Weekly Power Outlet US - Week 36

For the fourth week in a row, we're diving into electricity conservation alerts in ERCOT. But this week, there's a twist. Discover how battery storage played a crucial role, the challenges offshore wind projects are facing, and the ever-evolving energy market dynamics.

ERCOT EEA, Nat Gas, Offshore Wind Uncertainty

Energy Market Update Week 36, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

For the fourth week in a row, we get to talk about electricity conservation alerts in ERCOT. This week added some drama as reserves dwindled to roughly 2000 MW Wednesday night triggering an Emergency Energy Alert 2 as low wind output couldn't offset the earlier setting sun and the reduction of solar. The last time ERCOT issued an EEA2 was during the 2021 winter storm Uri.

It appears ERCOT has battery storage to thank for the escaping rolling blackouts. Between 7 and 8pm battery discharge jumped to almost 2200MW helping to close the gap in supply. As we mentioned last week, there is some irony in the timing of battery storage "saving the day". Battery operators are opposing new rules that ERCOT wants to implement- NPRR (Nodal Protocol Revision Request) 1186. ERCOT is arguing that the proposed changes are needed to improve the awareness, accounting, and monitoring of state of charge (SOC) for energy storage resources. Battery owners and operators point out that some of the proposed rules call for certain charge levels to be maintained at all times. Some owners compared it to never letting the gas level in your car fall below 50 percent.

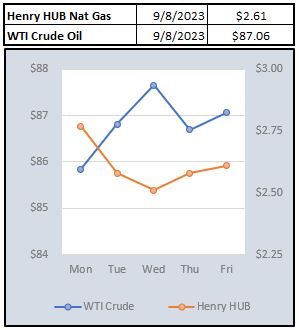

The EIA storage data showed an injection of 33 Bcf which was below the 41 Bcf estimates. The injection was flat week over week with last week's number at 32 Bcf. At this point the market has had muted reactions, but if this trend of flat to slightly higher week over week builds continues, the total storage will be back to 5- year averages, and it's safe to assume the market will start to care again.

Offshore wind projects in the US have been facing a growing list of hurdles lately. Whales dying off the east coast, and the potential association with wind projects, has gotten the most press, but is hardly the only issue. In the last couple weeks, we've heard some utilities have started to back out of contracts as project costs have escalated to points where the electricity isn't feasible. Orsted, the Danish energy company, is one of the largest players in the US offshore space. Last week they announced they would be taking large charges against its US wind portfolio as materials and cost of capital rise. This week, rating agency Moody's took notice and downgraded the company's outlook from stable to negative citing their earlier mentioned issues. Moody's said any improved outlook would need to include more visibility on projects and funding. Given some of the concerns with offshore recently, Moody's might have perfectly summed up how the consumer and investor markets are viewing the industry.

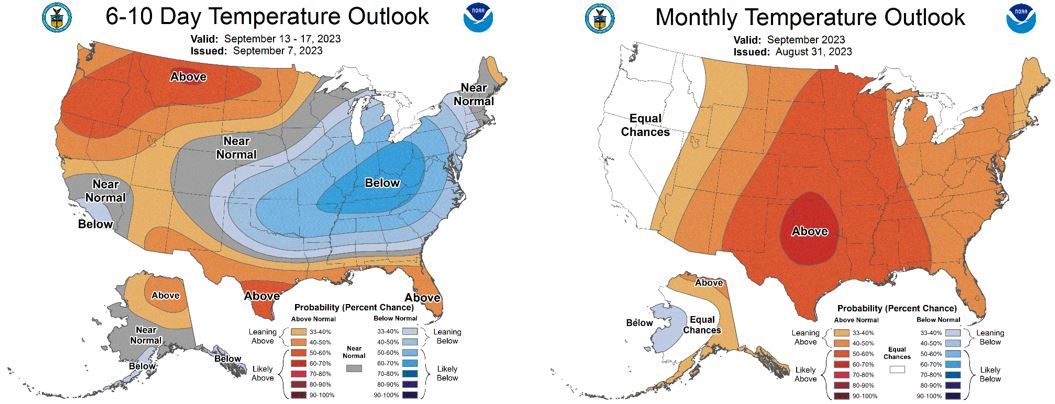

NOAA WEATHER FORECAST

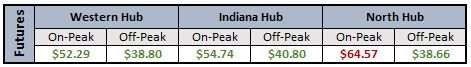

DAY-AHEAD LMP PRICING & SELECT FUTURES

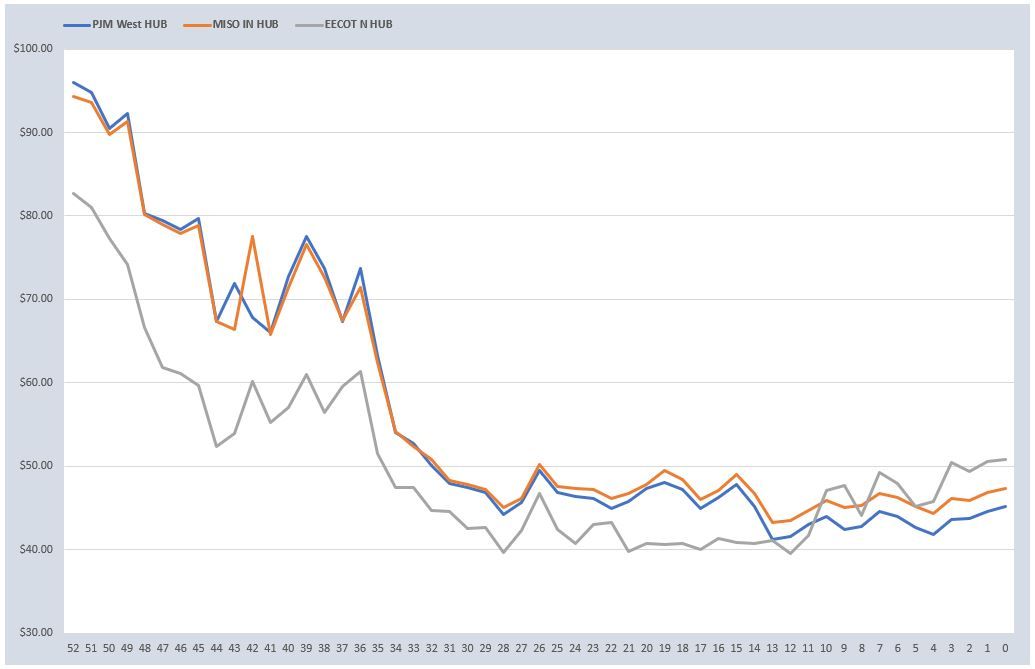

RTO AROUND THE CLOCK CALENDAR STRIP

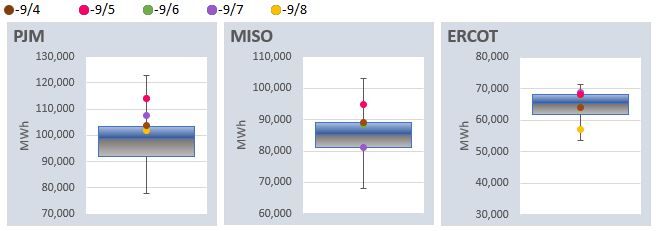

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: