Weekly Power Outlet US - Week 14

PJM Capacity Fallout, Homer City, and Natural Gas Slide Continues.

Energy Market Update Week 14, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

Last week we reported that PJM had delayed its 25/26 Base Residual Auction until they had a time to take in more comments and discuss and design new rule changes. This week the RTO announced it would be necessary to post modified results for the 23/24 3rd incremental auction citing "some issues where some existing generation resources were erroneously excluded from the calculation of the Reliability Requirement in modelled LDA.". While the events may not be correlated, this isn't helping the frustration associated with PJM's capacity market.

Speaking of PJM capacity, the fallout from Winter Storm Elliot continues. According to a story posted by Utility Drive, two power plant companies took measures to protect themselves from the penalties associated with underperformance during the capacity event. Lincoln Power filed for bankruptcy and Nautilus Power is seeking FERC protection. In filings, Lincoln's penalty is $38.9 million on two plants in Illinois with capacity around 800MW.

In related, although not capacity market induced, it was announced this week that Homer City would be closing this summer. Homer City had survived bankruptcies, the advent of fracking, and environmental concerns for years past its predicted demise, until this week. Homer City is the largest coal fired power plant in Pennsylvania and operates in the PJM RTO. Homer City's capacity is 1900 MW, although in recent years it has been operating at a lower rate. The owners of the plant have cited regulations, and declining financial results with lower electricity prices fueled by natural gas.

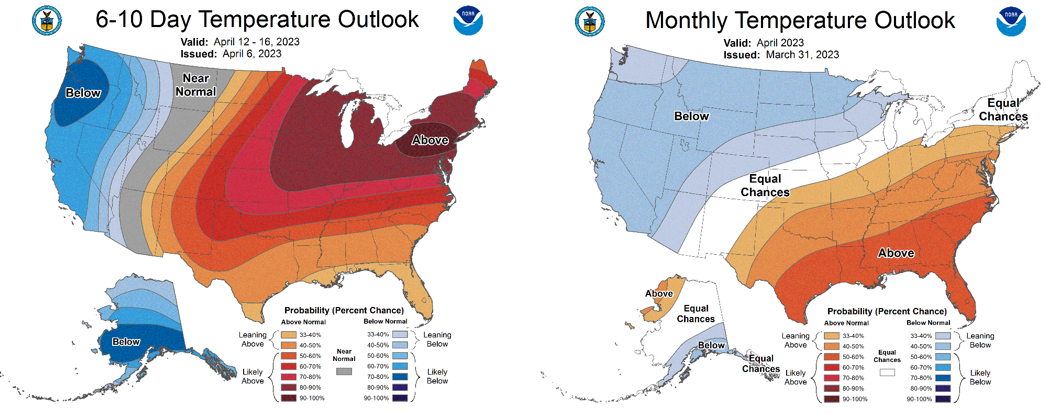

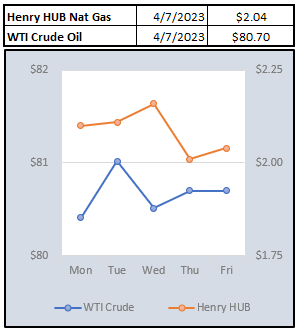

Natural gas can't seem to get out of its own way. Yesterday's storage report came in line with a withdrawal of 23 Bcf pushing the front month contract to test $2 on decent volume. Longer term, there are some headlines that could be constructive on natural gas, but right now the market is all about storage build, warmer weather, and production.

NOAA WEATHER FORECAST

I

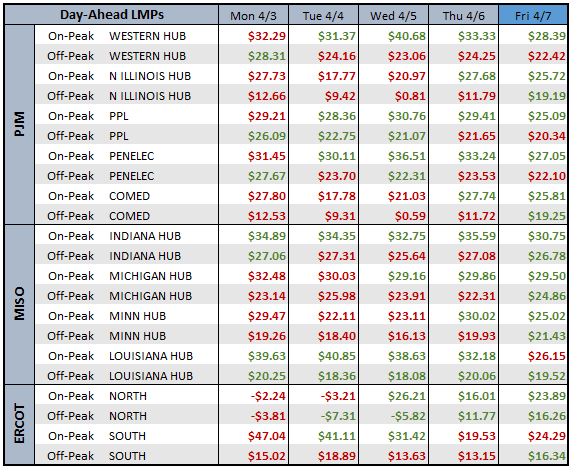

DAY-AHEAD LMP PRICING & SELECT FUTURES

We wanted to point out ERCOT North in the Day Ahead LMP pricing table. It's not often we see negative prices colored green signifying a week over week higher price. Negative single digit prices are an improvement over minus $20 LMP prices.

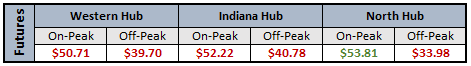

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: