Weekly Power Outlet US - Week 34

TX VPP, Summer Continues, European Nat Gas Storage

TX VPP, Summer Continues, European Nat Gas Storage

Energy Market Update Week 34, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

The Texas PUC announced two ‘virtual power plants’ (VPPs) are now qualified and able to provide dispatchable power to the Texas electric grid, which is operated by the Electric Reliability Council of Texas (ERCOT). This is a pilot project aggregating distributed energy resources (ADER) that was proposed roughly a year ago. Stored solar energy will be available for distribution as needed using Tesla batteries.

While the adoption of VPPs is a welcome step and cheered, the ability to scale will be key for any VPP program. For some context, this pilot is for roughly 7 MW. Yesterday's peak in ERCOT was around 85 GW. Ironically, the announcement of this came within 24 hours of ERCOT releasing another conservative operations message for the RTO as reserve capacity fell below 5000 MW.

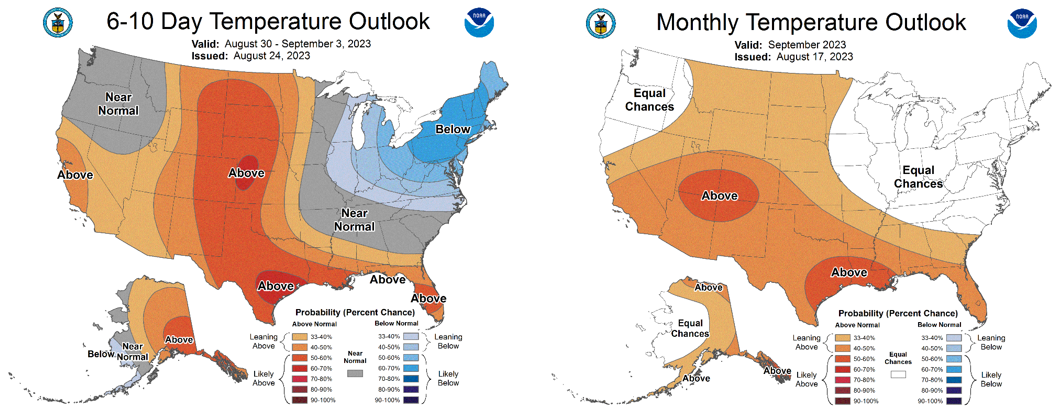

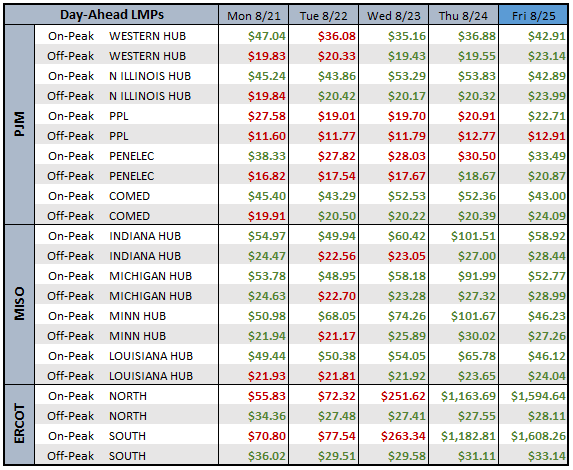

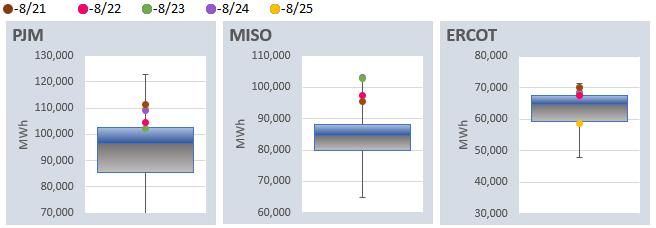

Speaking of heat, once again most of the RTOs issued alerts this week regarding grid reliability. While the temps were hot and there was some strain, it appears everyone made it through without any serious concerns. Day ahead and real time markets reflected the strain of the heat as average On-peak prices soared in ERCOT and reached triple digits in part of MISO. Looking at the weather maps, we may not be out of the woods just yet, but the calendar is telling us it's time to wind down the summer concern and prepare for shoulder season. As a reminder, shoulder season and baseload maintenance outages can lead to some pretty impressive volatility in the markets.

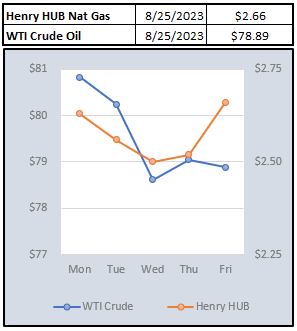

One of the drivers of last year's natural gas run was the shortage in Europe post the invasion of Ukraine. Our view has been that it wasn't unreasonable to think that there could be a repeat, although much more scaled down, where Europe might be in catch up mode heading into the fall with storage. In fact, it was such a concern, Europe had a Nov. 1 mandate that they be at 90% storage. As reported last week by S&P Global, they reached that benchmark on August 16. Even though a mild winter had tempered some of the fears that the goal wouldn't be met, it's fair to say even the most optimistic wouldn't have pegged this early to be at 90%.

While Europe seems to be under control, the Australian LNG port strike is still looming. The natural gas market still has an eye on the goings on of the talks, but given the status of Europe, a prolonged strike would be needed to cause serious concern.

NOAA WEATHER FORECAST

DAY-AHEAD LMP PRICING & SELECT FUTURES

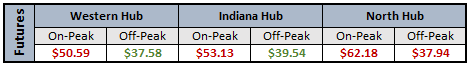

RTO AROUND THE CLOCK CALENDAR STRIP

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: