Weekly Power Outlet US - Week 25

Natural Gas, ERCOT Hot Weather Alert, and Pakistan LNG.

Energy Market Update Week 25, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

July natural gas has had a steady climb to $2.60 after trading near $2.20 at the beginning of the month. Yesterday's EIA storage was fairly benign as injection was close to expectations at 95 Bcf. The market may be holding gains on estimations that power burns will rise from 40 Bcf/d to the mid-to-upper 40 Bcf/d as the calendar flips to July.

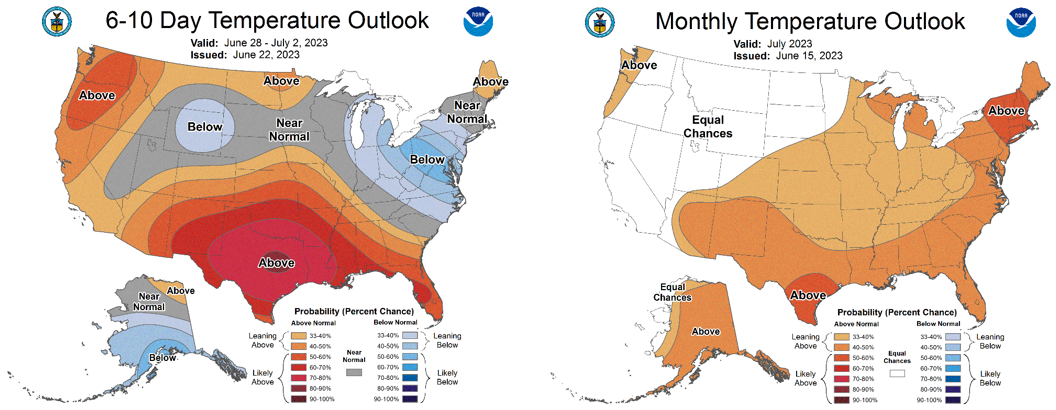

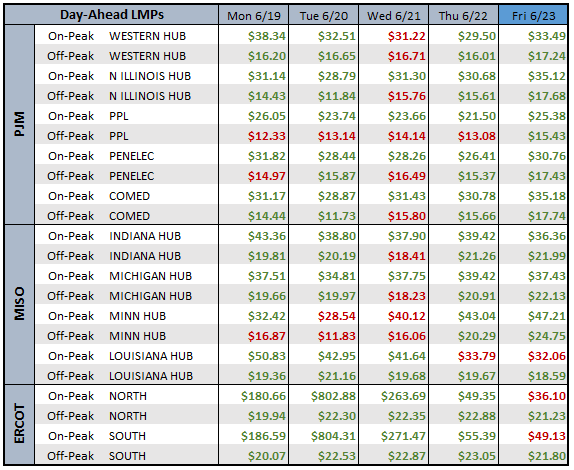

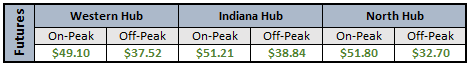

Last week we mentioned that hot weather alerts were being posted for ERCOT for the coming week. As it turned out, the alerts were very much warranted as temperatures soared to 100+ in most places. ERCOT experienced a few days where demand came close to capacity and voluntary conservative action notices were issued. Tuesday saw wholesale prices trade at the $5000/MW in the north and west as wind generation was lower than expected. Ironically, the following day saw day-ahead prices peak near $1000/MW, only to have the real time prices settle much lower for those hours near $250/MW as wind exceeded forecasts. Cooler weather has moved in giving ERCOT a respite for now. Next week is looking for more triple digit temperatures which again will test the system. There has to be some unsettling feelings as they look at the calendar, as it is only June. It could be a long summer in Texas.

This week it was revealed that Pakistan received no offers on a recent request for pricing for a number of shipments of LNG for this fall and winter. There have been various reasons given. One was that suppliers felt like Pakistan was just looking for pricing to use in negotiations with another supplier, in a truly 'lose my number' moment. The most likely and most reported reason was that no one wants to take the counterparty risk with Pakistan. One of our main points in coming US electricity volatility has been natural gas trading on a world market. While Pakistan is more of a stand-alone case and not the norm, counterparty risk associated with trading is worth watching and frankly hadn't been on our radar.

NOAA WEATHER FORCAST

DAY-AHEAD LMP PRICING & SELECT FUTURES

DAILY RTO LOAD PROFILES

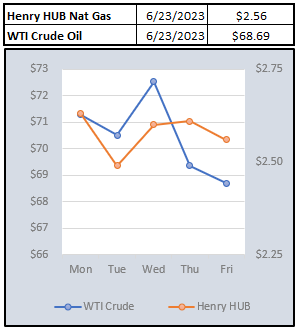

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: