Weekly Power Outlet US - 2024 - Week 30

Wait, What PJM?

Wait, What PJM?

Energy Market Update Week 30, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

So that happened!!! By now most have seen the PJM news regarding the capacity market auction results where the price for the delivery year 25/26 cleared at $269.92/MW Day. The clear price was over $400 in the BGE and Dominion zones. This reflects an increase of over 10x from this year's prices. PJM's capacity market auction has been anything but smooth the last couple years, with this one being delayed multiple times for various reasons.

Since it is earnings season which means investor calls for various investor-owned utilities, the timing was perfect to get some feedback from some of the investor conference calls. First Energy just happened to be reporting the day after the capacity results were released and CEO Brian Tierney had probably the best quote we've seen on this. When responding to a question from Barclays analyst Nick Campanella regarding the auction, Tierney responded, "I'd call yesterday's print (PJM capacity results) the canary in the coal mine, and the canary didn't make it."

Most observers and market participants had thought PJM's capacity results over the last couple years were not the incentive intended to be. Given the simple dynamics of more load coupled with more baseload generation being retired, at some point PJM was going to have a shortage of committed resources and prices would have to go higher. Expectations were that the rise would start with this auction, but 10x was certainly a shocker. As Tierney continued to comment on the situation, he stated that load can pretty much come online in real time, while new baseload generation takes time because of studies, permits, etc. This means that this number may not even spur new entry which is really the function of the capacity market. If that's true, this pricing might be just the beginning.

Also worth noting, offered demand response was lower this auction than last by almost 2-1. While we can't say this with certainty, it is fair to assume that the typical DR participants just didn't see the benefit/risk of being in the program at $28/MW Day, as was the case this year. Last year 10k MW was offered with 8k clearing, while this year only 6k MW was offered. As expected at these prices, all cleared.

This story is just getting started and we expect plenty of commentary over the coming weeks. Acumen will be on the story and try to make sense of it all.

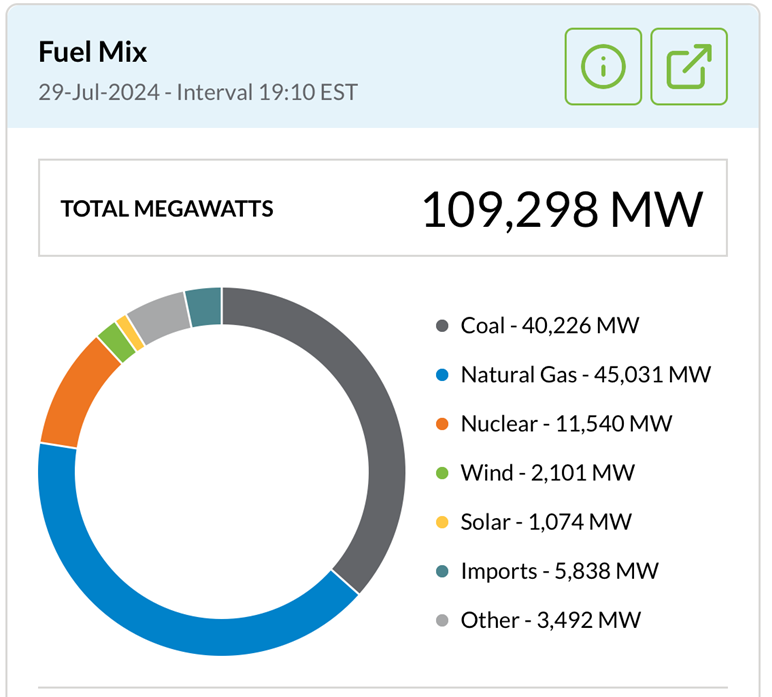

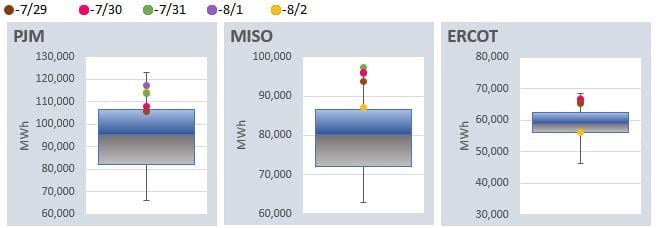

Summer is finally starting to summer in the Midwest and early this week MISO declared a capacity advisory as hot weather moved into the ISO region Monday. According to MISO, the declaration was forced generation outages, above normal temps, and higher load forecasts. Given the fuel mix, and by walking outside here in MN and realizing there isn't even a breeze, MISO had a little taste of what ERCOT feels in the fall when the wind and sun fade later in the day.

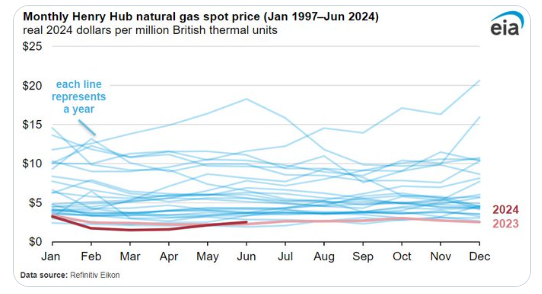

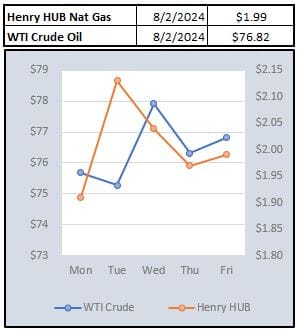

This week, EIA storage data showed natural gas injection lighter than forecasted. The market didn't seem to care as the forward contract has now broken $2 MMBtu on the downside. Interestingly, if that isn't low enough, EIA put out a chart showing natural gas using 2024 dollars as the base. The chart below puts into context the historically low prices the market is facing.

Speaking of natural gas, specifically LNG, when we do speaking engagements about market volatility, we mention LNG in the context of supertankers trading the commodity around the world. We also highlight how places like ISO-NE are subject to the world market because of the Jones Act which dictates LNG transport from LA to New England would need a US built, crewed, flagged ship and there are ZERO. Well, time to revise that slide as this week the 416-foot LNG bunker barge named Progress was delivered to Crowley Maritime. The capacity of this barge is stated to be 12,000 cubic meters of LNG, which is much smaller than the LNG tankers that sail the seas.....but it is a start. The Progress will be used as a fueling source for ships offshore, and not a transport.

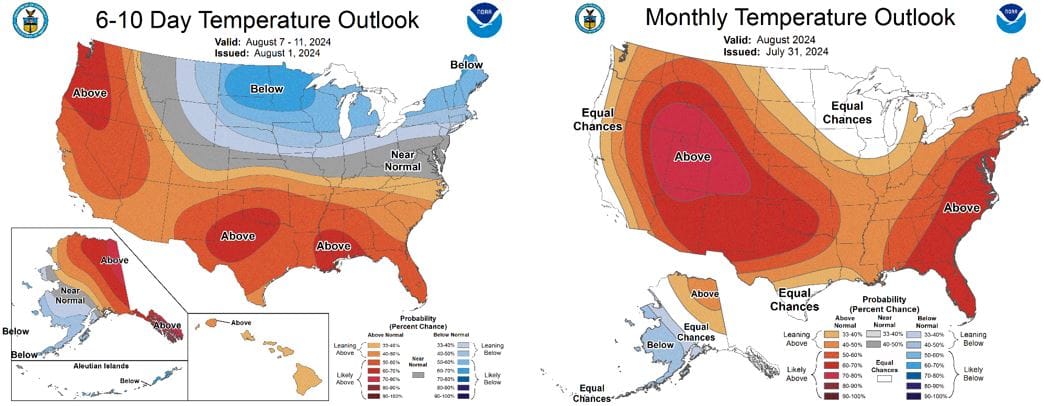

NOAA WEATHER FORECAST

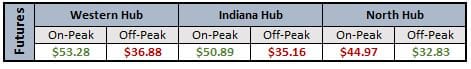

DAY-AHEAD LMP PRICING & SELECT FUTURES

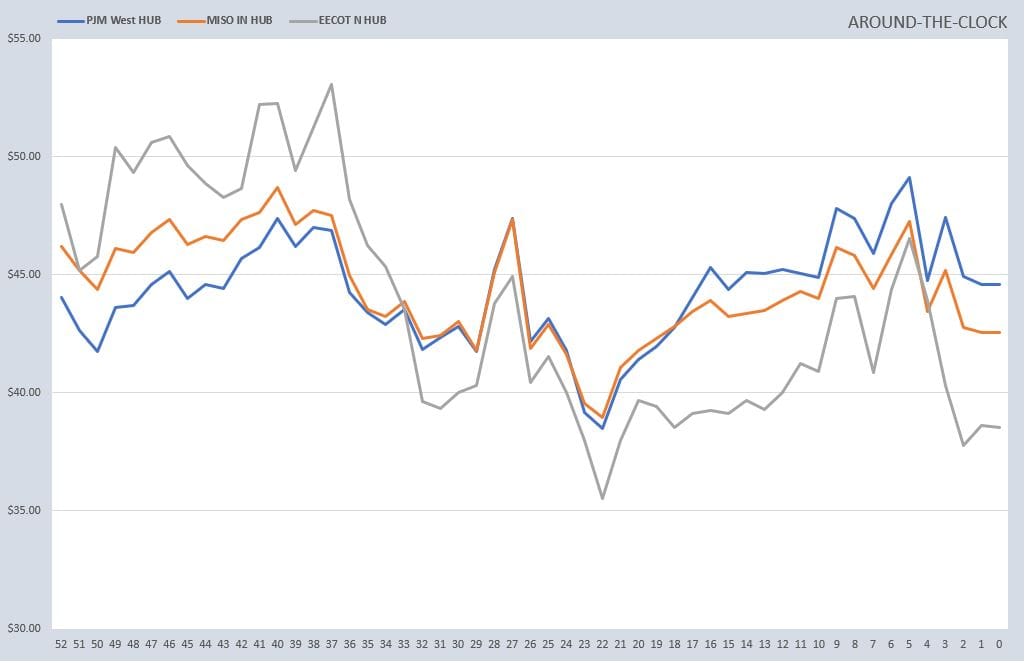

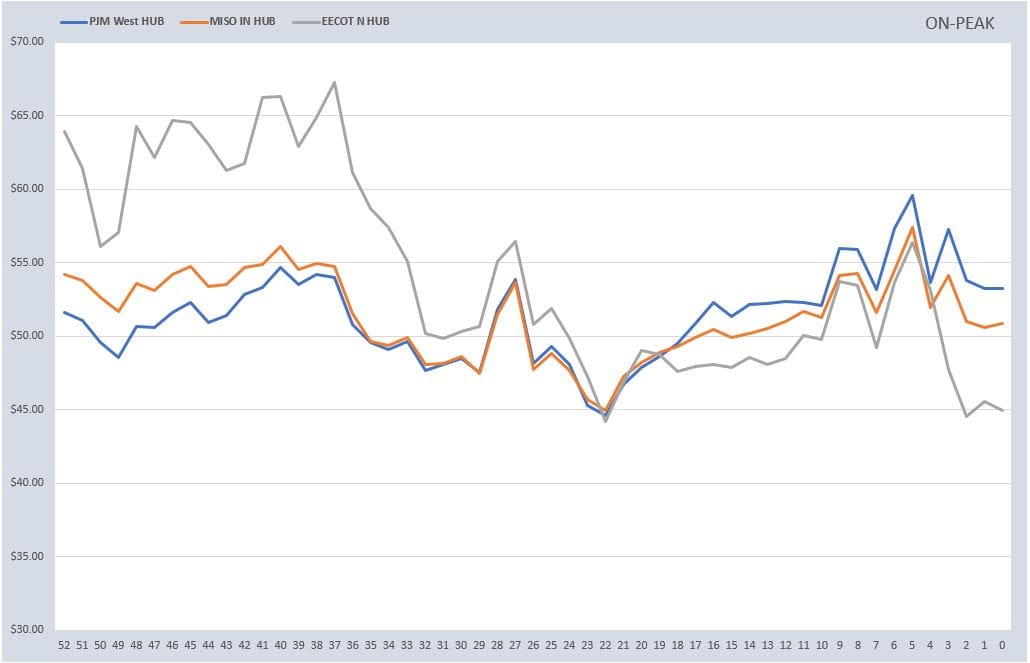

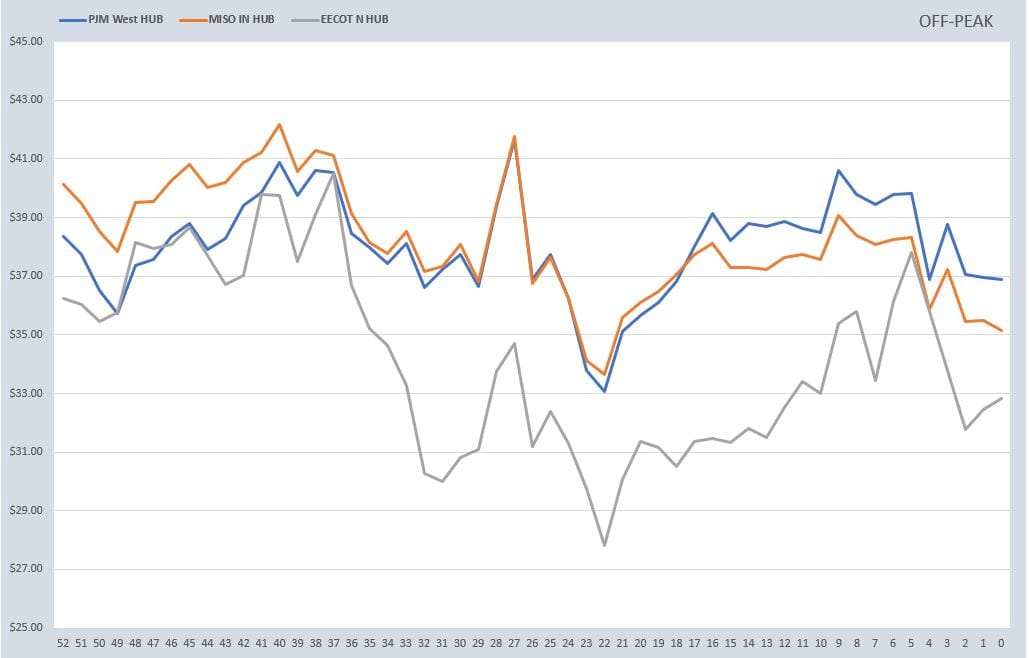

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: