Weekly Power Outlet US - Week 37

EIA's new outlook, IEA vs. OPEC debate heats up, and global power issues emerge.

STEO EIA, IEA vs OPEC, Foreign Grid Reliability

Energy Market Update Week 37, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

This week the EIA put out its monthly Short-Term Energy Outlook.

Of interest was the discussion about natural gas and power generation. In July, August, and now September, the US set records for gas consumption for electricity. The record usage has now pushed their forecast for 2023 consumption for electricity to 35.3 Bcf/d. That is a healthy 6% increase, or 2.1 Bcf/d from the previous record set last year.

They have also provided the 2024 forecast which calls for a 1 to 2 Bcf/d decline compared to this year. That would put the consumption back to roughly the 2022 levels. The decline is being attributed to competition from growing renewables.

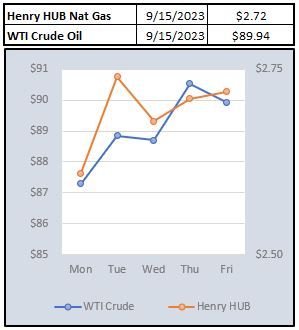

Natural gas futures traded relatively flat this week after a Monday rally. The weekly storage report was above consensus of 49 Bcf. Traders are still trying to digest the daily news coming out of Australia and the on-again, off-again strike at some large LNG terminals.

This week an Op-Ed appearing in the Financial Times by the International Energy Agency (IEA) got a fair amount of attention. This is a preview of the annual World Energy Outlook that IEA will release next month. The article called for peak fossil fuels by 2030 which they characterize as a welcome sight so the world can shift to cleaner sources of energy. According to the editorial, the report will suggest that increased EV, solar panel production, and a slower China will be catalysts to lower demand for coal, gas, and oil.

As expected, there were a fair number of skeptics to this, none bigger than The Organization of Petroleum Exporting Countries (OPEC). OPEC came out swinging calling the report ideologically driven, rather than fact-based. They called it an extremely risky and impractical narrative to dismiss fossil fuels and basically said 'we've heard this before'. OPEC Secretary General HE Haitham Al Ghais went even further stating, "such narratives only set the global energy system up to fail spectacularly. It would lead to energy chaos on a potentially unprecedented scale, with dire consequences for economies and billions of people across the world.".

We enjoy a good debate as much as anyone, but it feels like each side is talking their book in this one. While we enjoy reading the work IEA does, and often find ourselves somewhat skeptical of OPEC, to think EV adoption, solar panel production and China coal use dropping (especially as they were permitting a new plant a week) are going to be enough to pull back on fossil fuels in the next six years seems unlikely.

We often talk about how it could be much worse in the US with regard to prices and reliability. Eskom in South Africa is usually our example as they are the most transparent about it with regular social media updates. This week we got a couple more examples as both Nigeria and Kazakhstan had power issues.

Nigeria suffered a "total system collapse" early Thursday blacking out the country. The daily load total is usually around 4000 MW and no reason has yet been given for the collapse. Nigeria is Africa's biggest economy driven by oil exports. Power outages aren't uncommon, but a total failure is, and it has an impact on the oil and gas industry as they have to work around the issues.

Meanwhile in Kazakhstan, the Atyrau Oil Refinery suspended partial operations in order to prevent an emergency because of low voltage on the power grid. The refinery is one of the biggest in the country. The reason this caught our eye is because of comments made by the country's energy minister in August. Because of power outage issues, the OPEC+ country was facing the possibilities of cutting its export volumes for 2023. While the exact number wasn't known, parsing some comments and simple math gets the number to 10-20 million barrels of oil. While that's a pretty slight number in the grand scheme of things, it is a reminder of how dependent these countries are on a less than robust electric infrastructure.

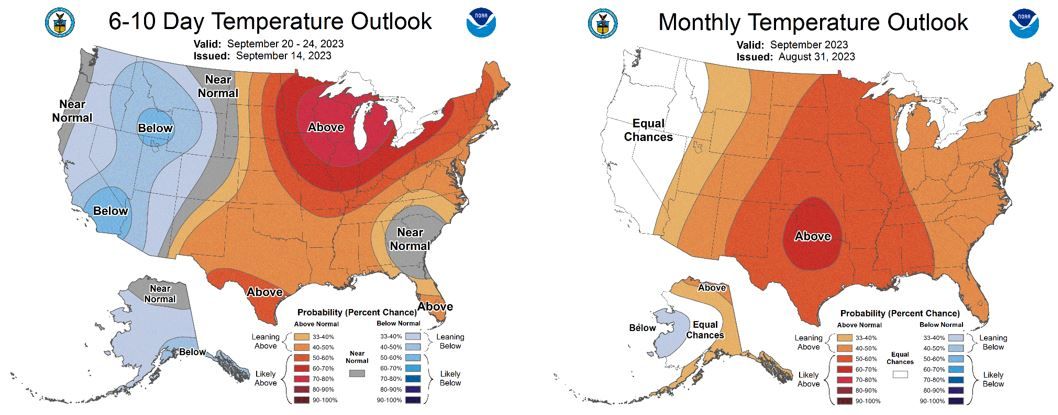

NOAA WEATHER FORECAST

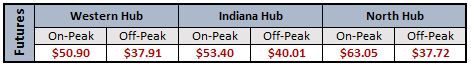

DAY-AHEAD LMP PRICING & SELECT FUTURES

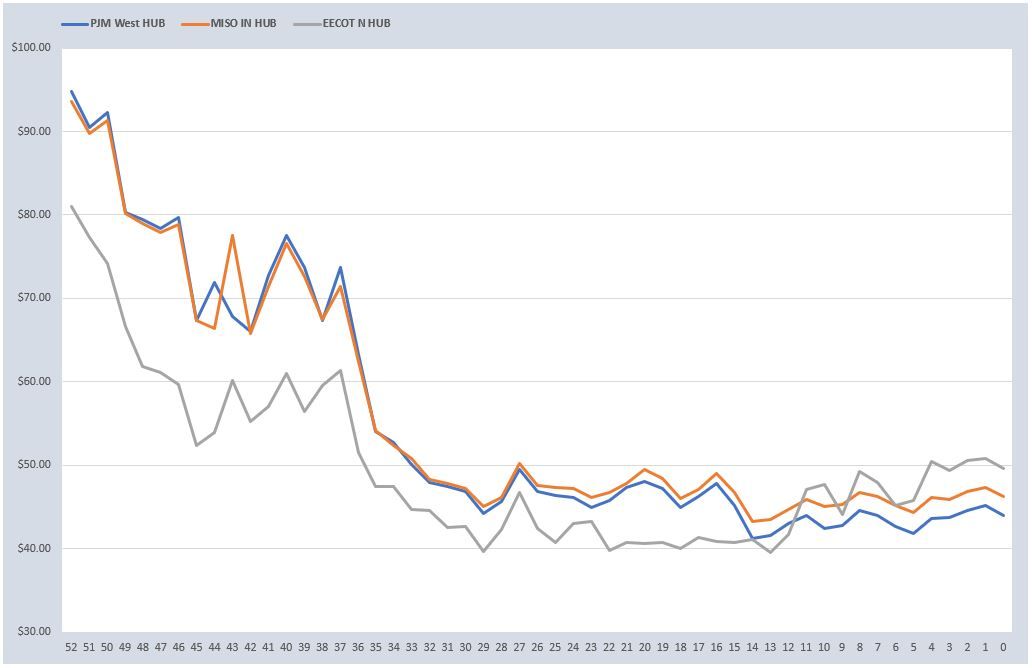

RTO AROUND THE CLOCK CALENDAR STRIP

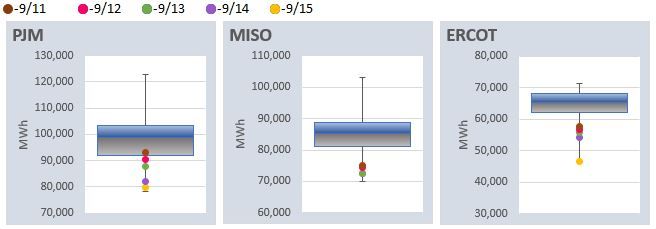

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: