Weekly Power Outlet US - Week 15

Natural Gas and Electricity Correlation, PJM Capacity Event, and Day Ahead LMPs.

Energy Market Update Week 14, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

US natural gas injection season is officially upon us. Thursday's EIA storage number was a build of 25 Bcf which was in line with expectations. US natural gas inventories are now at levels not seen since the Covid year of 2020. Analysts are putting pencil to paper going from heating degree days to cooling as they work through estimates. Above average storage levels has offset some bullish headlines in the LNG world where export expectations continue to rise. Regardless of headline potential, the market price is the market price and once again the front month is flirting with the $2 level.

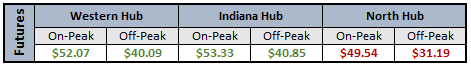

Interestingly, on the electricity side of the energy complex, the calendar year futures at the major hubs have held pretty stable over the last month plus as natural gas has continued to slide. Calendar on peak prices for PJM Western, MISO IN Hub, and ERCOT North have all seemed to find a floor around $50. Speaking to some traders this week, there seemed to be a consensus that if natural gas continues to languish, the premium electricity has enjoyed might start to erode bringing prices lower.

Updating the latest winter storm Elliott capacity performance in PJM is becoming a weekly segment. This week's highlight is the argument from some participants that they shouldn't be penalized for underperformance as PJM exported electricity to neighboring ISOs during the event which is not in accordance to PJM's own rules. Specifically, those in the ComEd zone claim that a Max Gen event was needed because of export to TVA. Had PJM curtailed export, the zone would have been able to handle the load required according to participants being penalized.

Even more interesting, Sun Energy, LLC, a solar owner and operator, was also one of the many generator and demand response capacity participants to receive a substantial underperformance fine. Sun Energy has filed a complaint over their fine with FERC. They aren't arguing the fine based on underperformance caused by an equipment failure or fuel issue, they are contending that 87% of their fine is coming from evening hours. Stated more simply, Sun is arguing it's pretty hard for solar to generate at night. While this is worth a chuckle, it does highlight that the PJM capacity fall out from Winter Storm Elliot will be on the front page for some time to come.

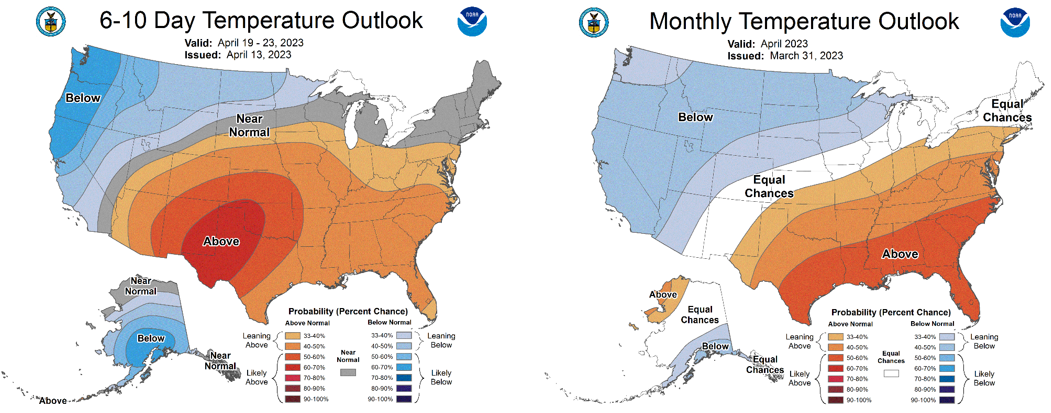

NOAA WEATHER FORECAST

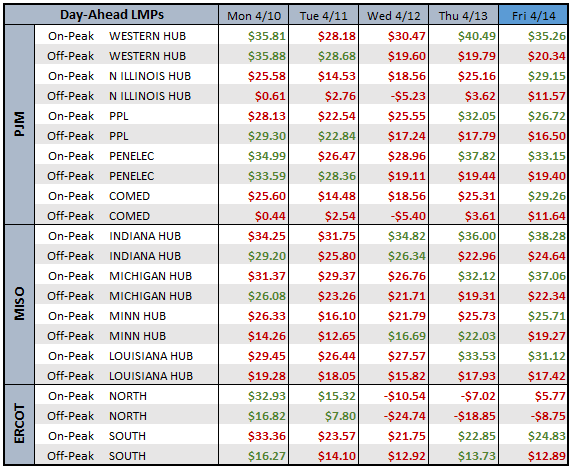

DAY-AHEAD LMP PRICING & SELECT FUTURES

We commented above on some of the calendar strip prices holding their ground as natural gas has come off. Turning our attention to Day Ahead, one can see above that prices have come off substantially from the winter and week over week. ERCOT North continues to draw attention as off peak pricing for the week was measurably in the negative. Ironically enough, there was more commentary this week about the state of Texas ponying up money to build more peak gas back up. Look for this to grab more headlines in the weeks and months to come.

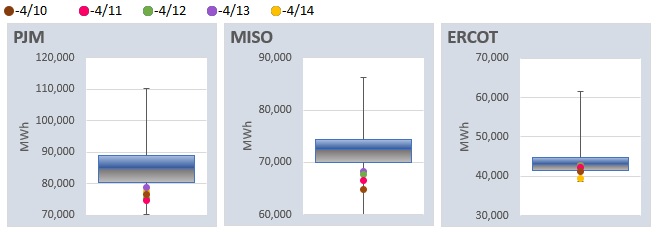

DAILY RTO LOAD PROFILES

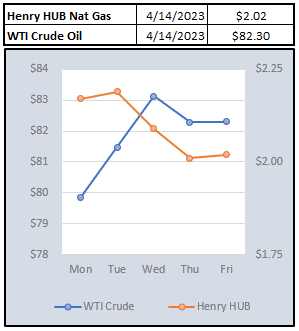

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: