Weekly Power Outlet US - Week 17

Natural Gas, Persian Gulf Happenings, and More Elliott Fallout for PJM.

Energy Market Update Week 17, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

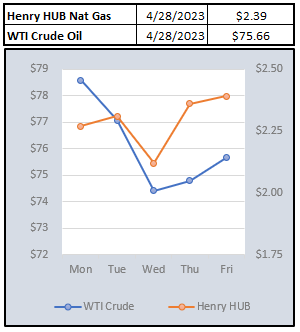

The May contract for natural gas rolled off the board this week and it was nothing short of a big yawner. In the past couple months, we've seen some movement as futures traders roll positions, but this time seemed pretty muted with just a slight uptick the last couple of days. The new front month June contract had almost no reaction to the EIA storage data released yesterday with the report being a repeat of previous weeks. Storage levels are above year-ago and 5-year trends and the weather is warmer in part of the country and colder in another. That's the recipe for muted moves right now. One thing of interest was spot prices averaged around $2 late this week. That's a far cry from earlier in the winter where pipeline bottlenecks and maintenance issues had spot well above the big board in some places, specifically California and the Northeast.

This week Iran seized a Turkish-owned supertanker with oil owned by Chevron heading to the US. The incident occurred in the Gulf of Oman, near the choke point Strait of Hormuz. This isn't the first such incident of its kind, and while not common, it's happening more and more. Why does this matter? This is the shipping route for all LNG leaving Qatar. As of last year, the US and Qatar were slightly behind Australia as legitimate LNG export players. As we've pointed out in the past, LNG has made natural gas trading around the world more fungible. Also, LNG from the Gulf helped Europe meet its winter storage levels after being isolated from Russia. If this situation escalates, it's not hard to imagine natural gas prices being subject to the same sorts of moves oil can see with shipping disruptions in the Gulf. While not an immediate concern in the markets, it is something worth considering.

Late last week, The Organization of PJM States, Inc. (OPSI) penned a letter to PJM expressing their concern regarding PJM's process to get new generation from their queue a reality. This is another fallout from Winter Storm Elliot as OPSI is concerned new generation onboarding is not keeping up with the retirements that are scheduled to come. They are one of many groups calling for a streamlined process.

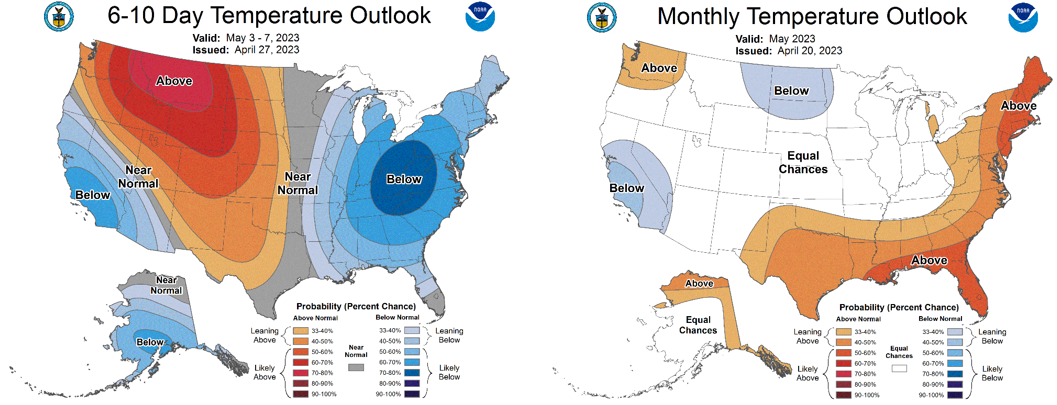

NOAA WEATHER FORECAST

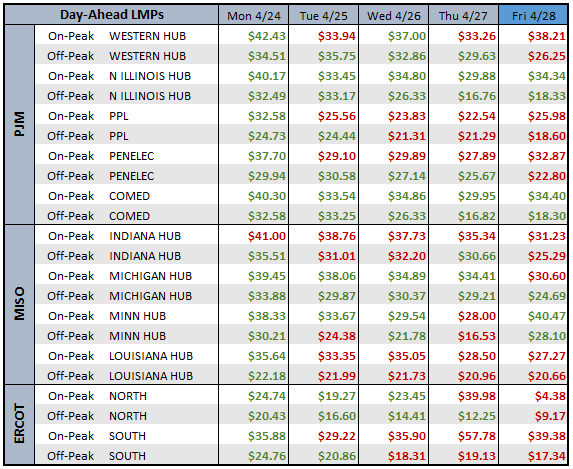

DAY-AHEAD LMP PRICING & SELECT FUTURES

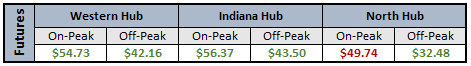

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: