Weekly Power Outlet US - 2024 - Week 5

PJM released their storm update report, FERC ISO 2222 & Weather Hedging Data

PJM Storm Update, FERC, Weather Hedging Data

Energy Market Update Week 5, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

PJM released a preliminary report on how the system performed during Winter Storm Gerri. Overall, they are giving themselves an early grade of it "performed well". Gerri wasn't as widespread across the whole ISO as Elliot was, which may have provided some relief. In the report, PJM talks about the better performance of gas units, better forecasting, and better coordination with other regions.

During the peak of the cold, the forced outage rate was around 16,000 MW compared to over 45,000 MW during Elliot. Fewer well freeze-offs and better pipeline coordination allowed for consistent delivery of natural gas. Another big difference from last year was the PJM accuracy in forecasting load. PJM's load forecast this year were consistently within 3% of peaks. During the peak of Elliot the forecasts were off by 10% which added to the lack of generation issue. Finally, PJM was able to export up to 12,000 MW to help neighboring regions during the cold. As stated, comparing Gerri to Elliot may not be apples to apples as this cold snap didn't cover the entire ISO which helped. That said, a small self-pat on the back is acceptable.

This week while doing some research on FERC 2222, we were reminded how much fun the commission can be. Commissioner Christie, when referring to PJM's trying to navigate the ongoing ISO compliance to 2222, stated, "The Order No. 2222 compliance morass keeps getting deeper, forcing market operators like PJM through a regulatory version of Dante’s Nine Circles of Hell". Now that's just funny, or maybe funny to electricity nerds.

Heading into the new year, FERC will be operating with only three commissioners as James Danly has moved on. As an aside, we wrote a couple weeks ago that Commissioner Danly was must-see TV when testifying in front of congress...he will be missed. Currently the commission is made up of Allsion Clement (D), Chair Willie Phillips (D), and Mark Christie (R). The three make up the minimum quorum to take up and vote on dockets. Remember during the early years of the Trump administration, there were unfilled seats that had the FERC at a standstill. While we haven't read all the rulings, from what we have seen, Christie and Clement seem to vote as the letter beside their name would suggest while Chairman Phillips could take either side making him a good swing vote. Some have suggested that a three-person commission might get more done with no possible 2-2 ties. While that may be true, it would be preferred that the commission seat five as additional staffs and commissioner could take on more work.

In past editions of WPO we have commented many times on the merit of using the markets to hedge electricity. Whether a load or a generator, taking advantage of market prices to fix costs or revenue can be done with a plan. We at Acumen take pride in the plans we've built to help in this process. As we often say, we are looking to build the plan and then let the market help us execute it....sort of a financial planner model.

One of our goals with the WPO is to provide information that could be market moving, as any model is only as good as some of the variables (information) included in its construct. We respect all hedging methodologies and try include information even if we don't find it relevant to our planning. With that, for all those who use this as a data point....

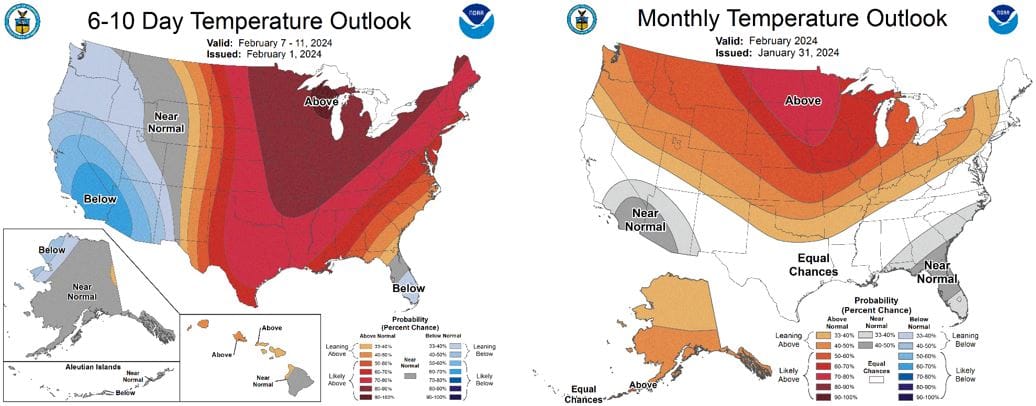

....I guess some beaver named Phil was somewhere cloudy in Pennsylvania revealing no shadows. Apparently, that means it's already springtime, that and 50s in the upper Midwest. Anyway, if you have that as a data point in your hedging model, remember to adjust accordingly. By the way, this Phil happens to have a great documentary about him starring Bill Murray. It's worth checking out.

NOAA WEATHER FORECAST

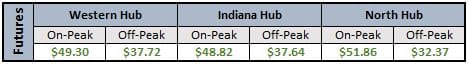

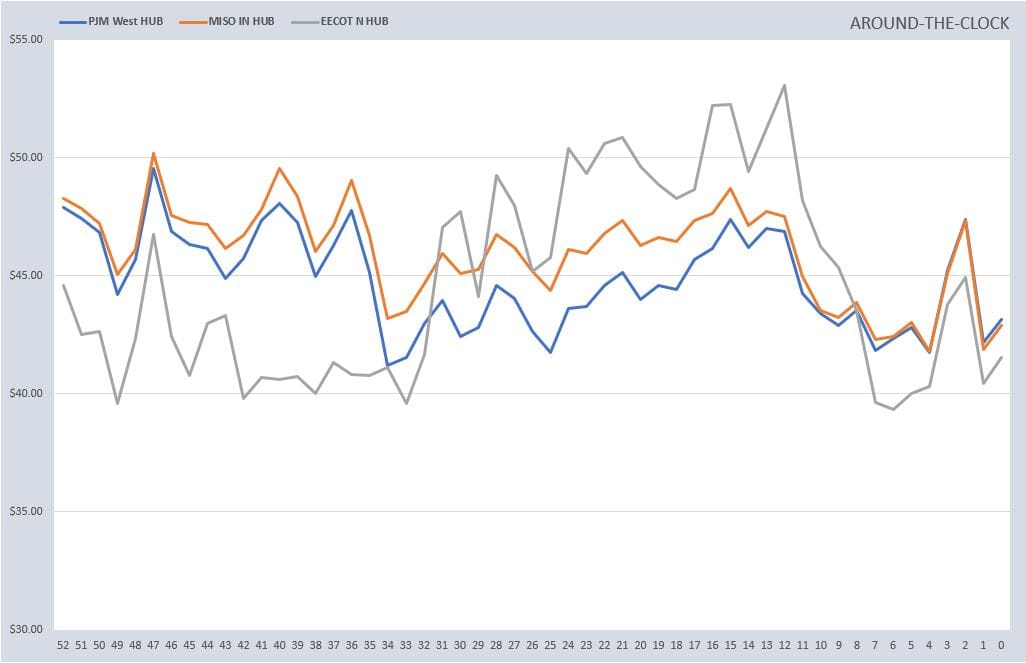

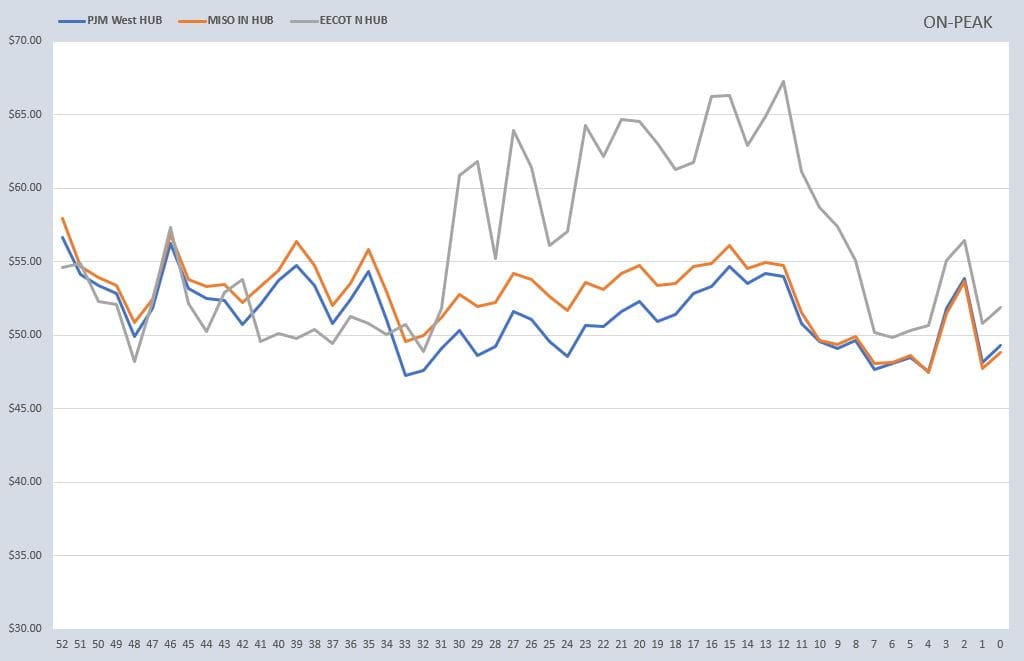

DAY-AHEAD LMP PRICING & SELECT FUTURES

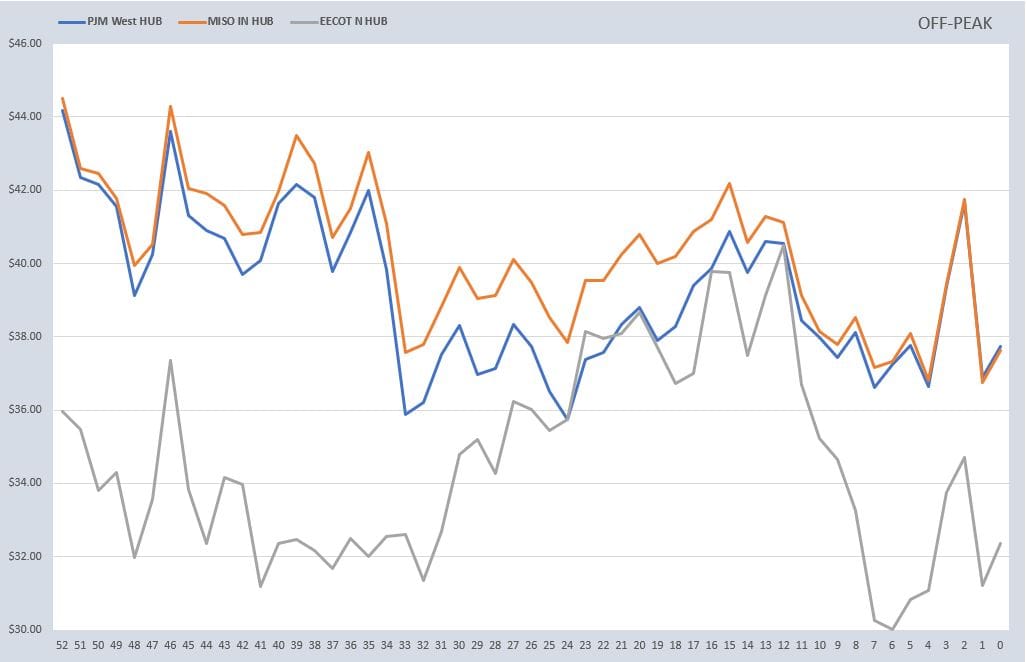

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

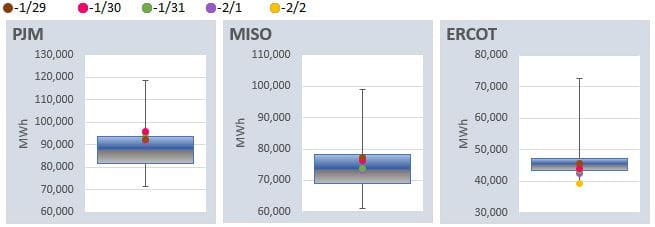

DAILY RTO LOAD PROFILES

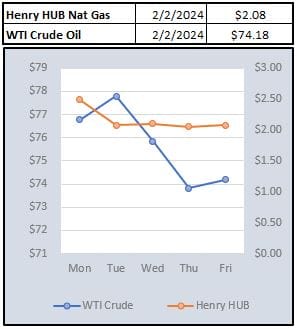

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: