Weekly Power Outlet US - Week 28

EIA Storage, Summer Weather, and LNG.

Energy Market Update Week #28, brought to you by Acumen.

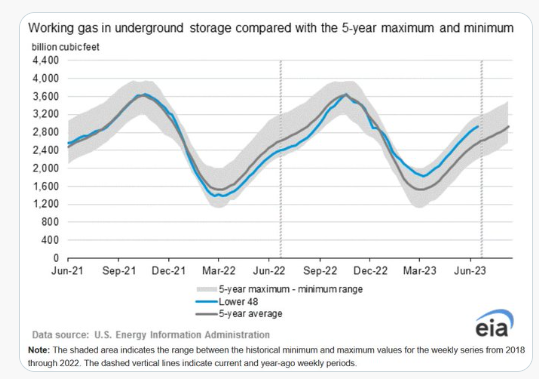

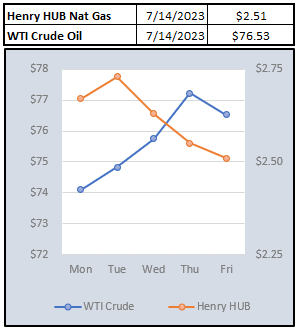

For More Updates Like This, Subscribe Here!The front month of natural gas sold off 3% yesterday after the EIA storage number was slightly below estimates. As the graph from EIA shows, storage levels are still well above last year and continue to work up the upper 5-year band. While the report was near the low end of estimates, cooler forecast, LNG maintenance, and slight revisions up from previous reports are keeping prices apathetic.

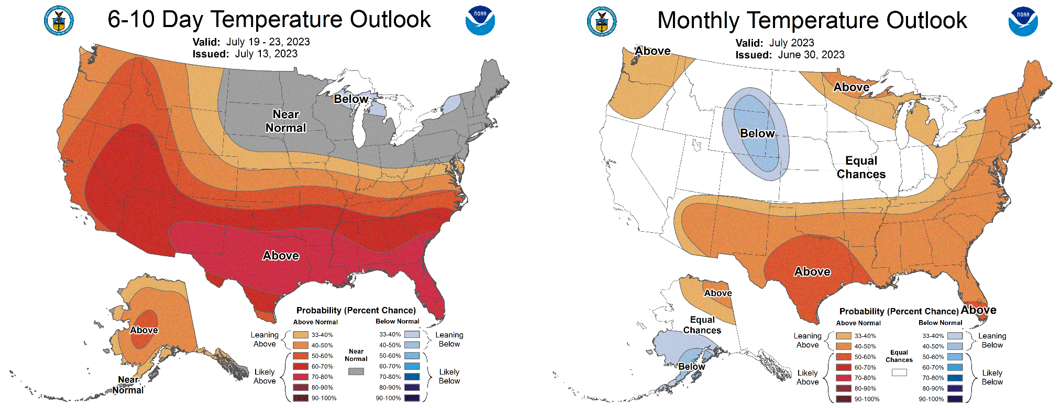

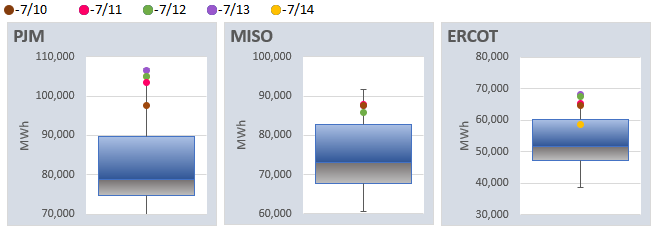

While forecasts do call for cooler weather, there are alerts out from CAISO, ERCOT, and PJM for warmer weather this weekend. SPP also put out a resource advisory in anticipation of warmer weather yesterday. A resource advisory in SPP usually is associated with storms or unpredictable wind.

For those that follow this blog weekly, you know we subscribe to the notion that the rise of LNG shipping might make natural gas a more fungible commodity, much like oil. As the US expands export capacity, our domestic prices may have to compete with the world price. This week there were a couple of news items on the LNG front that reinforce our thoughts. The most headline grabbing was arguably the best investor of all time, Warren Buffett, is buying into LNG. Berkshire Hathaway Energy agreed to purchase a 50% stake in the Cove Point liquefied natural gas facility for $3.3 billion in cash. Buffett has said in the past, given Berkshire's cash position that it was only interested in doing big deals. $3.3 billion would not be considered a big deal by Berkshire standard, so something must have gotten his attention.

The month of June saw China import 28% more LNG than it did a year ago. Price obviously had something to do with that as last June natural gas was in the midst of the European fill up. China also inked a 20-year delivery deal with Cheniere Energy for delivery of 1.8M metric tons/year of LNG adding to a deal signed last year for 900k metric tons/year over 13 years. While those numbers sound big, they would represent roughly 5% of US export capacity. In this case it may not be the size, but the fact that China is shopping.

NOAA WEATHER FORECAST

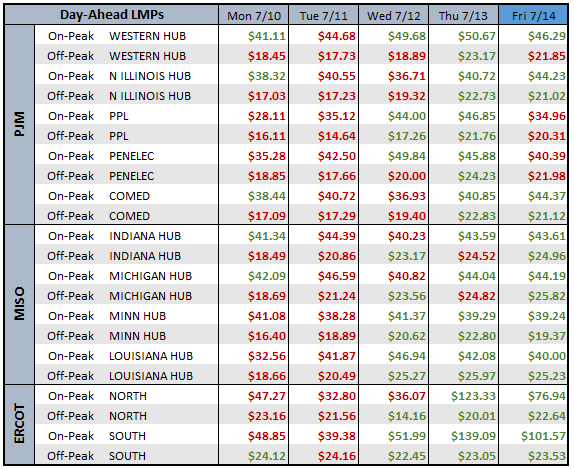

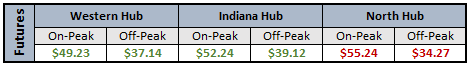

DAY-AHEAD LMP PRICING & SELECT FUTURES

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: