Weekly Power Outlet US - 2024 - Week 45

MISO winter good, EV?, Natural Gas

MISO winter good, EV?, Natural Gas

Energy Market Update Week 45, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

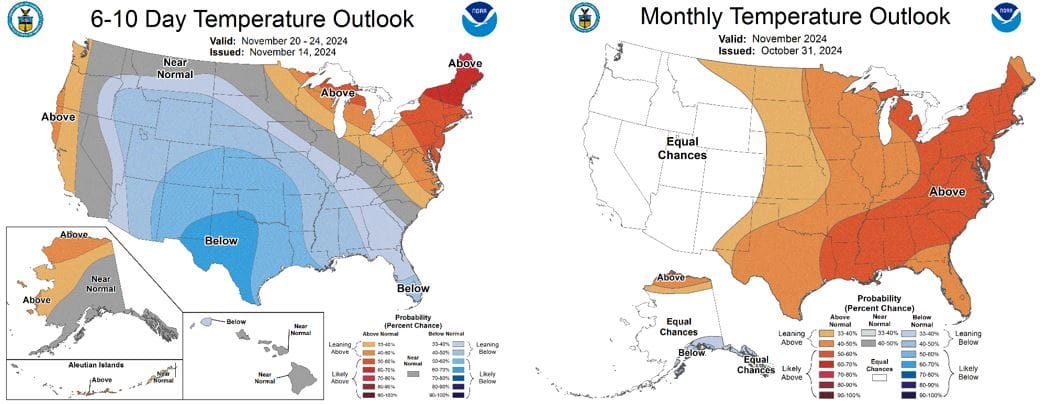

MISO shared its 2024-25 winter readiness outlook yesterday highlighting potential risks and that the ISO should have sufficient resources. The ISO uses multiple weather models in their analysis with the consensus temperature forecasts being normal in the north, slightly warmer in the central, and above normal in the south. MISO stated that it expects winter demand could surpass 107 GW with 122 GW under normal conditions to meet that number. For context the winter record was 109 GW on January 6, 2017.

It shouldn't come as a surprise that MISO anticipates plenty of generation in the winter. In just the second year of using seasonal capacity, winter prices cleared at $0.75/MW-day compared to the $30s for spring and summer. MISO stated that the seasonal capacity market is helping but warned of some of the issues of the intermittent generation stack.... “However, we must continue stakeholder and industry engagement to refine our processes and tools to provide maximum visibility to our operators. This is even more important as we continue to manage reliability through the ongoing energy transition.”

Over the last handful of years, grandiose predictions and policy have been attached to the EV market. If you have read WPO, you know we've been nothing short of very skeptical. Our number one reason was always the doubt that adoption would be as robust as touted. Yesterday it was announced that the Trump team would move to strike the $7500 consumer tax credit and that TSLA's Musk was onboard. That basically makes EVs $7500 more expensive in a market that has already been struggling. Congress would have to pass this, so nothing is a done deal at this point.

While abolishing the EV tax credit got plenty of headline this week, the real crusher was another almost weekly headline about a producer cutting plans. This week it was Ford, again. Last week Ford had said it was pausing production of the F-150 Lightning because of weak demand. Some shook it off as kind of, 'of course, no one wants an electric pickup truck'. This week, Motor1.com is reporting that Ford is reducing some output at their Cologne German factory as Volkswagen-related products are not selling all that well.

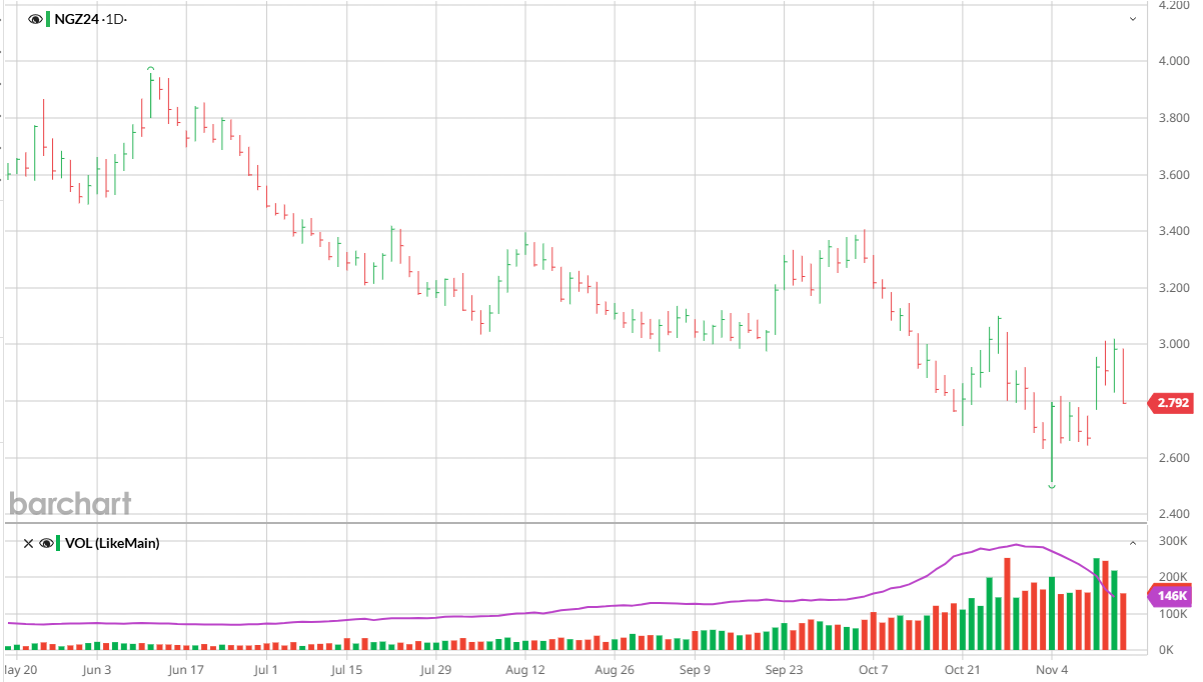

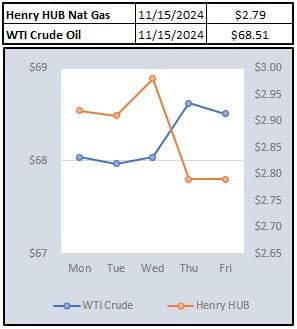

Natural gas had another interesting week as the chart below shows. The week is ending about where it started, but in between there was some discussion about colder forecast, Gulf storms, and one eye on Europe. European natural gas hit a YTD high around 46 Euros per MWh which is up about 40% since January. The European market has started to look at larger than expected withdrawals in November and some of the comments about potential disruption of what is still flowing out of Russia.

The EIA storage numbers showed a build of 42 Bcf compared to estimates of 44 Bcf which is in line with expectations. This number may have stopped any further rally for now.

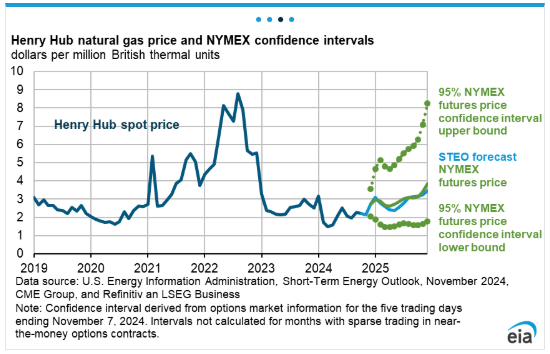

The EIA also produced their monthly Short-Term Energy Outlook (STEO) this week. We always appreciate the forecasts of price and production from this report. As noted in the chart below, the forecast has been inching up with winter averages of natural gas around $2.80/MMBtu at Henry Hub, and continuing higher throughout 2025 to average near $2.90 MMBtu.

Accordingly, higher prices have resulted in higher production forecasts. The expected US marketed natural gas production is forecast to grow by 1% from 2024 averaging about 114 Bcf/d. A good deal of that increase is expected to come from the Permian where past export capacity has kept production down.

NOAA WEATHER FORECAST

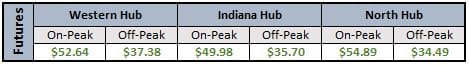

DAY-AHEAD LMP PRICING & SELECT FUTURES

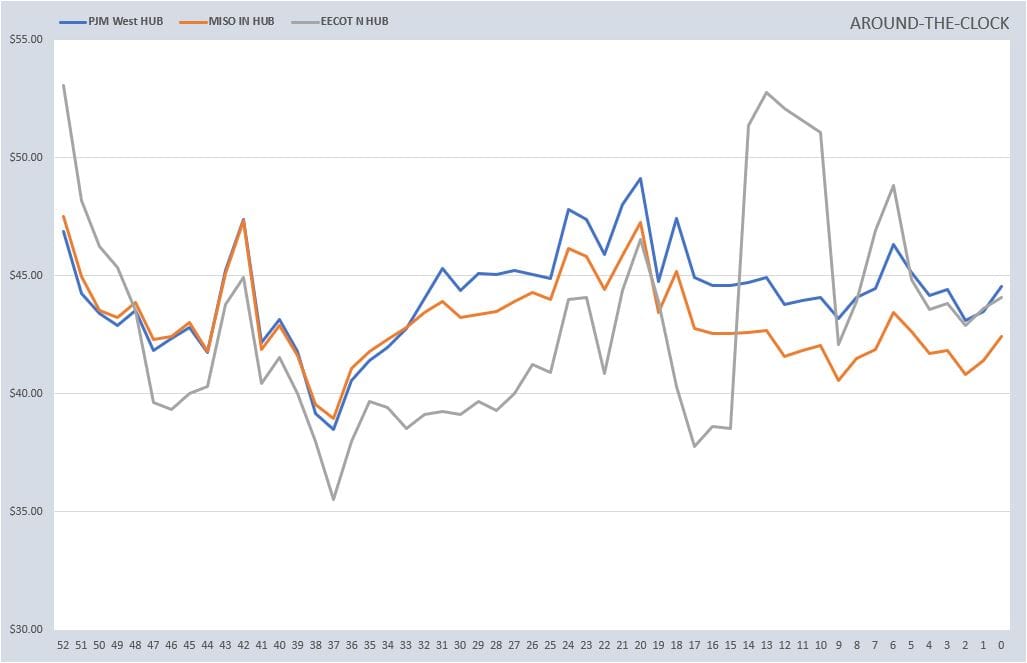

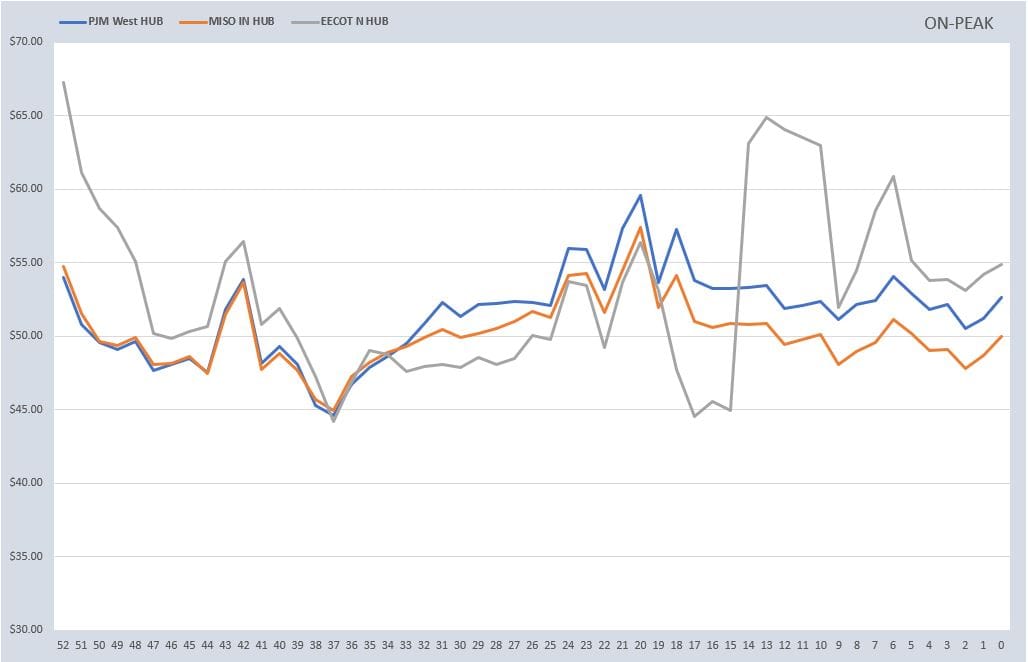

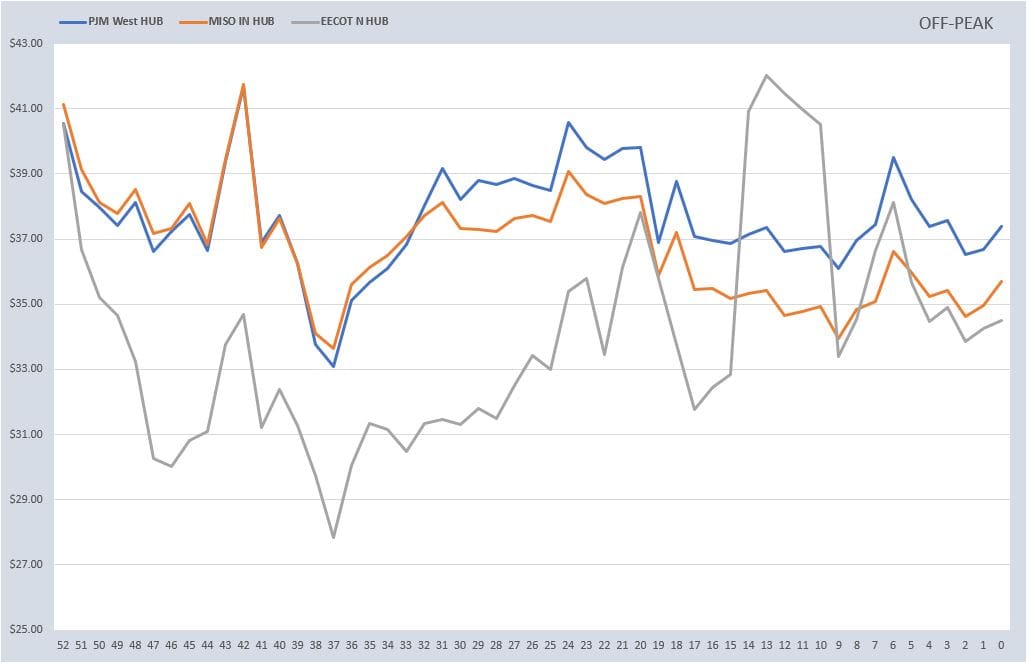

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

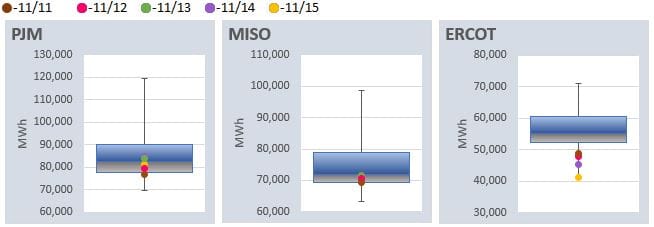

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: