Weekly Power Outlet US - Week 6

EIA storage numbers, China re-opening, and day-ahead prices in the single digits.

Energy Market Update Week 6, brought to you by Acumen.

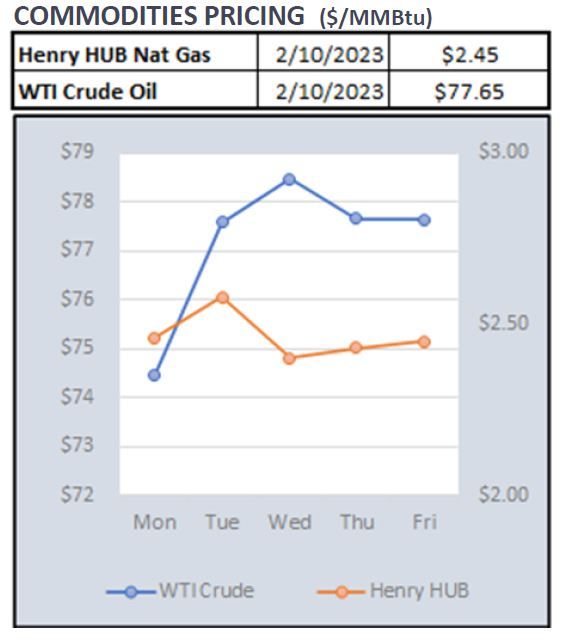

For More Updates Like This, Subscribe Here!EIA storage numbers were released yesterday with a slightly larger withdrawal than forecast at 217Bcf. The winter storm that hit East Central Texas was the culprit as the cold weather increased demand. Futures initially rallied on the news, but have settled back as the market realized the beat on withdrawal was because

of the pull in Texas. Production numbers were down slightly, but again because of some freeze-offs in Texas which were short lived.

China reopening has become more of a conversation on Wall Street with corporate CEOs and oil traders. The discussion has also slowly been moving into the natural gas market, specifically LNG. The summer saw a mad dash of LNG cargo heading to Europe and into Q42022, there was a backlog of ships waiting to unload. With the warm winter in Europe, the draw down has been below expectations, but China adds a new element. If China does reopen and become a destination for LNG, we could see some gas rally as the fungible nature of LNG shows up in domestic prices.

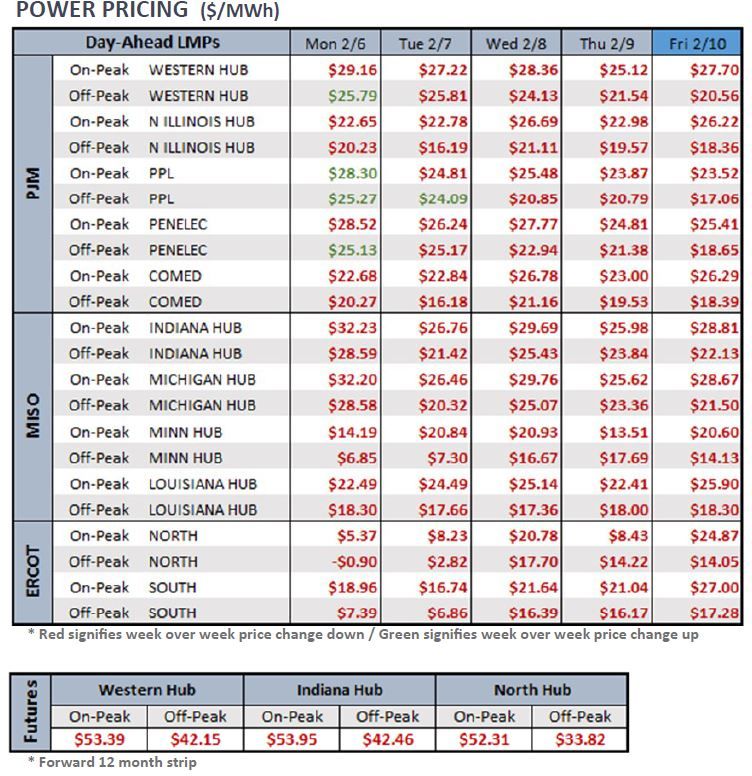

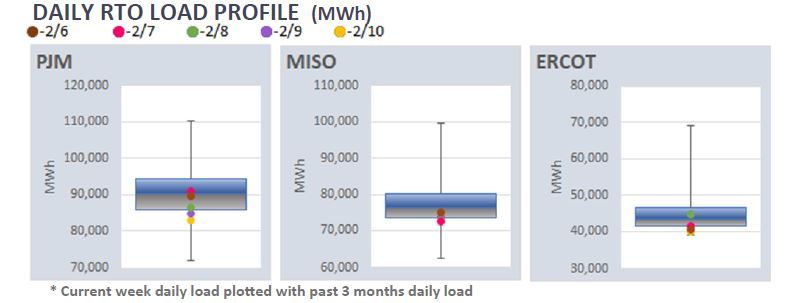

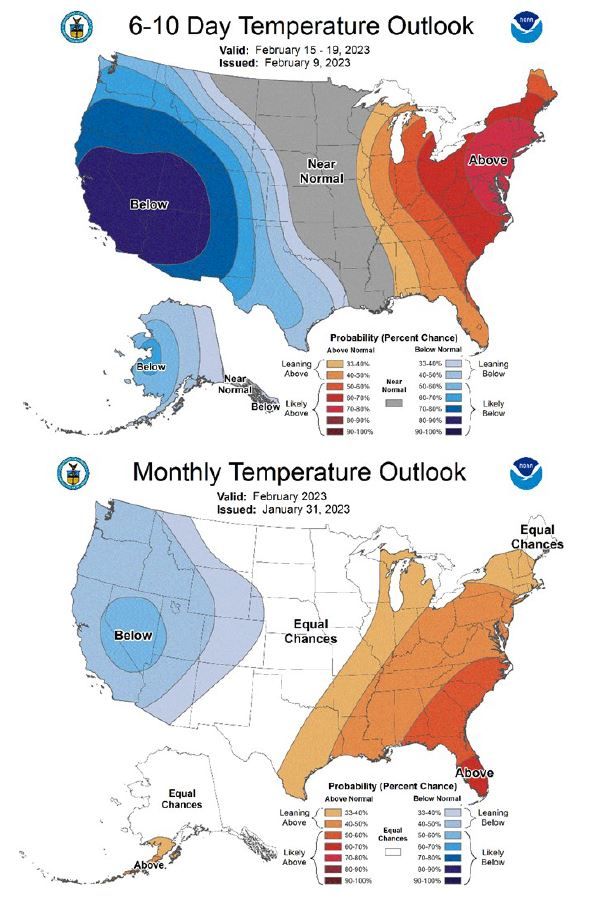

Finally, worth noting, warm weather across the Midwest coupled with wind generation pushed MISO MINN HUB and ERCOT North day-ahead prices into single digits.

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: