Weekly Power Outlet US - Week 18

Natural Gas Recap, AEP Update from Quarterly, and Transmission.

Energy Market Update Week 18, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

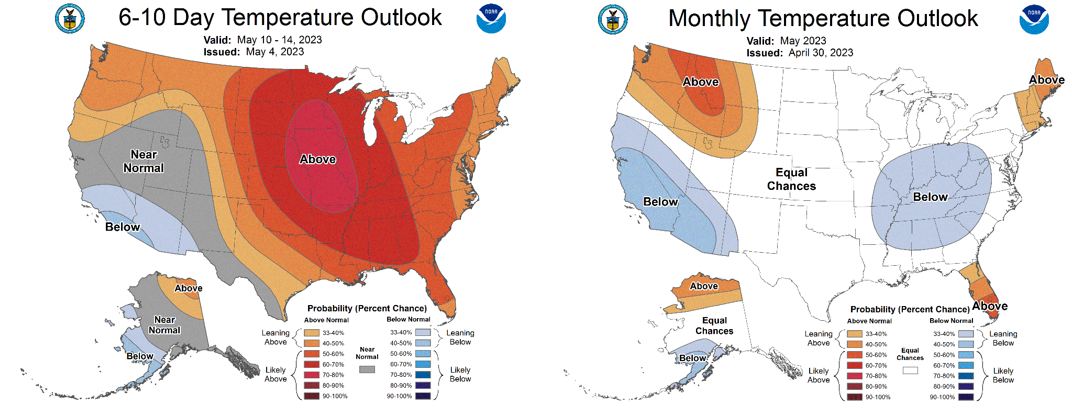

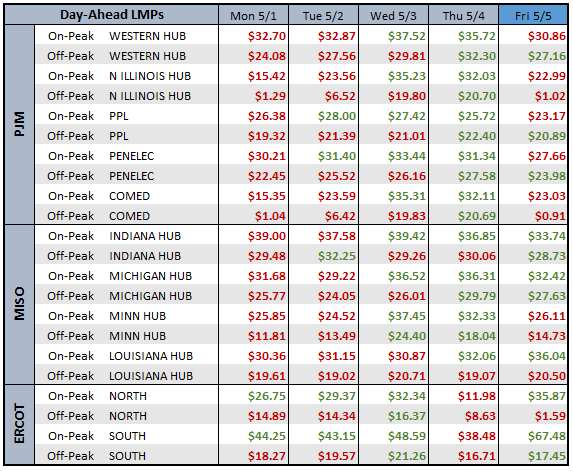

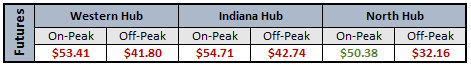

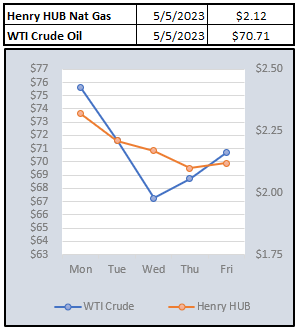

The EIA storage data showed a build of 54 MMBtu in yesterday's report, which was in line with expectations. Futures sold off as supply continues; it will meet any unforeseen rise in consumption. Before a slight rally today, the June '23 front month had traded to a contract-specific new low. Although the weekly weather report looks somewhat warmer, it's not AC-pumping heat that could move the needle. Looking at electricity, it seems the calendar strips we follow below have weathered (no pun intended) the $50 level and have inched up even with weaker gas pricing. A few weeks ago, we had mentioned that conversation amongst traders was that if gas continued to languish, the electricity markets might start to see what little risk premium was built in start to fall. Given pricing this week, we still haven't seen that.

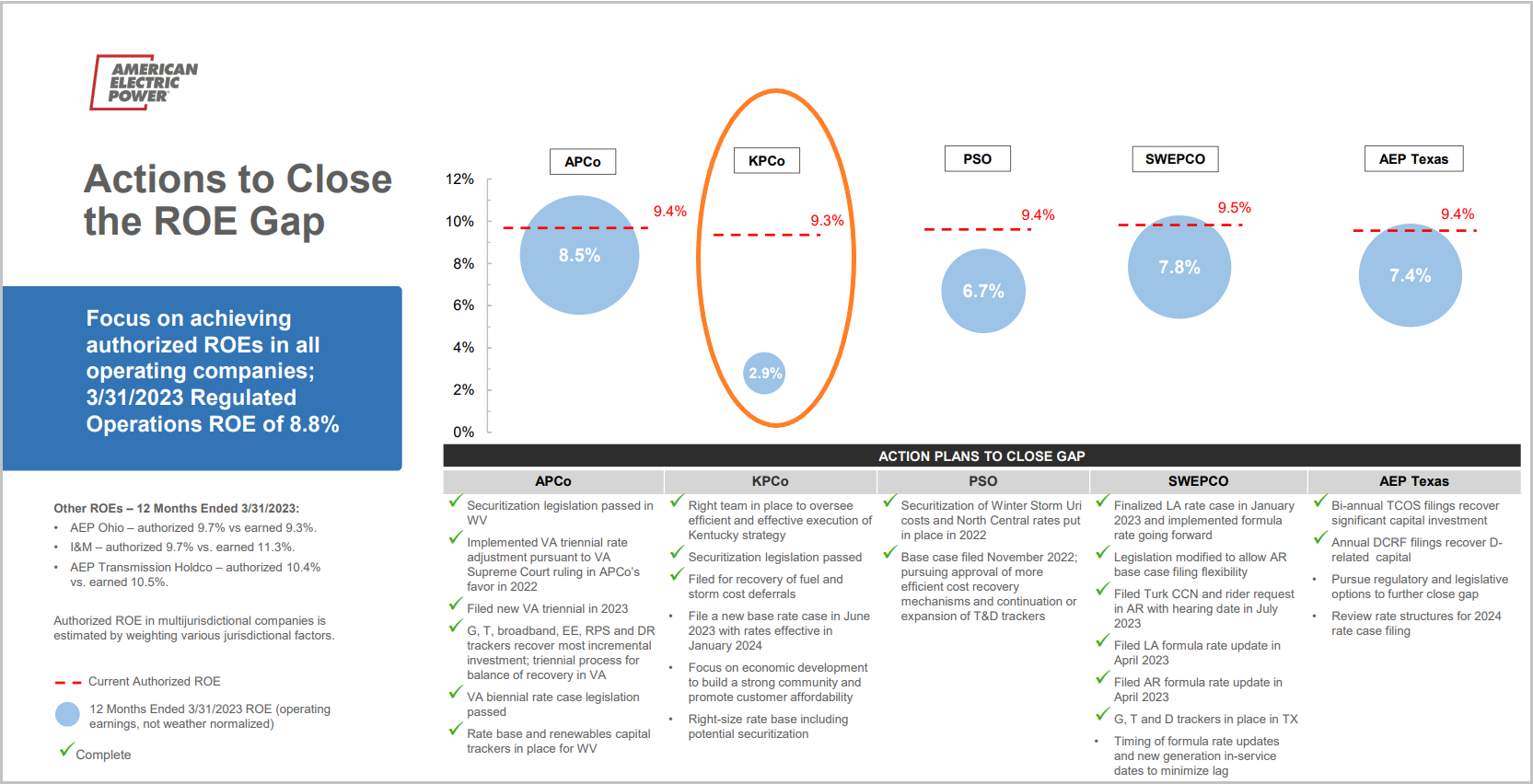

American Electric Power Company, Inc (AEP) announced 1Q2023 earnings this week and it was filled with newsmakers. AEP has been in divesture mode for a few quarters, and in a not-totally-unexpected move, they have added their retail business (which is mostly PJM) to the list of assets for sale.

More important to some of our readers is that the conference call included some of the first public comments on the failed merger of Kentucky Power and Liberty Utilities. In CEO Julie Sloat's opening comments, she disclosed Kentucky Power's earned ROE for the 12-month period ending 1Q2023 is 2.9%. As she said, "this does not reflect a financially healthy utility, which needs to be resolved in consideration of the interest of all stakeholders." When questioned by analysts, AEP said they plan on filing a rate case in June for 2024. They plan on having conversations with stakeholders and the commission to "scratch all the itches." In the words of Ms. Sloat, "stay tuned." Included is a slide from the earnings presentation showing a better picture.

Admittedly, we don't normally turn to the New York Times editorial page for our weekly news on the on-goings in the electricity world. This week we make an exception as they penned a piece that is near and dear to one of our main points about market volatility in the future, especially if the 'electrify everything' narrative continues. We don't need to dive deep into the article, because the title says it all. Read the article here: We Desperately Need a New Power Grid. Here's How to Make It Happen.

Citing a Department of Energy study we've mentioned, they state that the United States needs 47,300 gigawatt-miles of new power lines by 2035, which would expand the current grid by 57 percent. As large as that number seems, making it happen might be even more colossal. The article mentions the need for a streamlined approval and permitting process. They point to the TransWest Express powerline to be built from Wyoming to Arizona to carry wind generation. The project was conceived in 2005 and after 18 years of legal battles and revisions, it is a go. That said, it won't be completed for another five years.

NOAA WEATHER FORCAST

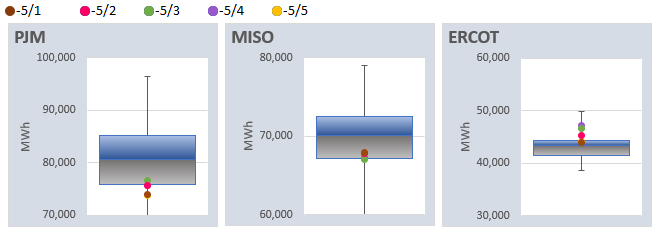

DAY-AHEAD LMP PRICING & SELECT FUTURES

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: