Weekly Power Outlet US - Week 47

Black Friday brings more than shopping deals as winter strip prices plummet to a stark contrast to last year. Despite potential European cold and ERCOT's cancelled capacity procurement, robust supply and pricing dynamics shape the market narrative.

Lower Nat Gas, Lower Electric Prices, and ERCOT Reserve RFP

Energy Market Update Week 47, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

This morning, or last night, started the time-tested tradition of rushing out to a supercenter in hopes of grabbing a big screen television for perceived pennies on the dollar, it's Black Friday!!!! For those long natural gas, this too could be considered Black Friday, or November.

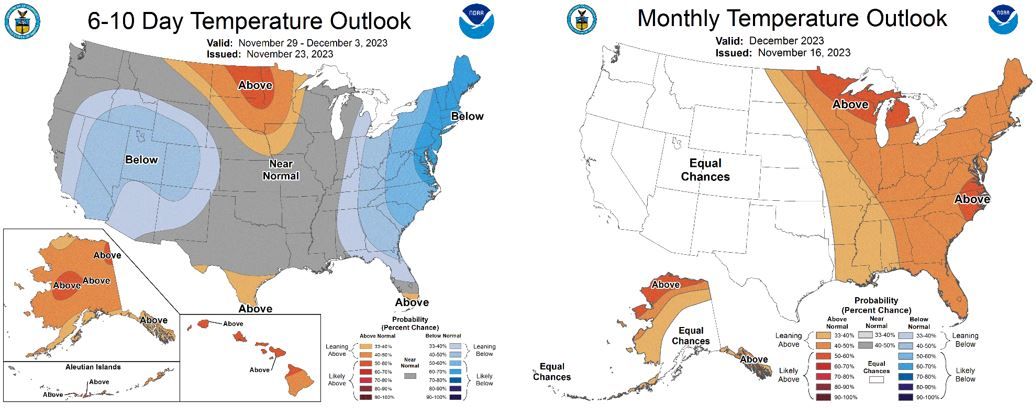

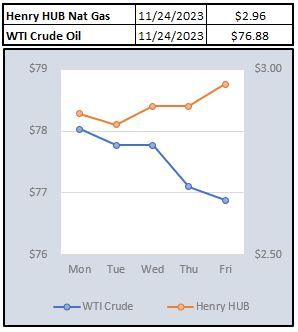

The balance of the winter strip for Henry Hub is now trading below $3/MMBtu, at roughly $2.90/MMBtu. For context, one year ago the same strip was trading at $7.29/MMBtu. A potential shot of cold air was quickly replaced by the ongoing super El Nino. There are some rumblings about a European cold for next week, but the market seems to have no interest. EIA data released Wednesday, showed a draw of 7 Bcf which was less than estimates. Supply continues to be robust as November is on track to average about 105 Bcf per day. That number would be roughly 5 Bcf higher than last November.

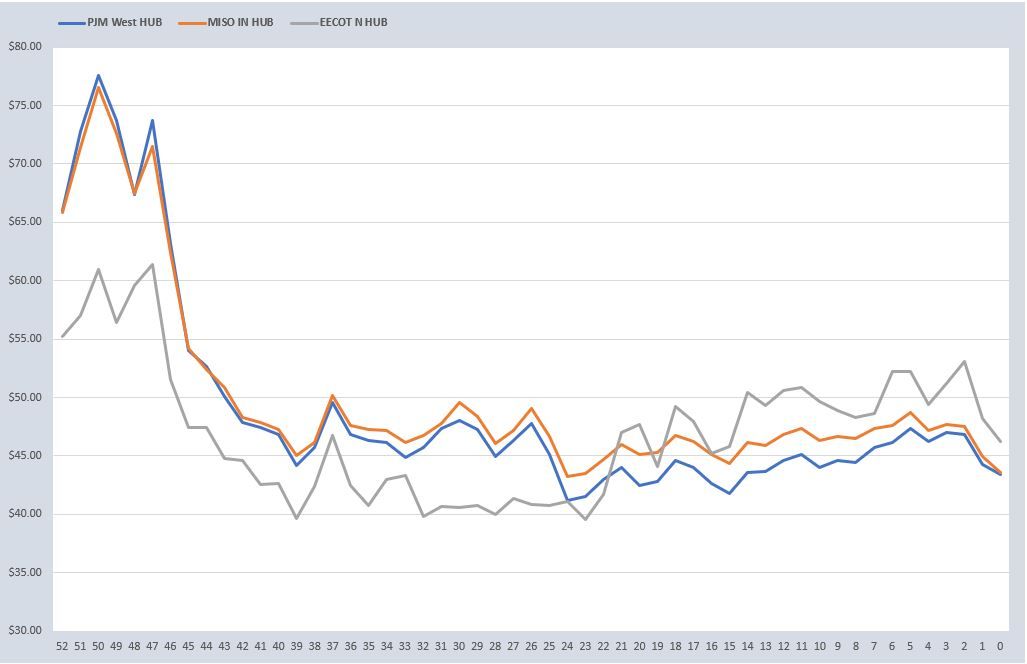

In the past, we've referenced the $50 level for calendar year On Peak pricing for the markets below. PJM and MISO have once again fallen to that level and will test in the coming weeks. Given the pricing action of natural gas, the moves in forward prices are understandable. That said, prices are remarkable seeing how we are just heading into December.

Late last week, ERCOT announced that they were cancelling an RFP designed to procure 3000MW of additional capacity for this winter through generation or demand response. The reason for the cancelation was only "11.1 MW of potentially eligible capacity" responded. Initially ERCOT said the request was for. "an extra layer of precaution to mitigate higher risk during extreme weather this winter.”. The RFP was based on an analysis that if another Elliot hit this winter, there was a 20% chance of deficient capacity to handle the load. In the press release announcing the cancelation, ERCOT pointed out that they expect to have adequate resources able to serve load demand.

NOAA WEATHER FORECAST

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO AROUND THE CLOCK CALENDAR STRIP

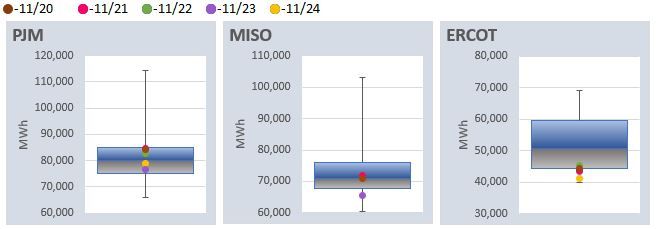

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: