Weekly Power Outlet US - 2025 - Week 11

EIA STEO REVIEW

EIA STEO REVIEW

Energy Market Update Week 11, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

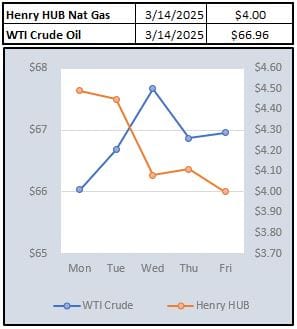

Every so often we get questions about why we are so keyed into natural gas as electricity folks. It's a good question and a reminder to explain. It's pretty simple, natural gas sets the marginal price for electricity almost all the time in every ISO. In short, when the ISOs price the day ahead electricity prices they start from cheapest to most expensive when meeting load expectations with generation. More times than not, natural gas units offered price to generate MWs establishes that equilibrium. That's why, as gas goes, electricity tends to follow.

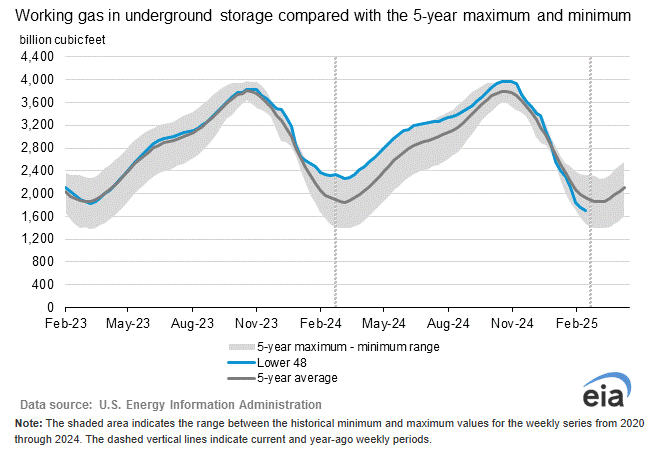

Anyhoo. Let's get on to some natural gas conversation. Within the next reporting week, we will be wrapping up what is typically withdrawal season and heading back into injection, where natural gas storage is replenished. This week saw the EIA storage report show a withdrawal of 62 Bcf, which was above the 40 Bcf expectation. The 62 Bcf now puts us at the second highest cumulative withdrawal season in the last fifteen years, only behind the 13-14 polar vortex year.

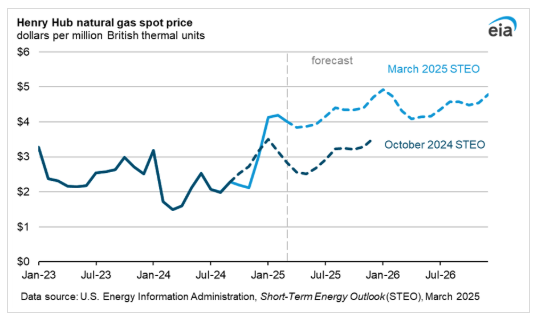

This week EIA released their latest Short-Term Energy Outlook (STEO). Followers know we love this report as it has a lot of great information. With that, we are going to take a little shot at EIA this week. Their estimates on gas and electricity are moving like an old sell side bank analyst following a tech stock moving price targets daily. The chart below shows the updated Henry Hub spot price estimates against last October's winter outlook. To be fair, as we've touched on above, there has been a big draw down in storage. That said, EIA is taking their estimates from just a month ago for 2025 from $3.80 to $4.20 which is roughly an 11% increase which is pretty interesting for month over month.

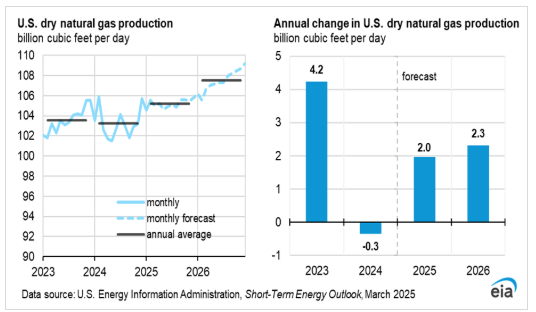

As prices move higher, history has shown that natural gas supply tends to come online. The second chart below shows EIA production numbers ramping. Some of this is explained with LNG exports along with domestic demand.

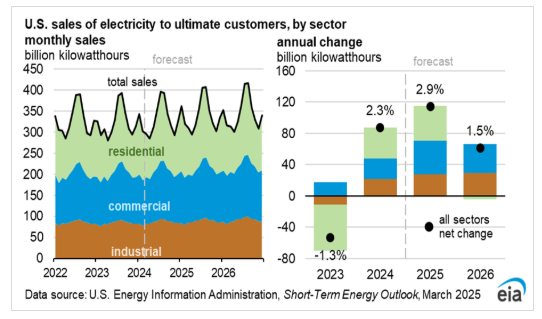

EIA also does some forecasting work on electricity consumption. As shown below, they care calling for an increase to C&I, while residential stays flat to trending down next year. The explanation for residential is basically winter won't be as harsh next year and return to normal. As would be expected given all the talk, C&I is a lot of data center talk.

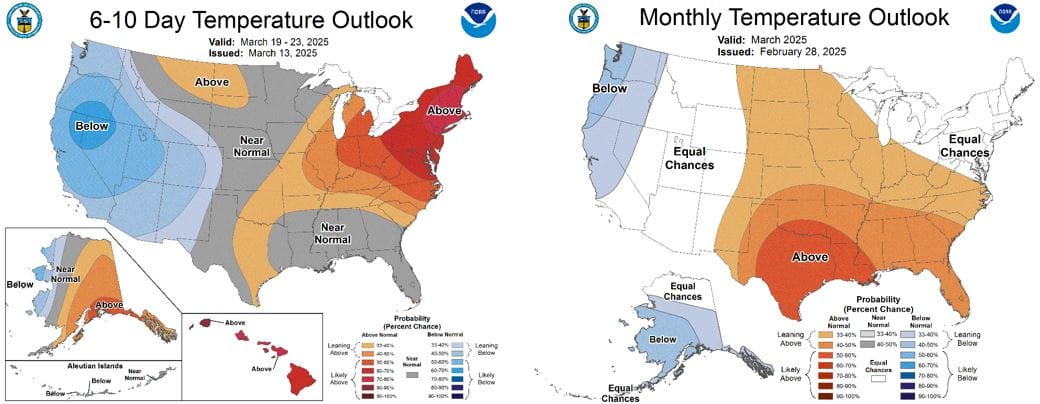

NOAA WEATHER FORECAST

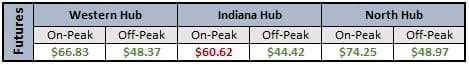

DAY-AHEAD LMP PRICING & SELECT FUTURES

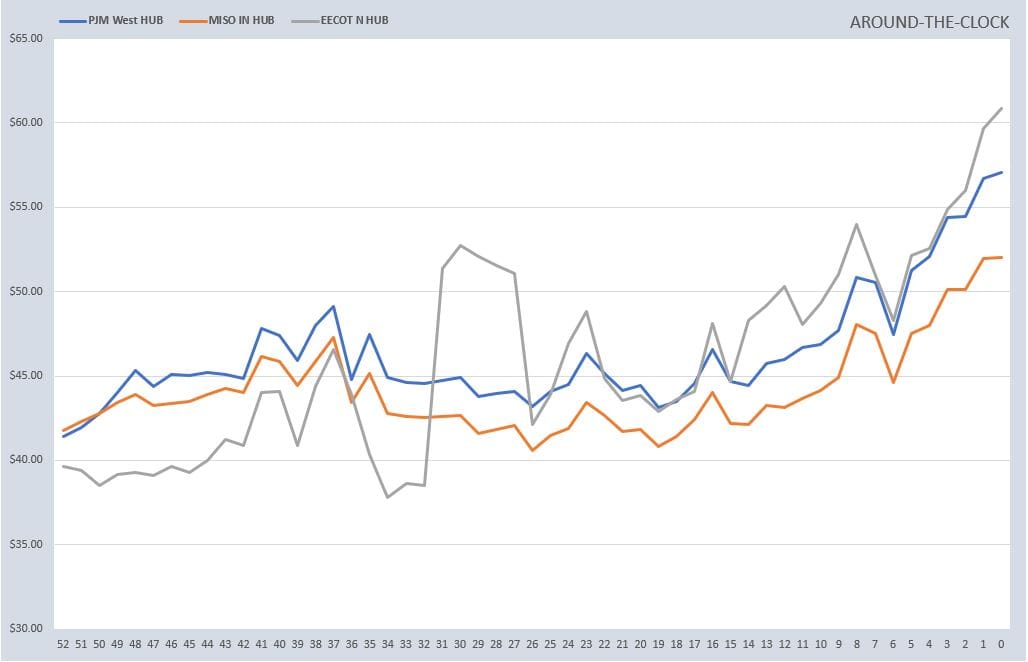

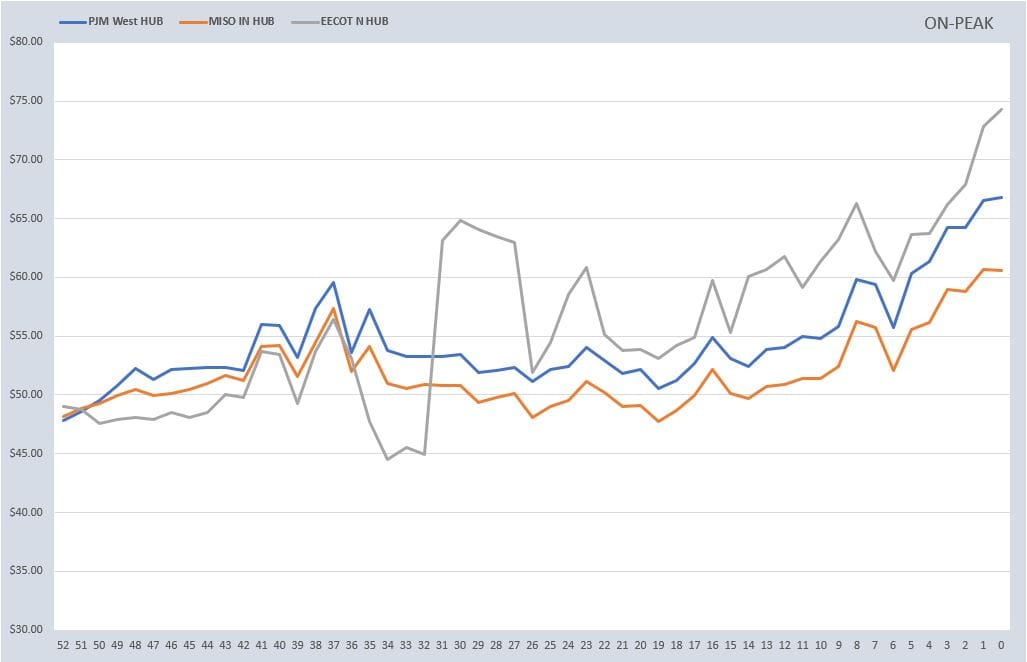

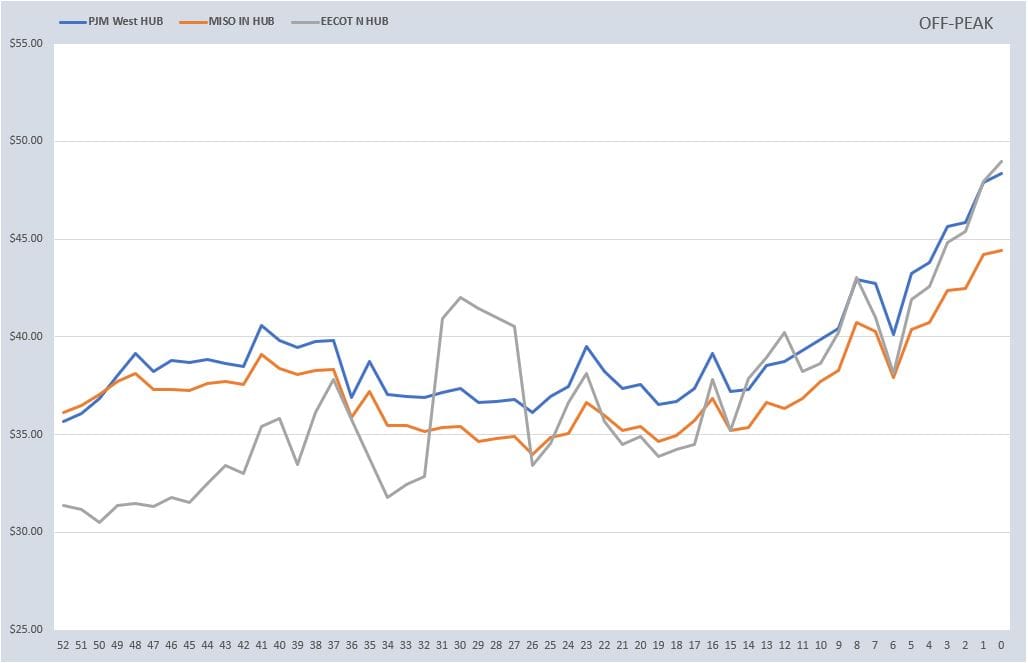

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

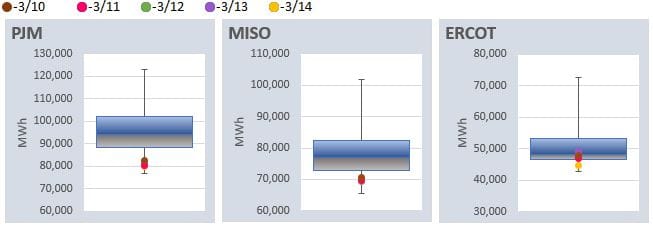

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: