Weekly Power Outlet US - Week 31

Heat Mostly Gone, FERC, Investment

Energy Market Update Week #31, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

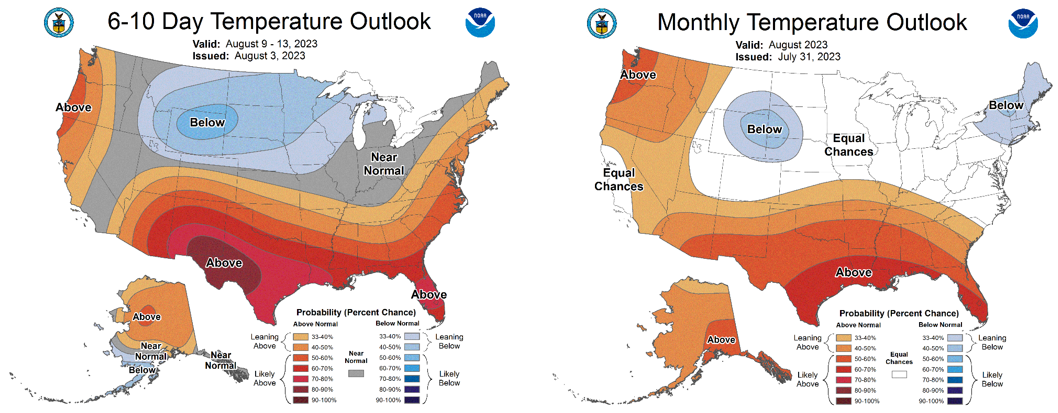

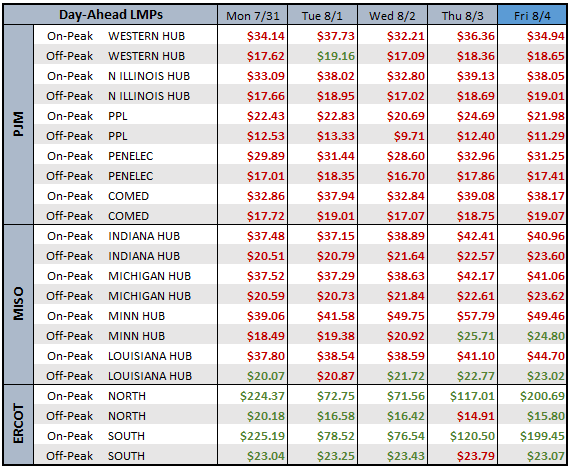

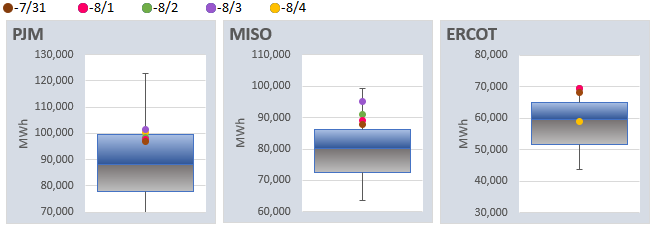

As noted last week, ISOs from CAISO to PJM were issuing hot weather alerts, max gen alerts, conservative action messages and more as the heat moved across the US. This week it moves back to the somewhat traditional summer of hot in Texas and beach weather everywhere else. There is no need to pull up your favorite weather app to confirm this, just take a look at the Day Ahead pricing table below for confirmation. The Thursday and Friday, week over week, peak Day Ahead prices are roughly $100/MW lower confirming reasonable summer weather out east.

Late last week FERC issued order number 2023 detailing some of their rulings on new generation project interconnection queues. FERC Chair Phillips went so far as to call it a "great day for all Americans.". While some might say that's a little much, there is no doubt this ruling has been long awaited and hopefully provides some clarity.

Without getting into all the details, the best description might be this ruling moves the interconnection queue process from a current first come first served, to a first ready first served. As a reminder, ISOs have been dealing with issues of having to do interconnection studies on potential projects. More and more that backlog included nothing more than "maybe" or "never will be" projects forcing finance and shovel ready projects to wait their turn. This ruling is designed to alleviate some of that delay and push those ready to go to the front of the line.

So far, we haven't heard much from the individual ISOs on the new ruling or the possible implementation. Frankly, some ISOs have already somewhat adopted rules that look similar to the FERC ruling. NYISO, according to RTO Insider, did say they are "digesting" the ruling. We look forward to hearing more in the coming days, but it's possible more a good step and not so much great.

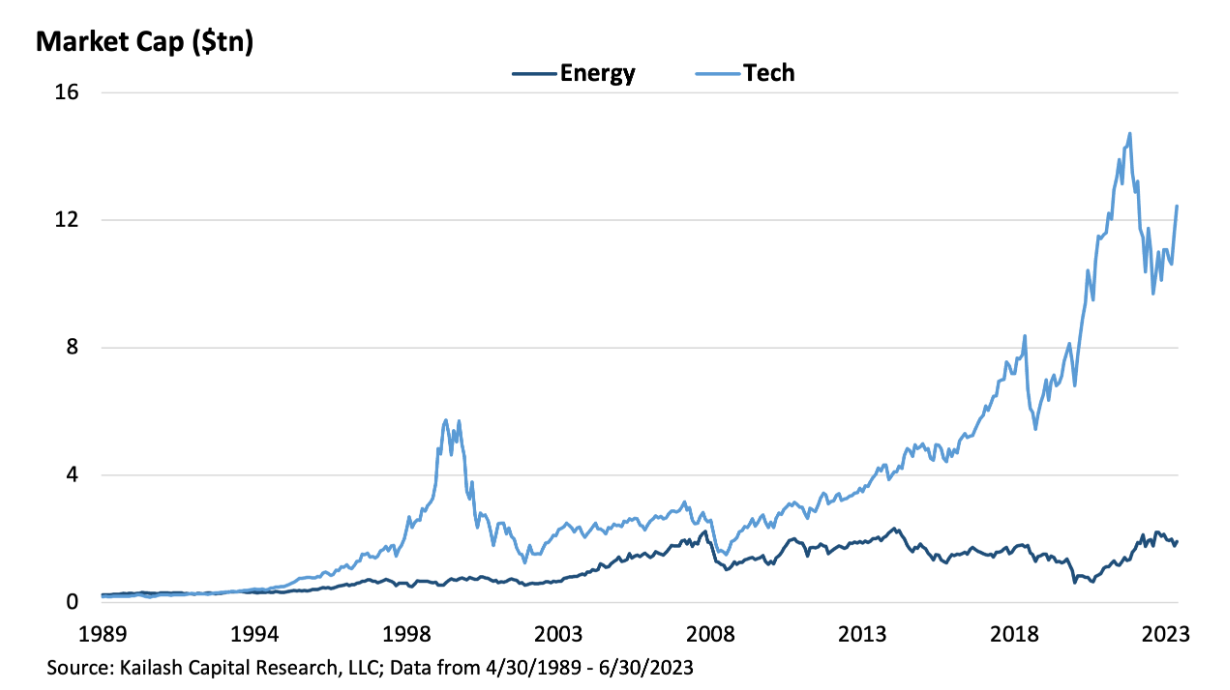

Last week we highlighted the latest move by the Fed and FOMC and how the cost of capital might impact the exploration of oil and gas. This week, research firm Kailash Concepts offered up another interesting, and different look at E&P. The chart below is from a white paper and blog post showing the growth in market cap of tech companies compared to energy. As pictured, today tech stocks have a market cap of around $12T compared to $2T for energy. The paper concludes most, if not all, is based on sentiment and not fundamentals. An interesting read.

NOAA WEATHER FORECAST

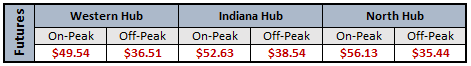

DAY-AHEAD LMP PRICING & SELECT FUTURES

DAILY RTO LOAD PROFILES

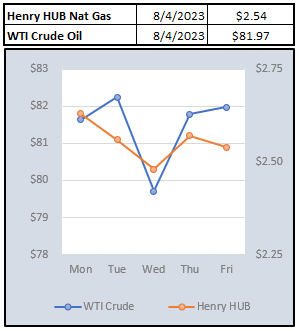

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: