Weekly Power Outlet US - Week 29

Another Scorcher, Nat Gas, NYISO Reliability

Energy Market Update Week #29, brought to you by Acumen.

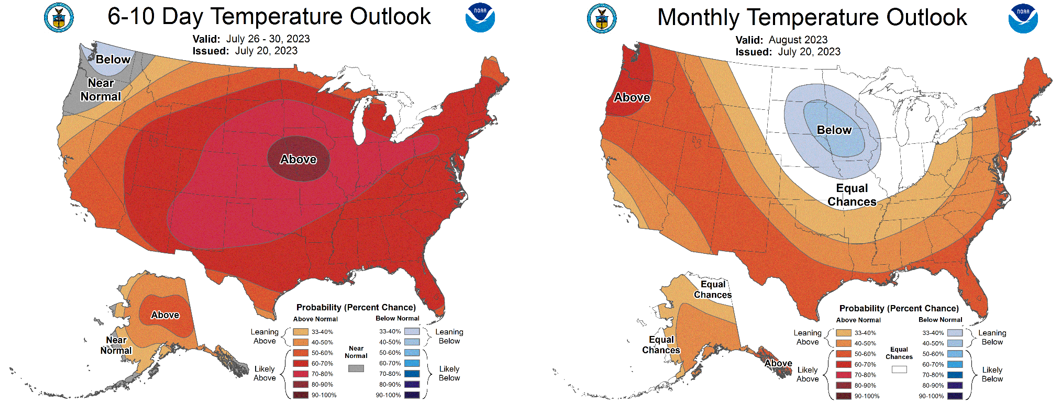

For More Updates Like This, Subscribe Here!In last week's report the NOAA 6-10 day temperature report was calling for well above average chances for hotter weather in the US South and Southwest. It's safe to say they nailed that one. There's been a lot of discussion lately about the hottest day on earth, including arguments about measuring ground temps or higher. Frankly, we didn't even know that was a thing.

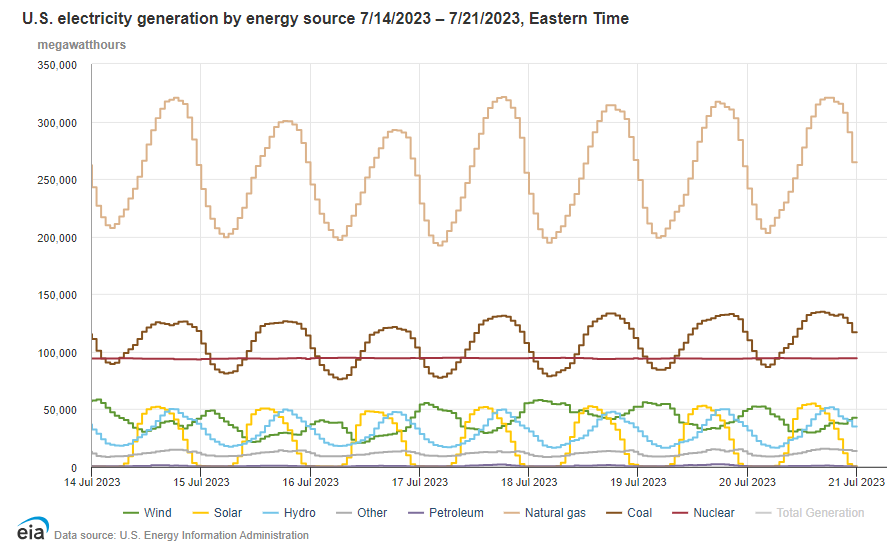

Every so often we are asked, 'why so natural gas centric when discussing electricity and pricing?'. Often pictures are better than words, so we will let some hourly data provided by EIA for one of the hottest weeks of the year answer the question. If you do some quick back of the envelope math, or eyeball it, with the numbers off the chart below, natural gas is almost 50% during peak hours.

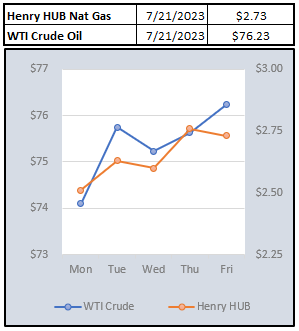

Speaking of natural gas, today is the first time in a month where weekly prices have the chance to close the week higher than it started. A somewhat lighter storage build, along with an 8% WoW burn for electric generation given the weather in the south, have been the catalyst. While not top of mind for market participants just yet, there are rumblings that the diminished rig counts might start cutting into production that has easily met demand this summer.

This week the NYISO released their second quarter short term reliability study. As with most of the reliability studies lately, there are potential issues here as well. Interestingly enough, along with the retired assets conversation that seems to be included in all these reliability reports, was a discussion about transmission overload being the biggest issue. In a demand scenario above baseline, NYISO could find itself up to 446 MW short of capacity margin. Right now, the nearest term remedy of this problem is a transmission line being built from Quebec to New York not scheduled to be in service until 2026.

NOAA WEATHER FORECAST

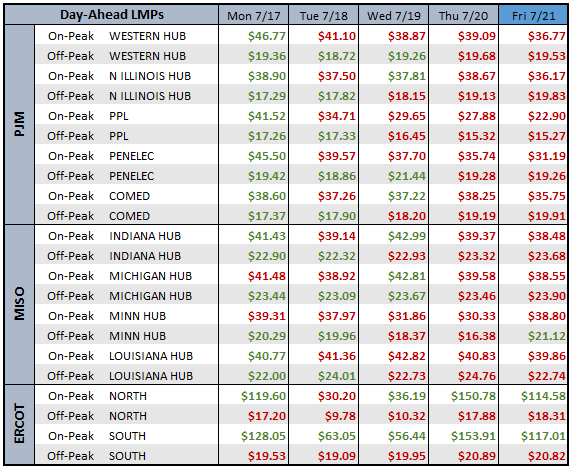

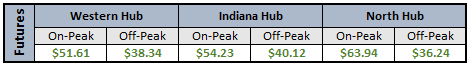

DAY-AHEAD LMP PRICING & SELECT FUTURES

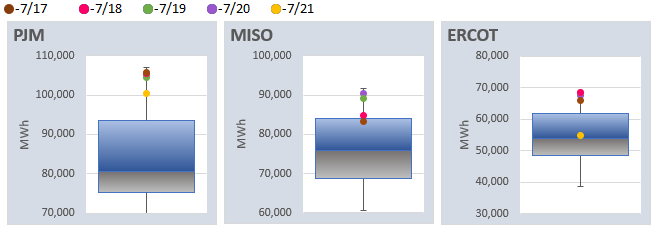

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: