Weekly Power Outlet US - Week 16

Nat Gas Market, EVs and Utilities, and KY Power No Deal.

Energy Market Update Week 16, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

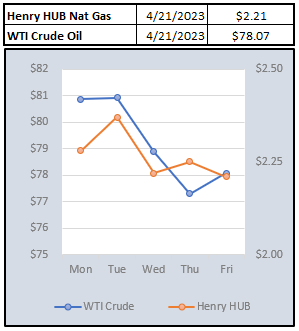

Natural gas tried to rise off the $2 level earlier in the week as places in the country enjoying 80s last week were experiencing snowstorms. Yesterday's EIA storage release quickly brought some reality back into the gas markets as storage levels were reported above forecasts. More importantly, storage levels are now well above last year's mark and the 5-year average. This isn't just a US story, EIA reported that Canada has similar metrics with plenty of gas in storage. The market has gone from trying to anticipate a demand pick-up, such as LNG exports to Europe later in the year, to now wanting to see those exports come to fruition. In other words, this has gone from a 'what could happen' market, to a 'show me' market and electricity prices will follow.

As the push to electrify while decarbonizing continues, utilities are going to face some challenges. While some of the goals might seem unattainable with current technology, it's clear that changes happening right now are already requiring new strategies. The current challenge is on the generation side where variable production is replacing baseload. Adoption of EVs is looking to be the biggest disruptor on the demand side as this has the potential to put some variability into load. This week, Herman Trabish of Utility Dive penned a very detailed look into some of the solutions to this issue, mostly centered around time-varying rates (TVR). Another issue is the question of how demand charges are recovered from a charging station with low utilization. For instance, a high-speed station might get used once a day and demand 1.8MW. We are adding a link to the article and recommend the quick read for more on this issue.

The on-again, off-again deal where Algonquin Power's Liberty Utilities would acquire AEP's Kentucky Power is very much off again. Algonquin said this week that the parties were terminating the deal that had been announced in 2021. Completing the acquisition was looking more and more like a long shot after FERC had sent the parties back to the table to draw up a more thorough picture of what rates might look like after the deal. More recently, the Kentucky Public Service Commission, amongst others, joined in and urged FERC to reject a revised application based on uncertainty around transmission rates. In the end, Algonquin pulled the plug, announcing that “... after careful consideration, and in light of the evolving macro environment, our board of directors and management team have determined that continuing with the transaction is not in the best interest of the company.”

While that may have been the company line, Algonquin might have been hearing some angst from shareholders. Chris Demuth Jr, Partner at Rangeley Capital, stated that “regulators were about to put this ill-conceived deal out of its misery so it was smart of Algonquin to kill it.” We aren’t sure if Rangeley is a shareholder, but it safe to assume he was echoing other shareholder sentiment.

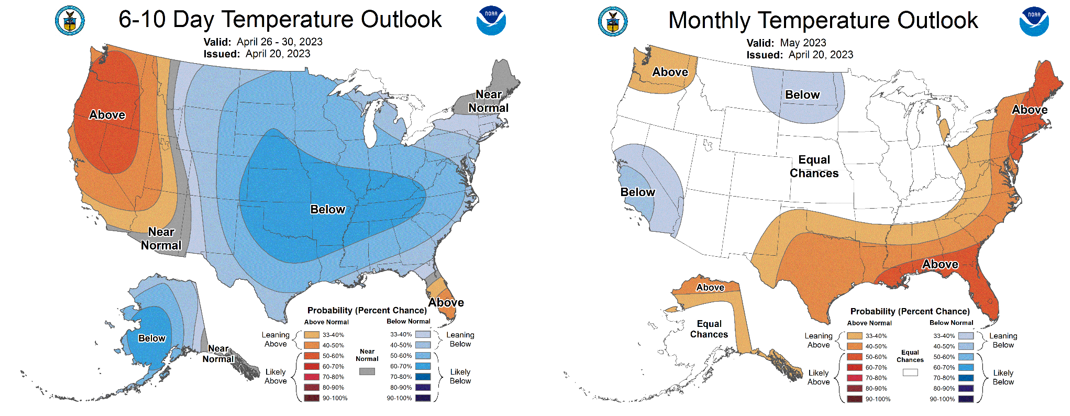

NOAA WEATHER FORECAST

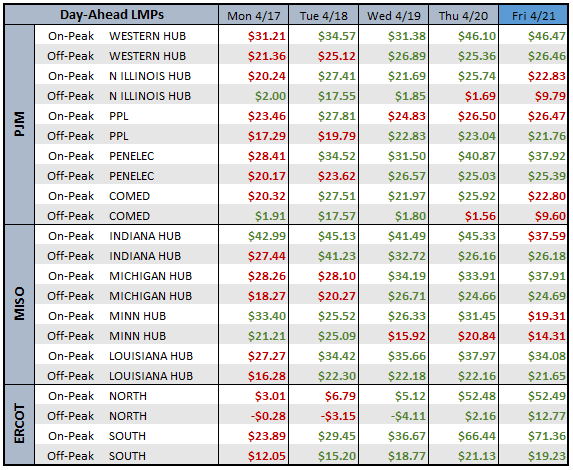

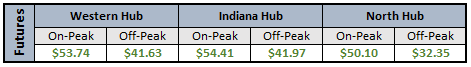

DAY-AHEAD LMP PRICING & SELECT FUTURES

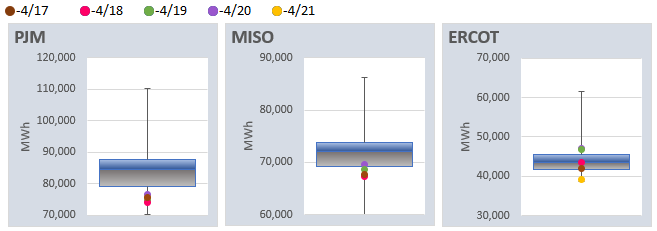

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: