Weekly Power Outlet US - Week 11

Capital Rationing, LNG, and PJM Capacity Reform.

Energy Market Update Week 11, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

Last week we ended our commentary talking about the essential failure of a bank, Silvergate, and the potential of more to come. This week that potential has become a reality as Silicon Valley Bank has become the second largest failure in US history, Signature Bank has failed, and First Republic has received a large capital infusion from other banks to stay afloat. As we know, the energy complex is capital intensive. As of today, the financial pundits are leaning toward the Federal government continuing to fight inflation, albeit at perhaps a slower pace. At the same time, be it the too-big-to-fail super banks or the small community banks, they will all be moving into defense mode as they measure investment rate duration risk against depositors.

In recent years, even with capital being fairly abundant, small and midsize producers have had a harder time as banks and Wall Street have asked for moderation from the sector. As we have noted, one of the reasons for the retreat in natural gas has been the production projections. Tighter capital conditions could be a precursor to tighter production conditions. We wouldn't expect this to show up immediately, but gas and electricity market participants need to keep an ear open for indications that "capital rationing" starts to become part of the conversation.

With all the drama in the banking system in the US, not much has been made of a strike in France protesting a rise in age to qualify for the government pension system. Of interest to the energy world is the fact that these strikes include the country's LNG terminals. Like the US, the warm winter in France has slowed the withdrawal of natural gas from storage, leaving them with seasonally higher levels in storage. If the strike persists, and France isn't able to refill storage at a normal rate, we could be looking at a situation this summer where a lot of LNG will be flowing to Europe. While we wouldn't expect it to be as drastic, the Berlin Airlift type flow to replace Russian gas helped lift domestic natural gas near $10. Some of the smaller countries in Europe count on France for gas export as they are even more isolated from the world market.

This week, PJM released a report on capacity reform driven by the events of winter storm Elliot. Without going into great detail, there are a couple observations worth pointing out. PJM is suggesting going from a summer test to a seasonal physical test on capacity verification along with some fortified modeling for "what if" scenarios. Also, no winterization and no capacity for generators. Given the new modeling metrics, physical assessment on generation, and requirements for demand response, it seems like PJM is setting up for tougher requirements, which may lead to higher capacity prices since the pool of participants may shrink. Finally, it does seem PJM is looking to reduce the penalty to be more aligned with capacity payments received. This is still an onerous penalty, but not as severe as the current net cone calculation.

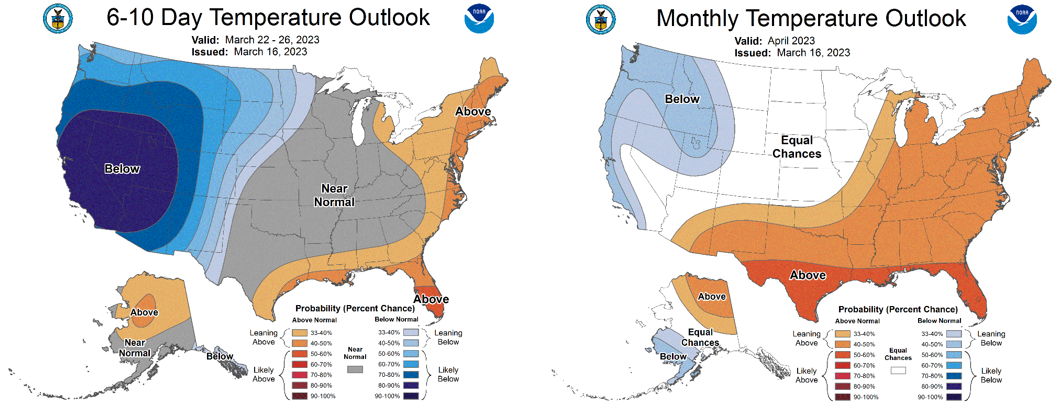

NOAA WEATHER FORECAST

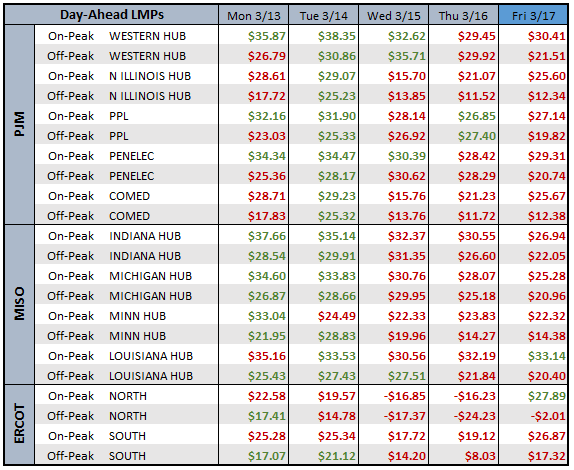

DAY-AHEAD LMP PRICING & SELECT FUTURES

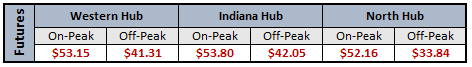

DAILY RTO LOAD PROFILES

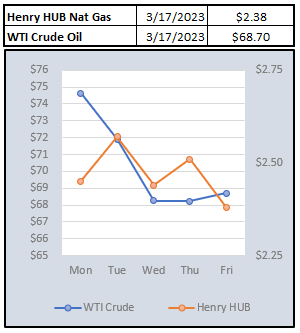

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: