Weekly Power Outlet US - 2024 - Week 35

Lower DA prices, LNG, Oil

Lower DA prices, LNG, Oil

Energy Market Update Week 35, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

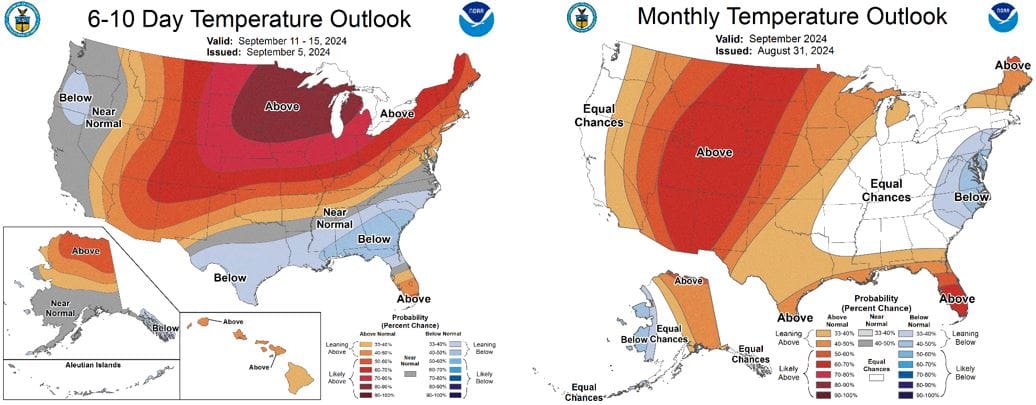

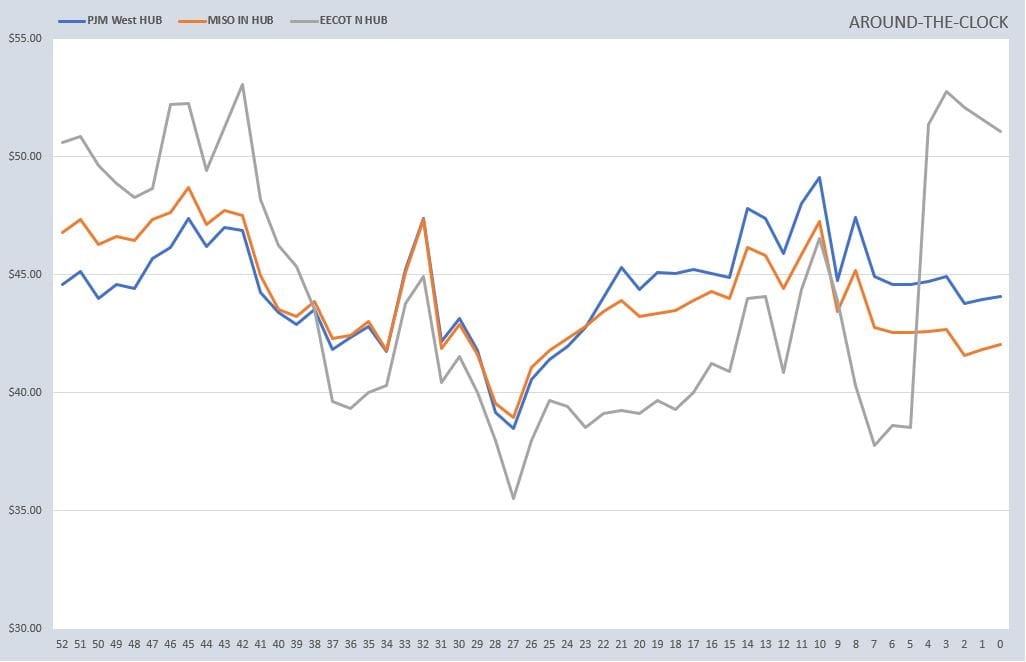

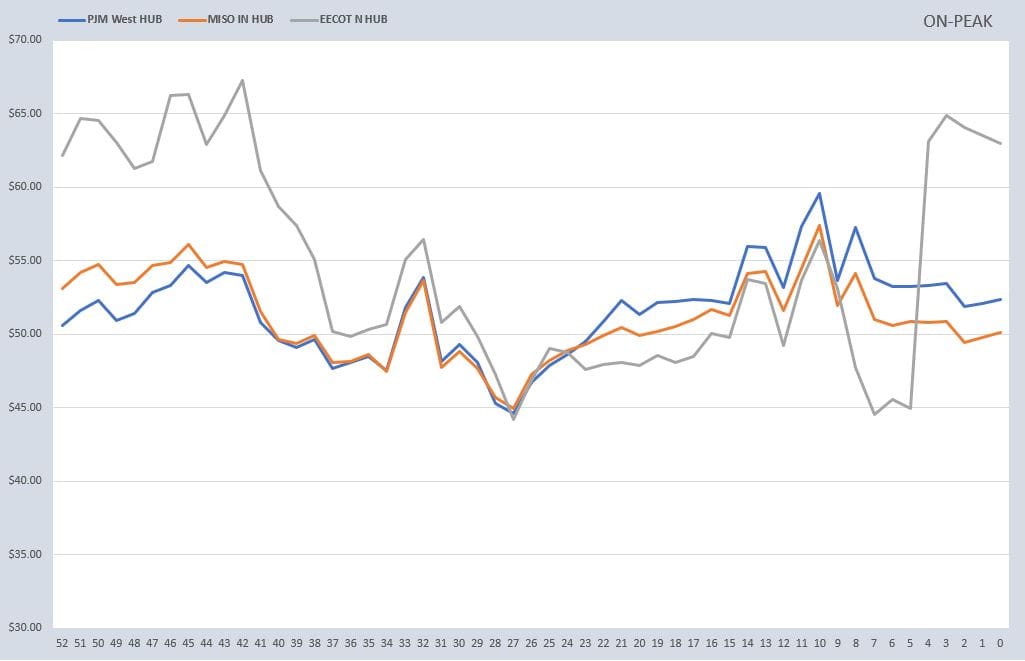

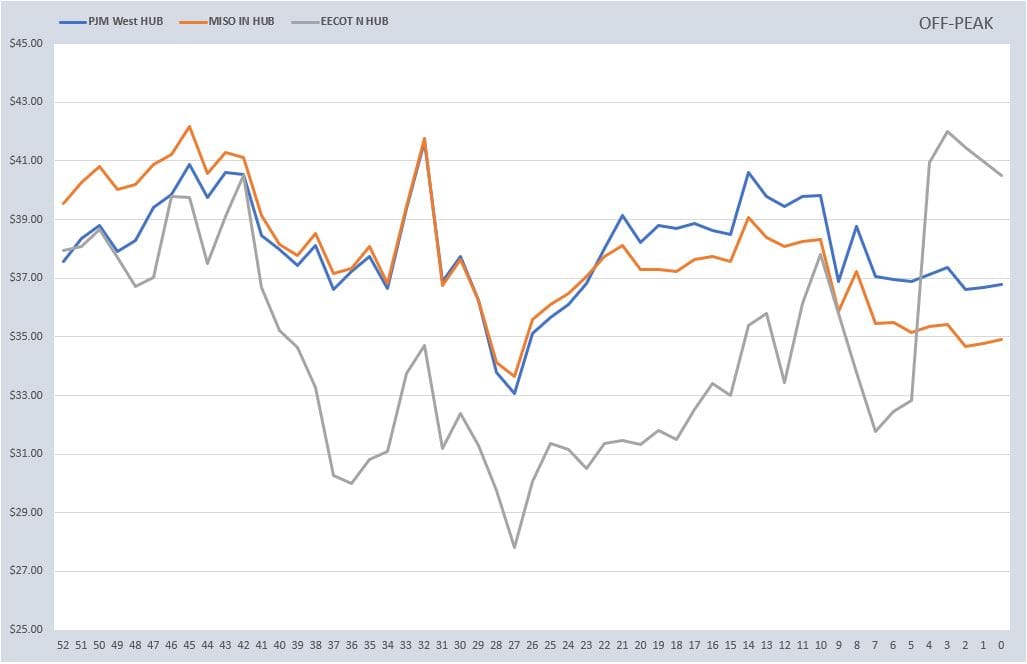

Summer kind of went out with a whimper as far as electric prices are concerned. As seen below, almost all week over weekday ahead pricing was lower as heat cleared, and a touch of fall fell on parts of the US. There does look to be some chances of unseasonal heat in the Midwest in the coming week, but for this weekend, it looks like cold in the upper Midwest and continued hot in the west and southwest.

From the earliest days of the Ukraine/Russia war, one of the themes was about how Russia's inability to export its oil and gas would be a hinderance to its effort. Whether it be global sanctions or infrastructure decay, it was thought their energy would become land locked and not able to make it to the world market. This week the US added even more sanctions as Russia has been operating a dark fleet of LNG tankers allowing for their LNG to reach the global markets. There has been some excellent investigative work done by journalists and traders tracking down some of these ships and their cargo destination. If interested, this week Bloomberg ran a thorough article discussing the network and the new sanctions.

As far as it concerns the US natural gas market, it was assumed that Russian gas being removed from the world market would increase the LNG prices thus helping push some US gas onto the LNG world market and elevating prices. While there have been many issues with LNG, specifically unplanned outages at export facilities, Russia's black market gas has helped supply the market. At this point experts just aren't sure how much is making it on the world stage.

In a somewhat related note, some traders have reported that Egypt has issued a tender for up to 20 LNG cargoes to cover power demand for the upcoming winter. Egypt has had a decline in domestic production and has reached is reaching into the market for the first time since 2018.

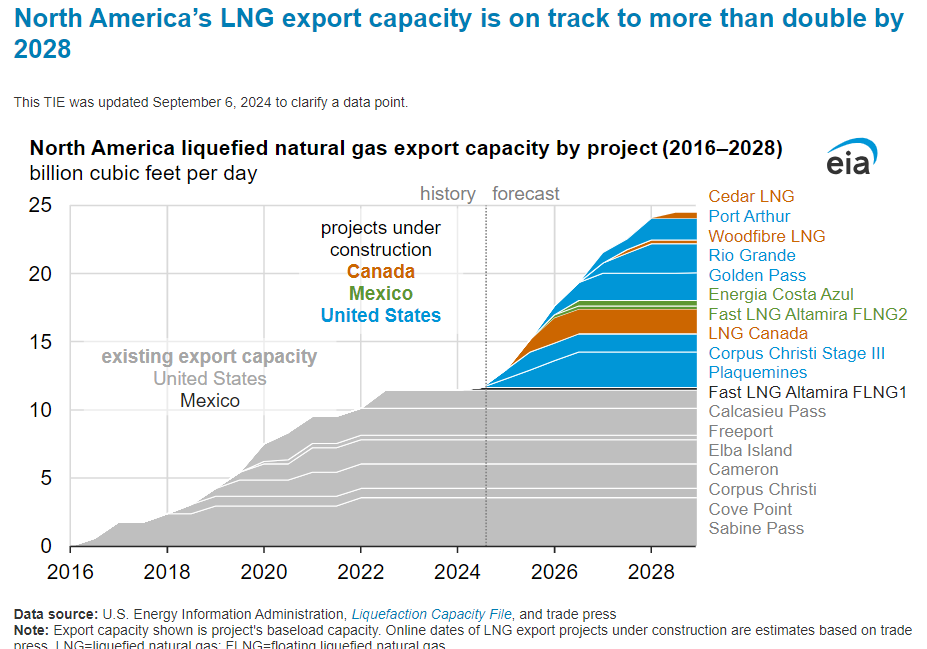

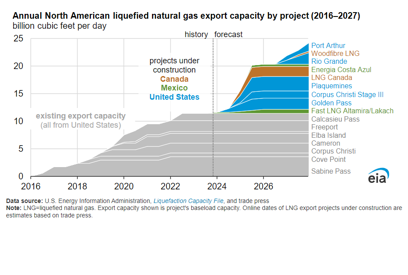

Speaking of LNG, this week EIA updated their projections for North American LNG export. While the expectation for export capacity hasn't changed much, the projects have. See below.

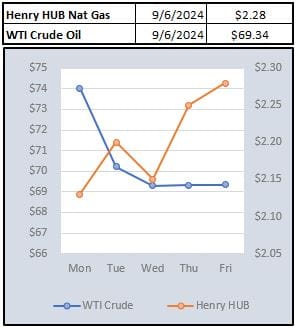

It is seldom or rare that crude discussion takes up any space in the WPO. That said, it's hard to ignore the move WTI crude has made this week as there has been a roughly $10 move lower.

The reason we mention it, is one of our natural gas themes has been gas production would need to curbed, at this point, to see some meaningful reduction on the supply side of storage. While the correlation isn't as strong as it used to be, a slowdown in natural gas production used to be driven by petroleum drilling here in the US. Should this pullback in crude be anything more than a blip, it's fair to assume that some production cuts would be coming which would spill over to natural gas.

NOAA WEATHER FORECAST

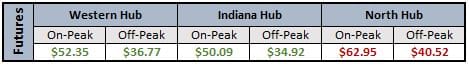

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

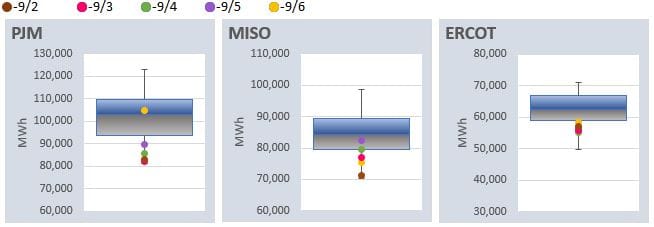

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: