Weekly Power Outlet US - Week 21

Welcome Summer, LNG, and Nvidia.

Energy Market Update Week 21, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

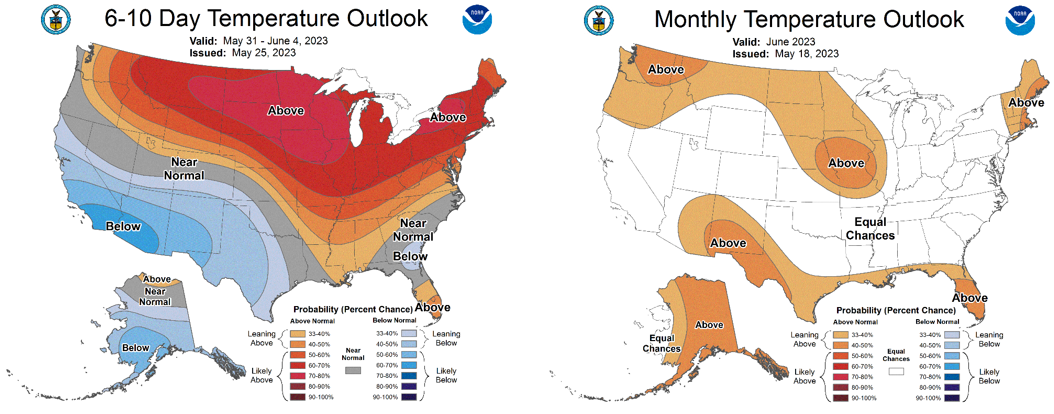

Set your radio channel to Yacht Rock and get out the flip flops, the unofficial start of summer is upon us! Day ahead pricing doesn't look like it, and weather maps are showing just spotty warming potential.

This week's EIA storage can be summed up with good build, lower demand, and strong production. The June contract rolls off the board so when we return from the long weekend, July will be our benchmark.

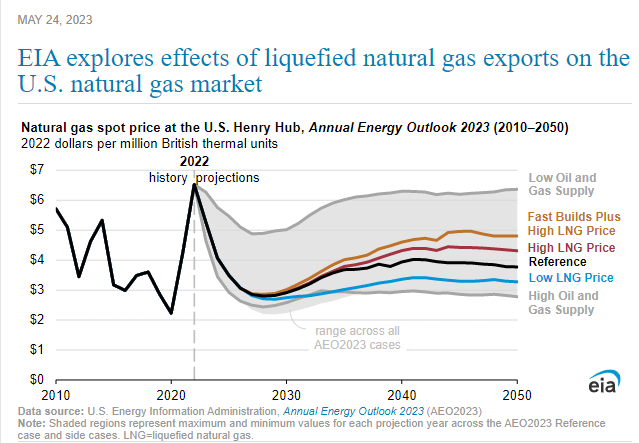

As we've expressed in the past, we are big fans of EIA and the data they provide. This week, they released a report on the effects of LNG pricing on US natural gas. This report grabbed our attention as we have argued that LNG could make natural gas a fungible commodity like oil, which would subject the US pricing to a world market. Above is a link to the report which includes the slide pictured below. The report lays out a few scenarios from lowest case to highest case with gas prices settling somewhere between $2.50 and $6.40/MMBtu in 20 years (although there seems to be some contradiction within the report). Using the same metrics, the report lays out scenarios where the US could export between 10-50 Bcf/day. Today we export roughly 12 Bcf/day. As the old saying goes, you could drive a truck through the spread in those estimates. Our interest in the report is that natural gas is trading today as if the lowest scenario will play out. We admit there are other factors into pricing, but we like the LNG angle a lot in our long-term thesis.

On Wednesday evening, computer chip maker Nvidia announced earnings with a massive uptick of forward guidance on revenues. We aren't the WSJ, so we aren't going to comment on financials or stock price, but there was some very informative conversation in the earnings conference call. A good portion of the call focused on data centers, specifically the AI demand and its exponential growth. Interestingly, CEO Jensen Huang discussed how computing of the past was CPU-based and it will be replaced by GPU-driven accelerated computing.

What we find fascinating in the discussion is the potential similarity to crypto mining. A lot of utilities, co-ops, and municipalities had to deal with disruption of load as crypto was moved from China to the US. In some cases, it was banned because it was too disruptive and both a financial and physical strain. It's not hard to imagine, given the conversation, that the very same problems associated with crypto will be included in AI computing. One of the promises of Nvidia chips is the ongoing development of lower power consumption. Hopefully the decline in power draw can be correlated with the increased demand, or the crypto problem may be back in the form of AI where a simple ban won't be an acceptable answer. If not already, this needs to be on the radar of those that need to forecast load.

This page doesn't speak tech, but plenty of people here at Acumen do if interested in more insight. Please feel free to reach out.

NOAA WEATHER FORCAST

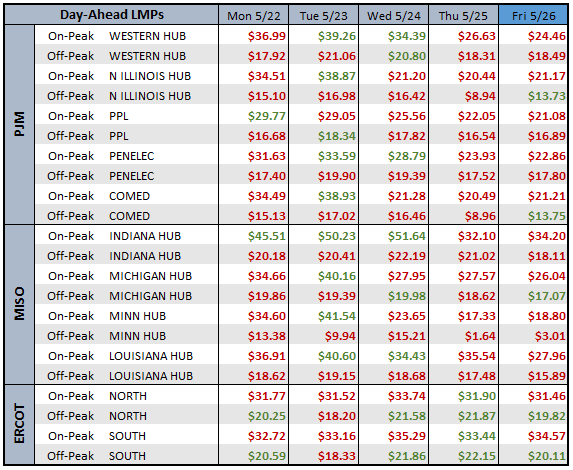

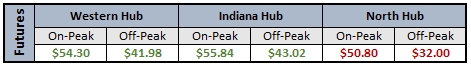

DAY-AHEAD LMP PRICING & SELECT FUTURES

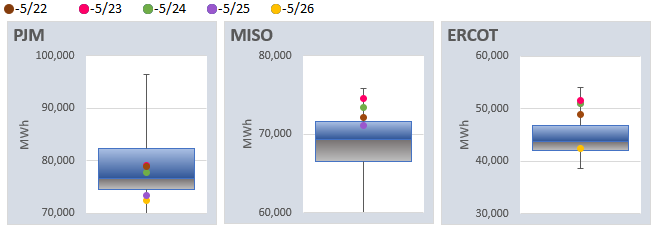

DAILY RTO LOAD PROFILES

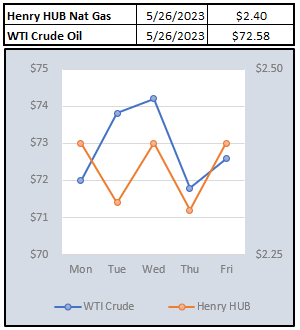

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: