Weekly Power Outlet US - Week 38

FERC/NERC's report on Winter Storm Elliott unveils key findings. Plus, dive into the Transmission Bill debate and LNG's rising role

Elliot Report, Transmission Bill, LNG Capacity

Energy Market Update Week 38, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

FERC/NERC released a final report on Winter Storm Elliott this week. As expected, there was a long list of issues with each adding to the unprecedented electric generation outages across multiple regions. Topping the list was natural gas with 63% of the outages from December 21-26 coming from natural gas units measured in MWs. While some mechanical issues were seen at gas generation units, natural gas infrastructure was a major cause with well freeze offs, production and pressure issues, and even icy roads preventing maintenance was blamed.

Interestingly, one of the other key findings was the Day-Ahead estimates by some of the balancing authorities. The average two day look ahead on forecasted load averaged an 8.8% miss amongst BA's. One of the BA's forecasted load was off 11.6% for December 23.

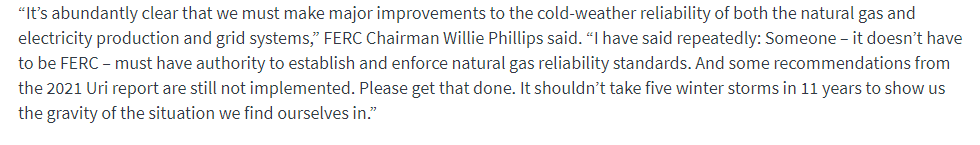

The report laid out 11 improvements to be considered for cold weather reliability. As would be expected, most centered around natural gas and the infrastructure required to deliver it. While not in the report, the included comment from FERC chair Phillips was pretty frontal about his feelings.

Back in May there was little attention paid to a bill Sen. John Hickenlooper, D-CO, was preparing to introduce. The bill essentially said that RTOs and transmission planning regions would be required to have the ability to transfer at least 30% of their peak load to other regions. Last week, with co-sponsorship by Rep Scott Peters, D-CA, the bill was introduced as The Big Wires Act. The talking points of the bill read much as they were explained last spring with the 30% capacity transfer. According to Sen Hickenlooper's press release, "the bill would cost the government no money. Instead, utilities and transmission developers within each of the transmission planning regions would be responsible for upgrading the grid.". Consider us skeptical when considering this could be passed without some government incentives. That said, any conversation around transmission improvement is a good conversation.

Interestingly, the press release talks about how this gained attention over being a possible component of the debt ceiling compromise last spring. Don't look now, but we are weeks away from another possible government shutdown.

A story this week appearing in Reuters is talking about how a new floating LNG terminal will be completed off the German Baltic Coast by the first quarter of 2024. The terminal will include two floating storage facilities and connect the mainland at Port Lubmin. Lubmin is important in that it is the connection point to Nord Stream meaning it has the capacity to get gas to the greater of Europe.

Coincidently, EIA announced that the US was back to the number one exporter in the world for the first half of 2023. Also, today Sempra announced that their phase 2 project at Port Arthur LNG has been approved by FERC. Ultimately, this will double the export capacity of this facility.

As a reminder, longer-term thesis for natural gas has been that LNG export and import capacity around the world is going to bring world market pricing to export markets. Announcements of expansion to each is another step toward the likelihood of market parity.

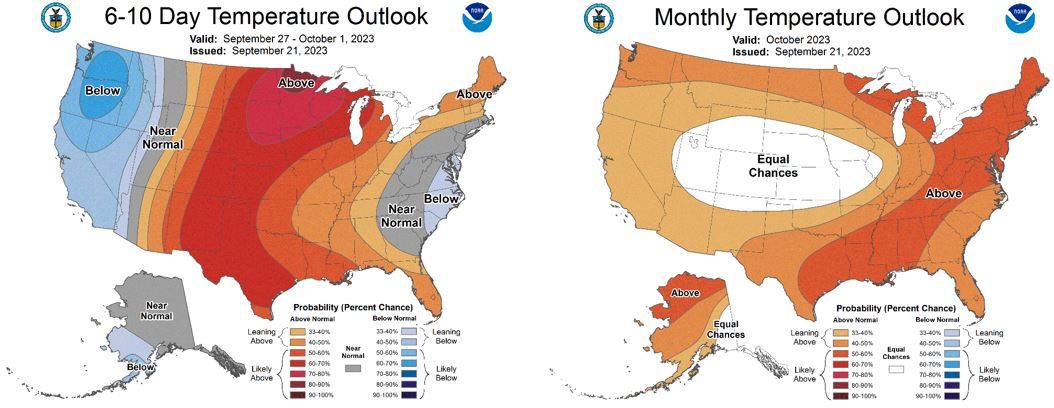

NOAA WEATHER FORECAST

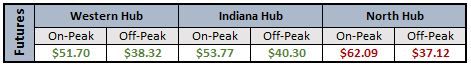

DAY-AHEAD LMP PRICING & SELECT FUTURES

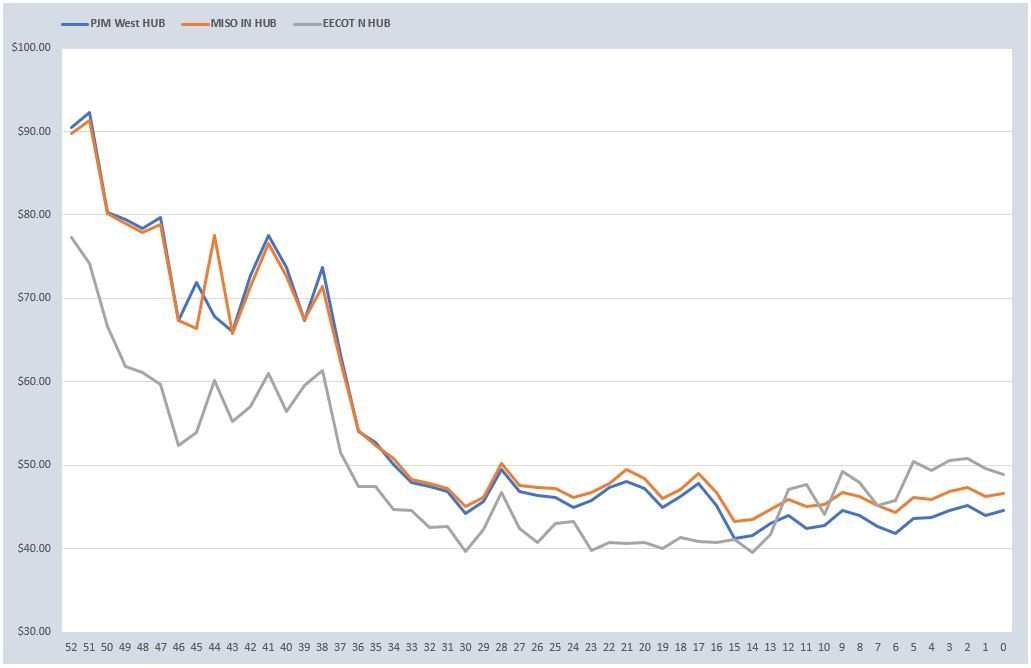

RTO AROUND THE CLOCK CALENDAR STRIP

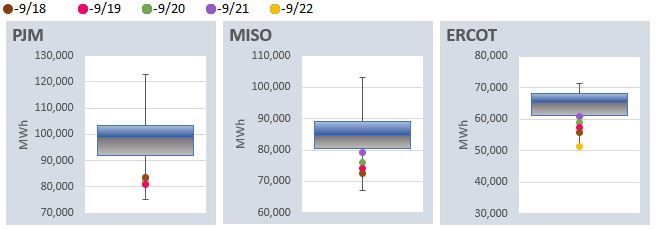

DAILY RTO LOAD PROFILES

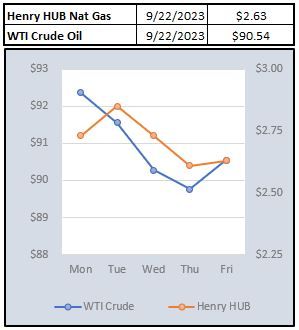

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: