Weekly Power Outlet US - 2024 - Week 49

Natural Gas, EU-Electricity, MISO BOD

Natural Gas, EU-Electricity, MISO BOD

Energy Market Update Week 49, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

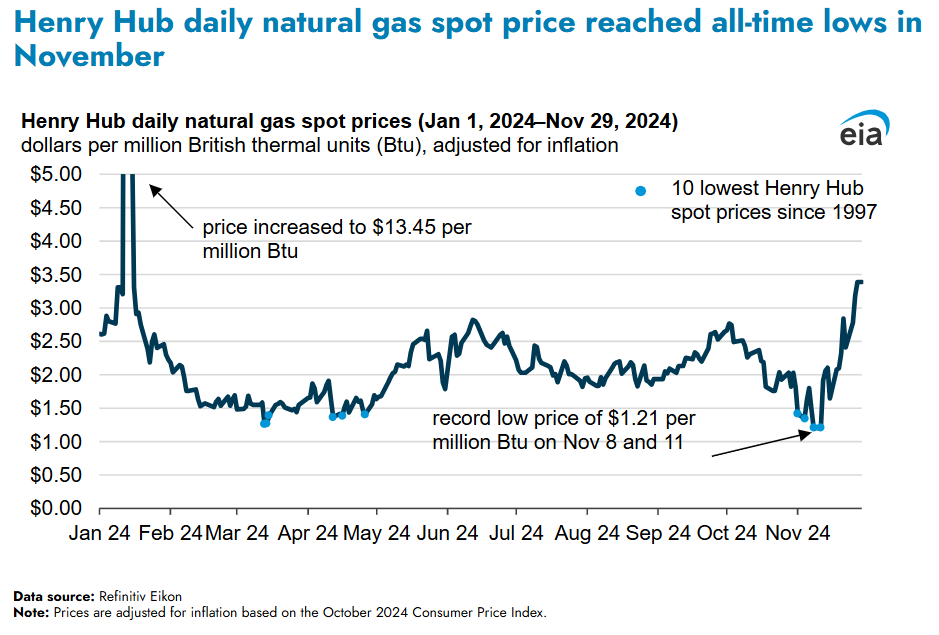

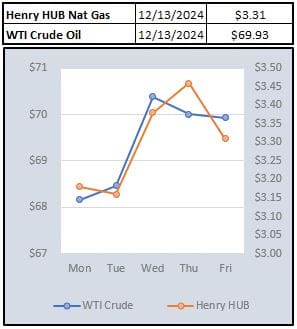

Last week we talked about some up and down weather forecasts that have driven the gas and electric markets. Well, it seems this week seems to be a repeat of that. Front month natural gas (January) started the week just over $3 after a big pull back, but traded as high at $3.55 before pulling back today.

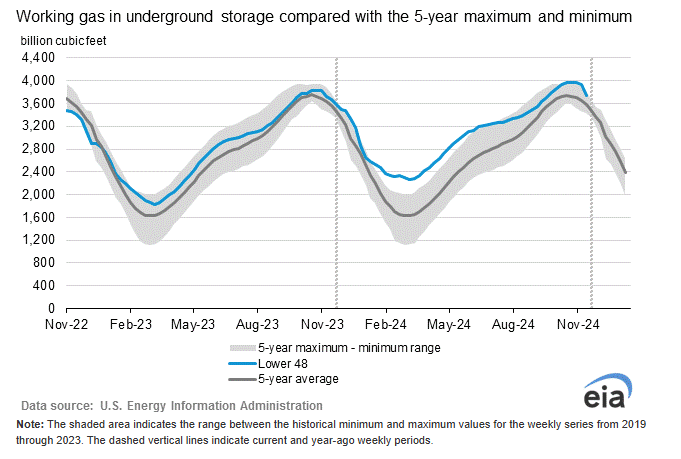

Yesterday's storage report showed a withdrawal of 190 Bcf which was above the 170 Bcf forecasted level. That put storage levels still above last year's levels and well ahead of the 5-year average. The market seemed to shake off the news as warmer forecast have emerged.

The chart below is a pretty good indication of where we were just a month ago as prices have started to climb on weather and some European concerns about gas levels this winter.

If you've been a long-time reader of the WPO, you understand sometimes we get stuck on a topic. Well, for better or worse, we might be on to a new one which is the electricity pricing imbalance in Europe. This isn't anything new, but given the natural gas situation and the transition to intermittent resources, this is becoming more and more of an issue economically.

If you type in European electricity markets in your favorite browser, you'll usually get a bunch of white paper links that mention things like transformative, forefront of energy transition, and this from the EU themselves....An integrated EU energy market is the most cost-effective way to ensure secure, sustainable and affordable energy supplies to EU citizens. Well, that might be debatable, or it has been this week. Norway, not an EU country, has been feeling some pain recently, and there seems to be a little consternation. Norway produces 90% of their electricity from hydro, but some of that gets exported to EU and UK through interconnectors which leaves some of Norway subject to market prices. According to a story in the FT, yesterday that left some parts of the country with prices at $1.18/kWh. Opposing political parties seem to be aligned that this can't stand. Instead of trying to summarize further, it might be best to let Norway's energy minister Terje Aasland's FT comment sum it up, "It's an absolutely shit situation".

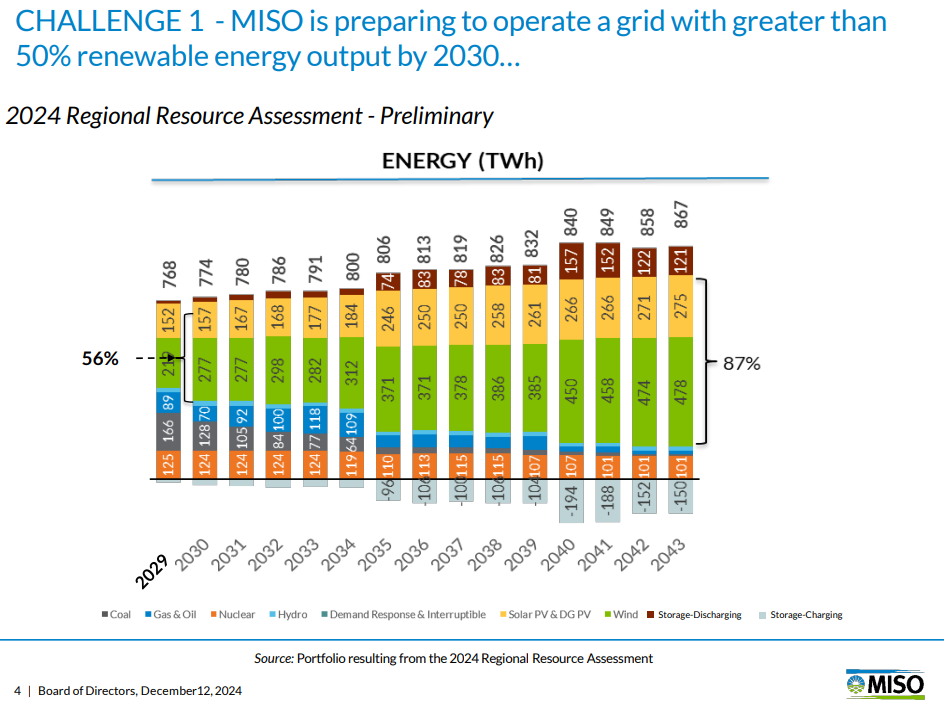

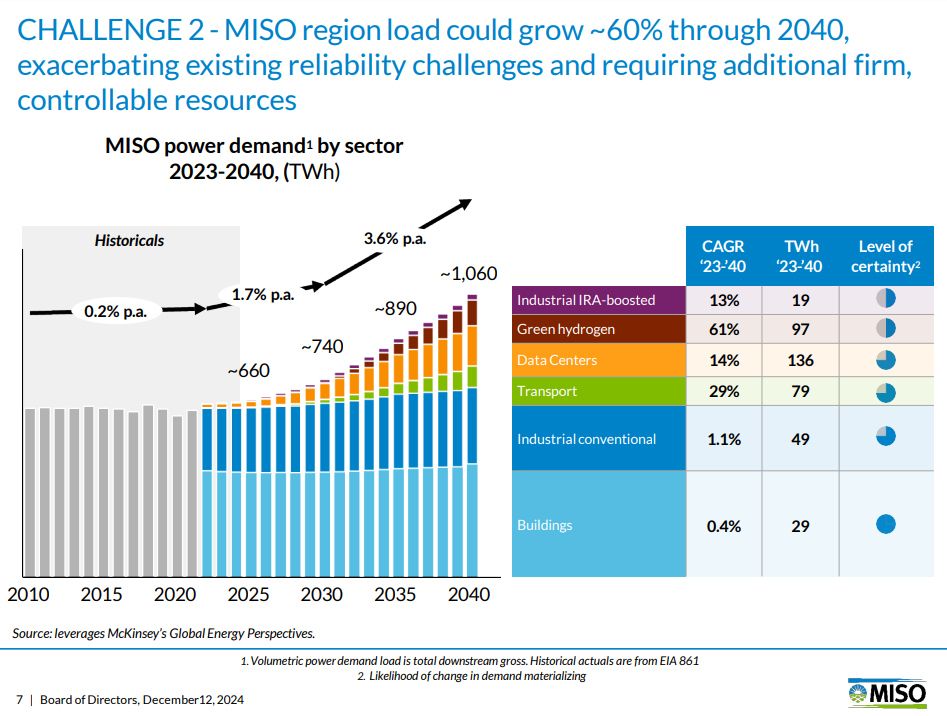

This week MISO held their Annual Meeting & Board of Directors: Open Session. As is usual there were plenty of updates from various working groups and committees which include a mix of interesting topics and some much less interesting. We tend to be more interested in things such as the Strategy Update: Reliability Imperative.

The report and presentation were interesting as the discussion had a hint of alarm regarding future growth and the ability to maintain reliability. Frankly, if we are being honest, listening to the entire meeting to get to this point gets a little tedious. Once we saw these slides pretty much back-to-back, we moved on to something else.

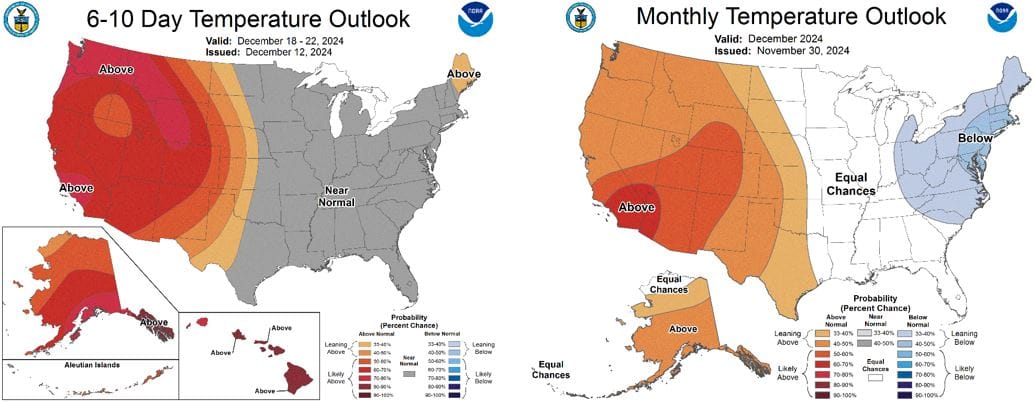

NOAA WEATHER FORECAST

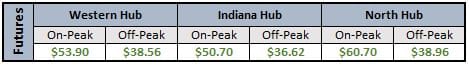

DAY-AHEAD LMP PRICING & SELECT FUTURES

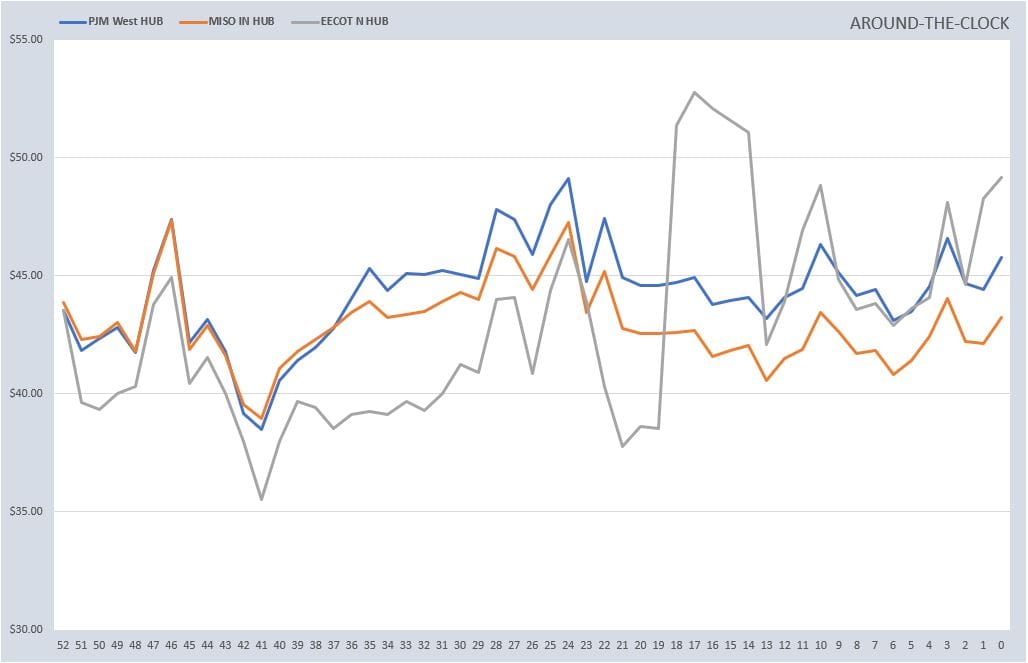

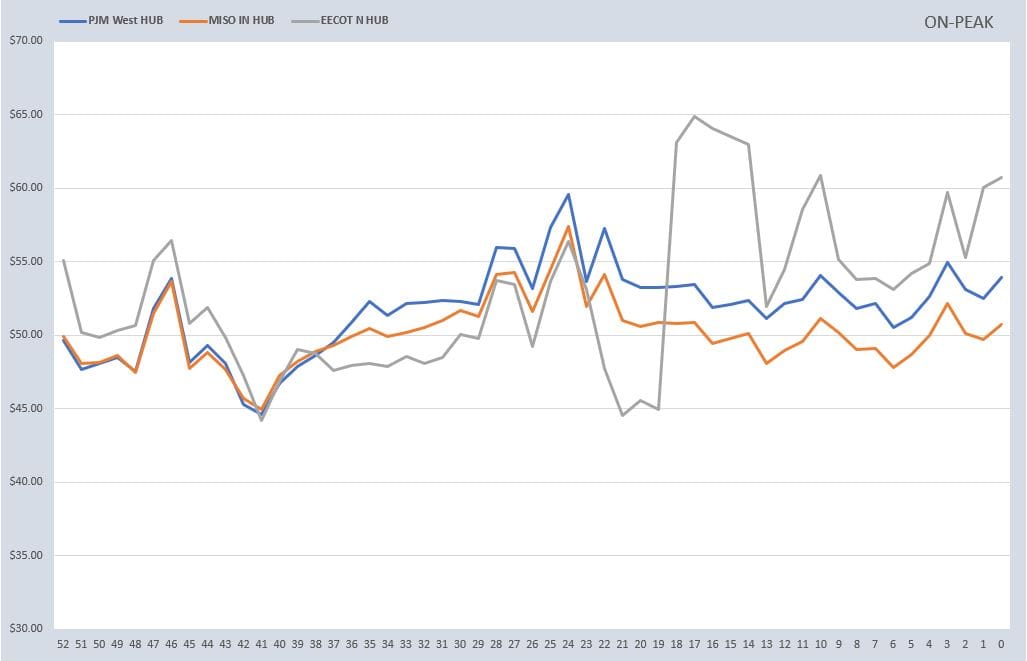

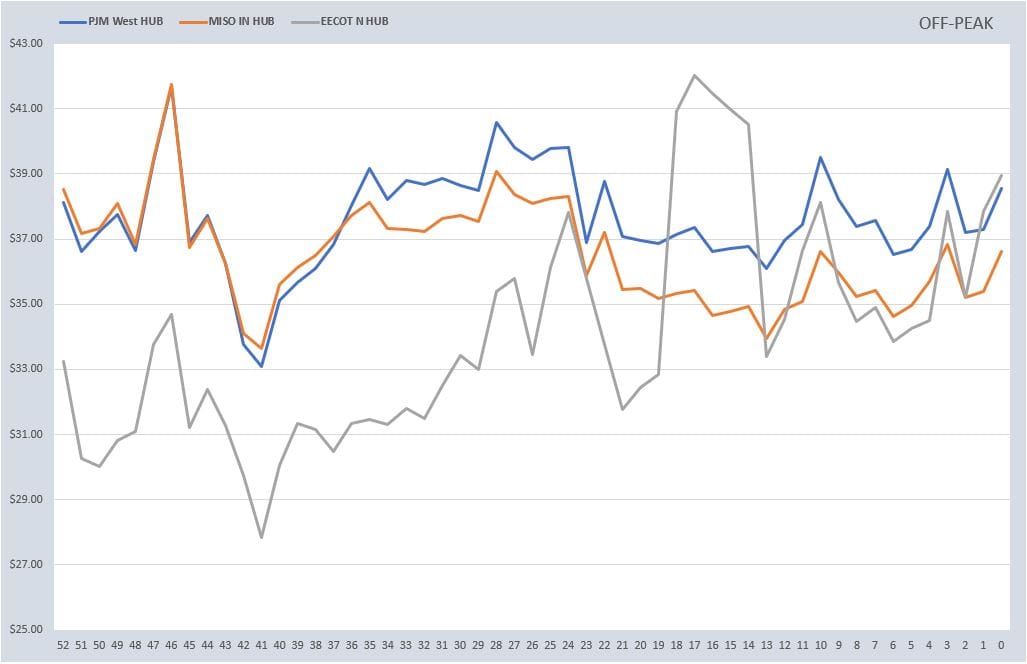

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

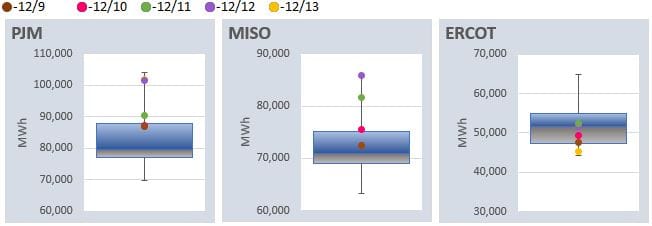

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: