Weekly Power Outlet US - Week 40

EIA gas storage insights, Germany's coal decision, and market trends to watch.

Oil/Gas, German Winter, Technical Look

Energy Market Update Week 40, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

EIA natural gas storage showed a slightly less build of 86 Bcf versus the expected 96 Bcf. Inventories remain over 5% of the 5-year average and are well ahead of last year by 11.5%. We are entering the season where a good amount of the country could be using their furnaces for AC, depending on the year. This adds an element of weather watching for traders.

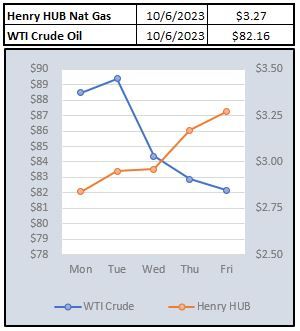

Speaking of traders, the front month (Nov) gas contract is indicating around $3.20 this morning. Considering it opened the week at around $2.85, that is an impressive move. While the electricity world is dominated by the natural gas market, we have to keep one eye on the oil market. As impressive as the natural gas move was this week, oil had almost an identical inverse move (see chart below for details). While the fundamental news in natural gas this week could warrant a sharp increase in trader mentality, oil might have also been a catalyst. Though not as popular as in the past, oil/gas has always been a "pairs trade" candidate for commodity funds. A pairs trade is where you are long of one of the commodities, and short of the other. In the past, sharp movements in one, usually meant the same for the other as the reciprocal trade needed to be made. As noted above, we believe this trade has gotten less popular (mostly because it's been a career ender in the past), but it is still worth keeping an eye on oil prices.

This week Germany announced they were keeping a stable of coal plants active for the winter. A concern of gas disruption or draw down was given for the reasoning. “The supply reserve will be reactivated in order to save gas in electricity generation and thus prevent supply bottlenecks with gas in the 2023/2024 heating period,” the government said.

In a related story from Oilprice.com, the head of Germany's biggest utility, RWE, said in an interview that there is not a buffer for this winter with regards to gas supply. A very cold winter, or disruptions, could lead to critical situations. This is of interest to us because this was the fear last year. So far, the gas market has been less interested in the warnings.

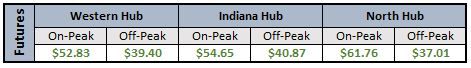

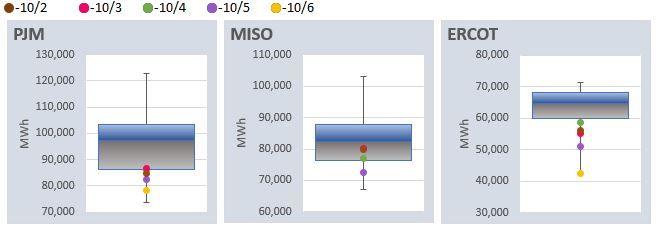

Technical analysis isn't always part of our day-to-day market study, but we do find value in it. Looking at the around the clock calendar strips below, both PJM and MISO have started to break out above a trend line dating back to the spring lows. Looking back a little further, the $50 level is important as a triple top was established. There is some more work to do, but if the market gets there and breaks out, it could be off to the races.

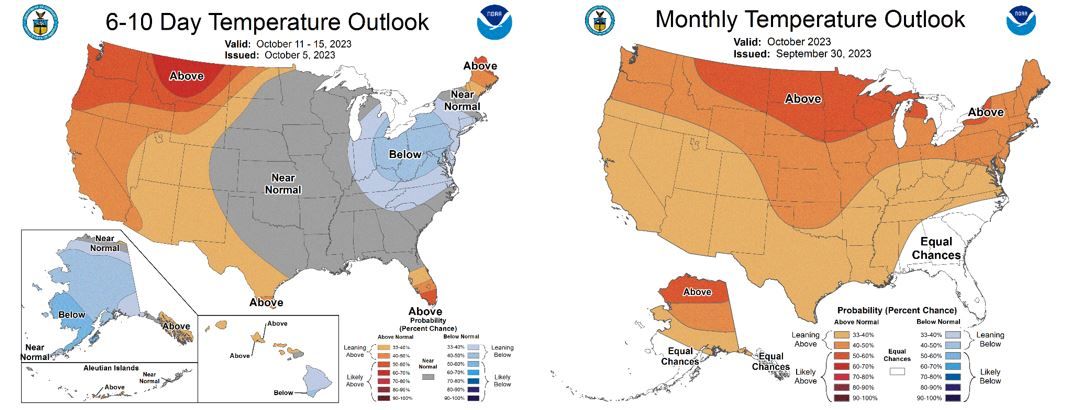

NOAA WEATHER FORECAST

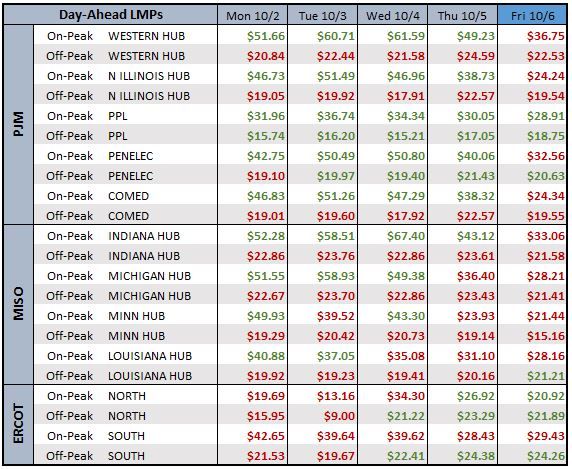

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO AROUND THE CLOCK CALENDAR STRIP

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: