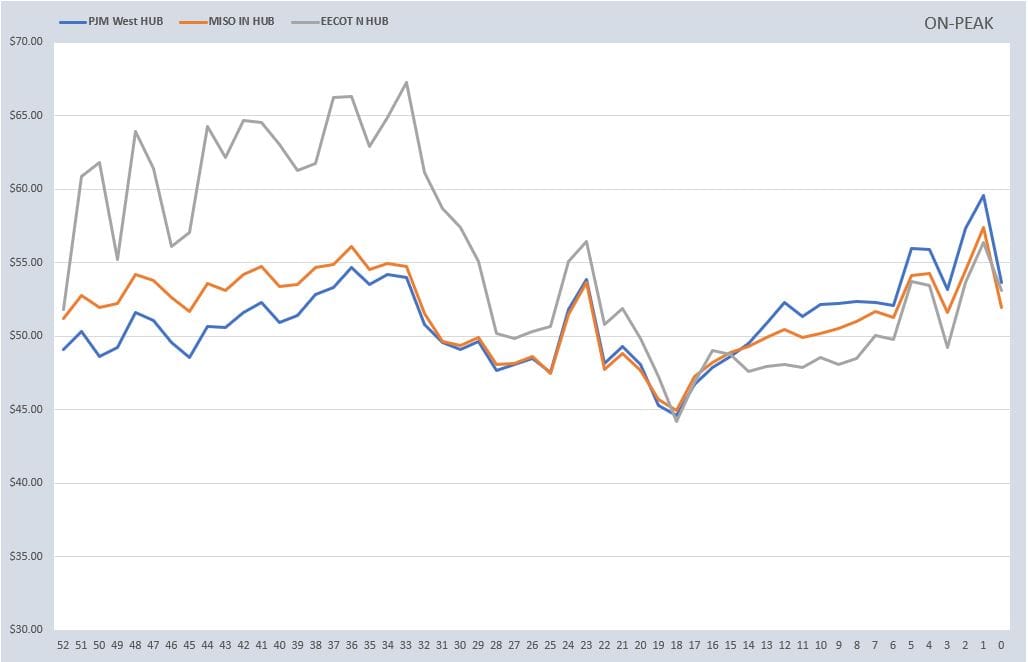

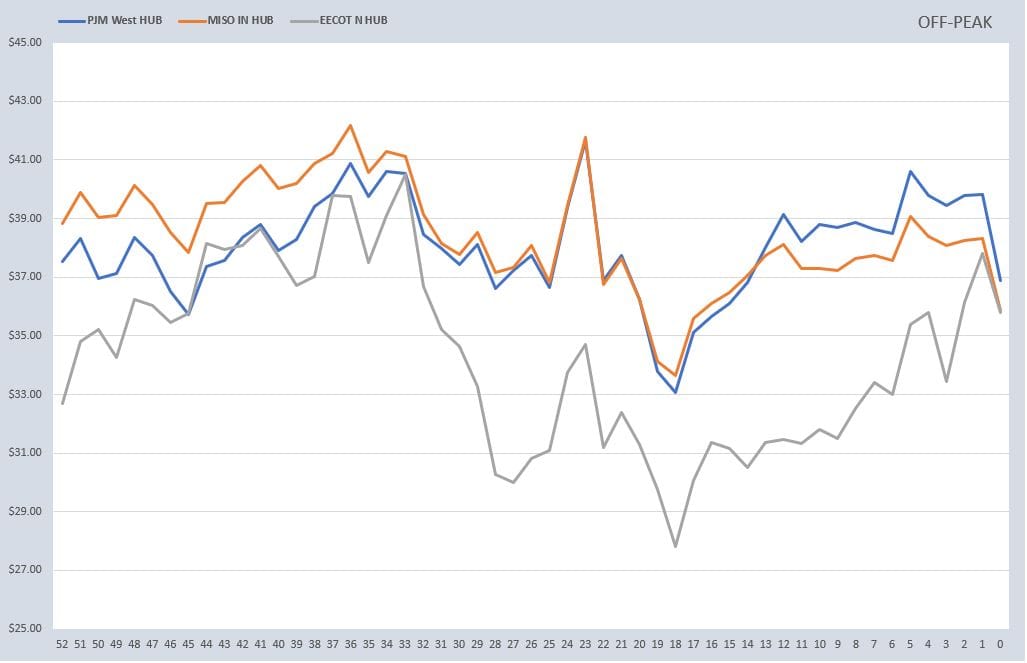

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

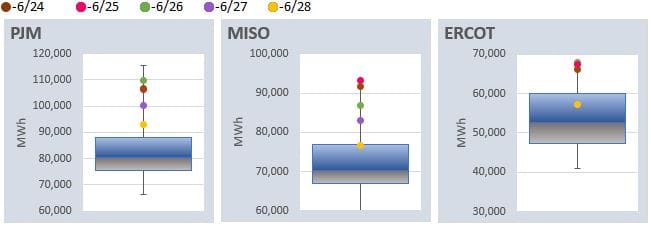

DAILY RTO LOAD PROFILES

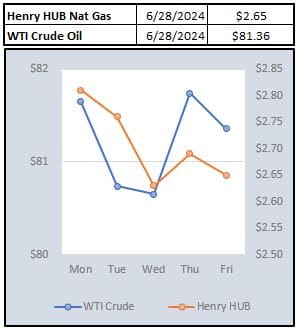

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: