Weekly Power Outlet US - 2025 - Week 6

Nat Gas, Plans for Headline Risk, Gold

Nat Gas, Plans for Headline Risk, Gold

Energy Market Update Week 6, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

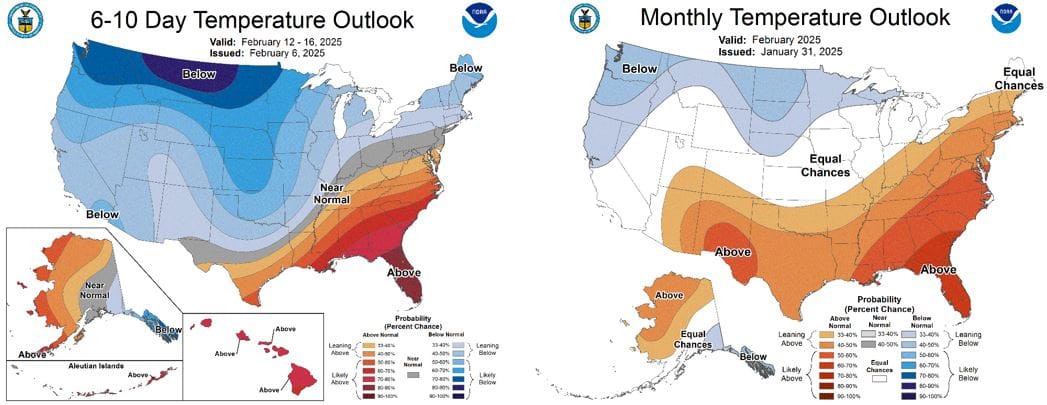

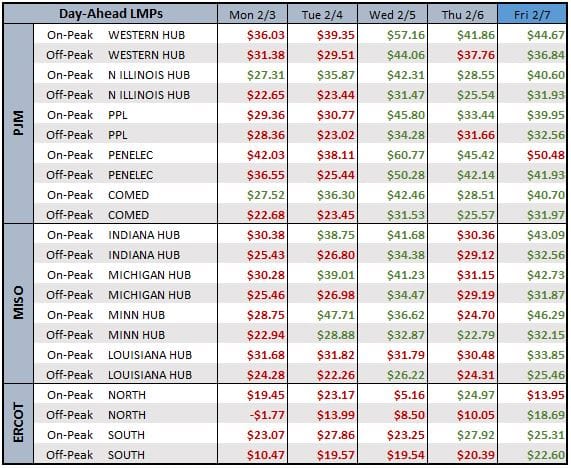

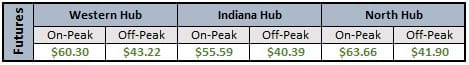

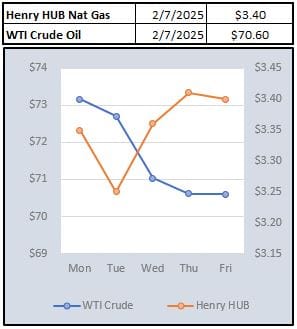

Natural gas had another rollercoaster week ending pretty much where we started. Electricity futures have followed the ride as they pointed higher to start the week as a new chill was in the air....maybe Phil from PA? Gas headlines were a mixture of bullish and bearish headlines as colder forecasts were offset by higher production with a bit of higher LNG export forecasted.

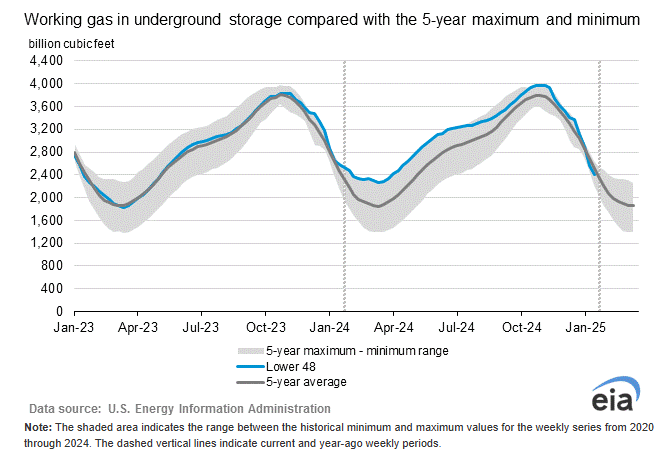

After the previous week delivered a big drawdown, this week's EIA data representing the week ending January 31, showed a withdrawal of 174 Bcf which was slightly higher than expectations. Storage has now dipped below the 5-year average as we finish out winter. This shouldn't be too alarming given the production numbers, but more cold weather with larger withdrawals will get some attention.

This week we had more than a couple headline grabbing questions on tariffs, department cuts, and even some European law. We were presented with Canadian oil pipeline maps, ISO statements, and LNG shipping prices, all with a "what do you think?".

Our response, as always with this sort of thing, "yup, those are interesting". We don't mean to be flippant, and we do have some thoughts, but if you've followed us for any period of time you know our response is something like, "if we knew, we'd be running a 5x30 (5% management fee, 30% of profits) hedge fund and be happy to send you the onboarding papers.".

Given the barrage of news this week, it might be a good time for a refresher. Obviously, we have thoughts and opinions on news and market reactions, but we've always been way more interested in controlling risks through hedging or procurement plans. In our opinion, it's always been way more productive to plan for how we would react for a given market move, instead of trying to predict the move. In our opinion, planning risk tolerance, time and volume allotment, and budget strategy within given market moves is a better use of time than trying to figure out what happens at EPA if 250 positions are eliminated. We know this isn't easy, and someone will say the ole Mike Tyson, "everyone has a plan until they get punched in the face.". Our response to that is always the same, if you got into the ring without the possibility of Mike Tyson punching you in the face, it's a bad plan.

Staying on topic, sort of....One of our pillars of energy volatility when we speak on the subject, is investor/trading speculation. For us in the electricity world, this usually shows up in the natural gas market. Sometimes moves in the market have nothing to do with fundamentals and everything to do with speculative actions. Over the past couple weeks, we've been seeing an example of this in gold. Gold isn't in our day-to-day electricity lexicon, but it's worth looking at for context of what can happen in commodities markets which includes natural gas.

According to the FT, borrow rates for gold on the London exchange have reached annualized levels of 10% instead of the normal 2% and lower. What does that mean? Let's say you borrowed gold to short $10,000 worth and held the position for a year. Regardless of the price of gold, you would owe $1000 just to hold the position. Now imagine if you borrowed money, leveraged, to place this trade. That means you have a finance cost on top of borrow cost and somewhere a margin clerk with two eyes laser focused on you. The fact that the borrow cost is 10% is the proof that there is a scarcity of gold to borrow, probably because lots of folks have the same trade on....you see where this is going? Over the past month, the most stable commodity in terms of trading range has moved 10% which is nothing for a semiconductor stock, but huge for gold. Over speculated positions with leverage can lead to one-way trades. Remember the old commodity trader saying, the market can remain irrational longer than you can stay solvent.

The title of our weekly publication isn't the Weekly Goldbug, so this isn't meant to be any call on gold. This is another look of what can drive prices and how having a hedging plan in place can keep your emotion out, or at least in check, of plan execution. Somewhere someone needing to be long gold isn't chasing the market, and conversely, someone has some gold to sell at these levels. All according to, or because of their plan.

NOAA WEATHER FORECAST

DAY-AHEAD LMP PRICING & SELECT FUTURES

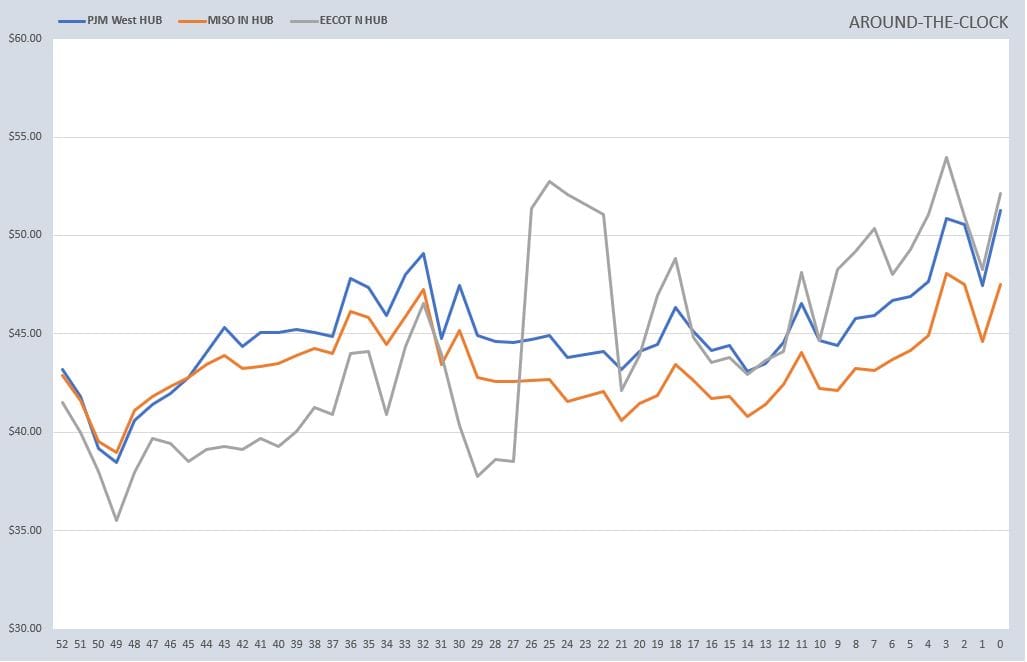

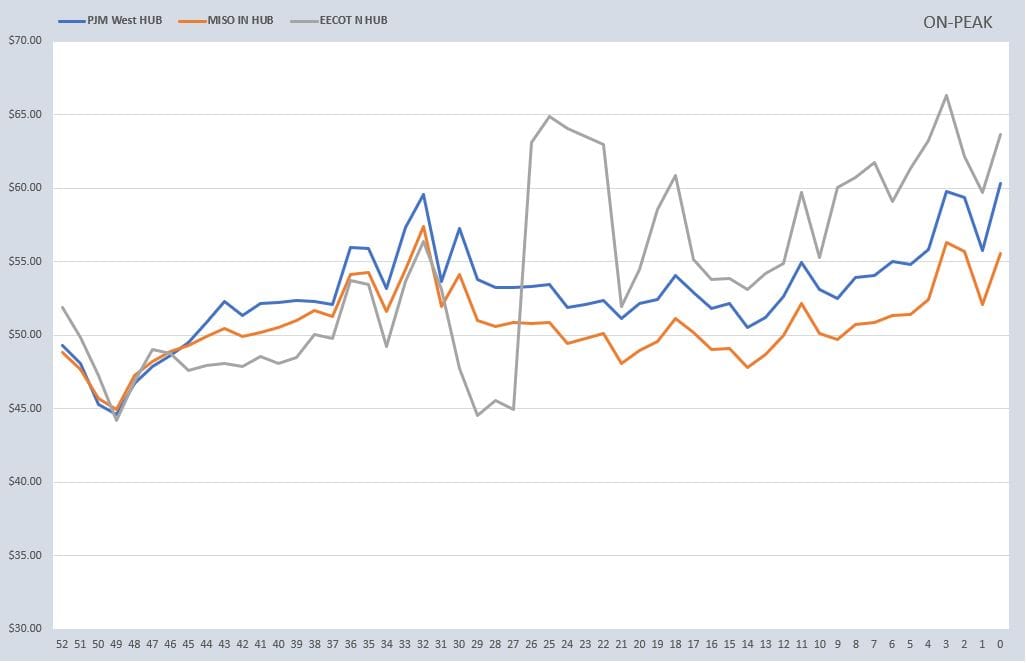

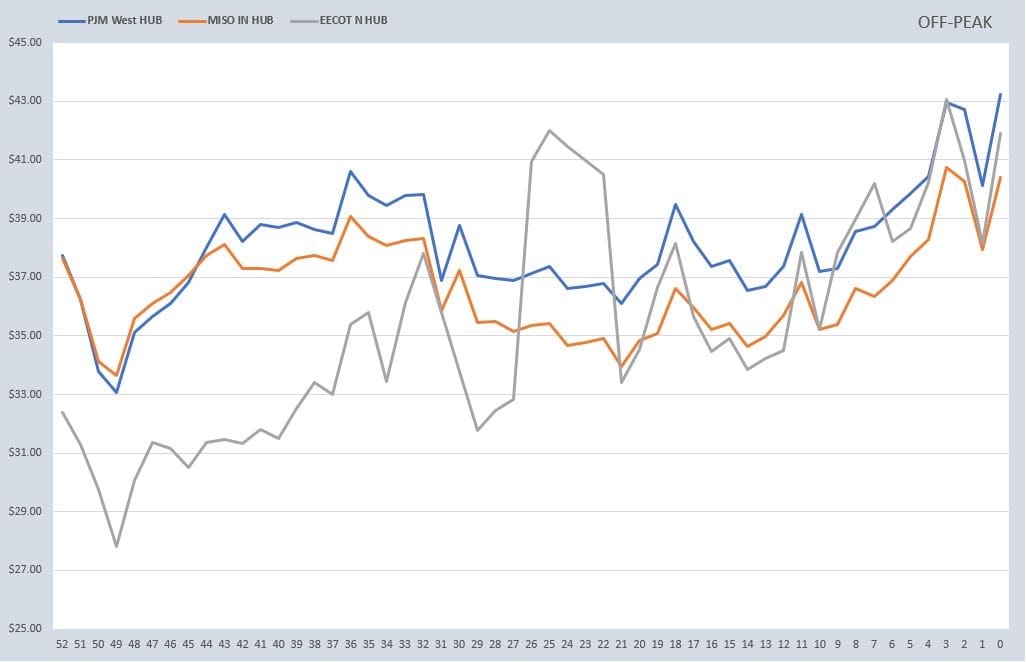

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

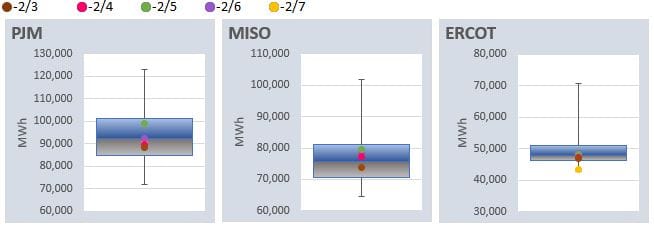

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: