Weekly Power Outlet US - 2025 - Week 8

More Cold?, FERC Data Center, FERC Capacity

More Cold?, FERC Data Center, FERC Capacity

Energy Market Update Week 8, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

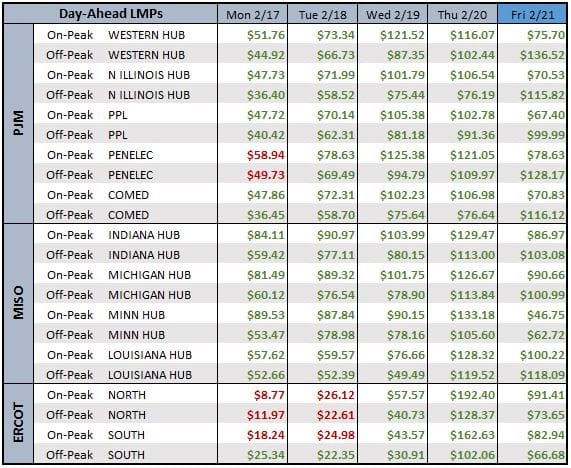

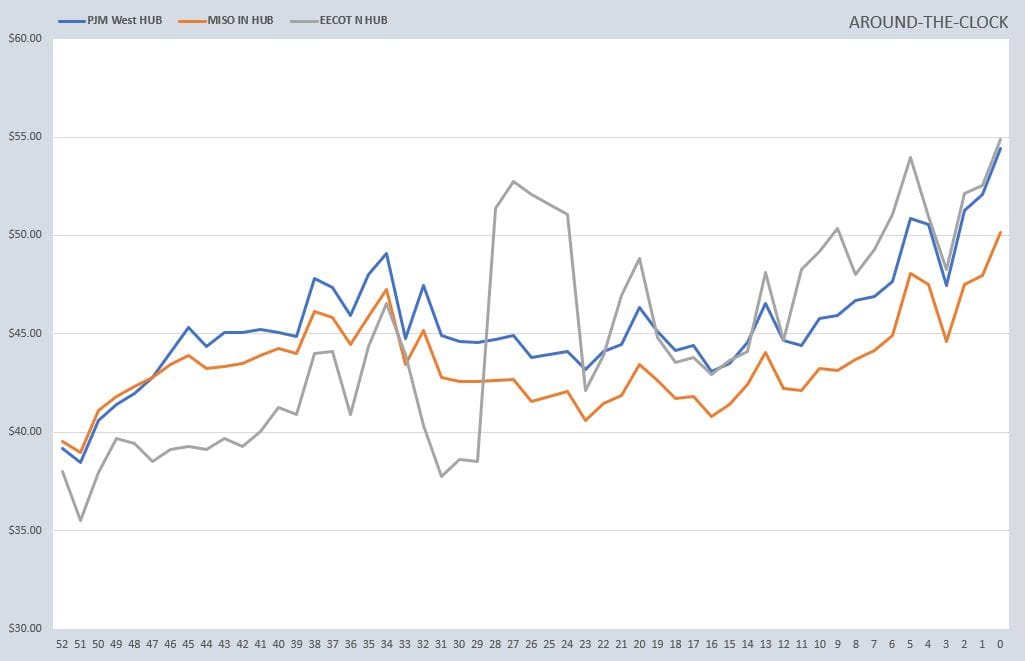

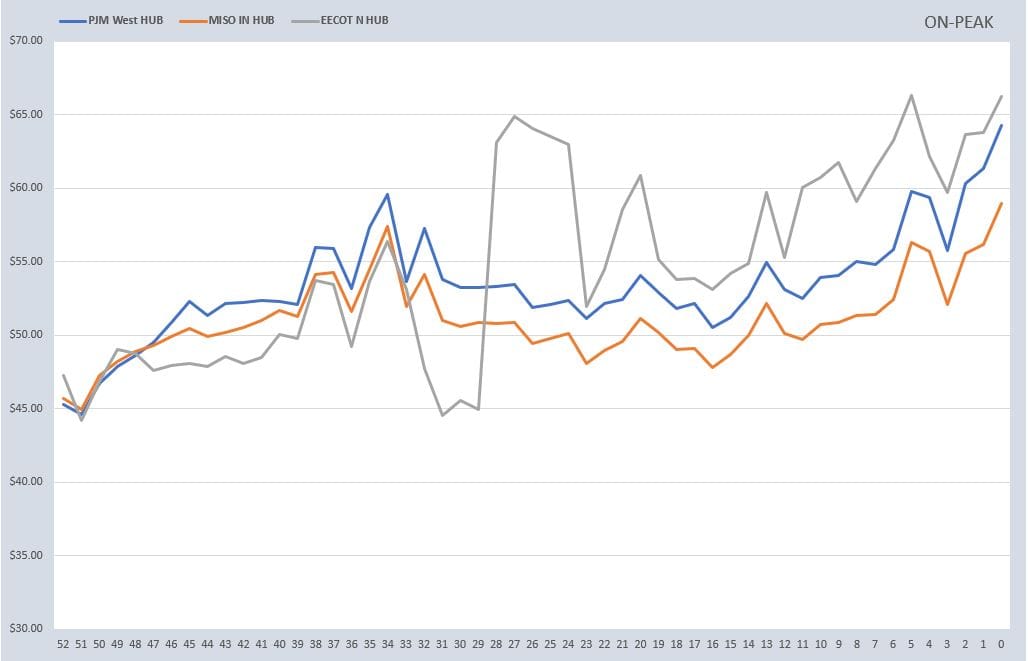

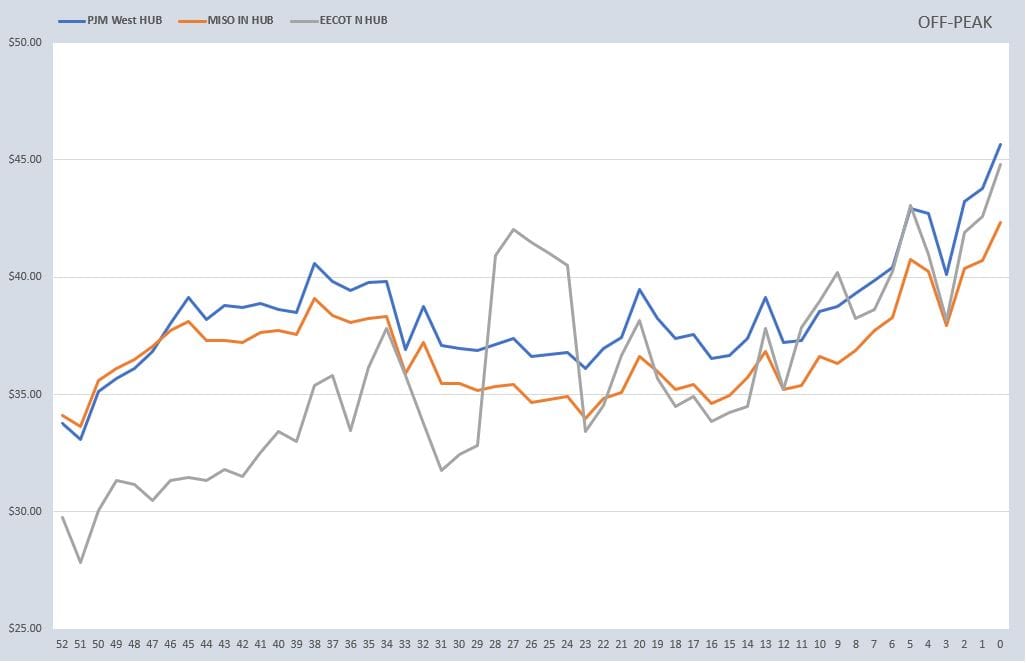

The recent, winter isn't over just yet, event swap across the mid and eastern US this week sending Day-Ahead electricity prices soaring. As seen below, there were plenty of triple digit prices this week for on and off peak.

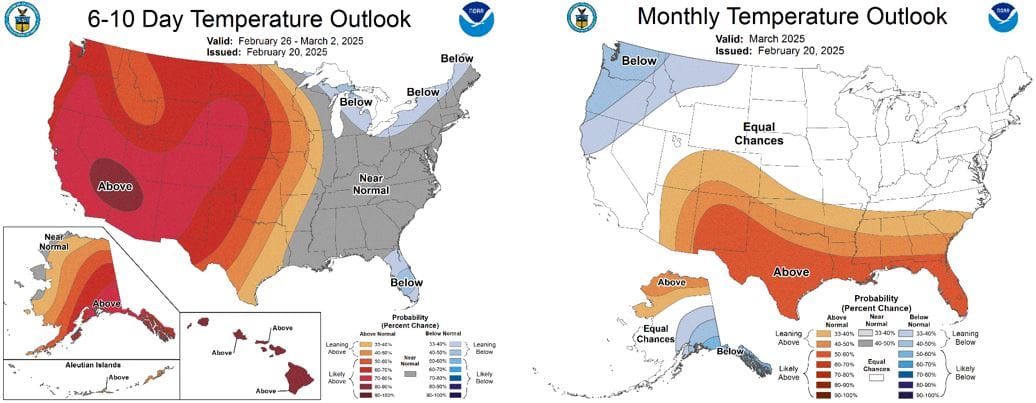

Natural gas also reacted to the weather as some early rumblings of another round of polar vortex was imminent for the beginning of March. That chatter has slowly faded, and looking at the 10-day forecast, it seems like we are back to more normal conditions. There are still some models that are showing colder temps a little further out.

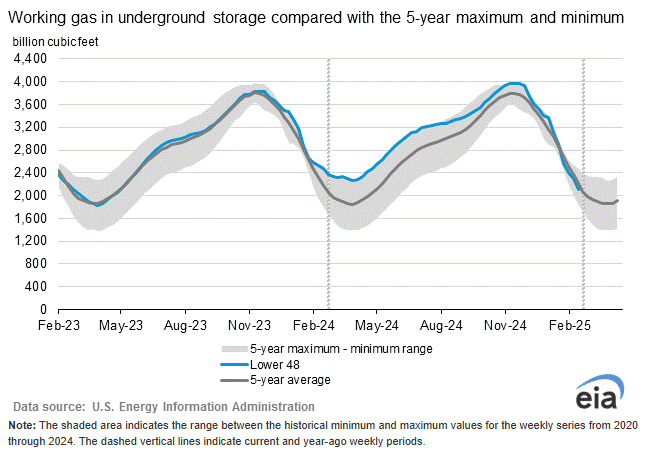

The EIA storage report showed a draw of 196 Bcf. This puts storage at 386 Bcf below last year and 118 Bcf below the 5-year average. If we do get another cold spell, we will dig into the number a little further as we start build season.

As mentioned above, some models are showing a quick warm up followed by another cold snap in March. Natural gas futures are reacting to that as the big move higher has held its ground after some profit taking yesterday. While the weather may be holding futures higher, there does seem to be a whiff of speculation in the market as the commodity markets continue to spin money from one resource to the next.

This week was a big FERC and we could have dedicated the whole WPO to it. Instead, we will just point out a couple of interesting things. Yesterday, FERC released action on co-location of data centers in PJM, meaning they have voted to launch a review of some of the issues associated with data centers on sight. This became a topic late last year as transmission arguments arose about who and how to pay. Chairman Christie stated, “Co-location arrangements are a fairly new phenomenon that entail huge ramifications for grid reliability and consumer costs. Given these ramifications, the Commission truly needs to ‘get it right’ when it comes to evaluating co-location issues.”

Also, FERC announced they will host a technical conference in June to address resource adequacy in RTOs. This has been a big concern of Chairman Christie over the years as he has argued for more transitional planning along with renewables. FERC commented that "issues to be explored" include: "current and impending risks to resource adequacy; the efficiency and effectiveness of capacity markets in ensuring resource adequacy at just and reasonable costs; design and performance comparisons between capacity markets and alternative resource adequacy constructs; and states’ desired role in managing resource adequacy.".

This statement should not be taken lightly. Given the issue of capacity in some of the ISO's, particularly PJM, this is a biggie. As we recall, ISOs and their market monitors have been at odds over the years on capacity and it might be fair to characterize FERCs involvement as all bets are off and options are on the table.

NOAA WEATHER FORECAST

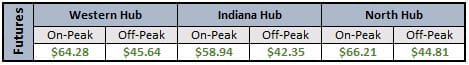

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO ATC, PEAK, & OFF-PEAK CALENDAR STRIP

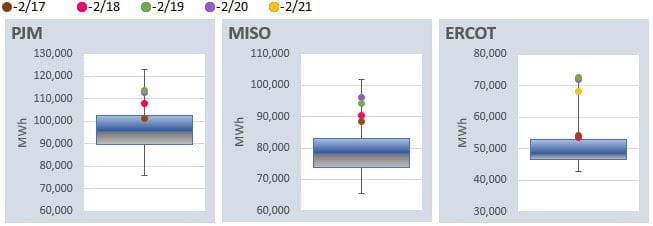

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: