Weekly Power Outlet US - 2025 - Week 12

Injection Season, Data Center Trip, Captive Gas

Injection Season, Data Center Trip, Captive Gas

Energy Market Update Week 12, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

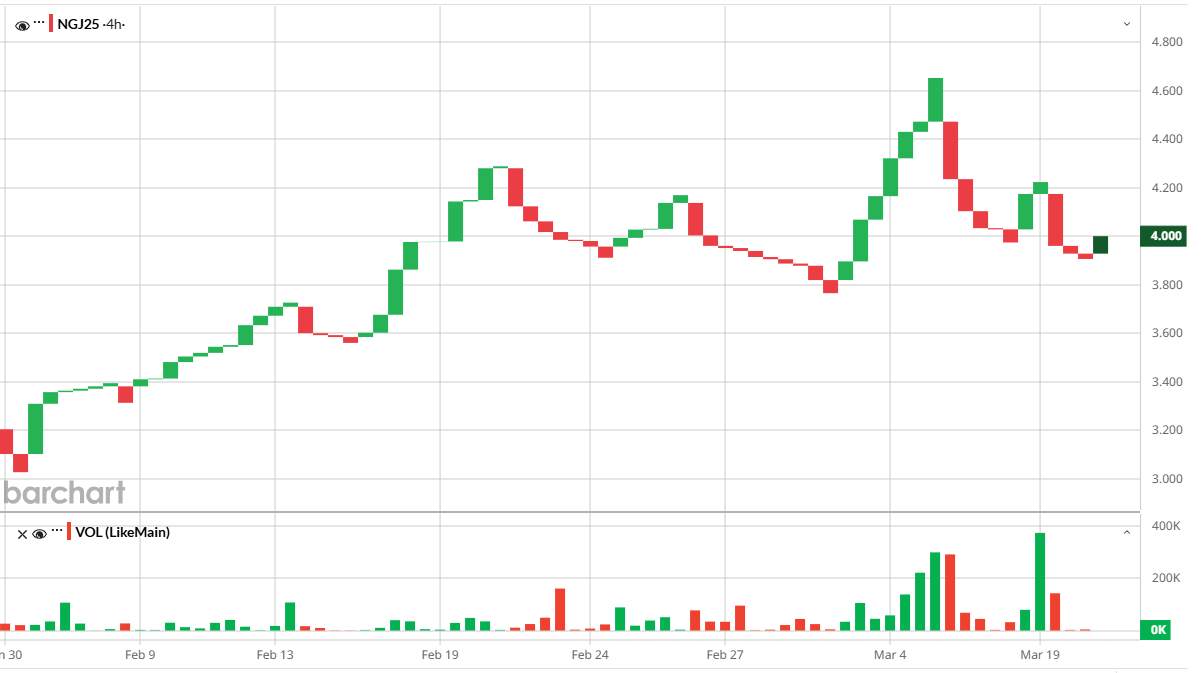

The natural gas market has had an interesting few weeks as digestible data points have been flying in daily. European storage, on again off again US winter, LNG shipments being diverted because of demand, and market speculation have been just a few things hitting headlines.

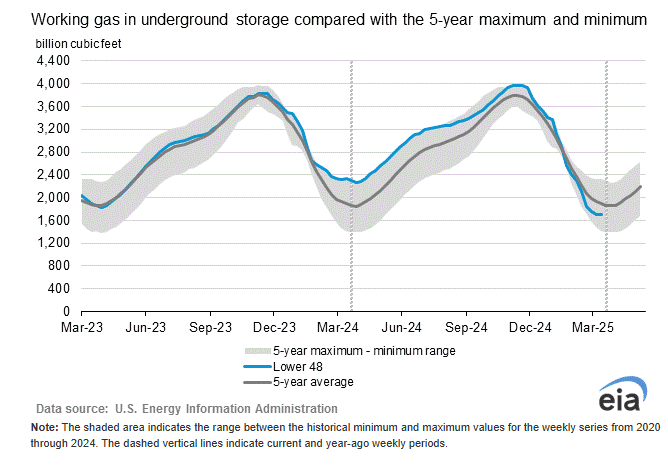

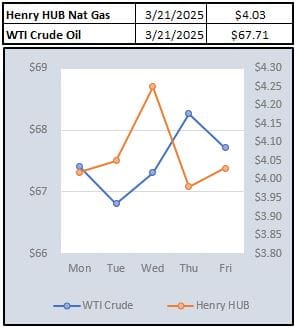

Yesterday was the unofficial start of injection season as EIA data pointed to 9 Bcf of natural gas being injected into storage. The estimates had ranged from small injections to small withdrawals and the market took this as bearish. The April contract was trading well into the $4.20s per MMBtu and quickly headed to the $4 level. We aren't necessarily market prognosticators, but if we were, we'd be on the side of more news volatility ahead. That could provide opportunities for both buyers and sellers of electricity....so be ready.

Not a week goes by when we can't include a good data center story or some commentary on it. Compute power is here to stay so these stories are more and more relevant. This week, a story by Reuters was passed around plenty on social media. This story focuses on an event that got a little coverage last summer, but data centers were just starting to be daily headline makers, so the story was here and gone with little fanfare. The article gives a little insight into what happened last summer when a large swath of data centers went into protect mode as a voltage surge was detected following a defect in a surge protector. Roughly 1500 MW of electricity was suddenly left with nowhere to go forcing PJM to quickly shut down generation. The article states this "near miss" almost led to cascading power outages. A ERCOT incident is also mentioned which just points out what we already know, data centers are going to present a host of new challenges for generation and grid operators.

One of our discussion points on drivers for future market volatility has been the coming fungible nature of natural gas markets made possible by LNG. Basically, as gas becomes more able to find markets, cheap US domestic gas will find more lucrative world markets.

This week, one of RBN Energy's blogs gives us a look at this, sort of. As an aside, RBN Energy is a must subscribe as they put out fantastic free content. Anyway, the article linked talks about the price discrepancies of the Alberta natural gas relative to other North American markets. Basically, the Albertan gas is locked by a lack of pipelines able to move it. This is a microcosm of what the US market has been over the last decade plus as the market has been captive keeping prices low to the benefit of US domestic users, including electric generation. When reading the article, think of what might happen to the price of gas in Alberta if sufficient pipelines were constructed to get it to other markets. Now take that picture and insert US gas and LNG.

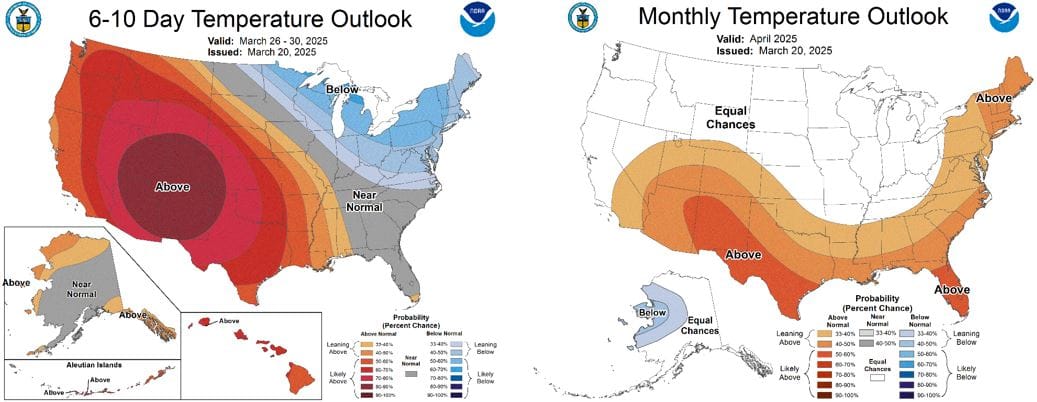

NOAA WEATHER FORECAST

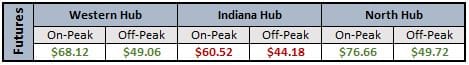

DAY-AHEAD LMP PRICING & SELECT FUTURES

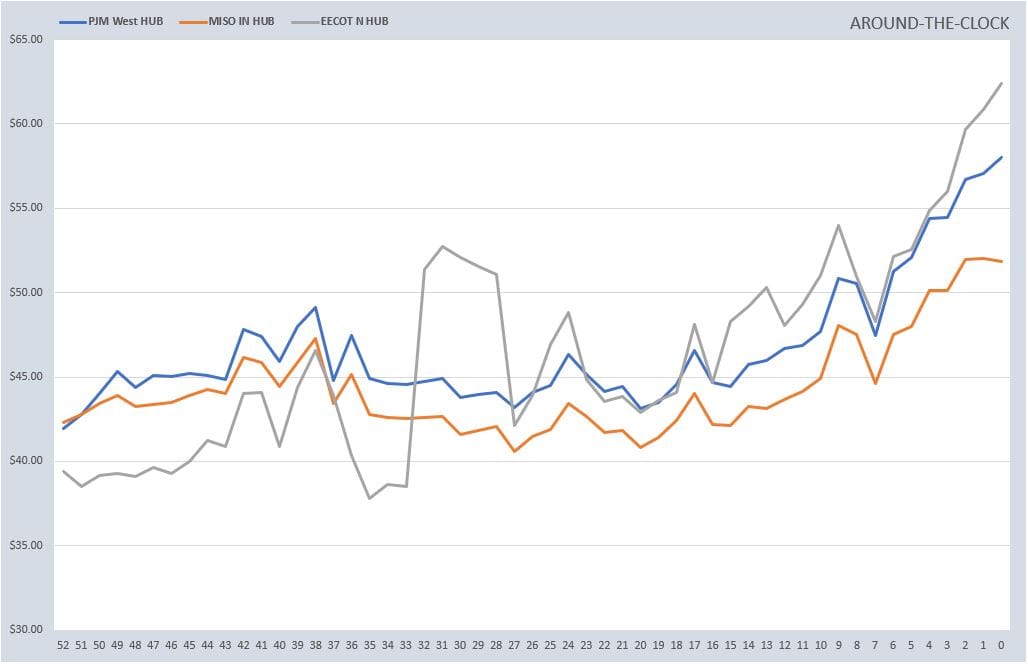

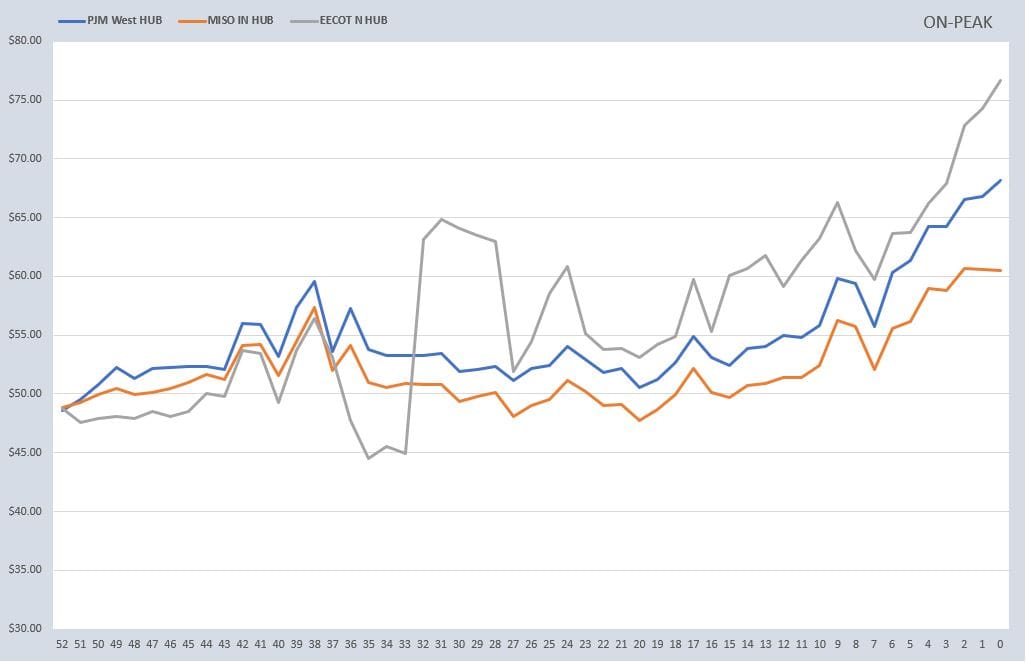

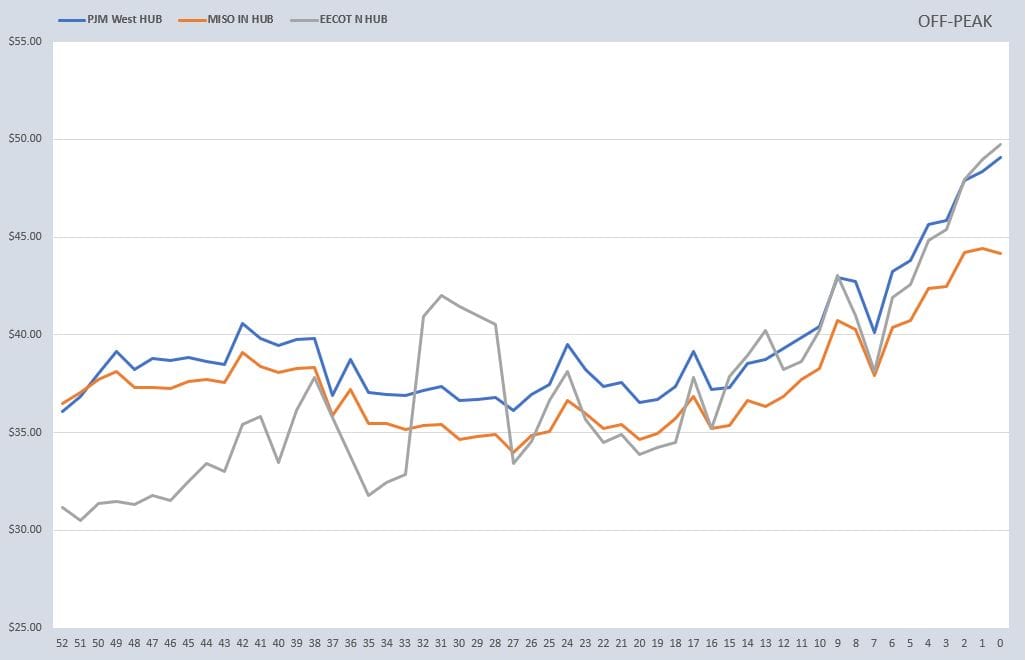

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

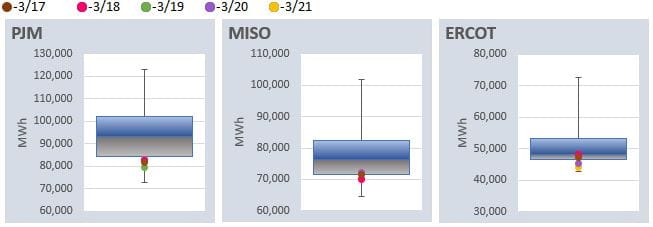

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: