Weekly Power Outlet US - Week 5

Elliott 2.0, natural gas withdrawal, and Wall Street conference calls.

Energy Market Update Week 5, brought to you by Acumen.

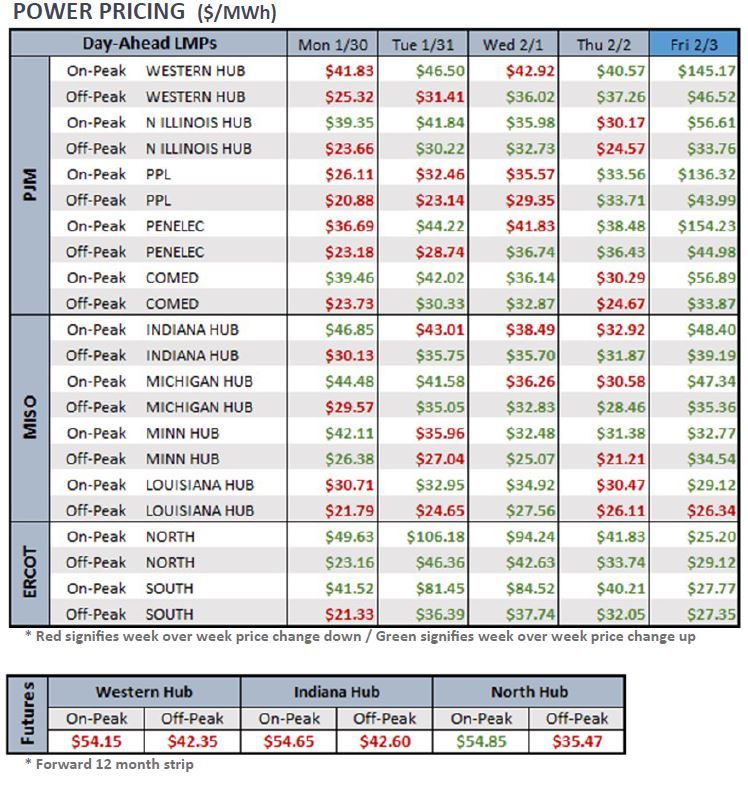

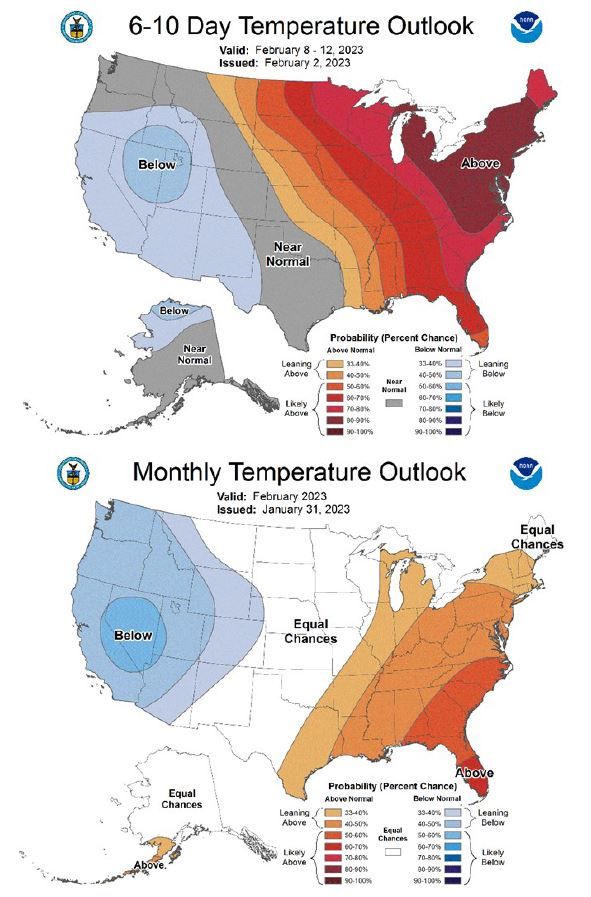

For More Updates Like This, Subscribe Here!Another cold Artic air blast is descending onto the East Coast today and tomorrow. PJM has issued a cold weather alert for the two days and has ramped units available to cover 163K MW of max load. They expect the peak to be in the mid 120’s, but after Elliot, they appear to be taking no chances. For context, the peak in Elliot was 140k MW. An interesting exercise will be comparing day-ahead pricing to real time for the next two days. As seen below, a good chunk of eastern PJM in triple digits for on-peak.

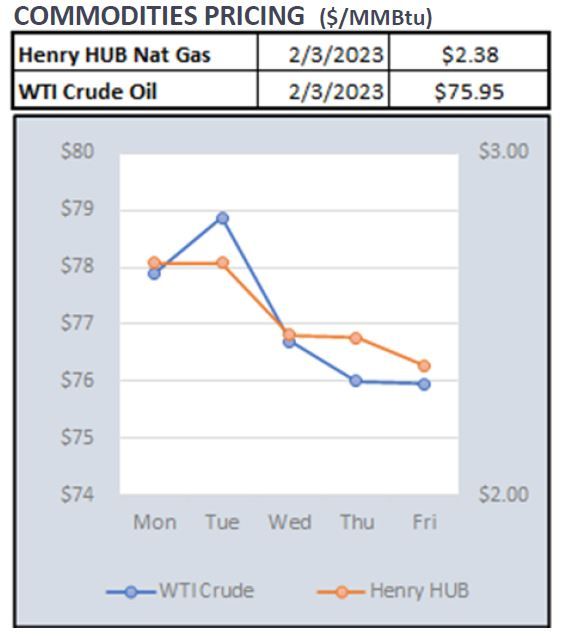

Natural gas continues to be the story in the electricity stack. The front month NYMEX contract is trading sub $2.40 this morning. This level hasn’t been reached since the spring of 2021 when we were just starting to emerge from the great COVID pullback. Looking at a two-year chart in natural gas, the drop since early fall has been nothing short of spectacular. Sticking with a seasonal theme, the most bold and confident skier wouldn’t attempt that drop-off seen on the charts. For the chart readers out there, the oversold indicators don’t go any lower.

The quarterly earnings conference calls have started across Wall Street. We try to take in a few by webcast, and read transcripts of others as time allows, trying to pick up a few things of interest. So far, the WEC call has been of interest as there was talk about the supply chain of solar panels and other gear-like transformers. Panels have made their way to the states but are still awaiting final paperwork, and it appears other gear seems to be available. This is a change from previous quarters where there were a lot of unknowns and very little visibility.

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: