Weekly Power Outlet US - Week 7

Natural gas slide continues, coal replacing LNG, and FERC Cold Weather Reliability Standards.

Energy Market Update Week 7, brought to you by Acumen.

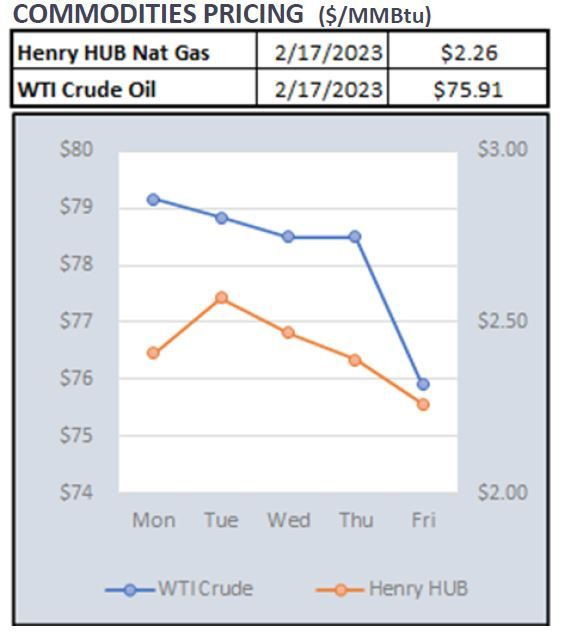

For More Updates Like This, Subscribe Here!Natural gas is now trading in the lower $2 range from around $8 this fall. It looks like economic theory is proven again as lower demand plus higher production equals lower prices. Ironically, there have been some analysts saying LNG terminal Freeport might be the only answer to lower prices right now. Recalling this last fall, it was Freeport and LNG exports being blamed for higher prices as too much domestic production was hitting the world market.

Speaking of LNG, this week Pakistan announced it plans to quadruple its coal capacity with “LNG no longer part of the long-term plan,” according to their energy minister speaking to Reuters. That would equal roughly 8GW of generation moving from gas to coal, which on the world market isn’t much, but a potential trend worth noting. As other countries, especially poorer ones, decide they can’t risk or afford worldwide LNG supply, it could keep domestic gas prices lower. One of our thesis points has been increased LNG export capacity will add a fungibility to natural gas trading, much like oil. If given the opportunity, natural gas will find its way to the highest paying market.

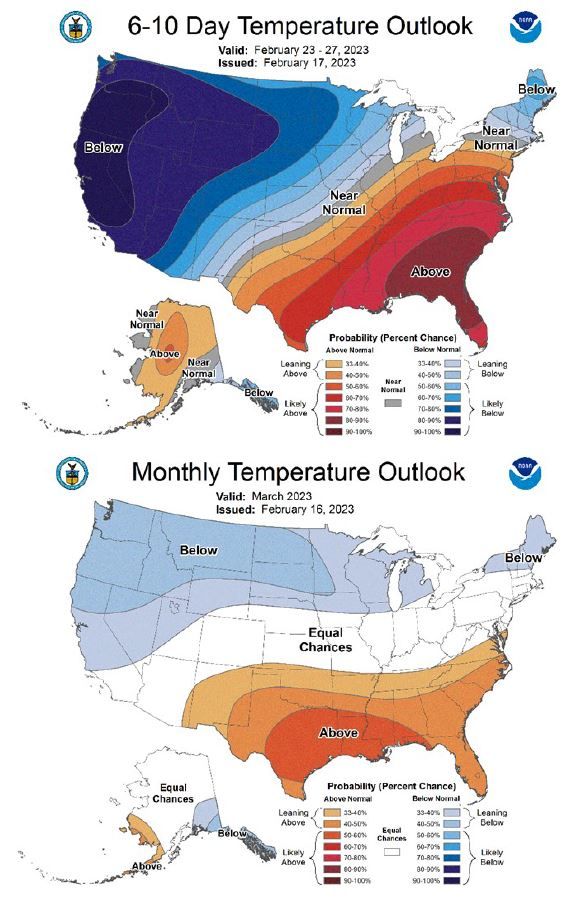

FERC released a presser yesterday approving some new cold weather reliability standards. While we haven’t taken a deep dive, the initial read seems like fairly common sense. Better cold weather plans, identify cold-sensitive equipment, training for maintenance, etc. Given Elliot caused problems across most of the country, we would expect this is the first of many changes coming from FERC and NERC with ISO specifics soon to follow.

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: