Weekly Power Outlet US - Week 4

A wild month of natural gas and electricity, PJM capacity, and Wall Street earnings season.

Energy Market Update Week 4, brought to you by Acumen.

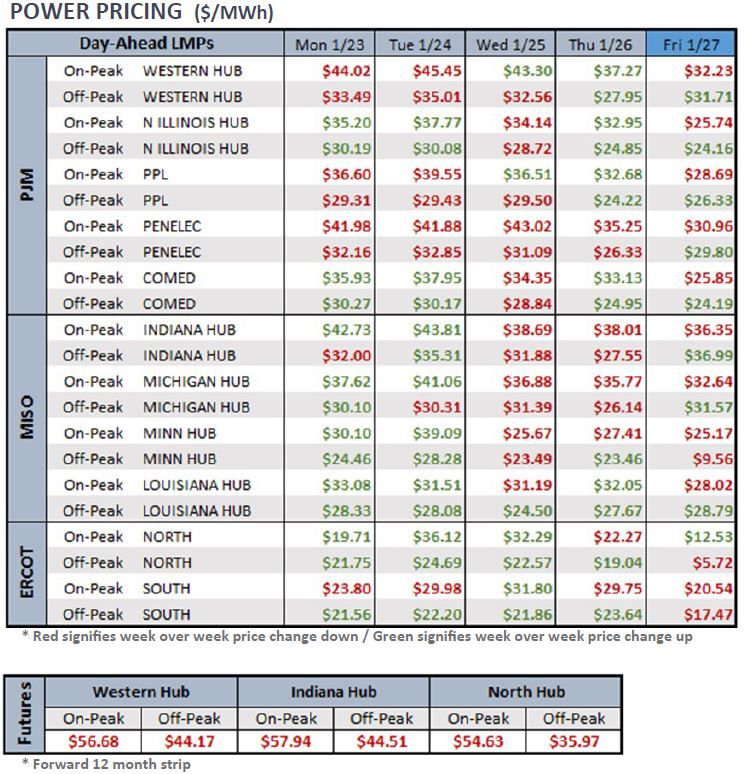

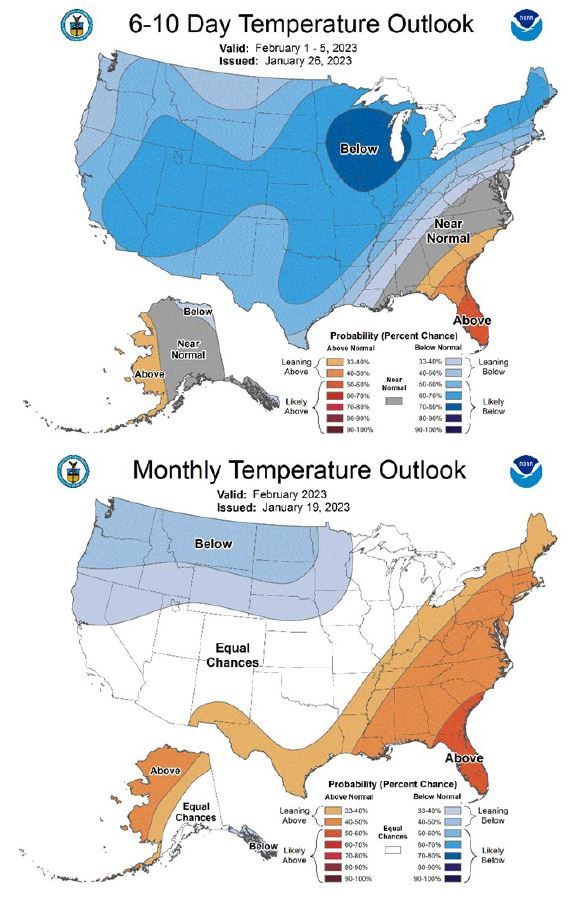

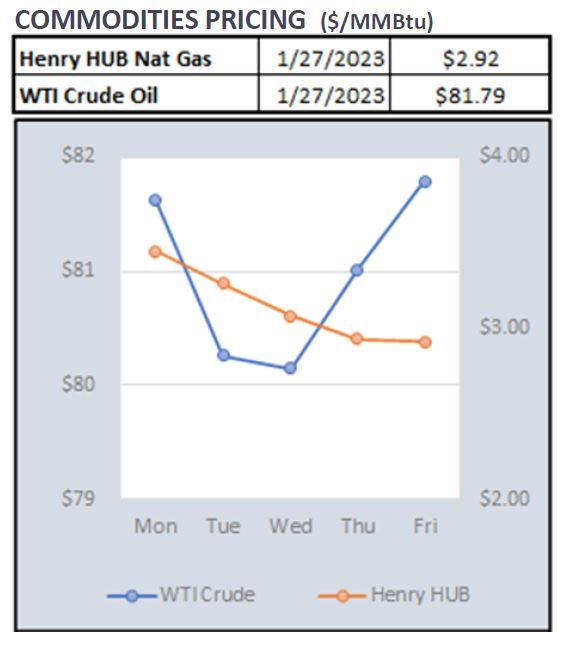

For More Updates Like This, Subscribe Here!Six weeks ago, the PJM Western Hub On-peak 12-month strip was trading in the $80. Today it’s below $60. Over the same time, NYMEX Henry Hub natural gas has dropped from $8 to under $3, a simply amazing reversal. Ample storage, warmer weather (this coming week aside), and increased production have all been headline reasons for the fall. In our view, those all make sense for some volatility, but moves like the one we’ve just witnessed seem more like exaggerated speculative money in the marketplace. Speculative positions in any commodity market are welcome as they provide liquidity, but every so often, they get to be the driving force that always seems to overshoot. When such events take place, hedgers need to be ready to execute.

Winter Storm Elliot is roughly one month in the rearview mirror. Utilities and ISOs have started the review process of what went right or wrong. This week PJM held a couple of informal meetings to start that process. We’d like to say we had something concrete to report, but it seems we are in the initial phase of something between finger pointing and concrete answers. We will keep readers updated.

Finally, Wall Street has kicked off quarterly earnings season and all the investor conference calls that go with. Trying to decipher all the news is somebody else’s full-time job, but we try to pick things out that are of interest. Chevron stated on their call that they are accounting for higher natural gas prices for all California refineries in the coming year. This aligns with CA bottlenecks we’ve highlighted and may be more than a passing issue for electricity in CA. More to come.

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: