Weekly Power Outlet US - Week 44

Explore the nuances and implications of Q3 reports in the energy and utilities sector, from commercial growth driven by datacenters to the challenges facing the wind energy industry. Dive into the trends and challenges as winter approaches, with natural gas and electricity prices.

Silly Season, Load Growth, Offshore Wind-Again

Energy Market Update Week 44, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

Four times a year public companies report their quarterly earnings which Wall Street affectionately, or with dread, dubs silly season. Volatility traders (options) usually welcome the days. A “long-term” fundamental portfolio manager with a client base that grades “long-term” performance with monthly statements may not enjoy. And finally, if you’re a compliance officer, you sit on the edge of your chair hoping the CEO and CFO don’t color outside the lines of what’s acceptable to report.

The anatomy of a quarterly conference call can be filled with nuance and even gamesmanship. The call makeup is generally the Wall Street analysts, that cover the company for their firms, waiting in a phone queue ready to ask management a question. This might be hard to believe, but different analysts might have different motivations. One analyst might lob a softball question, especially if the investment bankers reminded him or her of the pending bond deal they have coming with said company, while another might ask a brutally unfair question planted by a large commission hedge fund paying client who may be short the company stock. Now this is all frowned upon by the SEC, so let’s stick with it could happen rather than it does.

So now that we’ve droned on about the potential tomfoolery, count us in the camp that enjoys the quarterly reports. Even if we must read between the lines, we get a great look at the landscape that might confirm or change our thinking on various topics. In this week’s Power Outlet, we look at a couple of interesting things we took note of so far in Q3 season.

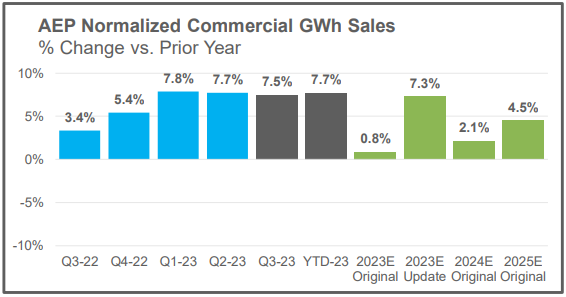

First, the AEP conference call. CEO Julia Sloat responded to a load growth question talking about a small uptick in retail consumption, industrial consumption flat driven by interest rates which makes sense. The real eye opener was commercial shown in the chart below.

As shown, commercial growth has been near 8% so far this year, substantially above forecast. The obvious question, where did the growth come from was answered with datacenters.

When it comes to load growth, we’ve been skeptical of electrify everything, mostly because it doesn’t make sense given the grid make up. Also, it’s becoming more obvious that EVs aren’t going to have the load footprint originally forecast-at least not yet. But, the calculus behind datacenter is growing and it’s real thanks to AI. While crypto mining has helped drive growth in datacenters, it was somewhat manageable by utilities as capacity allowed. It’s fair to assume that utilities will not have that option with AI as consumers will demand it. It might be time to expect capex to be even more of the conversation in these utility earnings calls going forward. Good luck to the management teams in the new cost of capital environment.

Next, the new punching bag of energy, wind. Last week we highlighted the issue at Siemens Energy with shares falling 40% on concerns over their wind division. Orsted, a Danish offshore wind developer, BP, and Shell added their names to the list this week.

Orsted took the brunt of the news as their shares fell to an all-time low after releasing numbers earlier this week. "The current market situation with supply chain challenges, project delays, and rising interest rates has challenged our offshore projects in the US, and in particular our offshore project Ocean Wind 1, which has led to significant impairments in Q3 2023. Therefore, as part of our ongoing review of our US offshore wind portfolio, we've decided to cease the development of Ocean Wind 1 and Ocean Wind 2.". The write down is being reported at $5.6 billion by Reuters. BP shares also traded lower on earnings as they had some issues across the board, which included a $540 million write down on US offshore wind. The head of renewables said the US offshore wind industry is "fundamentally broken". Finally, Shell confirmed this week that it is cancelling a PPA for the SouthCoast wind project off the coast of Massachusetts. Because of the rising costs of the project, they are choosing to pay the penalty rather than build the project.

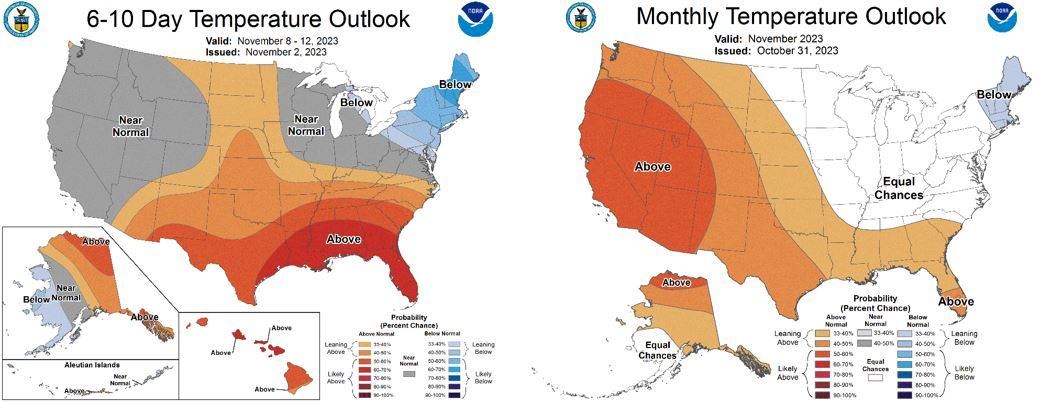

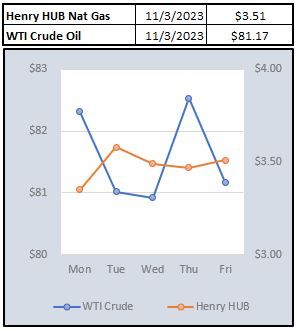

Natural gas futures bounced back a touch after starting the week lower. The EIA storage report came pretty close to estimates with a build of 79 Bcf vs estimates of 82 Bcf. While winter seems to have arrived in parts of the country, there isn't anything that looks unseasonal in the forecasts. Electricity prices were up week over week with slightly higher demand and gas pricing.

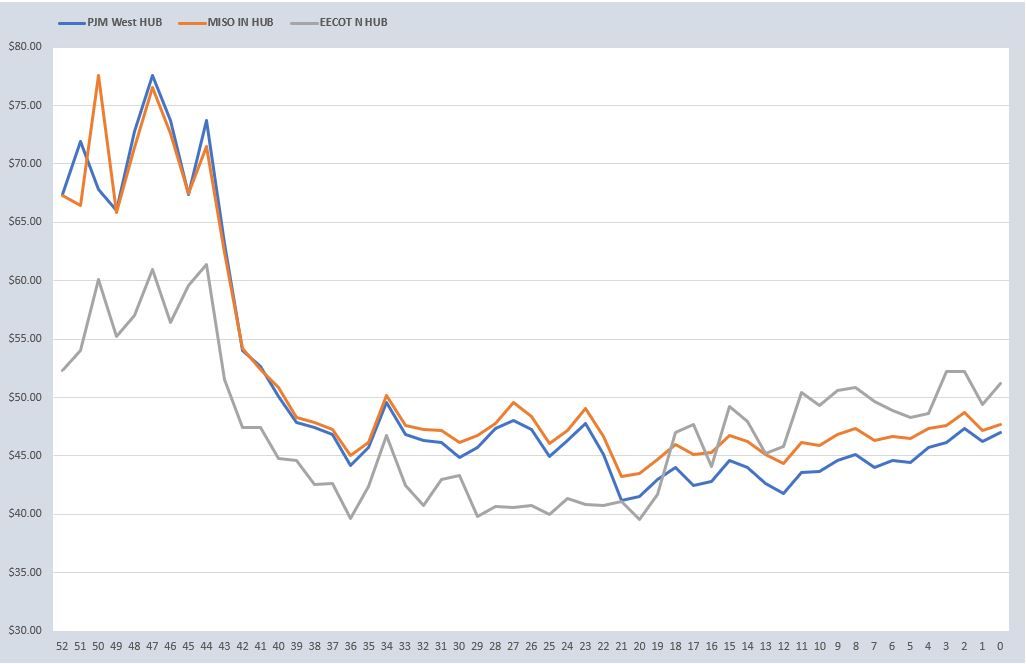

While not in a straight line up, around the clock electricity calendar strips continue a nice move higher since bottoming in the late summer. After a small give back last week, it looks like the trend up might be continuing. LNG, domestic storage, and weather are always on the radar, but heading into winter even more. Stay tuned.

NOAA WEATHER FORECAST

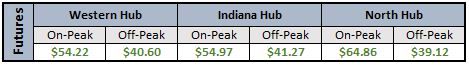

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO AROUND THE CLOCK CALENDAR STRIP

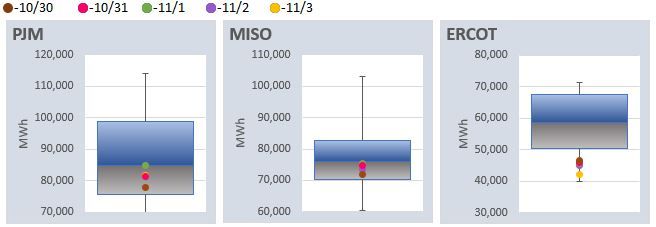

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: