Weekly Power Outlet US - 2024 - Week 8

Over estimation of EV load and the underestimation of AI load, MISO-reliability & NMISA.

AI-Load, Market Bottom, MISO-reliability, NMISA

Energy Market Update Week 8, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

One of the themes we've been championing the last year is overestimation of EV load and the underestimation of AI load. A few weeks ago, we talked about a Verge article interviewing Meta CEO Mark Zuckerberg. The article mentioned Meta's interest and intent on ordering Nvidia chips. We did some math that stated if Nvidia could get to their goal of 2 million chips sold in 2024, the power consumption of those chips would rank as the 5th largest city in the US, slightly ahead of Phoenix and behind Houston. Also, a while back we also commented on Hertz and their intent on selling off EVs. They stated that reliability, customer demand, and driver error were reasons to cut some of their inventory in rental centers.

This week, Wall Street gave us more examples of both. Unless you don't get a newspaper, turn on some financial news, or have an X account, there is no way you could have missed the Nvidia earnings news this week. There are plenty of research reports or articles to go into the details, but fair to say, they are will on their way to the 2 million chip goal. Conversely, with less fanfare, Rivian the EV truck maker announced layoffs and cutbacks on production. The reason given was lack of demand in the space right now and possible market saturation for those actually looking for EVs.

We aren't here to say EVs are already dead, we actually think they are kind of cool. Instead, we are just watching the trend, when a thirteen-year-old girl can ask her computer to draw a picture of her and Taylor Swift hanging out together, we might want to ask the electricity demand question.

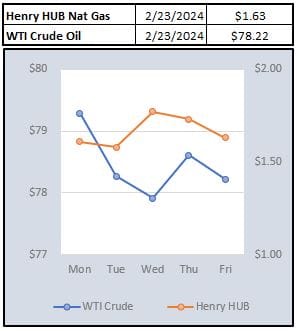

Over the last couple WPOs we've reminded the old axiom, that the cure for lower prices in the commodity world is lower prices. Some have asked what that looks like in real life. This week, we got it, again from another Wall Street report.

Instead of us trying to comment on it, we will just let Chesapeake Energy show what that looks like. Chesapeake is one of the largest natural gas producers in the US. Included in their quarterly earnings report was;

Chesapeake is currently operating nine rigs (five in the Haynesville and four in the Marcellus) and four frac crews (two in each basin). Given current market dynamics, the company plans to defer placing wells on production while reducing rig and completion activity. The company will drop a rig in the Haynesville and Marcellus in March and around mid-year, respectively, and a frac crew in each basin in March. These activity levels will be maintained through year end. Deferring new well production and completion activity will build short-cycle, capital efficient productive capacity which can be activated when consumer demand requires it.

The natural gas markets reacted to this with a one-day rally of nearly 10%. Alas, it was short lived as current fundamentals are driving the front month of the curve and prices have retreated to levels of the last two weeks. More comments like this, and the fundamentals that would come with less production are now needed to cut through excess storage as we exit winter.

It looks like MISO has missed our weekly segment on reliability reports. This week they decided to provide some material, so segment back on....at least for this week

PJM, MISO, ERCOT, ISO-NE, etc etc....we've all heard of the ISO/RTOs that make up the vast grid in this country. Fun fact....have you ever heard of NMISA? This year, Northern Maine Independent System Administrator https://www.nmisa.com/ is celebrating 25 years. NMISA covers the two northern most counties in Maine and with a load of roughly 130 MW.

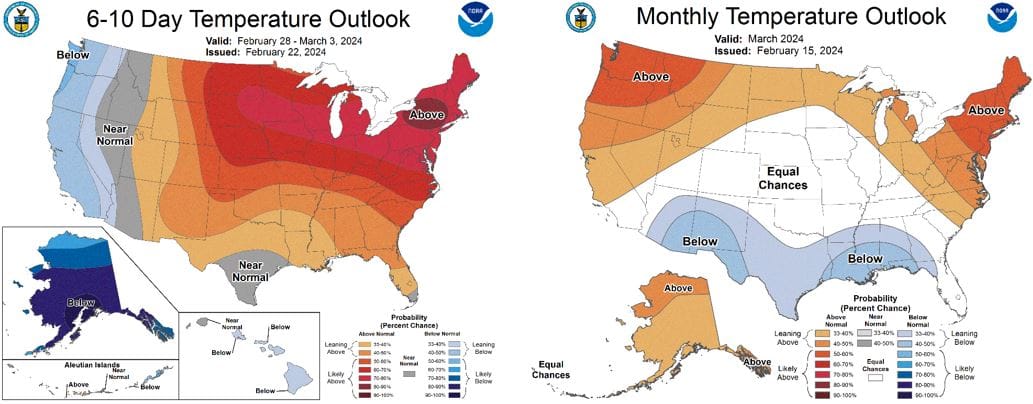

NOAA WEATHER FORECAST

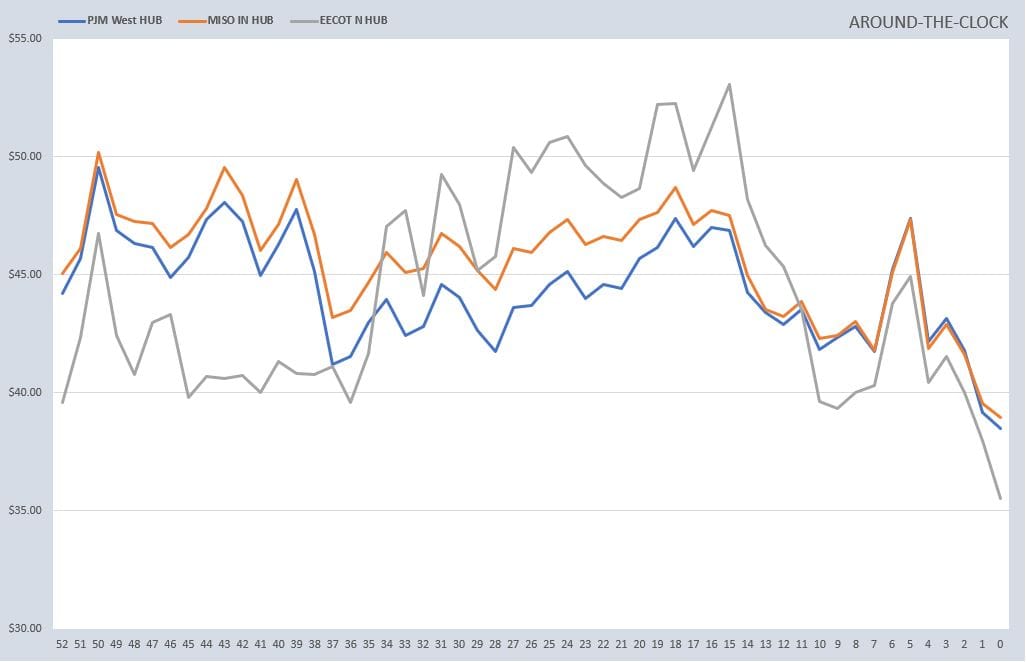

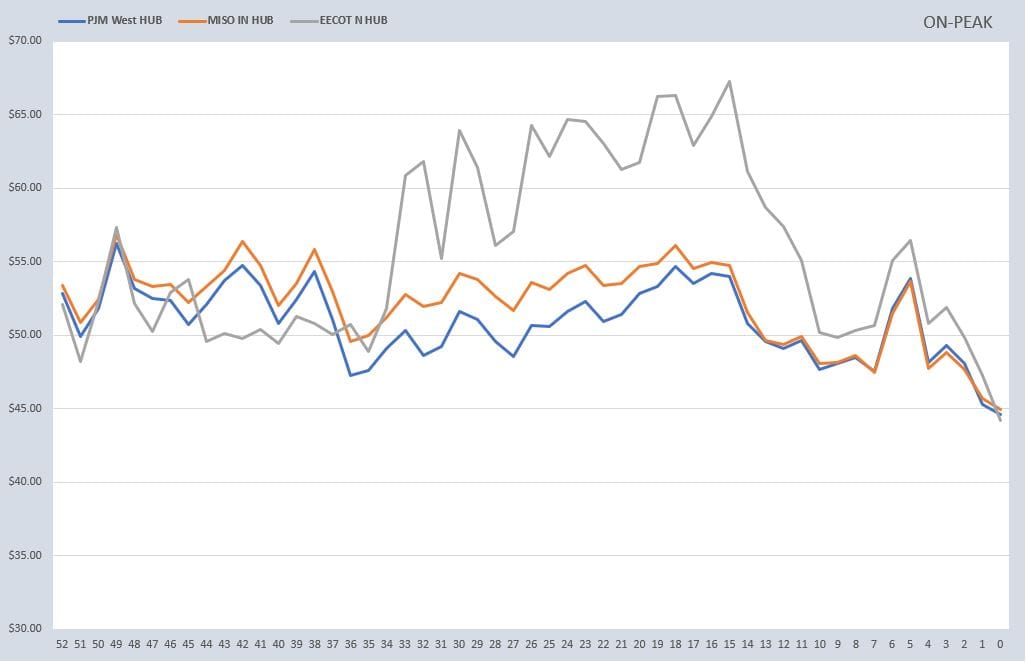

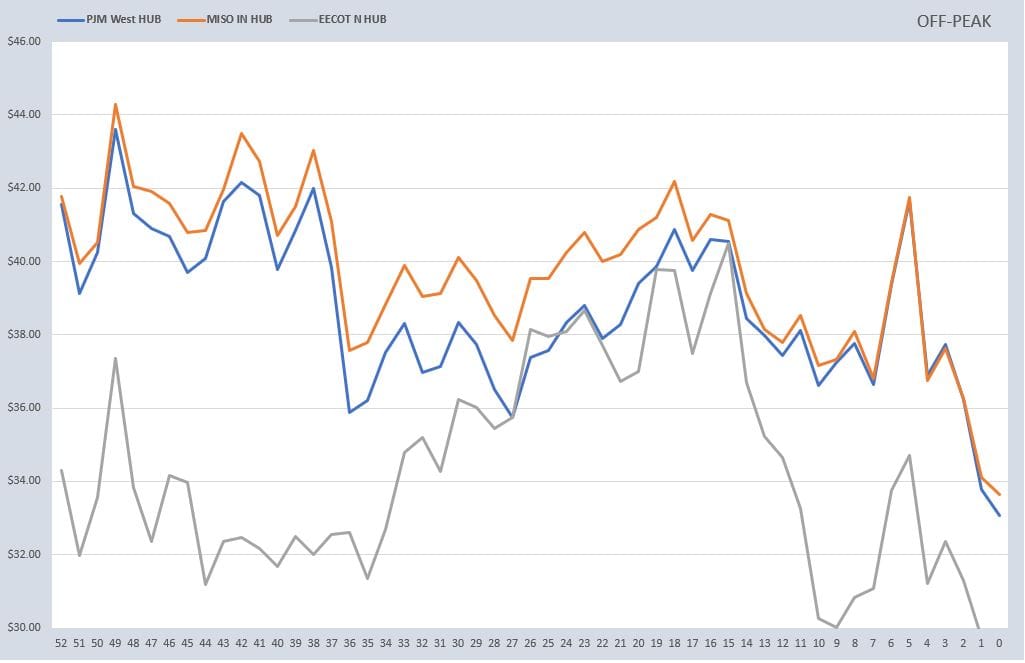

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: