Weekly Power Outlet US - 2024 - Week 33

ERCOT Hot, Europe Gas, PJM Capacity

ERCOT Hot, Europe Gas, PJM Capacity

Energy Market Update Week 33, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

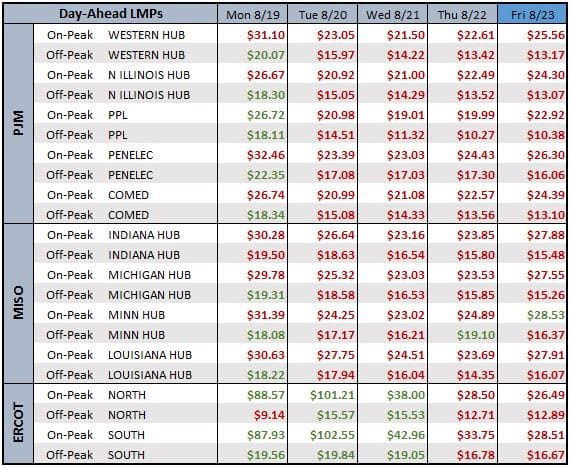

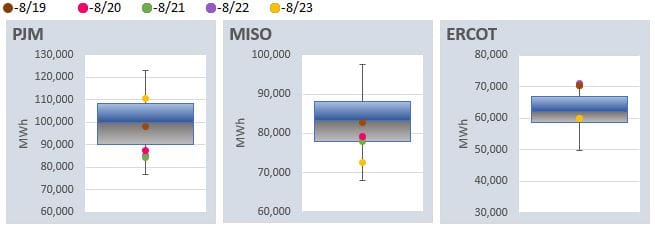

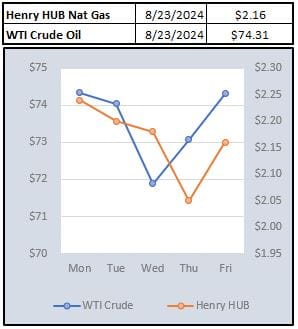

This week, power prices remained subdued as weather has moderated for most of the country and natural gas continued to trade well below recent highs. The exception was Texas, and ERCOT, where temperature records were broken this week. As shown below in day ahead pricing, ERCOT held in pretty well with record temps and load. Solar is mostly to thank as the heat was accompanied by plenty of sun. As mentioned last week, the time of summer is key for ERCOT with regard to its solar production. With plenty of sunlight still left in the day, load was able to be met as expected. As fall rolls on, it will be interesting to see if changes, specifically battery, will be able to alleviate a situation like last September.

The Dutch September natural gas futures contract has pulled back over the last three weeks, but not nearly as much as Henry Hub. Europe has now reached 90% storage capacity which is a far cry from just two years ago heading into the winter after the outbreak of war. Interestingly, S&P Global posted a story indicating that speculative funds have increased long positions while taking down some short positions over the few weeks. The article quotes a few traders saying that there isn't anything fundamental about the trade, just that the risk is greater to being short than long at this point. That may very well be, but sometimes following the money works.

Pick your favorite verb, shocked, bewildered, angered. There hasn't been much easing of the feelings since the results of the 25/26 PJM BRA auction were released. Late last week, Utility Dive, authored a story on how Maryland electric prices could rise as much as 24% because of capacity. Two plants that were scheduled to be retired were basically not allowed by PJM citing reliability-must-run. Because of the generation footprint, PJM needs these plants for reliability which means the capacity market will have to pay which meant the zonal cap of $466/MW-day was hit in the BGE zone in Maryland. The PJM BRA auction is a story that might be with us for a bit.

Next week WPO will be idle as we plan on celebrating the unofficial end of summer and the Labor Day weekend.

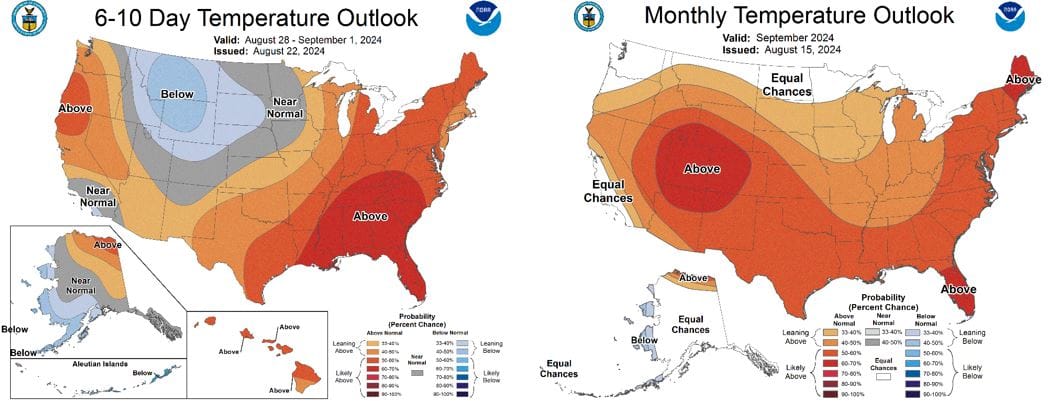

NOAA WEATHER FORECAST

DAY-AHEAD LMP PRICING & SELECT FUTURES

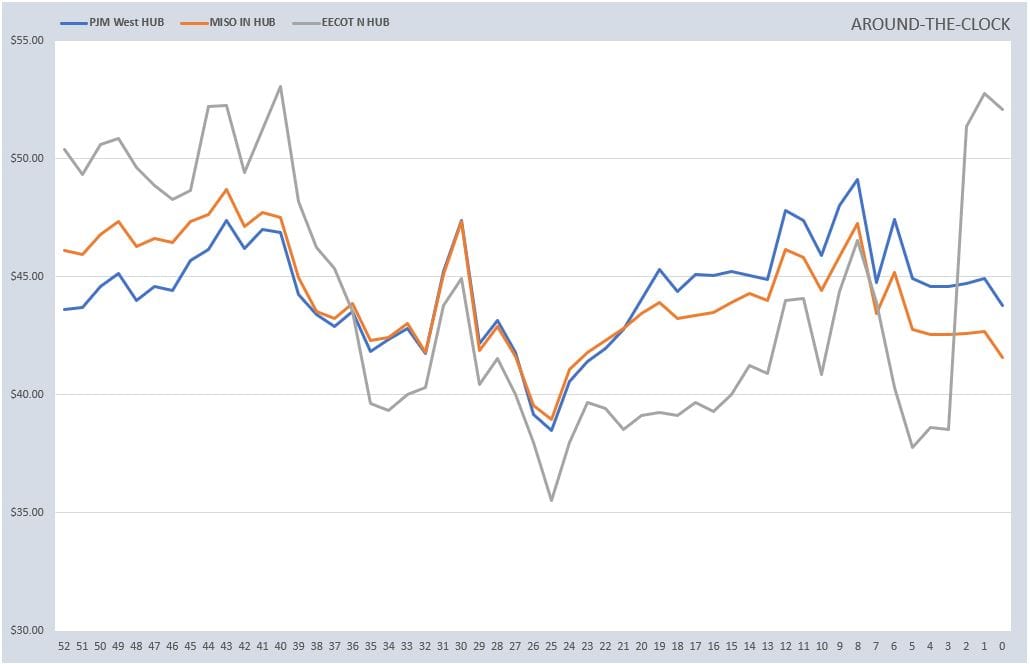

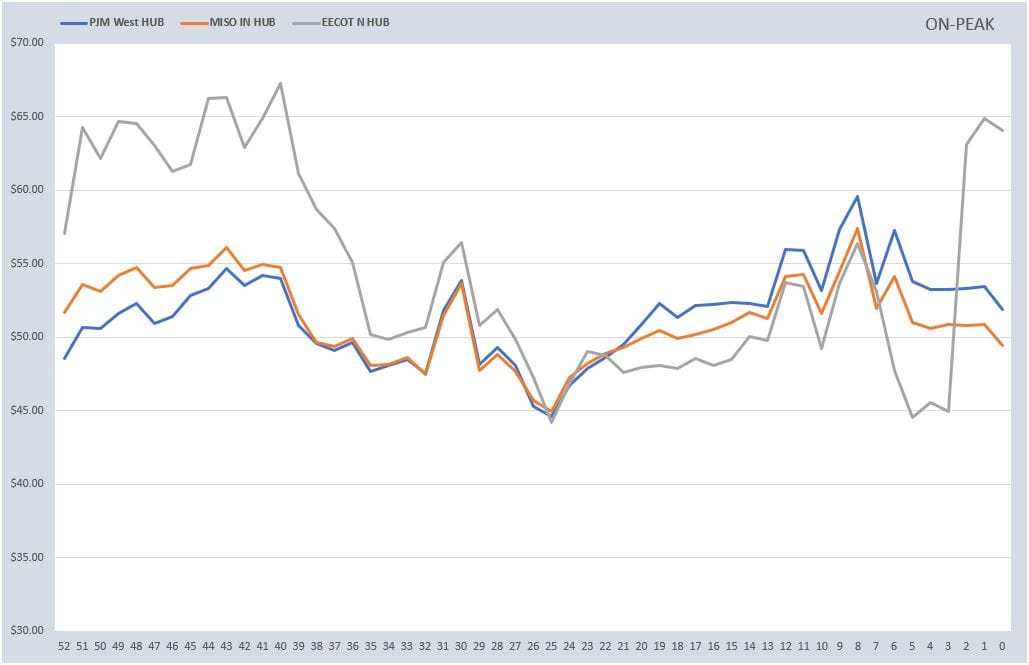

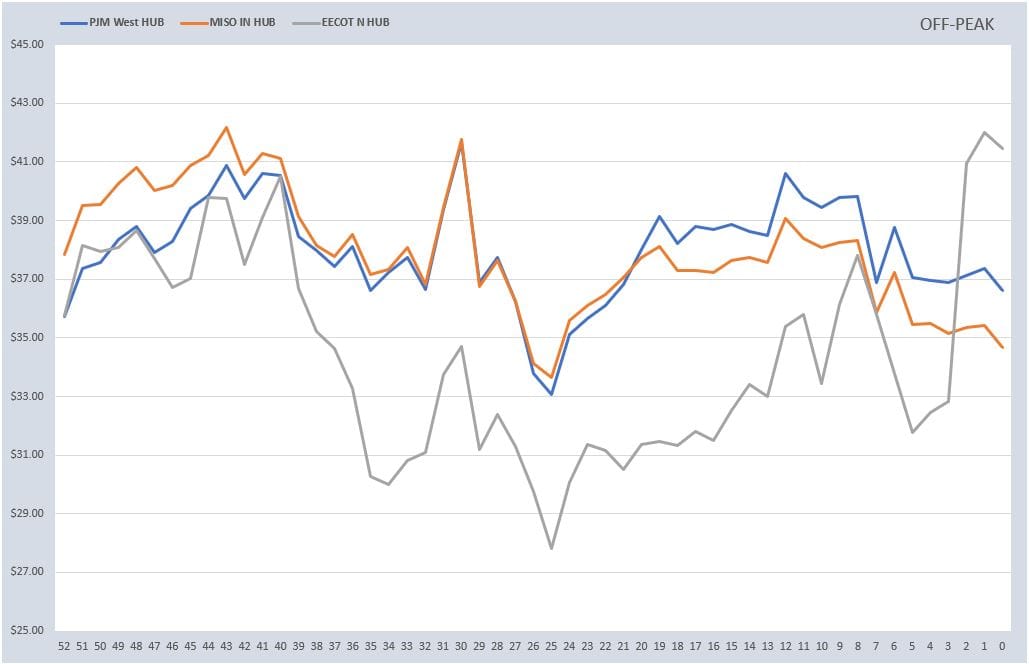

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: