Weekly Power Outlet US - Week 13

Natural gas $2, PJM Capacity Market, and a Lump of Coal.

Energy Market Update Week 13, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

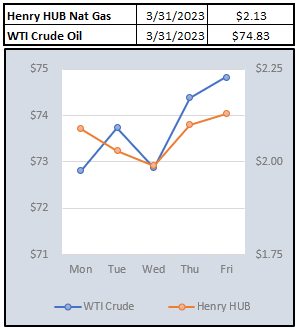

This week the April NYMEX natural gas futures rolled off the board settling just under $2/MMBtu with May now the prompt month future trading near $2.20 MMBtu. Thursday’s EIA storage report showed an inline draw of 47 Bcf, which leaves inventories roughly 30% higher than last year at this time.

There’s an old saying in the commodities world that we’ve repeated here a few times and it might be time to state it again, “the cure for low prices, is lower prices.”. Given the credit tightening that will undoubtedly be coming, higher production costs, and the lowering of prices, there is starting to be some talk about production estimates that might need to come down. If those conversations do materialize, it could be part of a bottoming process in gas. Supply, more than demand, has been the market driver of late.

PJM announced Monday that it will look to delay its 2025/26 Base Residual Auction which was scheduled for late spring. In their announcement seeking the delay, the board stated, “PJM should postpone executing any further auctions under the current rules until we go through the stakeholder process and file resulting rule change proposals with FERC.”. While this wasn't unexpected, it's another sign that the discussions of capacity reform markets have really just started and there will be plenty of debate and participant comments to come. Click the link for the full release.

We tend to give natural gas pricing most of the coverage when it comes to input fuel and electricity prices. This is for good reason as natural gas is the marginal fuel setting price a majority of the time across most RTOs. That said, it is worth pointing out the pricing in coal as it still matters here in the US and abroad. Central App and Illinois Basin coal prices have come off 33% in the last month. Lower Btu, but widely used Powder River Basin is off 10%. While coal has become less and less relevant in ISO generation stacks, it still plays a role and lower pricing of coal is still something worth watching.

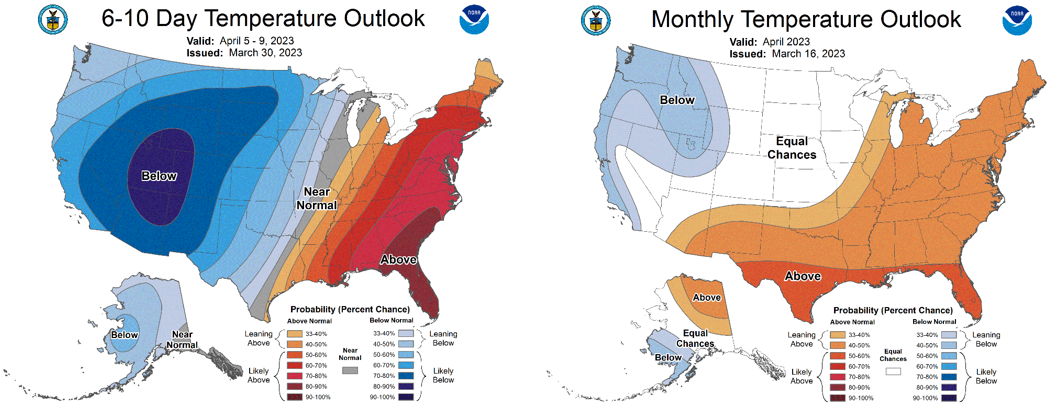

NOAA WEATHER FORECAST

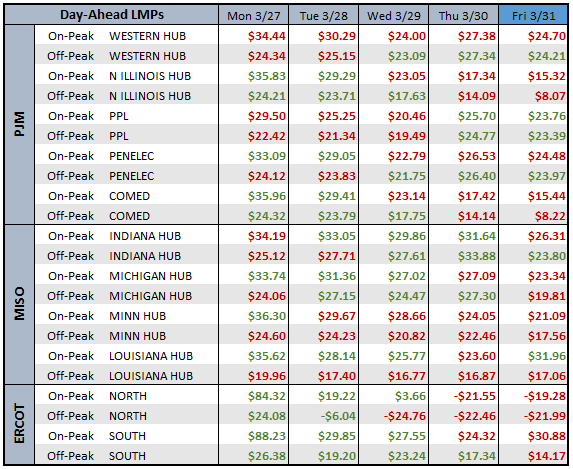

DAY-AHEAD LMP PRICING & SELECT FUTURES

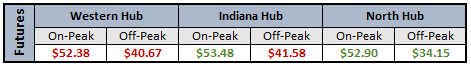

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: