Weekly Power Outlet US - Week 32

LNG Labor Strike, EPA vs ISO, PJM State Testimony

Energy Market Update Week #32, brought to you by Acumen.

For More Updates Like This, Subscribe Here!

For those that follow us on this blog or have had conversations about electricity markets, you know we aren't much on predicting energy prices. While others take on the tougher job of trying to predict market prices, we are more interested in preparing plans designed to take advantage of market movements. Our reasoning, the biggest moves in markets tend to come from the unknowns.

While not as drastic as Russia invading Ukraine, who had Australian LNG terminal workers striking on their bingo card? Prices have seemed to stabilize, but Tuesday and Wednesday saw the benchmark European natural gas futures rally almost 20% on this news. Australian LNG exports account for roughly 10-12% of the world supply so any disruption could be meaningful. Most of the Australian LNG goes to Asia, but as we saw last year, a shortage anywhere can mean a rally as LNG tankers make prices more fungible.

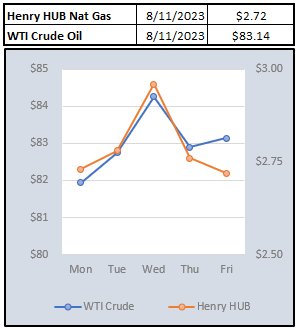

US natural gas futures have been in rally mode since the end of last week as production concerns have become headline again. News of the Australian strike gave an additional push with the front month contract Henry contract closing near $3. Yesterday's EIA storage numbers provided a stop and pull back in the rally as the storage numbers topped estimates.

This week PJM, MISO, ERCOT, and SPP issued a joint statement outlining some of their concerns over the EPA's proposed greenhouse emission standards for fossil generation. The ISOs some their thoughts up in one telling paragraph, “The Joint ISOs/RTOs are also concerned about the chilling impact of the Proposed Rule on investment required to retain and maintain existing units that are needed to provide key attributes and grid services before the compliance date required by the rule.”

Simply stated the rules call for large coal and gas generation to capture and sequester carbon by 2030 or 2032 depending on size and how often they are run. Gas plants can also accomplish the goals by combining green hydrogen to their burn.

Last week PJM Vice President of State and Member Services Asim Haque answered questions from a committee within the Kentucky Assembly on electricity and reliability. The headline read something about PJM representative says we need coal for longer. While catchy, this isn't new. Each FERC commissioner said the same thing earlier this spring to the Senate energy and natural resources committee. The conversation was had a little more depth than just we can't shut down coal. Questions about reliability, costs, and even what happens if one state's regulations cause issues in other states. Attached is the link, and worth a quick read. https://apps.legislature.ky.gov/publicservices/pio/release.ht

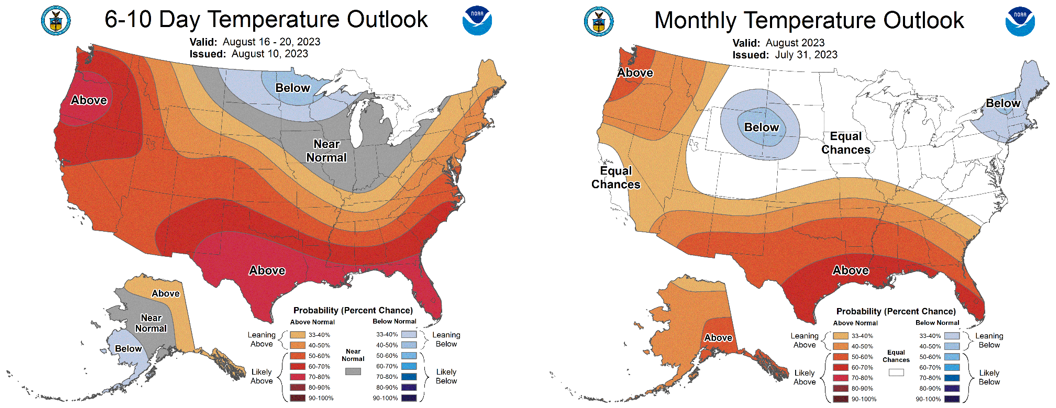

NOAA WEATHER FORECAST

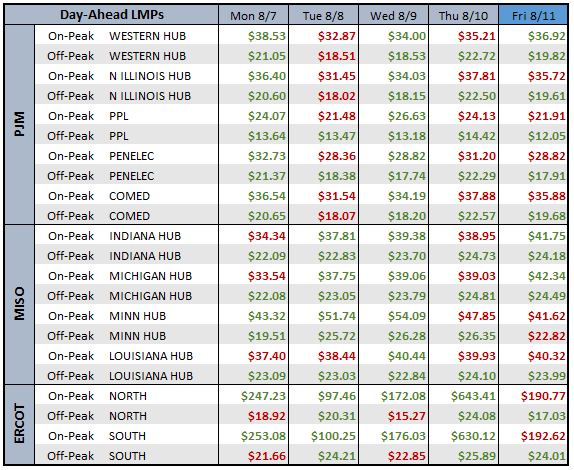

DAY-AHEAD LMP PRICING & SELECT FUTURES

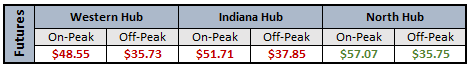

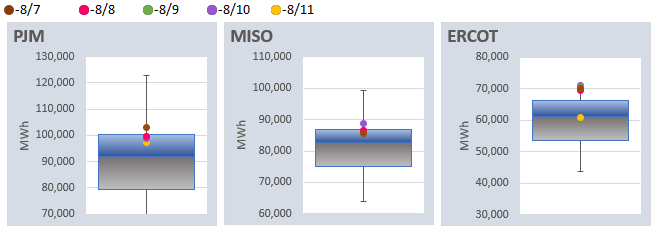

RTO AROUND THE CLOCK CALENDAR STRIP

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: