Weekly Power Outlet US - Week 20

NERC Assessment, Natural Gas Bullish?, Reliability, and It Can Always Be Worse.

Energy Market Update Week 20, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

This week, NERC released their summer reliability assessment for 2023. We are attaching the report for reading and recommend it as it is an easy read and nicely detailed. For those short on time or patience, we can sum it up: as long as conditions are normal, everyone should be just fine meeting load demand this summer. Should some ISOs see higher demand or more outages than anticipated, or a reduction of imports counted on in extreme conditions, there might be a problem. Here are the top spots for potential trouble and the associated reasons according to the report:

MISO - Performance of wind generators during periods of high electricity demand is a key factor in determining whether system operators need to employ operating mitigations, such as maximum-generation declarations and energy emergencies. MISO has over 30,300 MW of installed wind capacity; however, the historically-based on-peak capacity contribution is 5,488 MW.

IESO - Ontario has entered a period during which generation and transmission outages will be increasingly difficult to accommodate. The IESO expects these conditions to persist for the foreseeable future. IESO is strongly encouraging market participants to plan ahead and coordinate with IESO to ensure planned outages can be appropriately scheduled.

CAISO - The Western Interconnection is experiencing heightened reliability risks heading into the summer of 2023 due to increased supply-side shortages along with the ongoing drought impacts in some areas, continued wildfire threats, and expanding heat wave events. CA/MX shows adequate reserve margins under expected conditions on the peak hour. However, increased risk occurs during the hours after peak demand and into the evening due to the variability of energy availability. CA/MX is typically reliant on imports during these periods.

Natural gas summer futures reacted to the EIA storage report with a roughly 10% move higher Thursday as the storage build was roughly 10% below expectations. Market participants had already been on alert as natural gas rig count dropped the most since 2016 last week. The market has shaken any potentially bullish news recently citing plenty of supply. It's possible the narrative might be changing.

Worth noting, publicly traded LNG shipper Flex LNG mentioned in their earnings call this week that China LNG import has seen a recent uptick over YTD trend. It's fair to say that right now it's a data point to be watching, but if it continues then it's fair to assume the market will digest and add it to the bullish side of the leger.

Along with NERC, CAISO also released their summer assessment this week and stated some of the same concerns. If things are normal, thanks to a winter rain deluge, CA should have enough reserves to serve a normal load.

While our system of electricity generation and transmission has some pending issues we need to deal with, it's always good to remind ourselves it could always be worse. Not to be outdone by NERC and CAISO, Eskom (which is South Africa's generation, transmission, and coordinator all rolled into one state-owned utility) put out their winter (remember, southern hemisphere) assessment this week. We've mentioned Eskom in the past and it seems not much has changed. Due to shoddy maintenance, parts theft, and iffy generation, Eskom is bracing South Africa for plenty of generation shortfall for the winter, up to 25% of demand shortfall. Imagine if this quote from acting CEO Calib Cassim posted on the Eskom Twitter account came from the head of a US ISO.

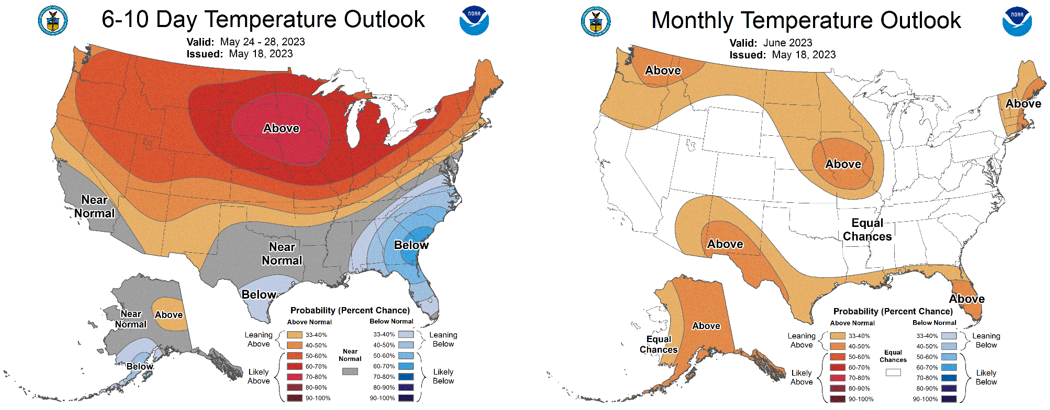

NOAA WEATHER FORCAST

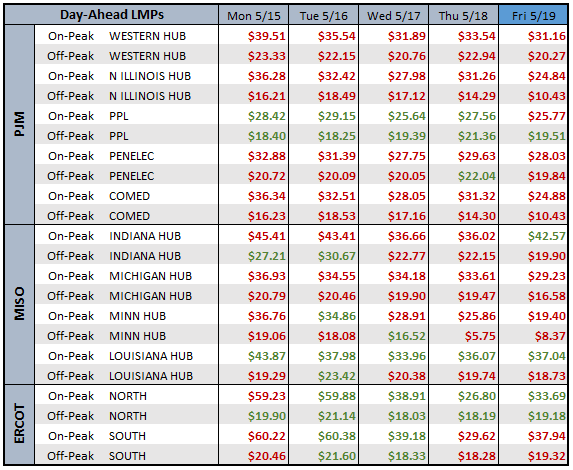

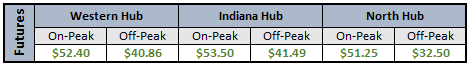

DAY-AHEAD LMP PRICING & SELECT FUTURES

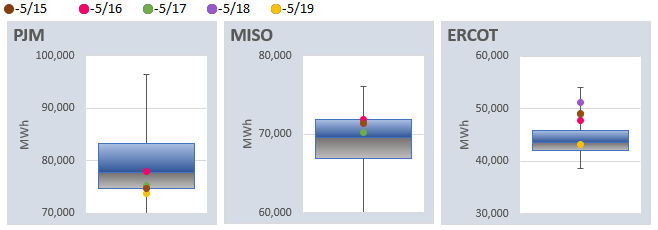

DAILY RTO LOAD PROFILES

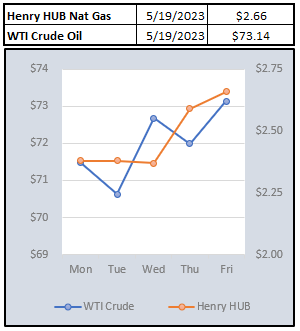

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: