Weekly Power Outlet US - 2024 - Week 27

Hurricane, Hot, and Natgas

Energy Market Update Week 27, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

In the world of electricity, this week Mother Nature was the star across the US. Every ISO had some sort of alerts, warnings, or actions as Hurricane Beryl moved through Texas all the way to the Northeast causing heavy weather followed by warmer temps. Day ahead prices reflected this as prices were up week over week, and in some cases substantially with the heat.

Hurricane Berly moved on to the Texas coast as a cat 1 storm and was felt by the residents of Houston. Some of the reports suggested that up to 2.7 million people had a loss of power, and estimates are for 500,000 to remain so until next week. As might be expected, this has started a debate on the resiliency of the grid. In some spots, it's been suggested that the infrastructure will have to be totally rebuild just to get power back. Quoting from an AP story, "residents have been frustrated that such a relatively weak storm could cause such disruption at the height of summer".

By the way, if you think it was or is hot where you are, you are not alone. The Alberta ISO tweeted this midweek....It’s hot! At these temps demand for electricity goes up – yesterday to a record peak of 12,122 MW. Conserving power at this time of year between 5-9:30 p.m. helps keep our grid strong for all Albertans.

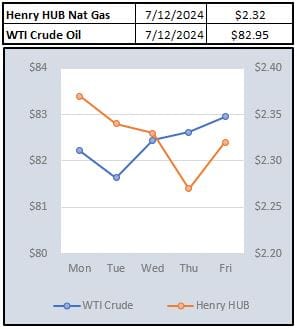

The front month of the natural gas market has fallen off a cliff over the last three weeks. Production numbers have rebounded from earlier this spring and are back above 100 Bcf per day in the US. While storage gets a fair amount of headlines, the production number has been driving the market players this spring. On top of that, the old days of storms in the Gulf being bullish are long gone. Now a Gulf storm like Berly means LNG gets shut in and the supply/demand balance tips even more to the left. For those keeping score, yesterday's EIA storage report showed a build of 65 Bcf vs estimates of 54 Bcf. Again, not much to see here

For a long time, we've been speaking about LNG and the potential to make natural gas somewhat fungible like oil. This week Honeywell took a much bigger step into the LNG market confirming it has agreed to acquire Air Products' liquefied natural gas process technology and equipment in an all cash transaction of $1.8 billion. Without going into some long engineering jargon we don't understand, Honeywell is saying this will help their end to end offering to the LNG industry.

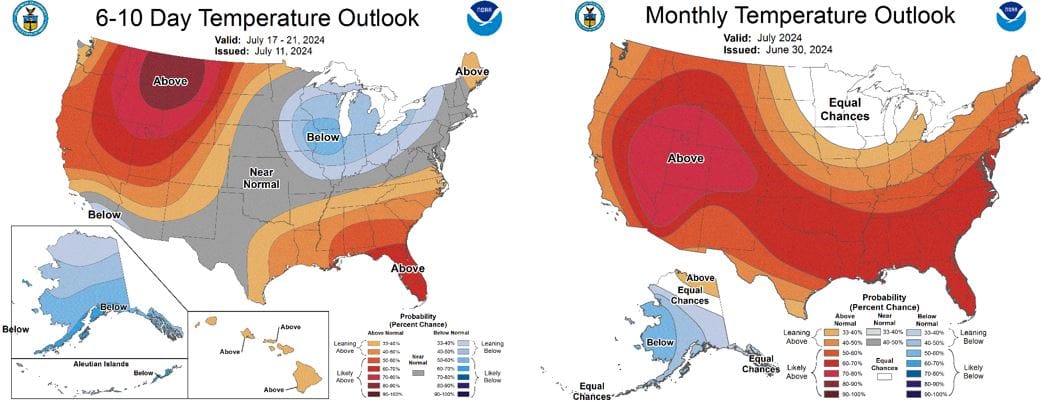

NOAA WEATHER FORECAST

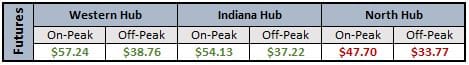

DAY-AHEAD LMP PRICING & SELECT FUTURES

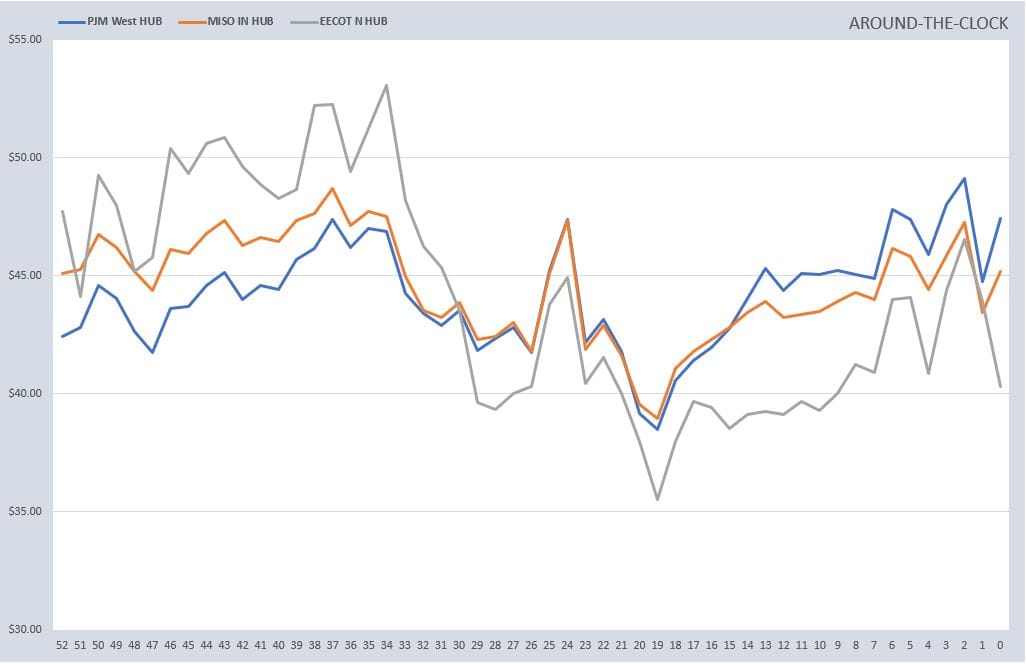

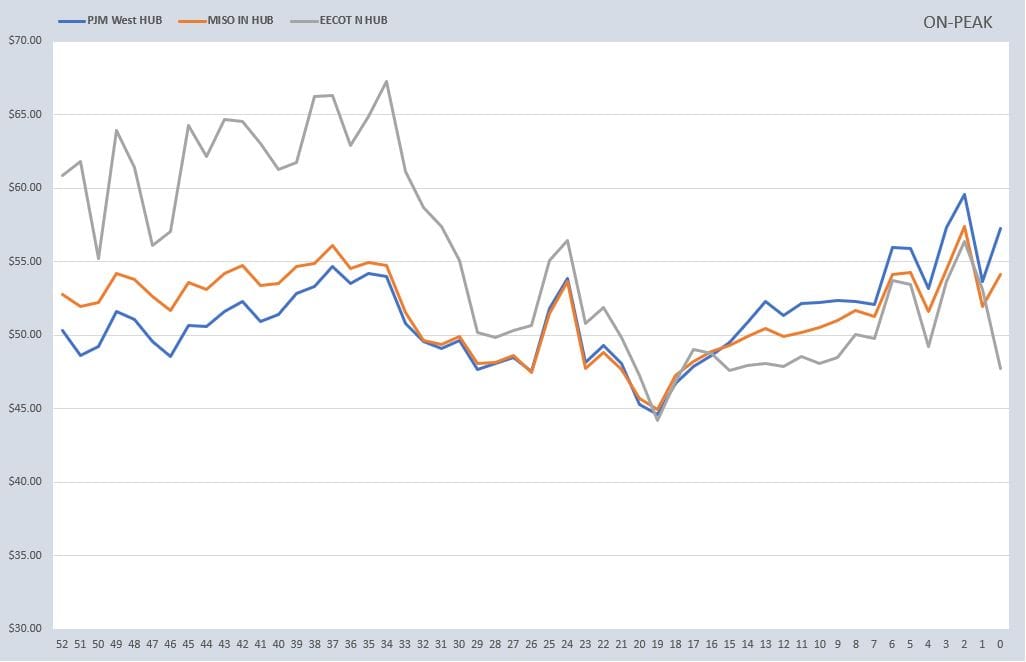

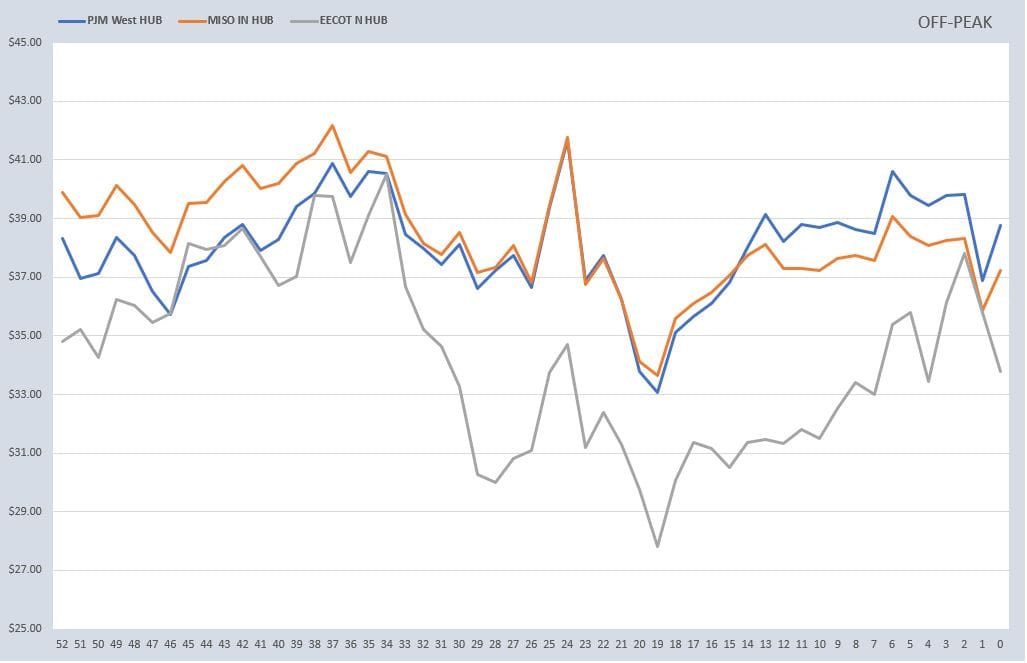

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

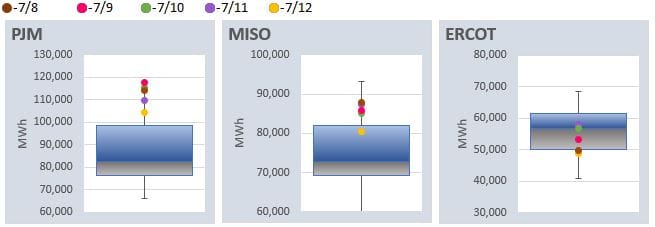

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: