Weekly Power Outlet US - 2025 - Week 15

Market Moves, Natural Gas Drivers

Market Moves, Natural Gas Drivers

Energy Market Update Week 15, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

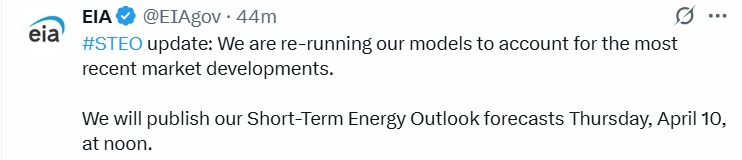

The above announcement earlier in the week from EIA perfectly sums up this week.

Interestingly enough, when EIA did release the STEO this week, there were plenty of caveats about modeling on old data when it comes to economic outlooks. It's hard to blame them as the situation at best is....fluid.

When we speak about the electricity market, and it first derivative natural gas, we always speak broadly. For instance, if this happens, it's fair to assume this could happen. We know people love price targets and predictions, but to us, that's a losing game. Not to mention, if we were any good at it, we'd be ordering a Corona on a beach this morning before our daily massage and golf game having just divested from our billion-dollar hedge fund.

Rather than try to be market prognosticators, we are more interested in plans that are designed to take advantage of market movements, regardless of the driver. The chart below is a good example. This is the May contract for natural gas. Within the span of a month, you could have been a seller and a buyer and gotten your price target. Market commentary always has some weather commentary, maybe some storage (in fairness, we comment on storage a lot), and perhaps an oddball talking point. Over the last month, you could visit any trading desk that deals in natural gas or electricity, and not one trader would be able to tell you the 6-10 weather forecast....it just doesn't matter. We would argue, and it's just our guess, the mid-March rally was an unwind of the popular long oil/short gas trade. All the trader knows is he has buy tickets, more driven by margin clerks than meteorologists. Fast forward two weeks and the trader has sell tickets, again nothing to do with fundamentals, but a sell everything and get liquid trade from those holding natural gas contracts for speculation. So, if you have a price target in your plan and you're a buyer of natural gas, you can sit back, feel and look good just like Billy Ray and Lewis (must be of a certain age to get the reference).

Now that we've pooh-poohed fundamentals, let's take a look at a few things that have changed this week. In our conversations about what is going to drive gas pricing we talk about LNG and fungible markets, load growth which is mostly driven by compute power, and supply of gas. We aren't going to dive deep into all of these, but some things are worth mentioning.

The EIA STEO did come out this week and in their natural gas assumptions for 2025, they ramped up US consumption driven by exports as more LNG export capacity comes online quicker. Their demand number now stands at 116 Bcf/d led by growth in LNG. What isn't mentioned, and maybe worth at least noting, there have been some quiet mentions that trade deficits by some countries can be made up by importing US natural gas. If natural gas becomes a currency in trade disputes, it's possible the number could be higher.

A huge story for the last year has been load growth, specifically data centers. It's made gas and electric participants listen to investment conference calls of big tech. This week Microsoft announced they were "slowing or pausing" some of their data center construction. Specifically, a $1 billion dollar project that was slated for Ohio. While this may be temporary, there have been rumblings the datacenter build has gotten ahead of itself. We shall see.

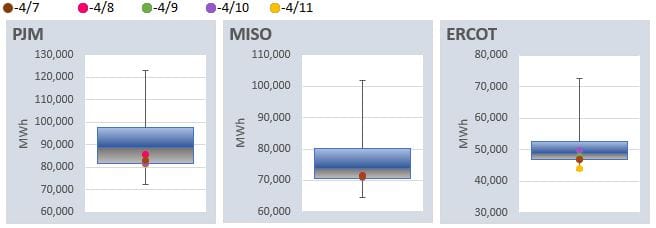

Finally, each week EIA releases storage data, and as mentioned before, everyone comments on it and that includes us. Most market commentary concentrates on the demand side of the equation. We've tried to look at supply, because there is no doubt the US has plenty of gas, it's all about the price. As oil has been trading just north or south of $60, more and more reports of breakeven prices have emerged for producers. Right now, the consensus is $50 is the breakeven for fields like the Bakken in North Dakota and once the market gets around $45, a lot more fields come into play. This is relevant to gas as producers may shut down oil and gas production given the price. Supply/Demand.

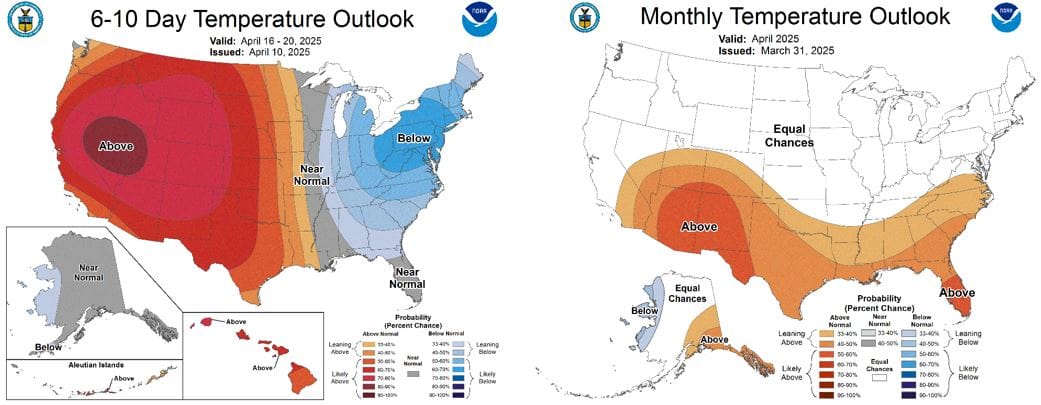

NOAA WEATHER FORECAST

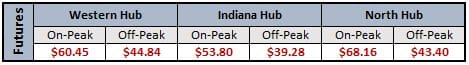

DAY-AHEAD LMP PRICING & SELECT FUTURES

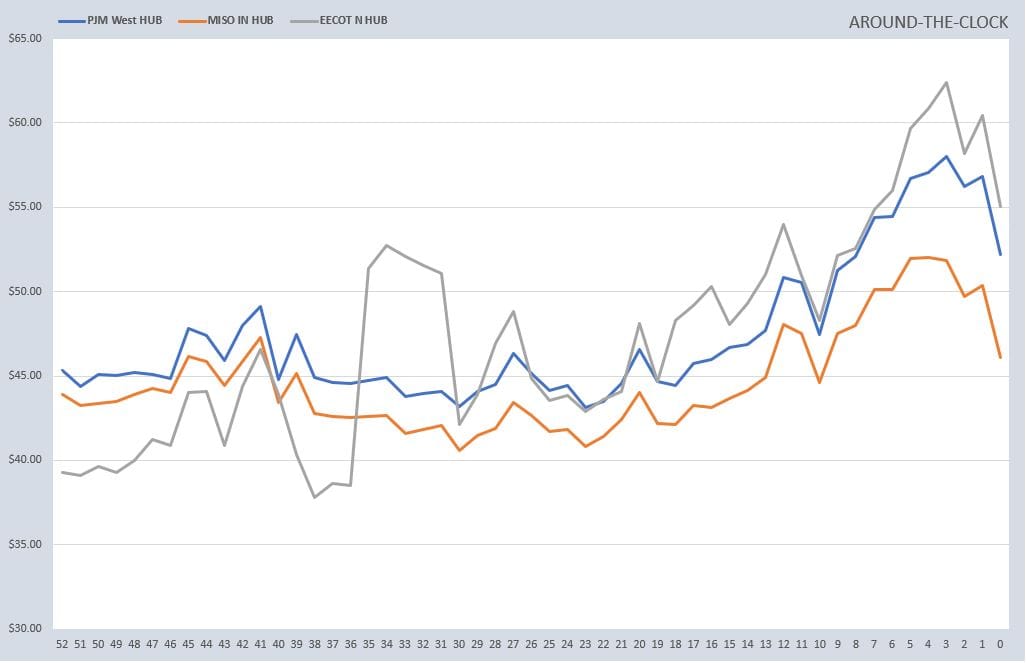

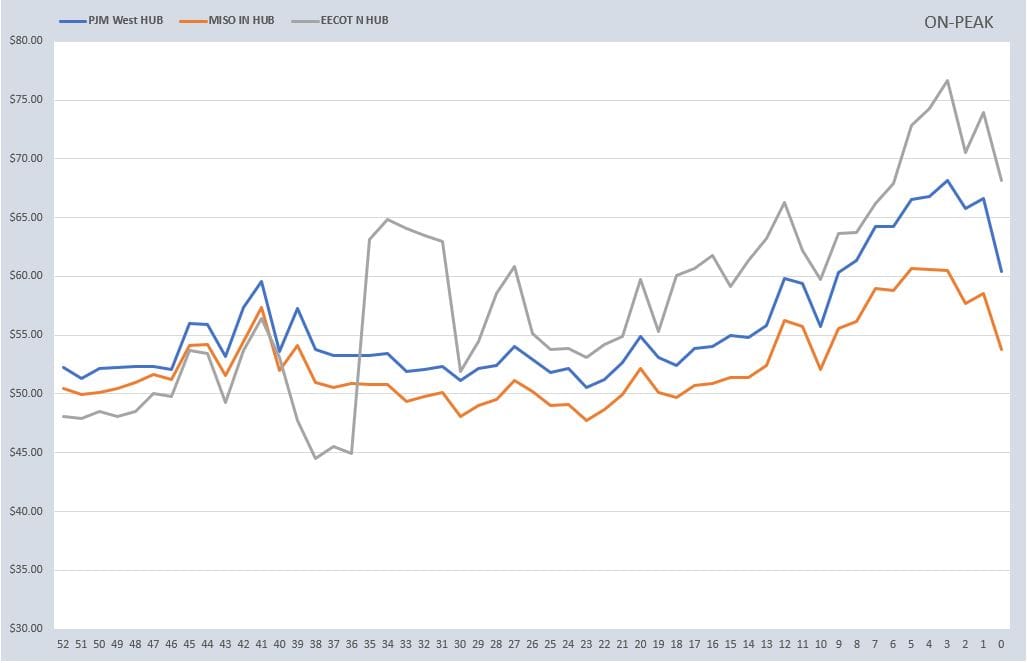

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

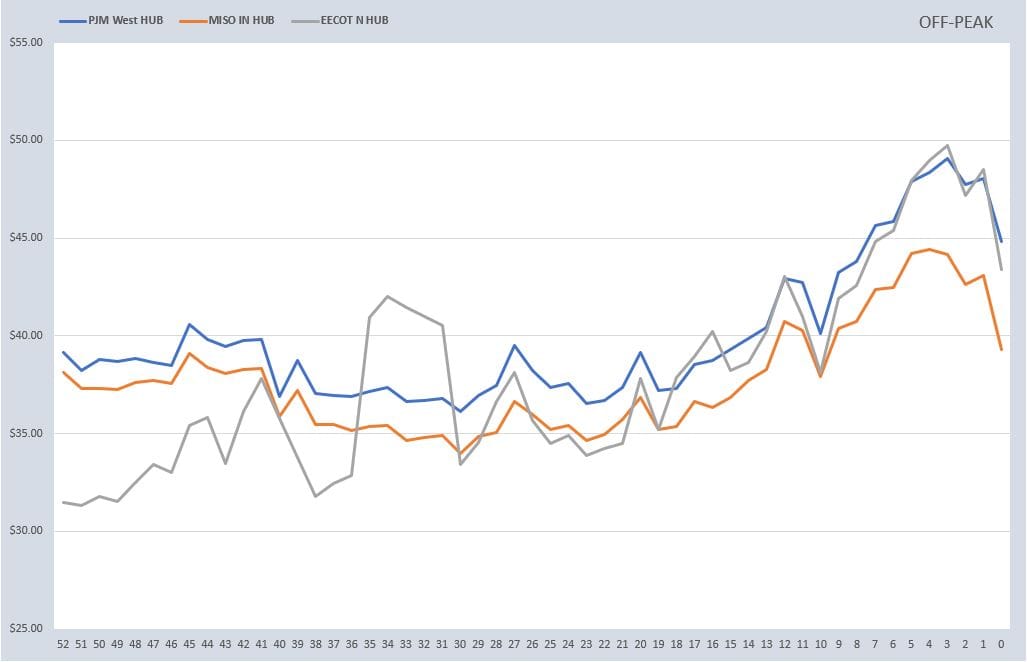

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: