Weekly Power Outlet US - 2024 - Week 28

East Coast Heat, Nat Gas, Vineyard Wind

Energy Market Update Week 28, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

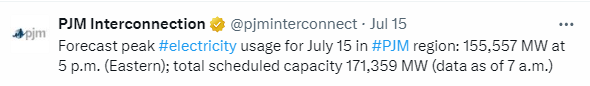

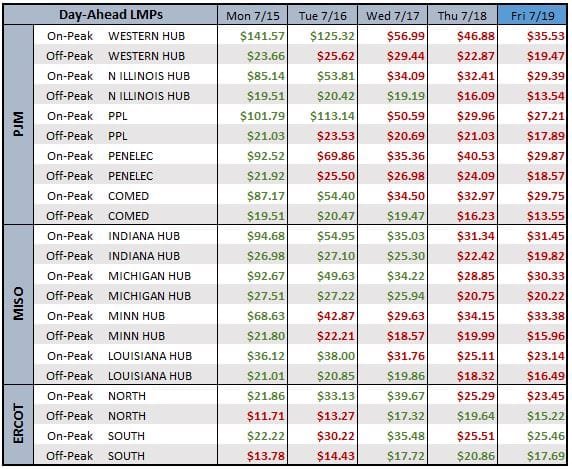

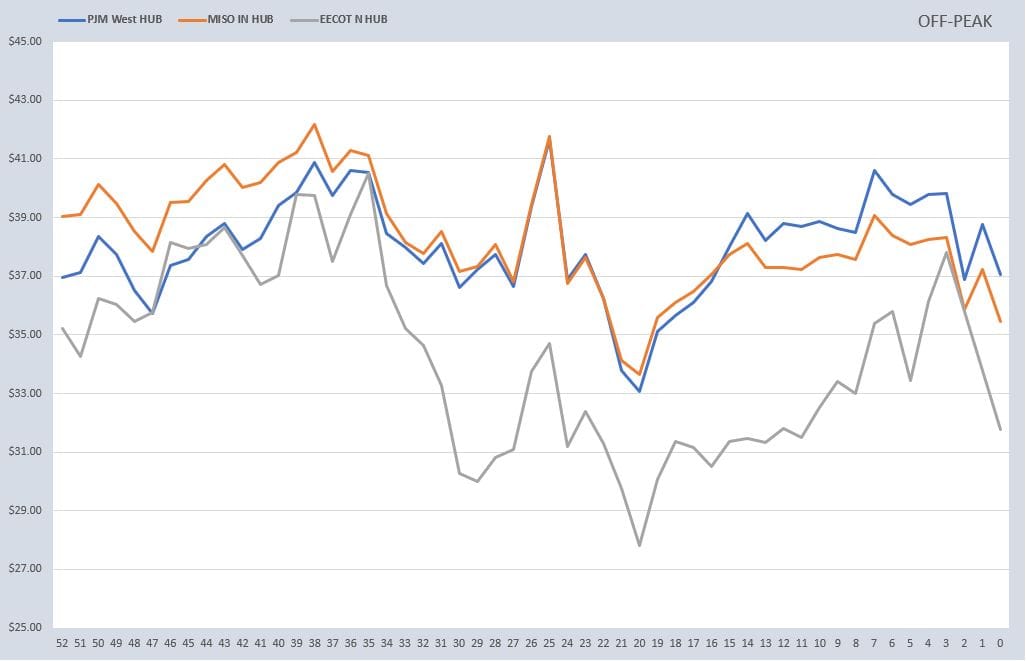

This week saw the first real blast of record-type heat across the East. Temperatures in Philadelphia reached over 100 degrees for four consecutive days, a first in history. PJM had issued Hot Weather alerts across the ISO and prices reflected this as on peak day ahead LMP prices were averaging over $100/MW in some zones. Additionally, some of the peak hours reached well above $1000/MW.

As seen above, PJM scheduled units to be online with the capacity of 171k MW for Monday. This is roughly 10k MW below the installed summer capacity of 182.5 MW. For some context, PJM was scheduling generation above forecast at the amount of one NYISO (20-25k MW) and it showed in the prices. Thankfully the excess scheduled generation wasn't needed and real-time pricing settled significantly below day ahead pricing, with some zones seeing peak hours scheduled well into the $1000/MW in the day ahead and settling in the $100/MW level in real-time.

There have been some questions on these price discrepancies. PJM's, or really any ISO, priority is reliability. Given the structure of the market with intermittent renewables, PJM has to schedule for reliability and that means calling on expense of peaking plants with baseload type certainty.

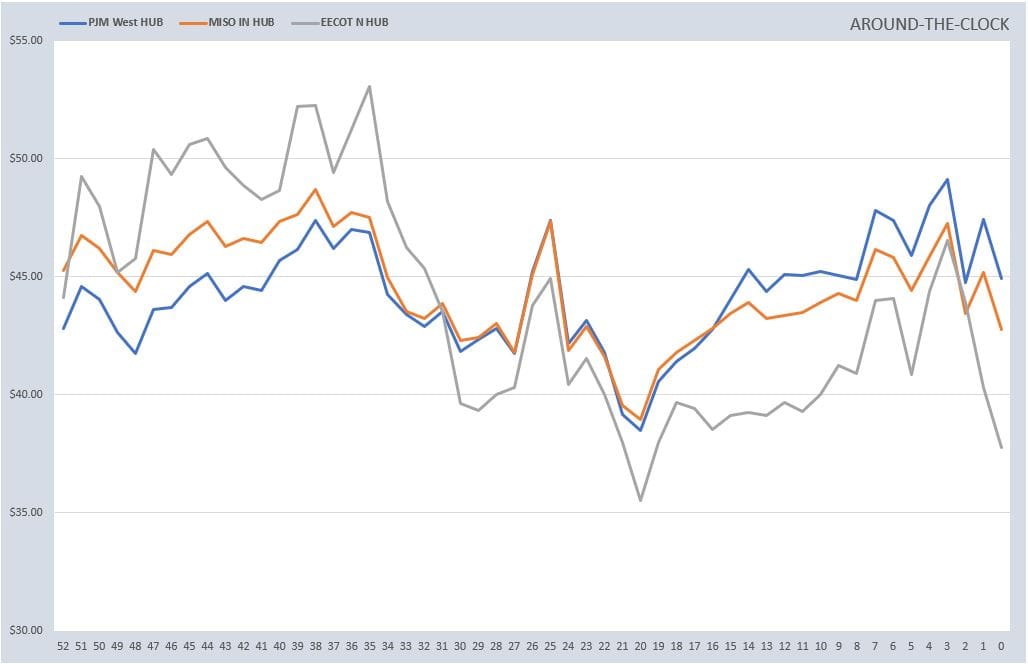

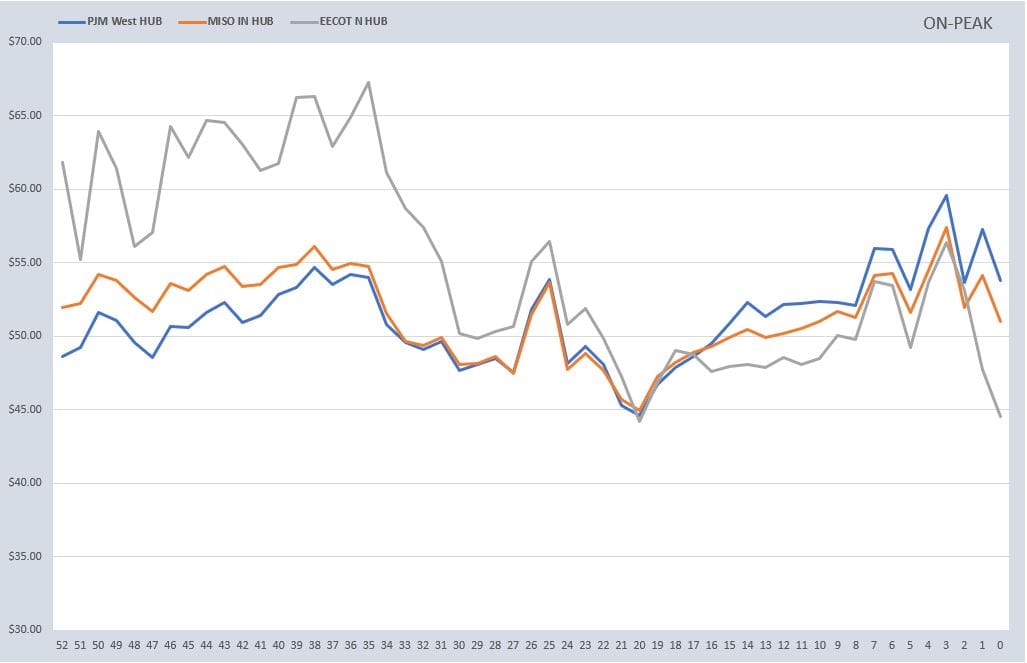

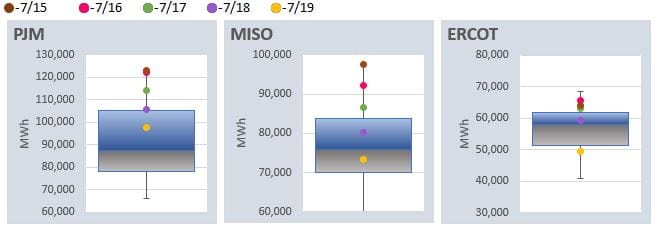

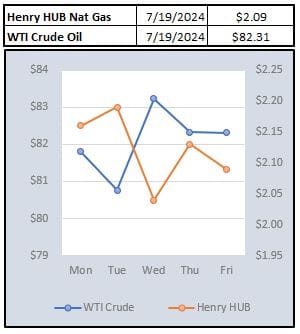

Interestingly, as day-ahead pricing was moving higher across the West, Midwest, and East, futures prices continued to pull back following lower natural gas prices. The natural gas market is still trying to recover from some shut-in export capacity due to Hurricane Beryl along with production above 100 Bcf/d. The market got a slight bounce as the heat dragged down the weekly storage to 10 Bcf versus an estimate of 27 Bcf, but that was short lived as front-month gas continues to trend near $2. Even as export capacity comes online, Europe is near full on storage so production numbers will be the mover of gas pricing for now.

Offshore wind has had a tough go of it here in the US over the past couple of years. In January the Vineyard Wind project off the coast of Nantucket in Massachusetts delivered its first MW marking a milestone. This week, a 300-foot piece of blade broke from one of the turbines in Vineyard, prompting the US Coast Guard to issue a statement advising mariners to use extreme caution. We mention this incident because this was a very controversial project with some very high-profile residents very against the project from the outset. The outcome of this will be closely watched by proponents and opponents of other projects we have mentioned in the northeast. Stay tuned.

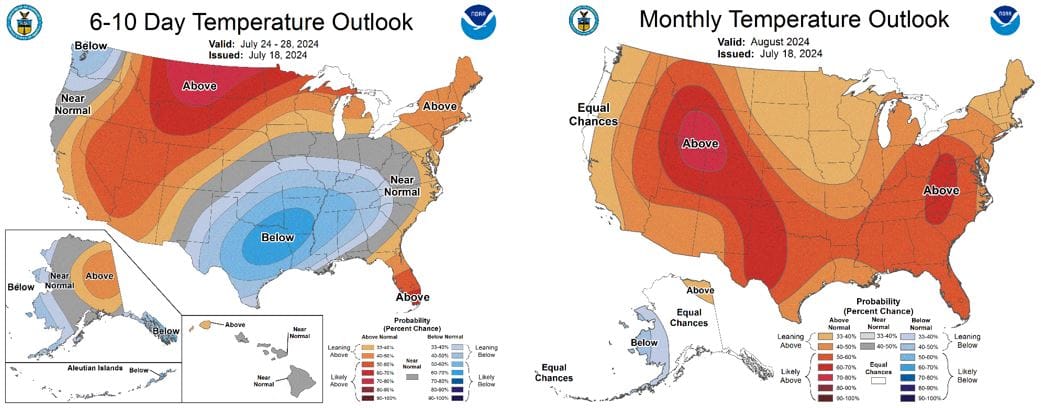

NOAA WEATHER FORECAST

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: