Weekly Power Outlet US - Week 48

Dive into the fluctuations of natural gas prices, renewable investments, and the evolving narrative of EV adoption. From market dynamics to policy shifts, discover the forces shaping the energy landscape this week.

Natural Gas Continued Slide, Renewable $, EVs

Energy Market Update Week 48, brought to you by Acumen.

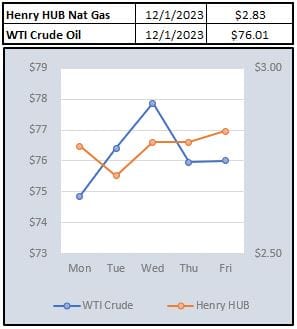

For More Updates Like This, Subscribe Here!Natural gas prices continued to slide this week with electricity futures following. Thursday's EIA storage data noted an injection of 10 Bcf. vs an estimate of a 10 Bcf withdrawal. Production continues to be robust as the November average will finish over 105 Bcf a day. Rather than add commentary, EIA's chart shows the picture. Given lower weather demand and higher production, the trend is looking like storage could set a new 5-year high. Earlier this week there was some commentary out of Europe of winter arriving early, but that didn't even register a pause in the slide in futures....even in the Dutch European market.

The phrase "follow the money" gets associated with politics a lot. The phrase is also popular with the Wall St. crowd. The money flow in assets will tell the story. Some renewable investments have been having a tough year, facing a variety headwinds. This week, in a Reuters' story citing Lipper data, the biggest renewable ETF, iShares Global Clean Energy, tracking clean energy stocks has seen money outflows of over $1 billion so far this year. This compares to over $2 billion in inflows in both 2020 and 2021. Invesco's Solar ETF is also down 38% so far this year and has seen record annual outflows.

Tom Bailey, head of research at ETF provider HANetf states pretty simply, higher rates means future earnings get discounted making a lot of projects much more expensive.

The EV market has kind of had a one step forward/one and a half back journey over the last couple of years. As mandates were ramping for EV adoption, utilities and LSEs were fretting about the load factor and infrastructure to serve. Over the last year or so, while there are still plenty of concerns, they've been tempered as the rate of adoption has become more measured instead of the whole country switching overnight.

Ironically, as the concerns by those tasked with fuel procurement and delivery have waned, it's now the dealers who are pushing back and proclaiming that the consumer is not adopting nearly as much as was predicted, or even mandated. This week, roughly 4000 dealers from all 50 states in the union sent President Biden a letter urging his administration to slow adoption regulations. While the group praised the advances in EVs, they claimed the consumer isn't adopting as quickly leaving excess inventory. They said slower mandated adoption rates will help the consumer, who isn't an earlier adopter, get more comfortable with the idea of EV ownership. They also mentioned some infrastructure and technology issues that ranged from the availability of reliable charging stations to weather related ranges.

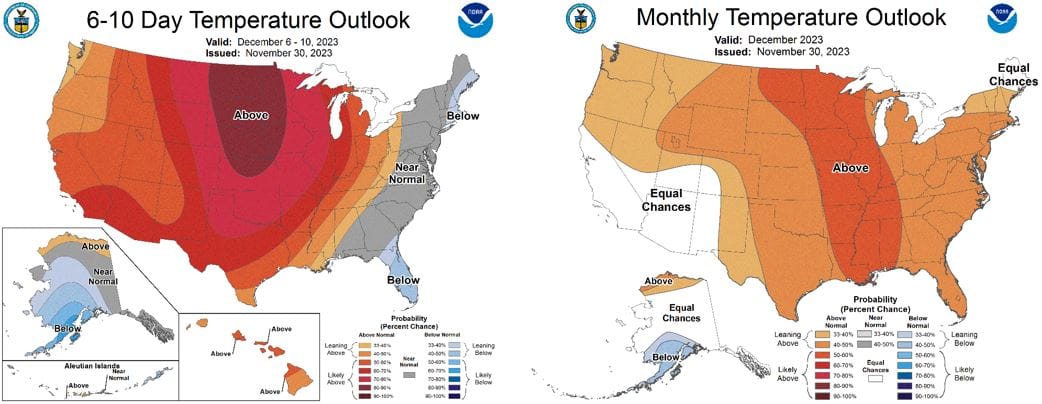

NOAA WEATHER FORECAST

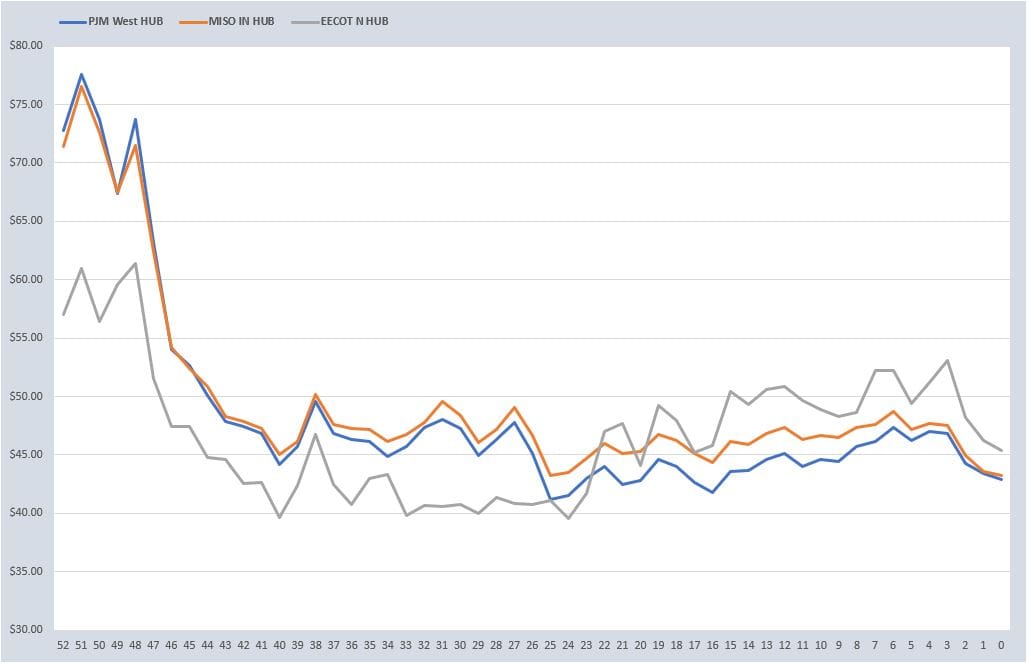

DAY-AHEAD LMP PRICING & SELECT FUTURES

RTO AROUND THE CLOCK CALENDAR STRIP

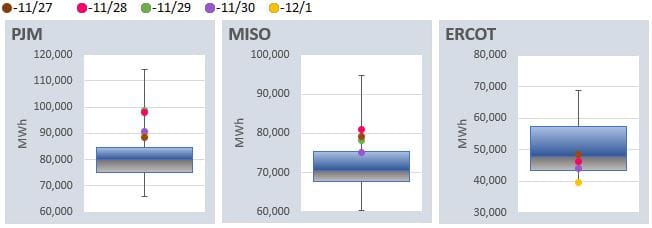

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: