Weekly Power Outlet US - 2024 - Week 32

End of ERCOT Summer, Nat Gas Withdrawal, PJM BRA

Energy Market Update Week 32, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

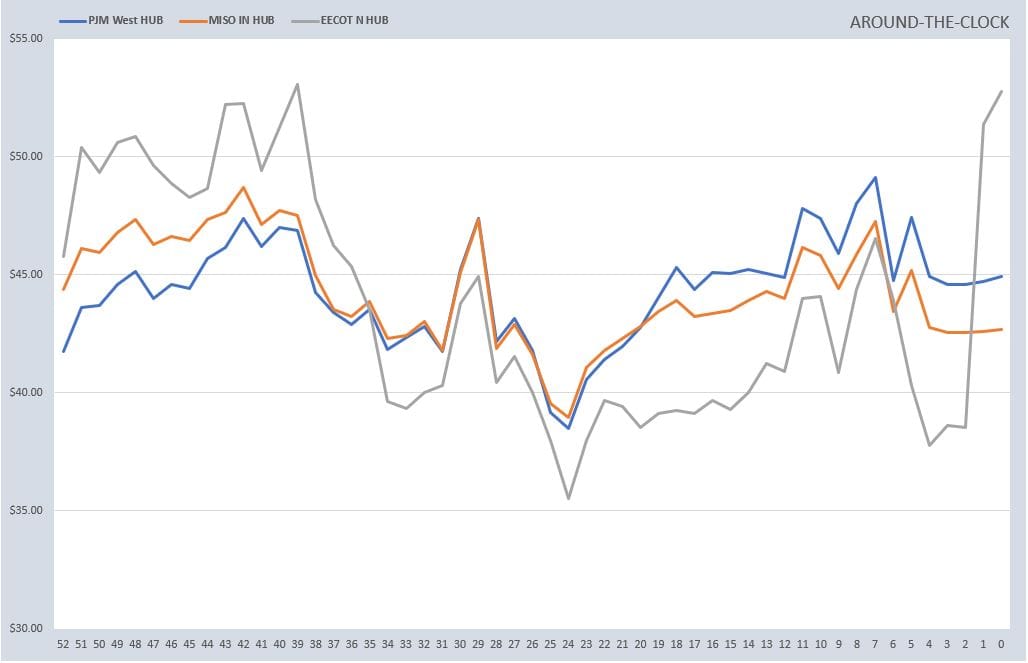

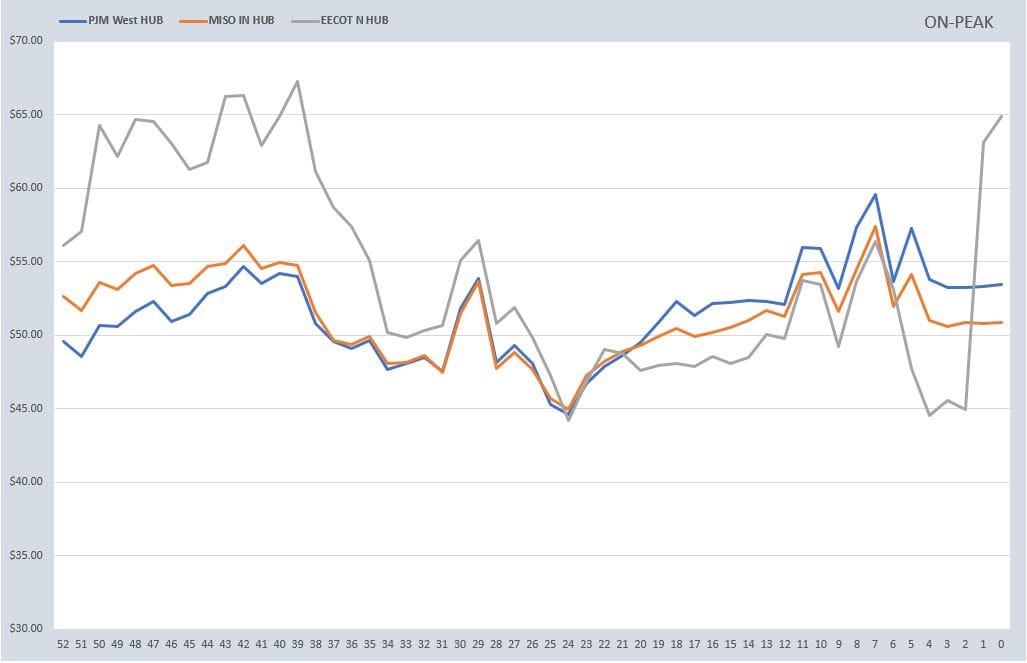

Day-ahead electricity prices continue to look like the nice and easy-going shoulder months and not the dog days of summer. As shown below, for the ISOs we monitor, prices were a mixed week over week regarding prices.

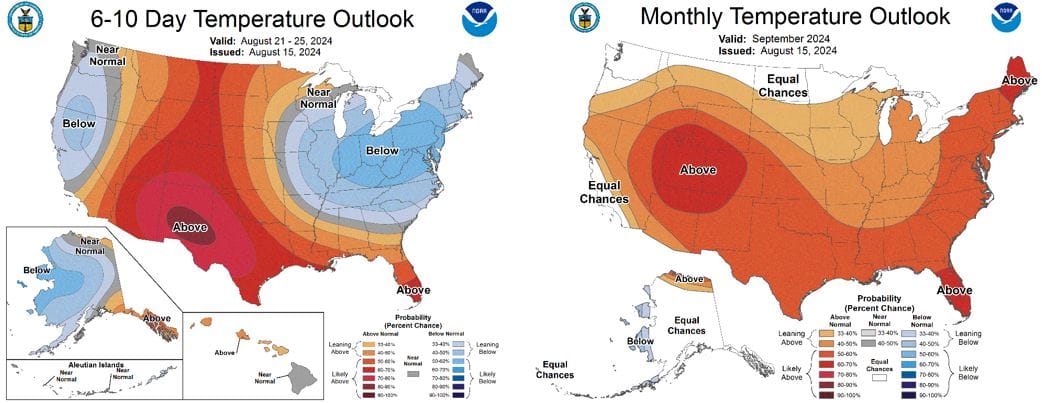

Anyone living in ERCOT might argue with the notion that the dog days of summer are "nice and easy". Looking ahead at the weather maps, the 6-10 shows a swath down the middle of decent probability that summer isn't going out with a whimper. That's on top of temps this weekend that will be in the triple digits across much of Texas.

Waking up the last couple weeks has reminded us that we are closer to the end of summer rather than the beginning. Nice bright mornings have given way to some darkness as we head to September. This hot weather in ERCOT and the morning darkness reminded us of last year about this time. ERCOT came perilously close to rolling blackouts as the early sun setting cut into solar output before the heating of the day subsided. The ISO had more than a few days were conservative alerts and actions were requested as demand came close to exceeding supply. This scenario could play out again this fall, and late summer, but it is worth pointing out that ERCOT has roughly 3x the battery storage it did last year. In June, ERCOT added another 650 MW of nameplate BESS capacity bringing the total capacity over 5000 MWs. ERCOT has brought this capacity online to prevent a repeat of last fall. It will be an interesting watch.

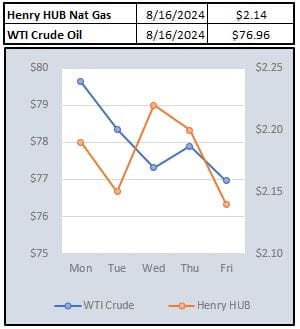

Speaking of ERCOT, no other ISO future market prices follow natural gas like ERCOT. Looking at the forward curve, there was a dramatic selloff following natural gas lower over the last month. As we mentioned last week, it looked like gas had finally reached the cure for lower prices is lower prices point and ERCOT has followed higher. Yesterday's EIA gas storage report included a rare summer withdrawal (previous 2016) with 6Bcf being taken from storage. Power demand in the south and continued lower production were the culprit. A negative number wasn't totally out of the blue, as some expectations had pointed out that possibility. The market initially rallied, but has come back this morning as the focus has shifted back to the fair weather across most of the US, excluding the South as mentioned above.

Pick your favorite verb, shocked, bewildered, angered. There hasn't been much easing of the feelings since the results of the 25/26 PJM BRA auction were released. Late this week, Utility Dive, authored a story on how Maryland electric prices could rise as much as 24% because of capacity. Two plants that were scheduled to be retired were basically not allowed by PJM citing reliability-must-run. Because of the generation footprint, PJM needs these plants for reliability which means the capacity market will have to pay which meant the zonal cap of $466/MW-day was hit in the BGE zone in Maryland. The PJM BRA auction is a story that might be with us for a bit.

NOAA WEATHER FORECAST

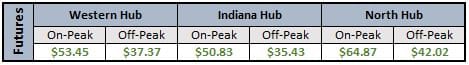

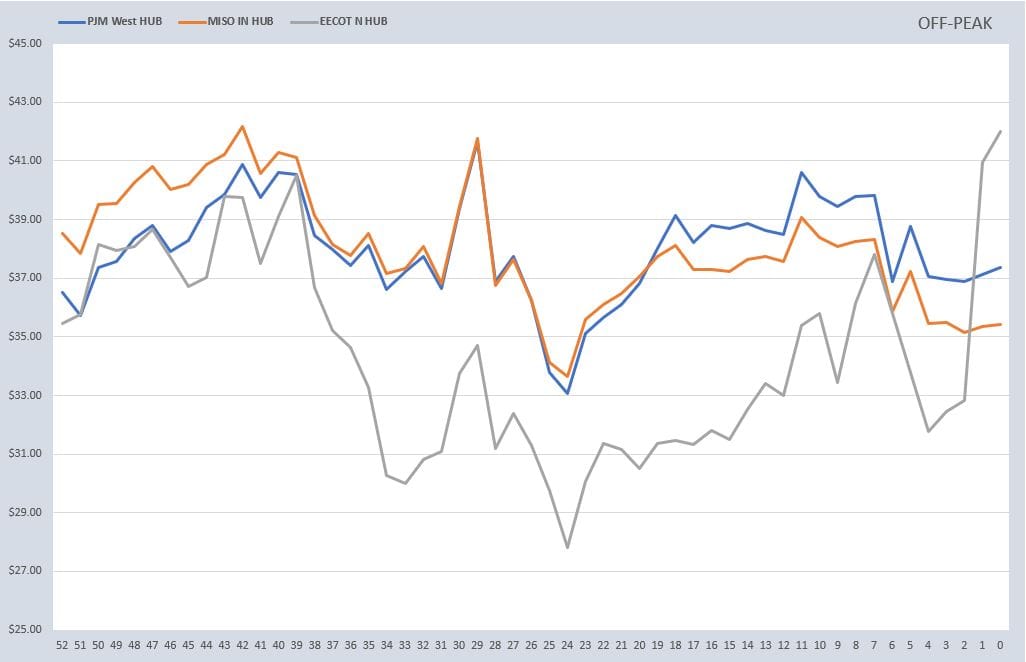

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

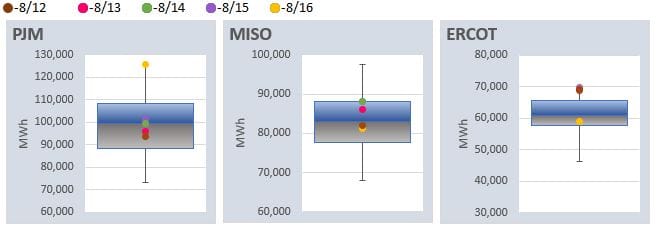

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: